Market Overview

The Singapore Aircraft Cabin Trash Compactors market has shown significant growth, with an estimated market value of USD ~ million in 2025. This market is primarily driven by the expansion of the airline fleet in the region and the rising need for efficient waste management systems in the aviation sector. The increase in passenger volumes at Singapore’s Changi Airport, one of the world’s busiest international airports, and the growing emphasis on sustainable aviation practices further contribute to the demand for compact and efficient cabin trash compactors. Singapore Airlines and other regional carriers are integrating these systems to improve operational efficiency and environmental sustainability.

Singapore stands at the forefront of the Aircraft Cabin Trash Compactors market in the Southeast Asia region. The city-state’s strategic position as a major aviation hub, with its state-of-the-art Changi Airport, drives the demand for advanced waste management solutions in the aviation sector. Singapore Airlines, with its commitment to high service standards and sustainability, is a key player in adopting innovative waste management systems. Additionally, the country’s strong regulatory framework for environmental sustainability pushes airlines in the region to adopt efficient trash compaction systems, solidifying Singapore’s dominance in this market.

Market Segmentation

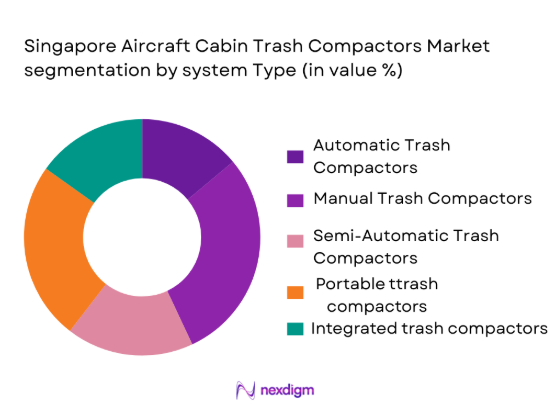

By System Type

The Singapore Aircraft Cabin Trash Compactors market is segmented by system type into automatic trash compactors, manual trash compactors, semi-automatic trash compactors, portable trash compactors, and integrated trash compactors. Among these, automatic trash compactors are currently the dominant subsegment. The adoption of automatic systems is rising rapidly due to their efficiency and ability to reduce operational costs for airlines. Automatic systems are capable of processing large amounts of waste without manual intervention, ensuring that the waste management process is quick and effective. Singapore Airlines, as an example, has integrated automatic trash compactors into its aircraft, enabling it to improve operational efficiency and enhance passenger experience during long-haul flights. The trend toward automation aligns with the broader move toward digital and automated systems in aviation, making automatic trash compactors the preferred choice for airlines in the region.

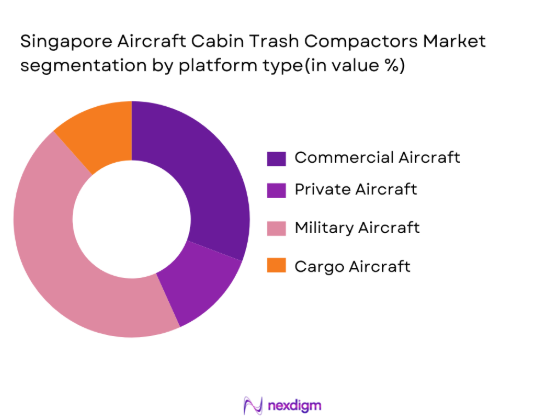

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private aircraft, military aircraft, cargo aircraft. Commercial aircraft dominate this segment, driven by the expanding fleets of regional and international airlines in the Asia-Pacific region. As one of the largest players in the aviation industry, Singapore Airlines continues to lead in adopting the latest cabin waste management solutions for its growing fleet. The demand for aircraft cabin trash compactors is closely linked to the increasing passenger volumes and the airline industry’s push toward improving sustainability efforts. Additionally, the large number of commercial aircraft in service in the Asia-Pacific region, particularly in countries like Singapore, further supports the dominance of this subsegment.

