Market Overview

The Singapore aircraft cockpit display systems market is currently valued at approximately USD ~ billion. This robust growth is attributed to increasing investments in aviation safety systems, technological advancements, and the push for modernization in both commercial and military aviation. Moreover, the growing demand for high-definition, real-time cockpit displays and the increasing focus on flight safety and operational efficiency are driving the adoption of advanced cockpit systems. The market’s growth trajectory is further fueled by the evolving regulatory environment that mandates advanced avionics systems to improve flight safety standards across both regional and international flights.

Singapore plays a dominant role in the cockpit display systems market, owing to its strategic location as a global aviation hub and its well-established aerospace and defense industry. The country’s robust aviation infrastructure, including Changi Airport, a leader in air traffic, directly drives demand for advanced cockpit technology for commercial airliners. Furthermore, its high-tech defense sector, including the Singapore Air Force’s modernization programs, positions it as a key player. Other influential markets in Southeast Asia include Malaysia and Thailand, where government investments in defense and commercial aviation are also driving cockpit system adoption.

Market Segmentation

By Display Type

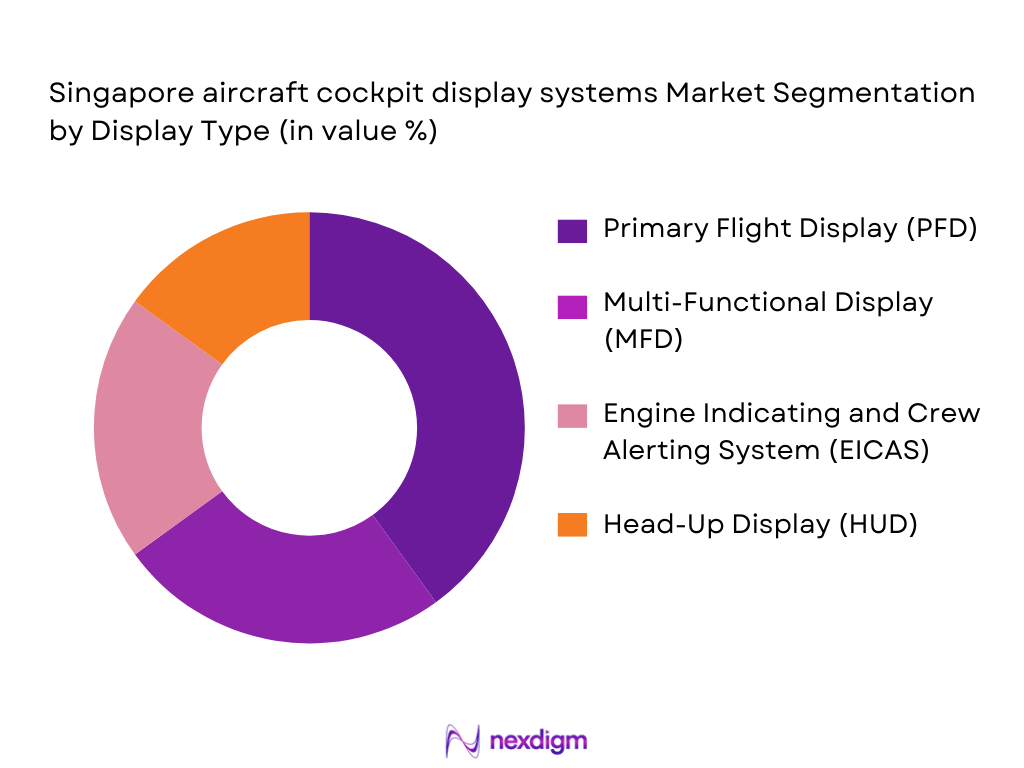

The Singapore aircraft cockpit display systems market is primarily segmented by display type into Primary Flight Display (PFD), Multi-Functional Display (MFD), Engine Indicating and Crew Alerting System (EICAS), and Head-Up Display (HUD). Among these, the PFD segment holds a dominant position in the market. This is due to its critical role in providing essential flight information, which is a regulatory requirement for flight safety. The adoption of PFD technology has increased significantly as commercial airlines and defense sectors focus on improving pilot situational awareness, leading to the widespread use of advanced PFD systems across Singapore’s aviation fleet.

