Market Overview

The Singapore aircraft cameras market is valued at approximately USD ~ million in 2025, supported by the strong demand for aircraft surveillance, safety, and real-time monitoring systems. This growth is driven by the increasing adoption of technology to enhance flight safety, improve operational efficiency, and meet regulatory standards. As aviation regulations continue to evolve, the need for advanced camera systems on commercial and military aircraft is expected to further fuel the market’s expansion. Additionally, the growing demand for surveillance in the Asia-Pacific region has significantly impacted the market dynamics.

Singapore, with its status as a major aviation hub in Southeast Asia, plays a dominant role in the aircraft cameras market. The country’s strategic location serves as a key gateway for both commercial and military aircraft, attracting numerous airlines and defense contractors. Singapore’s advanced aviation infrastructure, strong regulatory framework, and government initiatives to promote safety and technology integration position it as a leader in the aircraft cameras market. The presence of major aviation players and MRO providers in Singapore further solidifies its position in the regional market.

Market Segmentation

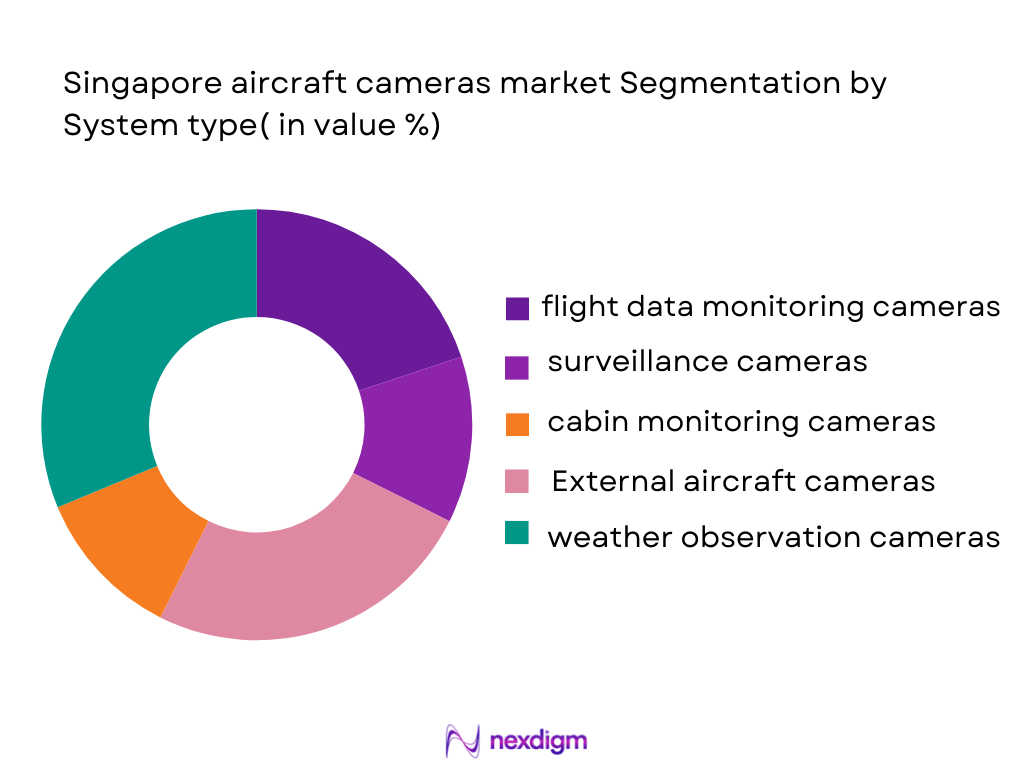

By System Type

The Singapore aircraft cameras market is segmented by system type into flight data monitoring cameras, surveillance cameras, cabin monitoring cameras, external aircraft cameras, and weather observation cameras. Among these, flight data monitoring cameras dominate the market, accounting for approximately 32% of the market share in 2024. The demand for flight data monitoring cameras has risen due to the increasing emphasis on real-time data collection and analysis to improve operational safety and efficiency. These cameras are crucial for monitoring flight conditions, collecting in-flight data, and complying with aviation safety regulations, making them indispensable in modern aircraft.

