Market Overview

The Singapore Aircraft Cargo Systems market is valued at approximately USD ~ billion in 2024, driven by the continuous growth of air freight demand, particularly in the Asia-Pacific region. As Singapore is a global logistics and aviation hub, it benefits from both regional and international cargo traffic, with its airport handling over ~ million tonnes of cargo annually. Additionally, the rapid technological adoption in automated cargo handling systems, and increased demand for temperature-sensitive goods like pharmaceuticals, have played a key role in market growth. The market size is further driven by the integration of IoT and AI in cargo systems, improving tracking, automation, and operational efficiency in freight operations.

Singapore, as a strategic global air cargo hub, plays a dominant role in the aircraft cargo systems market. The nation benefits from its well-established Changi Airport, one of the busiest cargo airports globally, handling diverse goods such as electronics, pharmaceuticals, and perishables. The country’s proximity to key trade routes and its robust logistics infrastructure, coupled with government incentives and policies promoting air cargo growth, contributes to its dominance. Additionally, ASEAN countries, including Malaysia, Thailand, and Indonesia, also contribute significantly to the market due to their expanding air cargo networks and regional trade agreements that benefit Singapore’s air freight services.

Market Segmentation

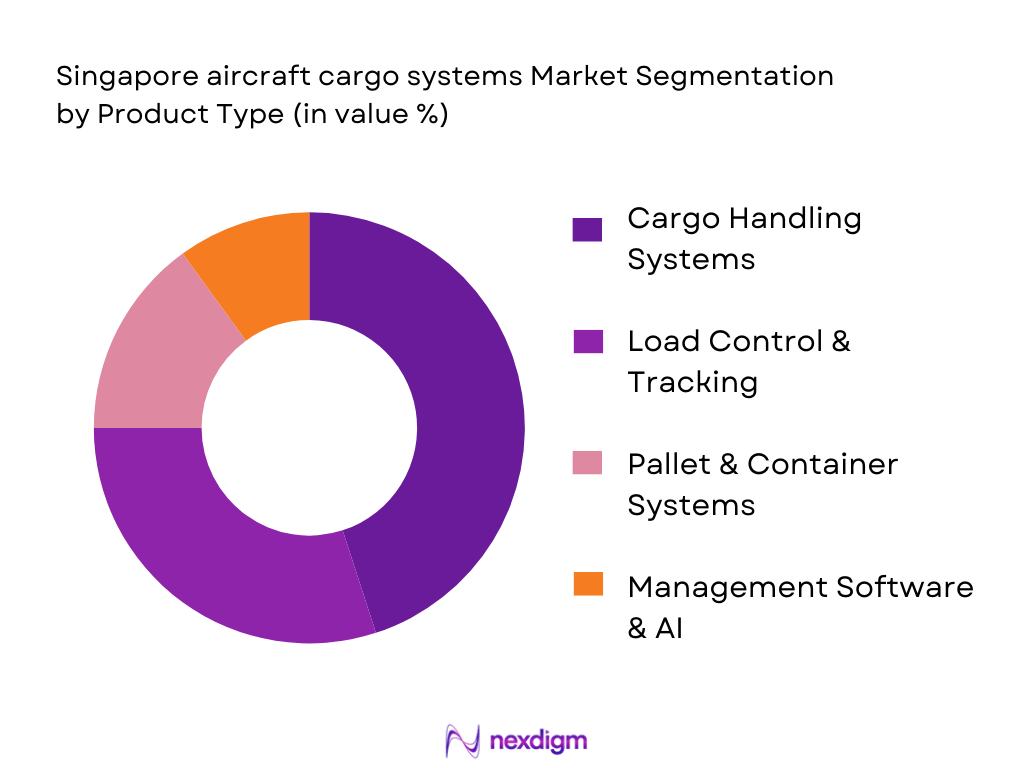

By Product Type

The Singapore Aircraft Cargo Systems market is segmented by product type into cargo handling systems, load control and tracking systems, pallet and container systems, and management software and AI optimization platforms. Among these, cargo handling systems dominate the market share, due to their ingrained presence in airports. Automated systems that facilitate faster and more efficient cargo processing are becoming standard across airports globally. The adoption of automated sortation and conveyor systems is essential to cope with the rising air freight volume. This segment is projected to maintain its leadership in the market as these systems are key enablers of efficient operations at air terminals like Changi Airport.