Competitive Landscape

The Singapore Aircraft Cabin Trash Compactors market is characterized by both global and regional players. Major players like Honeywell International, Collins Aerospace, and Moog Inc. are leading the market due to their established presence in the aerospace sector, comprehensive product offerings, and strong relationships with airlines. Additionally, regional players like ST Engineering and Panasonic Avionics have capitalized on the growing demand for waste management solutions in Singapore’s aviation sector. The competitive landscape reflects a consolidation of industry leaders, with both global and regional companies vying for dominance in the market by providing innovative, sustainable, and cost-effective solutions to airlines.

| Company | Establishment Year | Headquarters | Technology Focus | Primary Clients | Global Presence | R&D Investment |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | Lake Forest, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Cabin Trash Compactors Market Dynamics

Growth Drivers

Increasing Air Travel and Passenger Volume in the Asia-Pacific Region

Air travel in the Asia-Pacific region has seen a strong uptick in recent years, with Singapore Airlines recording an increase in passenger traffic by 10% in 2023. The Civil Aviation Authority of Singapore (CAAS) also reported that Singapore’s Changi Airport welcomed over 68 million passengers in 2023, showcasing the rising demand for air travel. This surge in passenger numbers directly drives the need for efficient waste management systems, including aircraft cabin trash compactors. Airlines are expanding their fleets to meet growing demand, and as a result, they must implement more effective waste management solutions to ensure cleanliness and operational efficiency onboard.

Rising Demand for Waste Management Solutions in Aviation

The growing awareness of environmental sustainability within the aviation sector is leading to an increasing demand for waste management solutions. Airlines, including Singapore Airlines, are investing heavily in advanced waste handling systems, such as trash compactors, to meet sustainability goals. In 2023, Singapore Airlines partnered with various environmental organizations to reduce carbon footprints and waste onboard. As of 2024, the airline industry in the Asia-Pacific region is focusing more on reducing waste generation and enhancing recycling efforts. This shift towards eco-friendly solutions increases the need for effective trash compaction systems that can reduce waste volume and support recycling processes.

Market Challenges

High Installation and Maintenance Costs for Aircraft Trash Compactors

The high upfront costs for the installation of cabin trash compactors remain a significant challenge. Installation requires modifications to the aircraft’s design to accommodate compactors, increasing the complexity and cost. Additionally, the maintenance of these systems can be expensive, especially when it comes to the sourcing of replacement parts and regular servicing. In 2024, airlines in Singapore are facing challenges related to the cost-effectiveness of installing and maintaining these systems, especially smaller carriers that are hesitant to invest heavily in these technologies due to budget constraints. Despite the advantages, the financial burden of initial and ongoing costs remains a challenge in the market.

Regulatory Challenges for Waste Disposal Systems in Aviation

The regulatory environment for waste disposal systems in aviation is complex and varies by region. Airlines operating in Singapore and other countries must adhere to both local and international waste disposal regulations, which can delay the implementation of new technologies. In 2023, ICAO (International Civil Aviation Organization) revised its environmental standards, including waste management guidelines for airlines. These stringent standards require extensive certification and testing before new systems can be installed on aircraft. This process can take time and increase operational costs, presenting a regulatory challenge for airlines in adopting new waste management technologies.

Market Opportunities

Adoption of More Compact and Efficient Trash Compaction Systems

As airlines seek to optimize cabin space and improve waste processing efficiency, there is a growing opportunity for more compact and efficient trash compaction systems. Singapore Airlines, for example, has invested in smaller and more efficient systems that take up less space while processing larger volumes of waste. In 2023, the airline tested a new, smaller trash compactor system that reduced waste volume by 40% compared to older models. These compact systems allow airlines to save space while managing waste more efficiently, which is essential as they look to enhance the overall passenger experience while adhering to sustainability goals.