By Technology Level

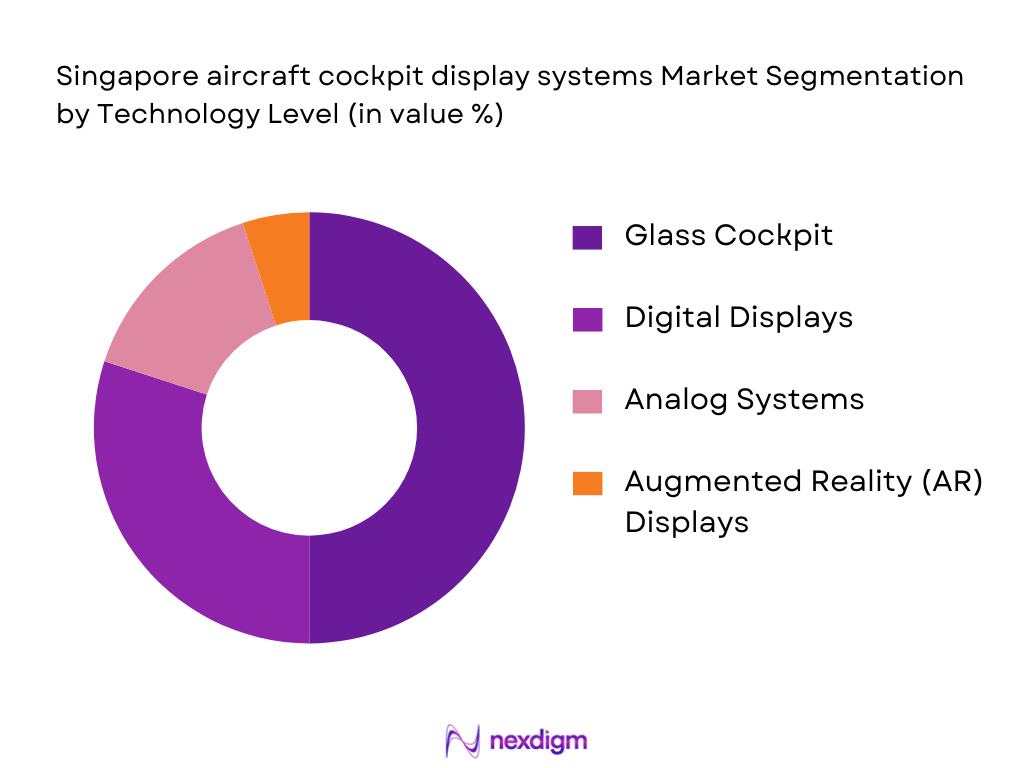

The market is segmented by technology level into analog, digital, glass cockpit, and augmented reality (AR)-based displays. Among these, the glass cockpit segment is the dominant technology in the market. This dominance is driven by its capability to integrate multiple flight functions into a single, cohesive display, offering pilots improved operational efficiency and reduced cockpit clutter. The trend towards digital transformation in aviation has encouraged airlines, especially those based in Singapore, to retrofit their fleets with glass cockpit systems, further boosting their market share.

Competitive Landscape

The Singapore aircraft cockpit display systems market is competitive, with several major players leading the market through innovation, technology, and strong market presence. Key players include global giants like Honeywell Aerospace, Collins Aerospace, and Thales Group, alongside regional players such as Singapore Technologies Engineering.

| Company | Establishment Year | Headquarters | Technology Type | Market Focus | Partnerships | Revenue |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| Singapore Technologies Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ |

Singapore Aircraft Cockpit Display Systems Market Analysis

Growth Drivers

Urbanization

Urbanization plays a pivotal role in the growth of the aircraft cockpit display systems market, particularly in Singapore, where urbanization continues at a rapid pace. The urban population of Singapore stands at approximately ~ million in 2024, contributing to a growing demand for advanced technologies across various sectors, including aviation. The expansion of urban areas increases the demand for more sophisticated infrastructure, such as airports, which directly impacts the demand for cutting-edge avionics technologies. Furthermore, urbanization enhances the demand for air travel, requiring airlines to integrate more advanced cockpit display systems to meet the needs of a growing aviation sector. The rise in passenger traffic, predicted to reach ~ million in 2024, further accelerates the need for next-generation cockpit displays that improve operational efficiency and safety.