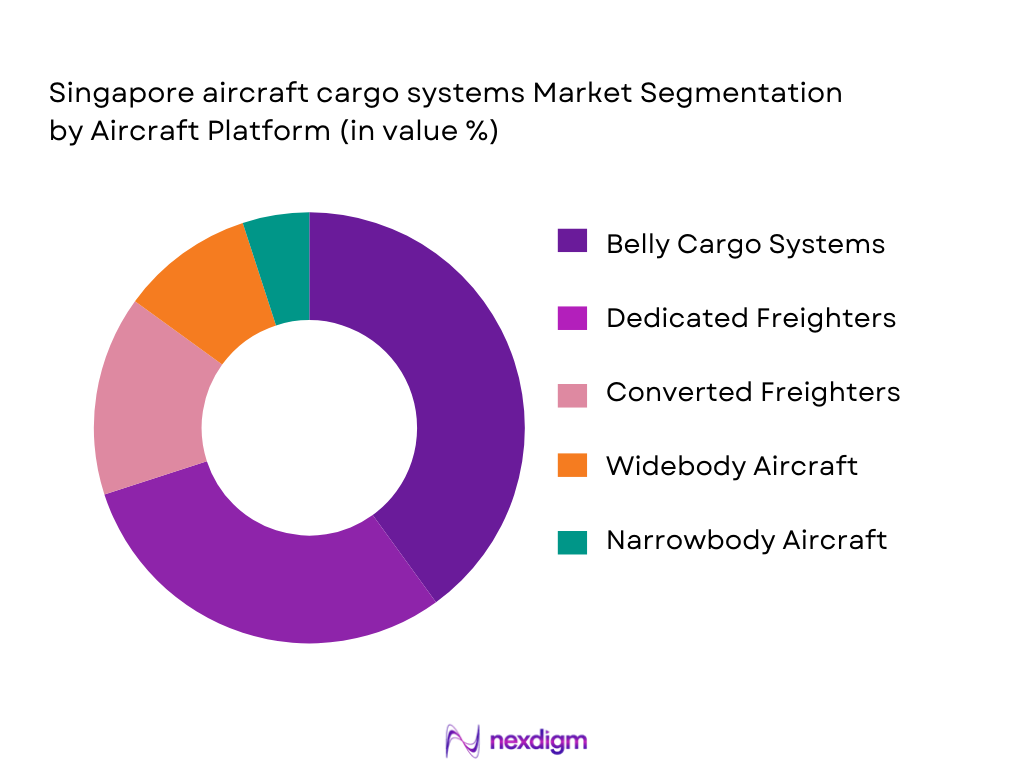

By Aircraft Platform

The market is also segmented by aircraft platform, including dedicated freighters, belly cargo systems, converted freighters, widebody aircraft, and narrowbody aircraft. The belly cargo systems segment holds the largest share in Singapore, due to the country’s strong connections with international airlines and the increasing capacity in bellyhold freight for passenger aircraft. This segment benefits from cost-efficient solutions, as utilizing the cargo space in passenger flights maximizes revenue per flight. The integration of smart tracking and load management systems has enhanced the competitiveness of this segment, and as airlines continue to scale, this segment will dominate in the coming years.

Competitive Landscape

The Singapore Aircraft Cargo Systems market is highly competitive, dominated by both established international firms and local industry leaders. Companies such as SATS Ltd., a key ground handler at Changi Airport, and global technology providers like Honeywell and Collins Aerospace, lead the market. These companies are strategically located in Singapore to leverage its strong air cargo infrastructure. The growing competition is fueled by innovations in automation, AI-powered cargo management, and the increasing shift towards sustainability, with players investing heavily in eco-friendly cargo systems.

| Company Name | Establishment Year | Headquarters | Cargo Systems Type | Technological Integration | Regional Coverage | Maintenance Network | Market Presence |

| SATS Ltd. | 1945 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | USA | ~ | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1957 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Daifuku Airport Tech | 1937 | Japan | ~ | ~ | ~ | ~ |

|

Singapore Aircraft Cargo Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in Singapore and the wider ASEAN region is a significant growth driver for the aircraft cargo systems market. With the continuous migration of people to urban areas, the demand for logistics and air freight services has surged. Singapore’s urban population was approximately ~ million in 2024, with a steady growth rate projected. Urban areas act as hubs for e-commerce, pharmaceuticals, and high-value goods, leading to increased demand for air cargo systems. Additionally, urbanization fosters infrastructure improvements, such as Changi Airport’s expansion, which further strengthens its cargo throughput capacity, enhancing the need for advanced cargo handling systems. The World Bank projects a continued increase in urban populations globally, driving the need for efficient, automated cargo systems