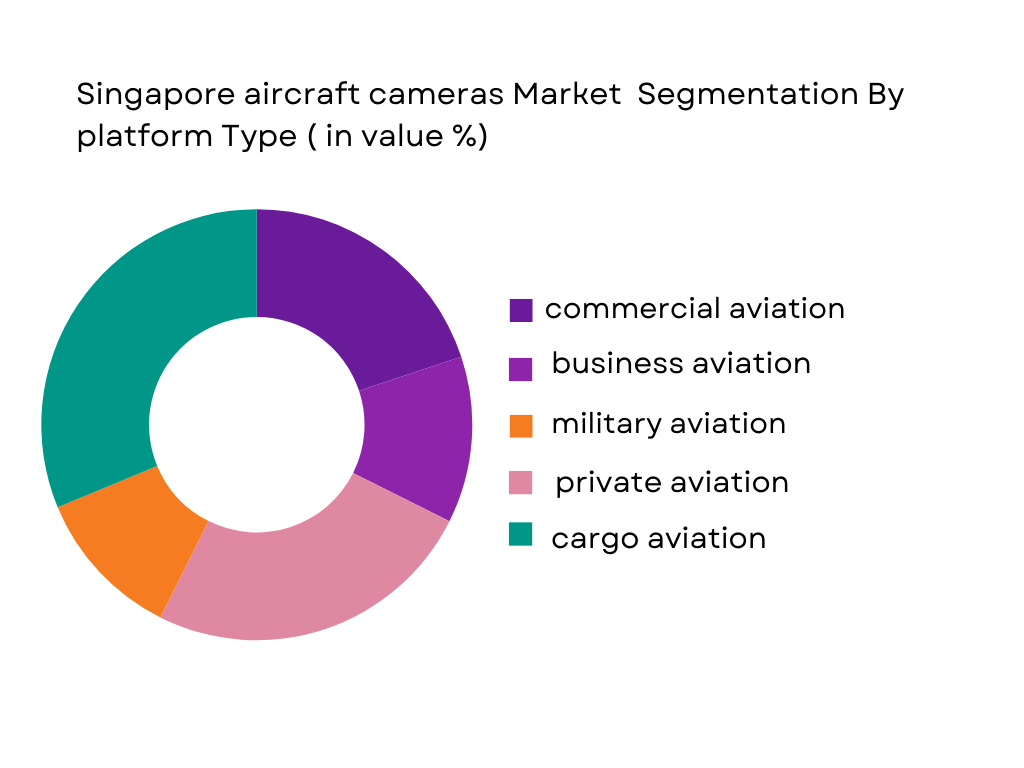

By Platform Type

The market is segmented by platform type into commercial aviation, business aviation, military aviation, private aviation, and cargo aviation. Commercial aviation accounts for the largest share of the market, estimated at 45% in 2024. The dominant share is driven by the rapid expansion of commercial airlines, which require advanced camera systems for surveillance, maintenance, and flight data monitoring. The integration of cameras into commercial aircraft helps improve passenger safety, ensures regulatory compliance, and enhances fleet management, all of which contribute to the segment’s dominance.

