Market Overview

The aircraft circuit breakers market in Singapore is valued at approximately USD ~ million in 2024, driven by the growth of the aerospace industry in the region, particularly in the context of Singapore’s strong manufacturing and MRO (Maintenance, Repair, and Overhaul) services for aircraft. The market’s growth is primarily fueled by increasing aircraft fleet size, the need for advanced electrical systems in modern aircraft, and the growing demand for more-electric aircraft solutions, such as electric propulsion and hybrid aircraft systems. Furthermore, government initiatives supporting aviation technologies and partnerships with global aerospace giants like Boeing and Airbus also play a critical role in driving the market.

Singapore is the dominant hub for aircraft circuit breakers in Southeast Asia, mainly due to its strategic location as a global aviation and aerospace center. It serves as the primary maintenance, repair, and overhaul (MRO) center for the region, drawing several major airlines and aircraft manufacturers to establish their presence. The country’s advanced infrastructure, well-developed aerospace cluster, and close ties with international aerospace players such as Rolls-Royce, GE Aviation, and Airbus further bolster its market leadership. Singapore’s consistent investments in aerospace research and development also position it at the forefront of electrical component innovation in the region.

Market Segmentation

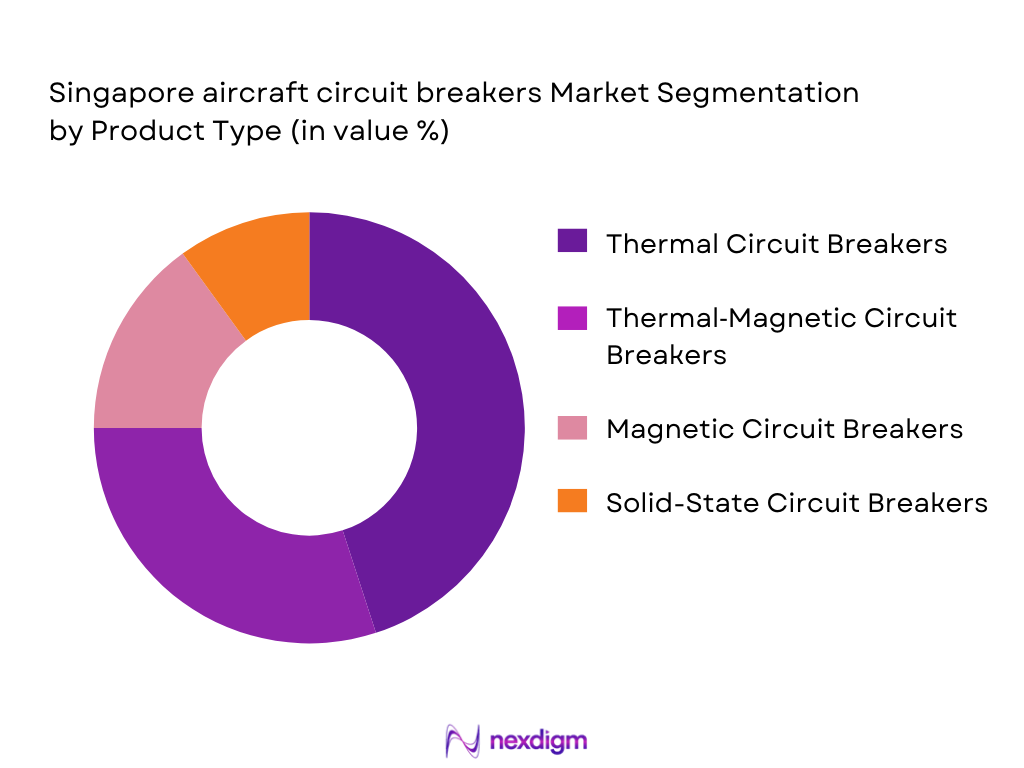

By Product Type

The Singapore aircraft circuit breakers market is segmented by product type into thermal circuit breakers, thermal‑magnetic circuit breakers, magnetic circuit breakers, and solid-state circuit breakers. Among these, thermal circuit breakers dominate the market due to their widespread usage in commercial and military aircraft. They are commonly used for their ability to handle overcurrent situations in a cost-effective manner. Thermal circuit breakers are reliable, have long lifespans, and are relatively easy to integrate into various aircraft electrical systems, making them the most widely adopted choice across different platforms.