Integration of Smart and Automated Trash Management Solutions

Smart technology, including IoT-enabled trash compactors, presents a significant opportunity for the market. In 2023, Singapore Airlines began testing IoT-enabled trash management systems, which allow real-time monitoring of waste levels, automatic notifications for waste collection, and optimization of waste handling schedules. This automation reduces the burden on cabin crew and ensures timely waste disposal. Airlines in Singapore and the broader Asia-Pacific region are increasingly looking to integrate these systems to improve operational efficiency. The rise of smart, automated solutions that reduce human intervention and optimize waste management processes will likely drive future growth in this market.

Future Outlook

The Singapore Aircraft Cabin Trash Compactors market is expected to see continued growth as airlines in the Asia-Pacific region, particularly Singapore, prioritize sustainability and operational efficiency. The growing emphasis on reducing waste and increasing recycling onboard will drive the adoption of advanced waste management systems, including automated and compact trash compactors. Furthermore, regulatory frameworks that demand eco-friendly waste management solutions will continue to accelerate the adoption of these systems. Over the next decade, technological advancements, such as IoT integration and machine learning for waste monitoring, will also play a key role in shaping the market’s future trajectory.

Major Players in the Market

- Honeywell International

- Collins Aerospace

- Moog Inc.

- ST Engineering

- Panasonic Avionics

- Safran Aircraft Interiors

- Zodiac Aerospace

- Diehl Aerospace

- Rockwell Collins

- B/E Aerospace

- Lufthansa Technik

- GE Aviation

- SITA

- Optimares

- Airbus Cabin Systems

Key Target Audience

- Aerospace Manufacturers

- Airline Operators

- Military Operators

- MRO Service Providers

- Aircraft OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Authorities

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify key variables such as fleet expansion, regulatory requirements, and technological advancements that influence the adoption of cabin trash compactors in Singapore. Desk research and primary data collection are used to define these variables.

Step 2: Market Analysis and Construction

We compile data on current and historical adoption rates of trash compaction systems in aircraft, analyzing market trends, consumer preferences, and regulatory compliance. The goal is to estimate the current and future market size based on these parameters.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through interviews with industry experts, including executives from airlines, aircraft manufacturers, and waste management system providers. These consultations help refine our understanding of the market’s dynamics.

Step 4: Research Synthesis and Final Output

We synthesize all gathered data, including insights from experts, to create a comprehensive market report. The final output includes market forecasts, segmentation analysis, and strategic recommendations for stakeholders in the Singapore Aircraft Cabin Trash Compactors market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air travel and passenger volume in the Asia-Pacific region

Rising demand for waste management solutions in aviation

Implementation of eco-friendly waste management regulations in airlines - Market Challenges

High installation and maintenance costs for aircraft trash compactors

Regulatory challenges for waste disposal systems in aviation

Technological limitations of current trash compactor systems - Market Opportunities

Adoption of more compact and efficient trash compaction systems

Integration of smart and automated trash management solutions

Rising demand for retrofit and upgrade solutions in older aircraft - Trends

Increased focus on green technologies and eco-friendly systems

Growth in the Asia-Pacific aviation market driving demand

Technological advancements in waste management automation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Automatic Trash Compactors

Manual Trash Compactors

Semi-Automatic Trash Compactors

Portable Trash Compactors

Integrated Trash Compactors - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Hybrid Fitments

Replacement Units - By End User Segment (In Value%)

Airlines

Private Jet Operators

Military Operators

Aircraft OEMs

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

OEM Distribution

Third-Party Procurement

Online Procurement

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product innovation, Technological advancement, Market share by region, Regulatory compliance, Customer service capabilities)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company profiles

Honeywell International

Collins Aerospace

Zodiac Aerospace

Moog Inc.

Diehl Aerospace

Safran Aircraft Interiors

ST Engineering

Panasonic Avionics

Rockwell Collins

Lufthansa Technik

Boeing

Airbus

GE Aviation

SITA

Airbus Cabin Systems

- Airlines adopting advanced waste management systems for operational efficiency

- Private jet operators integrating compactors for luxury travel needs

- Military operators adopting compact systems for logistical advantages

- MRO service providers focusing on cabin waste solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035