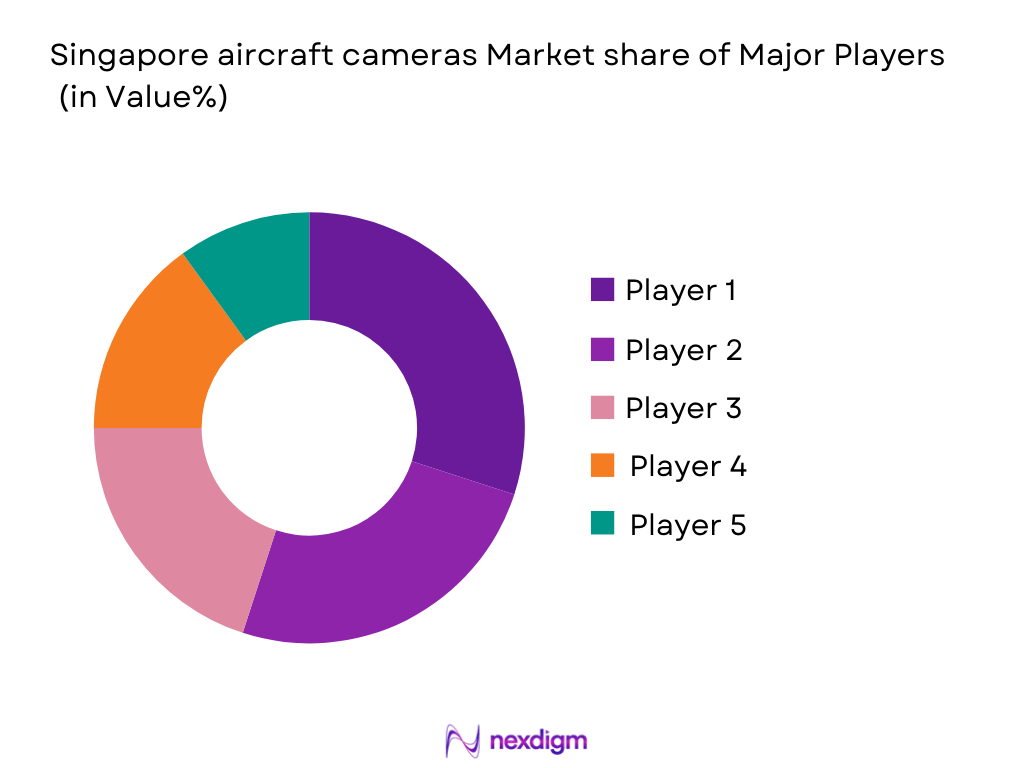

Competitive Landscape

The Singapore aircraft cameras market is characterized by strong competition from both established global players and regional companies. Major international companies such as Honeywell, Garmin, and L3 Technologies dominate the market due to their technological expertise, strong brand presence, and ability to provide comprehensive camera solutions. Additionally, local players such as ST Engineering and Singapore Technologies Aerospace also contribute significantly to the market, leveraging Singapore’s strategic position and advanced aerospace capabilities.

| Company | Establishment Year | Headquarters | MRO Services | Fleet Size | Service Locations | Key Customers |

| Honeywell | 1906 | Morris Plains, USA | – | – | – | – |

| Garmin | 1989 | Olathe, USA | – | – | – | – |

| L3 Technologies | 1997 | New York, USA | – | – | – | – |

| ST Engineering | 1967 | Singapore | – | – | – | – |

| Singapore Technologies Aerospace | 1980 | Singapore | – | – | – | – |

Singapore Aircraft Cameras Market Dynamics

Growth Drivers

Increasing Adoption of Surveillance Technologies for Safety and Security

The growing need for aviation safety has prompted the widespread adoption of advanced surveillance technologies in aircraft, including cameras. Surveillance cameras are integral to monitoring aircraft performance, ensuring flight safety, and mitigating security threats. The International Civil Aviation Organization (ICAO) has highlighted safety as a priority for aviation, with a focus on the implementation of technological advancements. Singapore, being a key aviation hub, aligns with these global efforts, as shown by the Civil Aviation Authority of Singapore (CAAS) increasing regulatory frameworks around safety systems, including enhanced monitoring solutions for both commercial and military aviation. In 2024, the CAAS has reinforced aviation safety measures, citing a 15% increase in the demand for surveillance solutions. The International Air Transport Association (IATA) has also pushed for improved in-flight safety systems, which have directly influenced the demand for surveillance cameras in Singapore’s aviation sector.