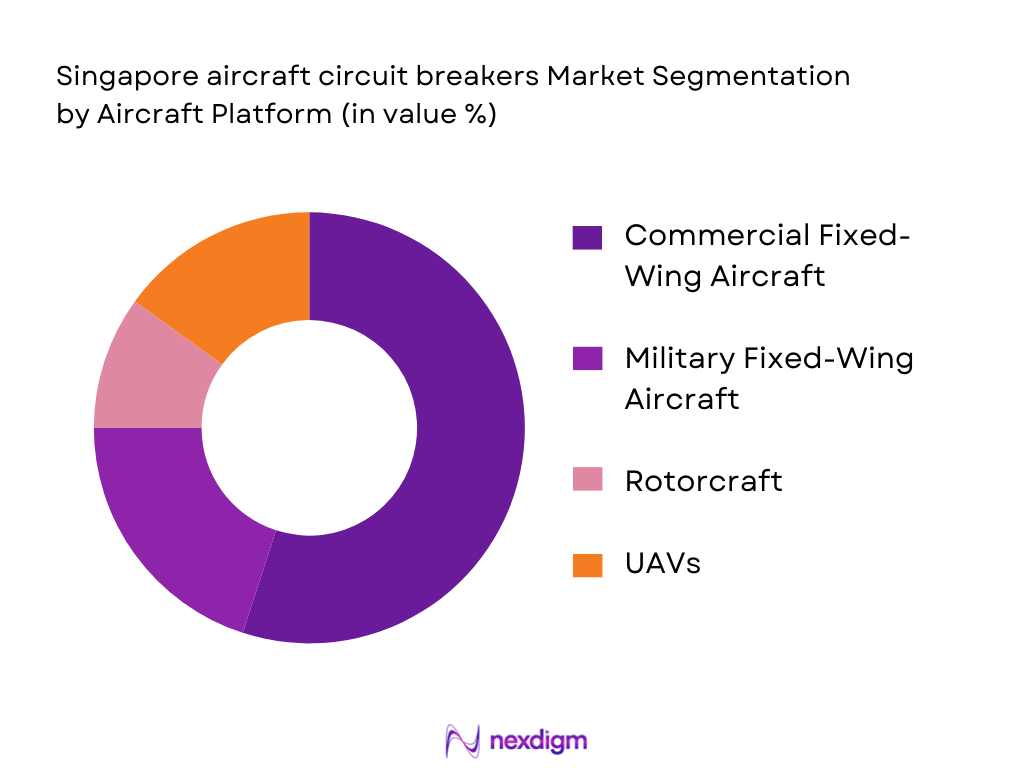

By Aircraft Platform

The market is also segmented by aircraft platform, which includes commercial fixed-wing aircraft, military fixed-wing aircraft, rotorcraft (helicopters), and unmanned aerial vehicles (UAVs). Commercial fixed-wing aircraft account for the largest share of the market. The dominance of this segment is attributed to the large number of commercial aircraft in operation, as well as the increasing demand for fuel-efficient, more-electric aircraft that require highly reliable circuit protection systems. Airlines, particularly in the Asia-Pacific region, are investing in modern fleets, contributing to the growth of circuit breaker demand.

Competitive Landscape

The Singapore aircraft circuit breakers market is characterized by a highly competitive landscape, with several key global and local players vying for market dominance. Major players in this market include Honeywell, Safran, and Eaton, which have established a strong presence through technological innovation and strategic partnerships with leading aircraft manufacturers and MROs. The market is also characterized by consolidation, with these players acquiring smaller firms to expand their product portfolios and enhance their market capabilities.

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Manufacturing Capacity | Strategic Alliances |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| Eaton | 1911 | Ireland | ~ | ~ | ~ | ~ |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Circuit Breakers Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver of the aircraft circuit breakers market in Singapore. As urban centers grow, particularly in Southeast Asia, the demand for air transportation increases. Singapore’s urbanization rate is steadily increasing, with a population density of over ~ people per square kilometer in 2025, and urban areas continuing to expand. This rapid urbanization is contributing to the demand for more infrastructure, including aviation systems that require advanced electrical protection devices. Furthermore, the expansion of Changi Airport, a global aviation hub, underpins the increasing need for electrical components in the aviation sector. Singapore’s investment in airport infrastructure projects further supports the aviation industry’s growth, propelling demand for sophisticated electrical systems.

