Market Overview

The Singapore Aircraft Cabin Management Systems market is expected to see substantial growth, with a market size estimated at USD ~ billion in 2025. This growth is fueled by the increasing demand for passenger comfort, advancements in in-flight entertainment, and the rising focus on operational efficiency in airlines. The global shift toward digitalization and connectivity in aviation has further accelerated the adoption of cabin management systems. Singapore, being a key aviation hub in Southeast Asia, plays a crucial role in driving the market, with high demand from both regional airlines and international carriers for advanced cabin solutions.

Singapore, as a global aviation hub, dominates the market for Aircraft Cabin Management Systems due to its strategic location, world-class airports, and strong airline presence. Changi Airport, one of the busiest and most technologically advanced airports globally, leads the region in adopting state-of-the-art cabin management systems. Additionally, Singapore Airlines, known for its luxury and customer-centric services, continues to push the envelope for innovation in cabin technology. The city’s strong aerospace and defense sector further supports the market’s dominance, fostering continuous development and adoption of advanced cabin management systems in the region.

Market Segmentation

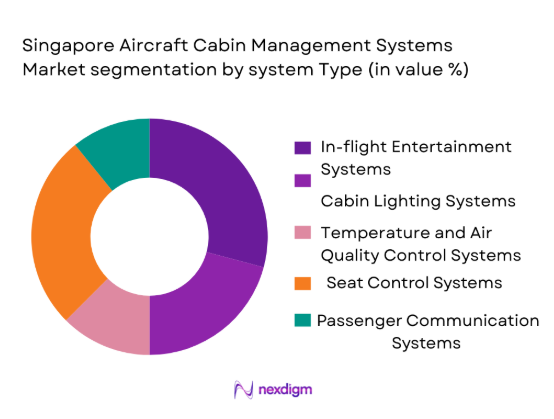

By System Type

The Singapore Aircraft Cabin Management Systems market is segmented by system type into in-flight entertainment systems, cabin lighting systems, temperature and air quality control systems, seat control systems, and passenger communication systems. Among these, in-flight entertainment systems are the dominant subsegment. The increasing passenger demand for a seamless, personalized entertainment experience is driving this segment. Airlines like Singapore Airlines have been at the forefront of adopting high-end entertainment solutions, such as on-demand movies, TV shows, and live television. Furthermore, the growing trend of connectivity-enabled in-flight services is driving the continued growth and innovation in in-flight entertainment systems, reinforcing their dominance in the market.

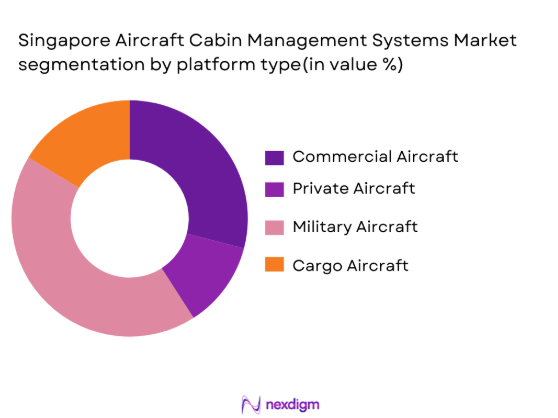

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private aircraft, military aircraft, cargo aircraft. Commercial aircraft dominate this segment, driven by the continuous expansion of airline fleets globally. With the rise of air travel in the Asia-Pacific region, particularly in Southeast Asia, the demand for commercial aircraft is at an all-time high. Airlines based in Singapore, such as Singapore Airlines, are known for adopting the latest cabin management technologies to improve passenger experience, which further propels the demand for such systems in commercial aircraft.