Rising Demand for Real-Time Flight Data Monitoring

Real-time monitoring of flight data is becoming increasingly crucial for enhancing operational efficiency and ensuring passenger safety. In Singapore, real-time flight data monitoring has been an essential element of the nation’s aviation infrastructure, with multiple local carriers adopting this technology to comply with the latest aviation standards. The Singapore government, through the Ministry of Transport, has worked to integrate advanced monitoring systems into the region’s aviation ecosystem. This has led to an increased investment in data-driven surveillance systems, such as cameras that monitor critical flight data in real-time. In 2024, Singapore’s aviation industry saw an uptick in investments in real-time flight data technologies, aligning with the nation’s goal of expanding its aerospace industry and boosting operational efficiency. In line with this, Singapore Airlines’ fleet modernization plans include enhanced data monitoring systems in aircraft, thereby driving demand for sophisticated camera systems.

Market Challenges

High Costs of Advanced Camera Systems

The integration of advanced camera systems in aircraft faces challenges due to high upfront costs. Aircraft cameras, especially those with high-definition capabilities and real-time data transmission features, can be expensive. For example, commercial-grade surveillance cameras, equipped with features such as infrared detection and high-definition imaging, can cost several thousand dollars per unit. This high cost has made it difficult for smaller carriers or emerging markets to invest in these technologies. Despite the Singaporean government’s support for aviation safety, the high costs associated with these systems remain a barrier for some regional players, especially in a post-pandemic recovery period where airlines focus on cost reductions. Furthermore, the integration of these high-end systems into existing aircraft platforms is often accompanied by substantial installation and maintenance expenses. In 2024, costs associated with camera installation and maintenance increased by an estimated 10% due to supply chain disruptions and inflationary pressures.

Technological Complexities in Integrating Systems with Aircraft Platforms

Integrating camera systems with existing aircraft platforms poses significant technological challenges. Aircraft manufacturers and MRO (Maintenance, Repair, and Overhaul) service providers in Singapore face challenges in ensuring seamless integration of new camera systems with diverse aircraft platforms, including older fleet models. The compatibility of cameras with various aircraft avionics and operational systems remains a key hurdle. In 2024, the Singapore government and CAAS are working with local MRO service providers to develop more standardized integration protocols. However, the process requires considerable investment in R&D and testing to ensure that these technologies are fully compatible with aircraft systems, which adds to the complexity and cost of implementation. The delays in successful integration are also exacerbated by the limited availability of skilled technical personnel capable of handling such sophisticated installations.

Market Opportunities

Rising Demand for Cabin Monitoring Solutions

The demand for cabin monitoring solutions is on the rise as airlines and aviation authorities focus on enhancing the passenger experience, improving cabin safety, and ensuring compliance with health protocols. Singapore’s thriving aviation industry is witnessing an increased demand for advanced cabin monitoring systems, which use cameras to monitor cabin conditions, ensure passenger safety, and enhance customer service. The Ministry of Transport has initiated several programs aimed at boosting the adoption of cabin monitoring solutions to maintain high safety and cleanliness standards in aircraft cabins. This trend has been supported by the government’s investment in technology upgrades for airports and airlines, contributing to the growth of this segment. Additionally, the use of cameras to monitor cabin conditions for health and safety compliance is a critical factor driving market growth in this segment. In 2024, several airlines operating in Singapore, including Singapore Airlines, are investing heavily in cabin surveillance technologies to meet these growing demands.

Potential for Integrating AI-Powered Cameras for Predictive Maintenance

The integration of AI-powered cameras for predictive maintenance in the aviation industry presents a significant opportunity for market growth. Singapore, with its strong technological infrastructure and emphasis on innovation, is a leader in adopting AI-driven technologies in aviation. AI cameras can detect early signs of wear and tear on aircraft components, reducing downtime and increasing the efficiency of maintenance schedules. This predictive maintenance approach can help airlines save on repair costs and improve aircraft reliability. In 2024, the Singapore government, in collaboration with local airlines and MRO providers, is investing in the development of AI-based systems for predictive maintenance. As the demand for such systems continues to grow, the potential for AI-powered cameras to revolutionize maintenance operations becomes increasingly apparent. The use of AI to analyze camera footage and predict component failures will likely lead to the widespread adoption of such technologies in the coming years.