Industrialization

Industrialization has contributed significantly to the growth of the aircraft circuit breakers market in Singapore. The manufacturing sector in Singapore continues to expand, supported by industrial growth in key sectors such as aerospace, electronics, and precision engineering. In 2025, the manufacturing sector in Singapore grew by ~ % and remains a crucial pillar of the economy. The expansion of the aerospace manufacturing industry, particularly in the production of components and aircraft systems, drives the demand for electrical protection devices like circuit breakers. As Singapore strengthens its role as a regional aerospace hub with high-value manufacturing, industrial activities boost the demand for advanced circuit protection technologies used in aircraft electrical systems.

Restraints

High Initial Costs

The high initial costs of aircraft circuit breakers can act as a restraint for the market in Singapore. The aviation industry requires premium-grade electrical components, and circuit breakers used in aircraft must meet strict safety standards, adding to their cost. For instance, high-end circuit breakers capable of handling high currents and complex electrical protection systems can be expensive, with initial costs exceeding SGD ~ per unit for certain types. This can significantly increase the upfront costs for airlines and manufacturers, particularly in the competitive aviation industry. As Singapore continues to prioritize cost-efficiency in its aviation sector, these high upfront costs may be a barrier for smaller businesses looking to adopt such advanced systems.

Technical Challenges

Technical challenges, particularly in the integration of circuit breakers with evolving aircraft electrical systems, present a restraint to market growth. As aircraft systems become more complex, especially with the move towards more-electric aircraft, circuit breakers must meet higher reliability standards and greater functionality. In 2025, the aviation industry in Singapore saw the introduction of more advanced systems, such as hybrid-electric propulsion, which demand new approaches to electrical protection. The challenge lies in adapting circuit breakers to work effectively in these more complex systems. The technical demands of ensuring system compatibility and ensuring certifications for new technology add an additional layer of difficulty for manufacturers.

Opportunities

Technological Advancements

Technological advancements in electrical systems for aircraft present significant opportunities for the aircraft circuit breakers market in Singapore. As the aviation sector transitions towards more-electric aircraft, circuit breakers need to evolve to meet the demands of these advanced systems. Currently, there is increasing investment in the development of solid-state and smart circuit breakers that can monitor and control the electrical systems more efficiently. In 2025, Singapore’s aerospace industry saw a rise in investments directed towards innovative electrical technologies that offer enhanced reliability and functionality. These advancements align with global trends in the aerospace industry, presenting a clear opportunity for local manufacturers to innovate and meet the growing demand for next-gen electrical protection solutions.

International Collaborations

International collaborations present further growth opportunities for the Singapore aircraft circuit breakers market. Singapore’s strategic position as a leading aerospace hub in Southeast Asia encourages partnerships between local manufacturers and global aerospace giants. The country’s involvement in the development of aircraft systems, including electrical components, is enhanced through collaborations with major companies like Airbus and Boeing. In 2025, Singapore hosted several key aviation summits and conferences aimed at fostering international partnerships in aerospace technology. These collaborations open up new markets for aircraft circuit breaker manufacturers and allow for the exchange of technological knowledge, positioning Singapore as a key player in the evolving global aerospace market.

Future Outlook

Over the next 5 years, the Singapore aircraft circuit breakers market is expected to show continued growth, fueled by advancements in electrical systems for next-generation aircraft, including hybrid-electric and all-electric models. The growing need for more efficient, lightweight, and reliable electrical protection systems will drive technological innovations in circuit breakers. Moreover, with the expansion of Singapore’s aerospace sector, particularly in MRO capabilities, the demand for high-quality, cost-effective circuit protection solutions is set to increase, driving the overall market growth. The market will also benefit from the country’s aerospace infrastructure and favorable regulatory environment for the aviation industry.

Major Players

- Honeywell International Inc.

- Safran Electrical & Power

- Eaton Aerospace Solutions

- TE Connectivity

- Rockwell Collins

- General Electric Aviation

- Rolls-Royce plc

- Meggit PLC

- Panasonic Avionics

- ABB Ltd

- ST Engineering Aerospace

- Raytheon Technologies

- Curtiss-Wright Corporation

- Thales Group

- Airbus

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Singapore Civil Aviation Authority)

- Aircraft Manufacturers (e.g., Airbus, Boeing)

- Aerospace OEMs

- Maintenance, Repair, and Overhaul (MRO) Providers

- Electronics Component Suppliers

- Electrical System Integrators

- Aviation & Aerospace Research Institutes

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a comprehensive market ecosystem for the Singapore aircraft circuit breakers sector, identifying key stakeholders such as MRO providers, aircraft manufacturers, and electronics suppliers. Secondary research will be conducted to define and validate key market drivers, product types, and regional dynamics.