Industrialization

Singapore’s industrialization has significantly contributed to the development and adoption of advanced technologies in aviation, including cockpit display systems. The country’s manufacturing sector has consistently grown, with an expected industrial output growth rate of ~ % in 2024. This growth fosters the development of high-tech infrastructure, including aerospace and defense industries, which are key drivers of advanced cockpit display systems in demand. Industrialization results in increased investments in the aviation and defense sectors, necessitating the use of state-of-the-art cockpit display systems for better safety, operational control, and efficiency. The country’s focus on maintaining its status as a global aviation hub is leading to increased procurement of these systems for both commercial and military aircraft.

Restraints

High Initial Costs

The high initial costs of advanced cockpit display systems remain a significant restraint in the growth of the market. These systems require substantial investments in R&D, testing, certification, and installation. In 2024, the estimated cost of retrofitting an aircraft with state-of-the-art cockpit displays can exceed USD ~ million, a factor that limits their widespread adoption, especially for smaller or regional airlines. This cost barrier is often compounded by the additional expenses associated with ensuring compliance with aviation safety and regulatory standards. Despite the long-term operational benefits of these systems, the upfront investment remains a challenge for some operators, particularly in the context of rising global inflationary pressures and tightening aerospace budgets.

Technical Challenges

The technical challenges related to the integration and maintenance of cockpit display systems pose a significant barrier to market expansion. The transition from legacy systems to digital and glass cockpit technologies can be complex and resource-intensive. Many aircraft, particularly older models, require extensive modification and testing to accommodate the latest display technologies. In 2024, over ~ % of Singapore’s commercial airline fleet is still equipped with older analog systems, creating difficulties in integrating newer, more sophisticated displays. The technology upgrade process involves overcoming hurdles such as software compatibility, data synchronization, and training personnel, which can delay the adoption of advanced cockpit systems.

Opportunities

Technological Advancements

Technological advancements in cockpit display systems present substantial opportunities for growth in the market. The integration of augmented reality (AR) and artificial intelligence (AI) into cockpit display systems is currently transforming the aviation industry. For instance, in 2024, AR technologies are enhancing pilots’ situational awareness by overlaying critical information directly onto their field of view, improving both flight safety and efficiency. As of now, more than ~ % of the new aircraft deliveries in Singapore are incorporating AR-based displays. Furthermore, advancements in machine learning algorithms are allowing for predictive maintenance, reducing downtime and increasing operational efficiency. These technological developments create a significant market opportunity by providing a compelling reason for airlines and defense agencies to modernize their avionics systems.

International Collaborations

International collaborations between global aerospace companies and Singapore-based defense and aviation entities create a fertile ground for the adoption of advanced cockpit display systems. Singapore’s strategic partnerships with international companies such as Boeing, Lockheed Martin, and Airbus have already led to collaborative efforts in upgrading the country’s air force and commercial fleet with cutting-edge avionics technologies. With the growing demand for military modernization in the region, such collaborations are expected to increase the procurement of advanced cockpit systems, particularly for defense and commercial aircraft. This trend is evident from Singapore’s increasing defense budget, which is projected to grow by ~ % in 2024, facilitating further investments in avionics. These partnerships also provide opportunities for local technology firms to innovate and enter new markets, increasing the adoption of Singapore-made cockpit technologies across the globe.

Future Outlook

The Singapore aircraft cockpit display systems market is set to experience steady growth over the next five years. Factors such as the ongoing push for modernization in both commercial aviation fleets and military aircraft, as well as the increasing focus on flight safety, are expected to drive this growth. Moreover, advancements in augmented reality and artificial intelligence technology, which promise to further enhance cockpit displays, will also contribute to the market’s positive outlook.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Singapore Technologies Engineering

- Rockwell Collins

- Garmin Ltd.