Competitive Landscape

The Singapore Aircraft Cabin Management Systems market is highly competitive, with both global and regional players vying for market leadership. Major players like Honeywell International, Collins Aerospace, and Thales Group dominate due to their extensive portfolios, global reach, and longstanding relationships with airlines and aircraft manufacturers. Additionally, regional players in Singapore, such as ST Engineering, benefit from close proximity to key aviation stakeholders and a strong local presence in the Asia-Pacific region, making them highly competitive in terms of innovation, service delivery, and cost-effectiveness.

| Company | Establishment Year | Headquarters | Market Share | Technology Focus | Primary Clients | Global Presence |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ |

| Panasonic Avionics Corporation | 1979 | Lake Forest, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Cabin Management Systems Market Dynamics

Growth Drivers

Increased Demand for Passenger Comfort and Experience Improvements

As the aviation industry continues to recover and expand, the demand for enhanced passenger comfort has increased significantly. Airlines are focusing on improving the in-flight experience to meet rising expectations. In Singapore, the Civil Aviation Authority of Singapore (CAAS) reported that air travel traffic increased by over 10% year-on-year in 2023, demonstrating the growing number of passengers. Airlines are incorporating advanced cabin management systems to meet these expectations, including improved lighting, seating, and temperature control. Furthermore, Singapore Airlines has consistently invested in high-tech cabin features such as personal entertainment systems and mood lighting to enhance passenger satisfaction, making it a key driver of demand.

Technological Advancements in In-flight Entertainment and Communication Systems

Technological advancements in in-flight entertainment (IFE) and communication systems have transformed the passenger experience. With improvements in high-speed internet access, satellite communications, and connectivity during flights, airlines are increasingly adopting advanced cabin management systems. Singapore Airlines, for instance, integrates cutting-edge IFE systems, including Wi-Fi and real-time video streaming, in its aircraft to offer passengers a seamless travel experience. In 2023, the implementation of such systems led to a marked increase in customer satisfaction. As technology continues to evolve, the adoption of high-speed, robust communication solutions onboard remains a key factor driving the demand for advanced cabin management systems.

Market Challenges

High Integration Costs for Complex Cabin Management Systems

Integrating complex cabin management systems into aircraft is expensive and requires significant investment in both technology and infrastructure. As of 2023, the cost of retrofitting aircraft with advanced cabin management systems has been a barrier for smaller airlines and operators in the Asia-Pacific region. The installation and integration of such systems require customized solutions and skilled labor, raising costs. Singapore Airlines, however, continues to prioritize innovation and invests in high-end solutions, ensuring that the integration is seamless and enhances the overall passenger experience. Despite this, the high cost remains a challenge for less capitalized operators.

Stringent Regulatory and Certification Requirements for Aircraft Systems

The stringent regulatory and certification requirements for new aircraft systems pose a significant challenge to the market. Regulatory bodies like the Civil Aviation Authority of Singapore (CAAS) and the European Union Aviation Safety Agency (EASA) require rigorous testing and certification for cabin management systems. In 2023, delays in regulatory approvals for cabin system innovations created bottlenecks in the adoption process, as manufacturers and airlines were forced to comply with safety protocols and ensure the systems meet all legal requirements. This has increased the time to market for new technologies, impacting the pace of adoption in the region.

Market Opportunities

Increasing Focus on Sustainable and Energy-efficient Cabin Technologies

The aviation industry is increasingly focusing on sustainability, with airlines adopting energy-efficient cabin management systems to reduce their carbon footprint. Singapore Airlines, as part of its sustainability efforts, has integrated energy-saving technologies into its aircraft. These include LED lighting systems and more efficient temperature control mechanisms that reduce energy consumption. With global pressure on the aviation sector to lower emissions, cabin management systems that offer energy-efficient solutions present a significant growth opportunity. In 2023, airlines in the Asia-Pacific region, including Singapore, began to invest heavily in these solutions as part of their broader environmental sustainability goals

Growth of Luxury and Private Air Travel Driving Demand for High-end Cabin Management Systems

The rising demand for luxury and private air travel, particularly in regions like Asia-Pacific, is driving the demand for high-end cabin management systems. As of 2023, Singapore has seen a significant increase in private jet travel, with affluent travelers seeking premium in-flight experiences. High-end systems offering personalized control of lighting, temperature, entertainment, and even real-time communication have become a standard feature in private aircraft. This demand for luxury in private and business aviation has created a lucrative opportunity for manufacturers to cater to the growing need for sophisticated cabin management solutions.