Industrialization

Industrialization in Southeast Asia, especially in countries like Singapore, has contributed significantly to the rise of air cargo demand. Singapore’s industrial sector, which saw an output of over USD ~ billion in 2024, is central to the global supply chain, with major industries such as electronics, chemicals, and pharmaceuticals driving freight volumes. As Singapore continues to foster its position as a logistics and industrial hub, the expansion of its industrial base directly correlates with an increase in demand for sophisticated cargo systems. Furthermore, government initiatives aimed at advancing the digitalization of logistics and smart manufacturing are accelerating the adoption of advanced air cargo solutions to support industrial growth. Source: Singapore Economic Development Board

Restraints

High Initial Costs

High initial costs remain a significant restraint for the widespread adoption of advanced aircraft cargo systems in Singapore. The installation of automated cargo handling systems, which include conveyor systems, robotics, and digital load control technologies, requires substantial capital investment. For instance, the cost of installing a fully automated cargo handling system at Changi Airport is estimated to exceed USD ~ million. Despite this, long-term operational savings and improved efficiency are key factors for companies opting to invest. However, the high initial capital cost can still be prohibitive for smaller logistics firms and airports. This financial barrier often slows down system upgrades, especially when compared to less expensive manual alternatives.

Technical Challenges

The adoption of new technologies in aircraft cargo systems also faces technical challenges, particularly in integration and compatibility with existing infrastructure. Systems such as IoT sensors, AI-driven load optimization, and robotics require highly specialized technical expertise, which can pose integration difficulties in airports with legacy systems. Additionally, maintaining a seamless and efficient operation with a mix of automated and manual systems can create operational bottlenecks. Technical failures, such as issues with cargo tracking or system downtimes, can have a significant impact on air cargo operations, leading to delays and loss of efficiency. These technical hurdles are compounded by the shortage of skilled labor to operate and maintain advanced systems, which further challenges smooth adoption.

Opportunities

Technological Advancements

Technological advancements present significant growth opportunities for the Singapore Aircraft Cargo Systems market. In recent years, there has been increasing adoption of automation, AI, and IoT within cargo operations. Changi Airport, for example, has seen significant investments in these technologies, including the introduction of smart baggage systems and autonomous vehicles for ground handling. These advancements not only improve the efficiency of cargo handling but also reduce human error and operational costs, creating long-term savings. Moreover, with the rise of AI-driven cargo management platforms that optimize route planning and cargo load efficiency, there is a growing opportunity for airlines and logistics providers to improve their cargo operations further.

International Collaborations

International collaborations offer substantial opportunities for the market, particularly as air cargo demand increases in Asia-Pacific. Singapore, as a major logistics hub, is strategically positioned to form international partnerships with global cargo service providers. For instance, Singapore Airlines Cargo has collaborated with multiple logistics companies to expand its freighter operations globally, facilitating better cargo services for sectors like e-commerce, pharmaceuticals, and perishable goods. Additionally, ASEAN’s trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), are expected to bolster regional trade flows, indirectly increasing the demand for advanced air cargo systems. These international collaborations enhance cargo connectivity and operational efficiency, opening new growth avenues for both local and international stakeholders.

Future Outlook

Over the next 5 years, the Singapore Aircraft Cargo Systems market is expected to see substantial growth, fueled by technological advancements in automation, IoT, and AI for tracking and cargo management. The increasing demand for efficient air freight solutions, particularly for time-sensitive goods, combined with Singapore’s strategic location as a key international logistics hub, will continue to drive the market. As regional trade continues to grow, particularly within ASEAN and APAC, the market will witness increased adoption of cutting-edge cargo systems that provide greater efficiency and real-time insights into cargo management, improving overall supply chain performance.

Major Players in the Market

- SATS Ltd.

- Honeywell Aerospace

- Collins Aerospace

- Vanderlande Industries

- Daifuku Airport Technologies

- JBT AeroTech

- Atec (Aviation Technical Services)

- Airbus Operations – Aircraft Freight Systems Division

- Boeing Air Cargo Systems

- Panasonic Avionics

- Kuehne + Nagel

- DB Schenker

- Unisys

- Safran Electronics & Defense

- Siemens Logistics

Key Target Audience

- Airlines Fleet Managers

- Ground Handling Operators

- Freight Forwarders & Integrators

- Logistics Providers (E-commerce logistics firms)

- Airport Authorities (Changi Airport Group)

- Government & Regulatory Bodies

- Investment and Venture Capitalist Firms

- Air Cargo Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical market variables, including technological integration, freight volumes, and logistics network expansions. This will be done through secondary research, exploring industry reports, trade publications, and proprietary databases to define these variables clearly.