Step 2: Market Analysis and Construction

This phase entails the collection and analysis of historical data, including aircraft fleet growth, regulatory impacts, and evolving trends in electrical systems. A bottom-up approach will be used to understand market penetration and forecast future growth patterns for circuit breakers.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from OEMs, MROs, and regulatory bodies will be interviewed to validate market hypotheses. These consultations will provide practical insights into the current and future trends within the aircraft electrical protection market, which will help refine forecasts and strategies.

Step 4: Research Synthesis and Final Output

Data obtained from secondary and primary sources will be synthesized to create a robust market model. Final outputs will include detailed reports on market trends, forecasts, competitive landscape, and strategic insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions specific to aviation electrical protection devices, Assumptions & boundary conditions (Singapore assembly vs export focus), Primary research framework (industry experts, test labs, aerostructure buyers), Market sizing & forecast approach, Data triangulation & validation)

- Singapore Aerospace Electrical Components Landscape

- Strategic Role of Electrical Protection Systems in Modern Aircraft

- Value Chain & Ecosystem Mapping (Supply Partner Depth, Tier‑Level Distribution)

- Supply Chain Risk & Resilience (Semiconductor/Metal prices)

- Lifecycle & Certification Pathways (FAA/EASA/Singapore CAA)

- Innovation & R&D Clusters (Test Labs, Simulation Facilities)

- Growth Drivers

Electrification & More‑Electric Aircraft megatrend

Singapore’s aerospace manufacturing ambitions

Safety & redundancy compliance rigor

- Market Challenges

Certification complexity (multiple authorities)

Raw material price volatility

Supply chain lead times for precision components

- Market Opportunities

Growth in UAV / eVTOL production

Digital circuit breaker systems

Local test & certification services

- Market Trends

Shift to intelligent electrical protection

Integration with digital power management

Lightweight, high‑reliability designs

- Regulatory & Standards Landscape

FAA/EASA/TCCA/Singapore CAA electrical protection requirements

Compliance matrices for aircraft circuit protection

Certification process timelines & bottlenecks

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Breaker Technology (In Value %)

Thermal Circuit Breakers

Thermal‑Magnetic Circuit Breakers

Magnetic Circuit Breakers

Electronic / Solid‑State Circuit Breakers

- By Electrical System Type (In Value %)

AC Systems

DC Systems

- By Voltage Classification (In Value %)

Low Voltage (<1kV)

Medium Voltage

High Voltage (e.g., e‑Propulsion / More‑Electric Aircraft)

- By Aircraft Platform (In Value %)

Commercial Fixed‑Wing

Military Fixed‑Wing

Rotorcraft (Helicopters)

UAV & Urban Air Mobility Platforms

Business Jets / GA

- Singapore & Asia‑Pacific Competitive Map

- Market share by value & volume

Production volume & capacity mix

Export vs domestic utilization - Cross‑Comparison Parameters (Certification Footprint, Design Authority & IP Ownership, Supply Chain Integration, ASP & Margin Structure, Reliability & Failure Rates, Aftermarket Support & Test Services, Deployment in Next‑Gen Platforms)

- SWOT Profiles of Key Players

- Price Sheet Benchmarking by SKU Tier

- Adoption Curve Analysis (by Platform & Segment)

- Detailed Company Profiles

Honeywell International Inc.

Safran Electrical & Power

Meggit PLC (circuit protection division)

TE Connectivity

ABB (Aerospace Solutions)

Schneider Electric Aviation Division

Curtiss‑Wright Controls

Eaton Aerospace Solutions

Littelfuse, Inc.

Bussmann Aerospace

Rockwell Collins (circuit protection group)

Boeing Defense & Space (electrical systems)

Airbus Electrical Systems

SIA Engineering Company (MRO integrations)

ST Engineering Aerospace

- User requirements & procurement benchmarks

- Total Cost of Ownership (TCO) determinants

- Decision criteria analysis (reliability, weight, lifecycle)

- End‑user willingness to pay & replacement cycles

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035