Future Outlook

Over the next decade, the Singapore Aircraft Cabin Management Systems market is expected to experience steady growth. This will be driven by increasing passenger expectations, advancements in technology, and the continuing evolution of the aviation industry. The shift towards sustainable aviation practices, including the adoption of energy-efficient cabin solutions, will play a significant role in shaping the future of the market. Additionally, the growth of regional carriers and the increase in air travel within Southeast Asia will continue to create demand for more sophisticated and integrated cabin management systems, further boosting market growth.

Major Players in the Market

- Honeywell International

- Collins Aerospace

- Thales Group

- ST Engineering

- Panasonic Avionics Corporation

- Safran Aircraft Interiors

- Moog Inc.

- Diehl Aerospace

- Rockwell Collins

- Zodiac Aerospace

- Lufthansa Technik

- Safran Cabin

- Optimares

- Aircraft Cabin Systems

- CTT Systems

Key Target Audience

- Aerospace Manufacturers

- Airline Operators

- MRO Service Providers

- Government Regulatory Bodies

- Aircraft OEMs

- Private Jet Operators

- Investments and Venture Capitalist Firms

- Airport Authorities

Research Methodology

Step 1: Identification of Key Variables

This phase involves collecting data on market drivers, trends, and challenges by reviewing historical data and industry reports. We identify critical variables influencing the demand for cabin management systems, such as airline fleet sizes, passenger comfort preferences, and regulatory requirements.

Step 2: Market Analysis and Construction

The analysis focuses on the various types of cabin management systems, including their applications in different aircraft platforms. We analyze data from primary and secondary sources, including airline adoption rates and technological advancements, to build a comprehensive view of the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the future growth of the market are tested through consultations with industry experts, such as airline executives, aircraft OEMs, and MRO service providers. These interviews provide insights into technological developments and customer adoption trends.

Step 4: Research Synthesis and Final Output

The final research phase consolidates data gathered from market reports, expert interviews, and case studies. This phase synthesizes findings to ensure the accuracy of forecasts and provides actionable insights for stakeholders in the aircraft cabin management systems industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks]

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for passenger comfort and experience improvements

Technological advancements in in-flight entertainment and communication systems

Growing airline fleet sizes in the Asia-Pacific region - Market Challenges

High integration costs for complex cabin management systems

Stringent regulatory and certification requirements for aircraft systems

Supply chain challenges and component shortages - Market Opportunities

Increasing focus on sustainable and energy-efficient cabin technologies

Growth of luxury and private air travel driving demand for high-end cabin management systems

Rising demand for retrofit and upgrade solutions in older aircraft - Trends

Growing adoption of IoT and connectivity in cabin management systems

Shift towards more eco-friendly and fuel-efficient aircraft cabins

Rising importance of personalized passenger experiences through cabin management

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

In-flight Entertainment Systems

Cabin Lighting Systems

Temperature and Air Quality Control Systems

Seat Control Systems

Passenger Communication Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgrades & Replacements

Hybrid Fitments - By End User Segment (In Value%)

Airlines

Private Jet Operators

Military Operators

Aircraft OEMs

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

OEM Distribution

Third-Party Procurement

Online Procurement

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product innovation, Technology adoption, Regulatory compliance, Market presence, Strategic partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company profiles

- Honeywell International

- Collins Aerospace

- Thales Group

- Lufthansa Technik

- Rockwell Collins

- Safran Aircraft Interiors

- Panasonic Avionics Corporation

- Boeing

- Airbus

- Zodiac Aerospace

- Moog Inc.

- Diehl Aerospace

- Yazaki Corporation

- Goodrich Corporation

- Bae Systems

SWOT Analysis

Porter’s five forces

- Airlines investing in advanced cabin management systems to enhance passenger comfort

- Private aircraft operators adopting high-end systems for premium experiences

- Military operators requiring advanced systems for operational efficiency

- MRO providers focusing on retrofit and upgrade services for older aircraft

- Future Market Value 2026-2035

- Future Installed Units 2026-2035

- Price Future by System Tier 2026-2035

- Future Demand by Platform 2026-2035