Step 2: Market Analysis and Construction

The market analysis phase includes the compilation and examination of historical data to assess past growth rates, cargo throughput, and technological penetration in air cargo systems. The aim is to build a well-rounded understanding of the sector’s economic footprint.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to the market’s growth trajectory will be validated by consulting with industry experts from aviation authorities, cargo system manufacturers, and logistics providers. This will be achieved through structured interviews and consultations to gain qualitative insights into future market dynamics.

Step 4: Research Synthesis and Final Output

The final phase will engage with multiple stakeholders, including manufacturers and operators, to confirm product segment performance and market trends. This step ensures that the final output is comprehensive and accounts for all operational and market-specific nuances.

- Executive Summary

- Research Methodology (Market Definition and Scope (Cargo Systems vs. Air Freight vs. Logistics Integration), Market Assumptions (Throughput, Freighter Traffic Growth, Cargo Yield Trends), Data Sources and Validation Framework , Market Sizing & Forecasting Model (Bottom‑Up Freight Volume & Value), Primary Research Approach (OEMs, Tier‑1 Suppliers, Cargo Handlers, Airlines), Secondary Research

- Definition and Scope

- Market Genesis (Role of Singapore as Strategic Cargo Hub)

- Cargo Systems in Regional Context

- Supply Chain & Value Chain for Cargo Systems

- Cargo Throughput Sizing & Changi Hub Capacity Metrics

- Infrastructure & Node Analysis (Changi Cargo Terminals, SATS Operations)

- Growth Drivers

Air Cargo Demand Growth (E‑Commerce, High‑Value Goods)

Asia Pacific Freighter Growth & Singapore’s Node Role

Infrastructure Expansion (Terminal Capacity, Digital Cargo Corridors) - Market Challenges

High Capital & Integration Costs

Regulatory Complexity & Security Compliance - Technology & Digital Trends

IoT & Real‑Time Tracking Adoption

AI Load Optimization

Digital ULD Ecosystems - Regulatory Environment

Civil Aviation Authority of Singapore Standards

Customs & Security Protocols - SWOT & Value‑Chain Bottleneck Analysis

- Porter’s Five Forces (Cargo Systems Tier Analysis)

- By Value, 2020-2025

- By Volume, 2020 -2025

- By Average Price of Platforms/Services, 2020 -2025

- By Cargo System Type (In Value %)

Cargo Handling Systems

Load Control & Tracking Systems

Pallet & Container Systems

Management Software & AI Optimization Platforms

Cold Chain & Temperature‑Controlled Modules - By Aircraft Platform (In Value %)

Dedicated Freighter Cargo Systems

Belly Cargo Systems

Converted Freighter Platforms

Widebody vs. Narrowbody Cargo Systems - By End‑User (In Value %)

Airlines

Ground Handlers & Airport Cargo Operators

Integrators & 3PLs

E‑Commerce Logistics Providers

OEMs & Cargo Systems Manufacturers - By Technology (In Value %)

Automated Systems

Robotics & AGVs

IoT & Sensor‑Enabled Cargo Tracking

AI‑Driven Load Planning

Sustainable / Green Systems

- Market Share by Value & Volume (Cargo Systems Tier)

- Cross‑Comparison Parameters (Product Portfolio Breadth (Types of Cargo Systems),Technology Integration Level (AI/IoT Adoption), Regional Footprint & Coverage,Airport Partnerships / Handler Alliances

Service & Maintenance Network, stalled Base Units & Throughput Metrics, Pricing & OEM Tier Positioning, Sustainability / Green System Certifications) - Company SWOT Profiles

- Pricing Benchmarking

- Detailed Company Profiles

SATS Ltd (Cargo Handling & System Integrations, Changi Operations)

Airbus Operations – Aircraft Freight Systems Division

Boeing Air Cargo Systems & Loadmaster Solutions

Honeywell Aerospace – Cargo Management Systems

Safran Electronics & Defense – Cargo Handling Units

ATEC (Aviation Technical Services)

JBT AeroTech

Vanderlande Industries

Daifuku Airport Technologies

Kuehne + Nagel (Cargo Systems Deployment Partner)

DB Schenker – Cargo IT & Handling Solutions

Collins Aerospace – Cargo Controls

Siemens Logistics – Smart Freight Systems

Panasonic Avionics – Cargo Tracking Solutions

Unisys – Cargo IT Integration Platforms

- Cargo System Utilization Profiles

- Fleet & Handling Capacity Metrics

- Purchasing Economics & Budget Allocation Patterns

- Pain‑Point & Needs Analysis (System Downtime, Scalability, Handling Mix)

- Decision‑Making Cycles & Procurement Drivers

- Future Market Size by Value, 2026-2035

- Future Market Size by Volume, 2026-2035

- Average Frame Cost Outlook, 2026-2035