- Elbit Systems

- Cobham Aviation Services

- Safran Electronics & Defense

- AU Optronics

- Universal Avionics Systems

- L3Harris Technologies

- Panasonic Avionics Corporation

- Mitsubishi Electric

- Siemens AG

Key Target Audience

- Investments and Venture Capitalist Firms

- Aviation Manufacturers

- Aerospace & Defense Contractors

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, Ministry of Defence Singapore)

- Commercial Airlines and Airlines’ Maintenance Teams

- MRO Service Providers

- Military Aviation Units

- Airport Operators and Air Traffic Management Services

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing an ecosystem map of the aircraft cockpit display systems market in Singapore. Desk research is utilized, drawing from secondary and proprietary databases to gather industry-level information, with a focus on identifying the key variables that influence market dynamics such as regulatory standards and technology adoption.

Step 2: Market Analysis and Construction

Historical data is collected to understand the market penetration of cockpit display systems across various aviation sectors in Singapore. The analysis includes assessing the market performance of display types, technology levels, and regional distributions, providing a solid foundation for forecasting future market trends.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts are conducted to validate market hypotheses developed during the initial research phase. This includes conducting interviews with aviation manufacturers, commercial airline operators, and regulatory authorities to refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered insights, including expert interviews and historical data, to create a comprehensive market report. This ensures that the final analysis accurately reflects market conditions and anticipates future trends in the Singapore aircraft cockpit display systems market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Data Collection Framework, Primary & Secondary Research Integration, Singapore Regulatory Data Sources, Forecasting Models, Data Quality Control, Limitations)

- Definition and Scope of Cockpit Display Systems

- Strategic Role in Aviation Safety & Operational Efficiency

- Singapore’s Avionics Ecosystem Context

- Genesis and Evolution

- Singapore Aviation Cluster Development

- Historical Adoption of Digital Cockpits

- Cockpit Display Technology Roadmap

- Business Cycle & Adoption Curve

- Supply Chain & Value Chain Analysis

- Growth Drivers

Flight Safety Prioritization

Digital Cockpit Transition

Fleet Modernization Programs

- Market Restraints

High Certification & Compliance Barriers

R&D Cost Intensity

- Opportunities

AR & AI Display Adoption

Local MRO Growth

Retrofit Demand in ASEAN Ops

- Key Trends

Glass Cockpit Adoption

Light‑Weight Display Tech

Predictive Analytics Capabilities

- Regulatory Landscape

CAAS Certification Requirements

EASA/FAA Alignment

ADS‑B / CNS/ATM Impacts

- SWOT / Ecosystem Mapping

- Porter’s Five Forces

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Display Type (In Value %)

Primary Flight Display (PFD)

Multi‑Functional Display (MFD)

Engine Indicating and Crew Alerting System (EICAS)

Head‑Up Display (HUD))

- By Aircraft Type (In Value %)

Commercial Airline

Military & Defense

Business Aviation

Rotorcraft

UAV/Drone Class

- By System Integration Type (In Value %)

Line‑fit OEM

Retrofit Upgrade

Third‑Party Avionics Integration

- By End User / Operator Class (In Value %)

Full‑Service Carriers

Low‑Cost Carriers

MRO Providers

Defence Wings

- Market Share by Value & Units (Singapore Specific)

- Cross‑Comparison Parameters (Company Profile, Strategic Positioning, Display Tech Breadth, R&D Investment Intensity, Certification Credentials, Supplier/Partner Networks, After‑Sales Support Footprint, Installed Base, Pricing Tier Band, Retrofit vs OEM Focus, Regulatory Compliance Score)

- Detailed Company Profiles

Honeywell Aerospace

Collins Aerospace

Thales Group

Garmin Ltd.

Rockwell Collins (now part of Collins Aerospace)

Airbus Avionics Division

Boeing Avionics / Boeing Displays

Elbit Systems

Cobham Aviation Services

Leonardo S.p.A.

Safran Electronics & Defense

AU Optronics Corp.

Alpine Electronics, Inc.

Universal Avionics Systems Corp

L3Harris Technologies

- Singapore Airlines & Regional Operators Demand Profile

- Military Aviation & Defence Display Requirements

- MRO and Certification Pathways

- Operator Procurement & Decision Frameworks

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035