Future Outlook

Over the next 5 years, the Singapore aircraft cameras market is poised for significant growth driven by the increasing demand for advanced surveillance, monitoring, and safety technologies across both commercial and military aviation sectors. The continued focus on safety and operational efficiency in the aviation industry, coupled with advancements in camera technologies such as AI-powered systems and 360-degree cameras, will drive the market’s expansion. As regulations surrounding flight safety and real-time monitoring continue to evolve, the demand for innovative aircraft camera solutions is expected to rise, ensuring sustained market growth in the future.

Major Players

- Honeywell

- Garmin

- L3 Technologies

- ST Engineering

- Singapore Technologies Aerospace

- Rockwell Collins

- Panasonic Avionics

- Moog Inc.

- Thales Group

- Vision Systems

- Videotec

- Aircraft Cameras Ltd.

- Dart Aerospace

- GoPro

- Sagem

- Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Civil Aviation Authority of Singapore)

- Airlines operating in Southeast Asia

- Aircraft manufacturers

- Aircraft leasing companies

- MRO service providers

- Regional airports and infrastructure developers

- International aviation associations

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research focuses on identifying the critical variables that impact the aircraft cameras market, including the different camera systems, platforms, and procurement channels. This step involves comprehensive desk research, utilizing secondary sources such as industry reports, regulatory guidelines, and company data to map out the key factors that drive market demand.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and compile an in-depth assessment of market penetration, including the adoption of various camera types and their integration with different aircraft platforms. The research also includes the evaluation of key growth drivers such as increasing safety regulations and technological advancements in surveillance systems.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through expert interviews with professionals from aviation safety, aircraft manufacturers, and MRO service providers. These insights are gathered through structured consultations that provide operational and financial perspectives, helping to refine the data and validate the projections.

Step 4: Research Synthesis and Final Output

In the final step, the research team synthesizes all collected data and expert feedback to ensure the accuracy and reliability of the market analysis. This comprehensive approach includes a thorough validation of data through market surveys and additional expert consultations to confirm key trends and developments, ensuring a precise and actionable report on the aircraft cameras market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing adoption of surveillance technologies for safety and security

Rising demand for real-time flight data monitoring

Government regulations enforcing advanced onboard monitoring systems - Market Challenges

High costs of advanced camera systems

Technological complexities in integrating systems with aircraft platforms

Regulatory hurdles and certification delays - Market Opportunities

Rising demand for cabin monitoring solutions

Potential for integrating AI-powered cameras for predictive maintenance

Growing commercial aviation sector in Southeast Asia - Trends

Integration of AI and machine learning in aircraft camera systems

Focus on eco-friendly and energy-efficient camera technologies

Technological advancements in 360-degree camera systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Flight Data Monitoring Cameras

Surveillance Cameras

Cabin Monitoring Cameras

External Aircraft Cameras

Weather Observation Cameras - By Platform Type (In Value%)

Commercial Aviation

Business Aviation

Military Aviation

Private Aviation

Cargo Aviation - By Fitment Type (In Value%)

OEM Equipment

Aftermarket Equipment

Retrofit Solutions

Integrated Systems

Standalone Cameras - By End User Segment (In Value%)

Airlines

Private Operators

MRO Service Providers

OEM Manufacturers

Military & Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

OEM Partnerships

Third-Party Distributors

Online Channels

Service Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Technological Innovation, Customer Service, Regional Presence, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company profiles

Garmin

Honeywell International

L3 Technologies

Moog Inc.

Rockwell Collins

Thales Group

UTC Aerospace Systems

Sagem

Videotec

Vision Systems

Aircraft Cameras Ltd.

Dart Aerospace

Aerospace Cameras

Panasonic Avionics

GoPro

- Growing demand from commercial airlines for enhanced safety features

- Military applications requiring advanced surveillance solutions

- Increasing use of aircraft cameras for fleet management

- Rising adoption of cameras in cargo aircraft for improved monitoring

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035