Market Overview

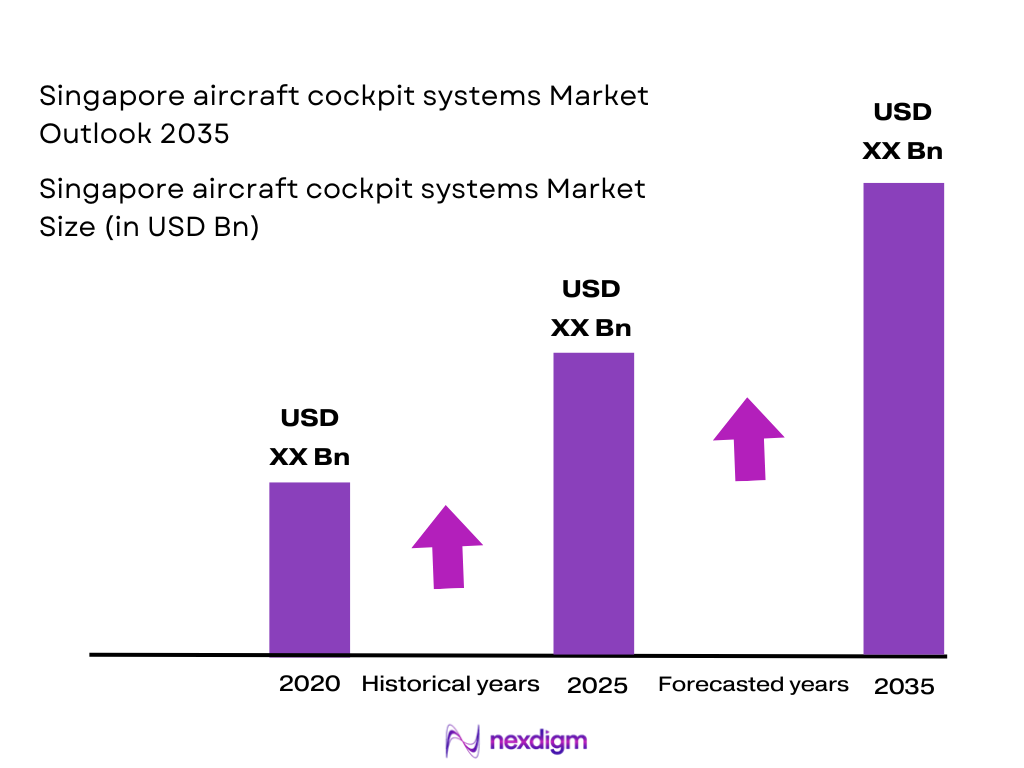

The Singapore Aircraft Cockpit Systems Market is valued at USD ~ billion in 2025, with a steady growth trajectory observed across both commercial and defense aviation sectors. The market is primarily driven by technological advancements in cockpit automation, the growing trend of aircraft fleet modernization, and increased investments in avionics systems by airlines and military operators. Factors such as regulatory requirements, especially in safety and communication standards, are further boosting the market. Additionally, the region’s status as a key hub for aircraft maintenance, repair, and overhaul (MRO) services in Asia contributes to its growth, facilitating the demand for cockpit system upgrades and retrofits.

Singapore is the dominant player in the aircraft cockpit systems market in Southeast Asia. The country’s robust aviation infrastructure, home to one of the busiest international airports in the world, Changi Airport, makes it a vital hub for both commercial and military aviation. Singapore’s strategic location, along with its strong emphasis on aviation technology innovation and certification standards (such as CAAS regulations), positions it as a leader in the market. Additionally, Singapore’s growing MRO services sector and established presence of global aerospace companies ensure its continued dominance.

Market Segmentation

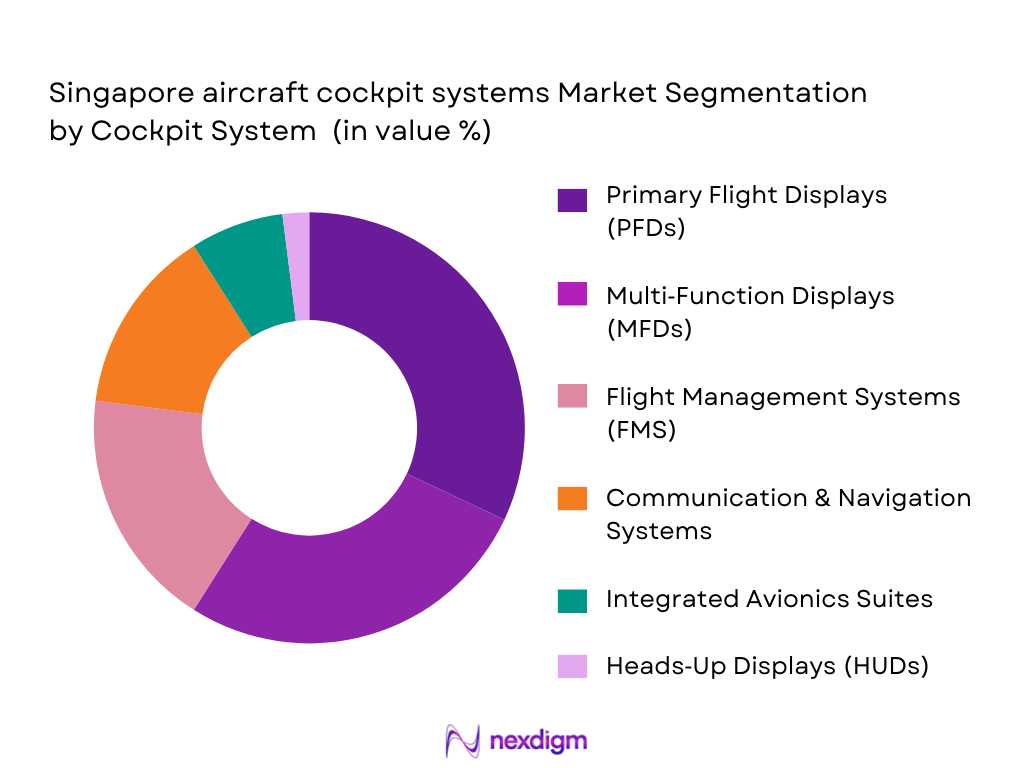

By Cockpit System Type

The Singapore Aircraft Cockpit Systems market is segmented into various cockpit system types, with Primary Flight Displays (PFDs), Multi‑Function Displays (MFDs), Flight Management Systems (FMS), Communication & Navigation Systems, Integrated Avionics Suites, and Heads‑Up Displays (HUDs). Among these, Primary Flight Displays (PFDs) dominate the market share. PFDs are crucial for providing pilots with essential flight data such as altitude, speed, and heading, and have become a standard feature across both commercial and military aircraft in Singapore. The widespread adoption of glass cockpits in modern aviation, which integrates digital displays for easy interpretation of flight parameters, further drives the demand for PFDs.

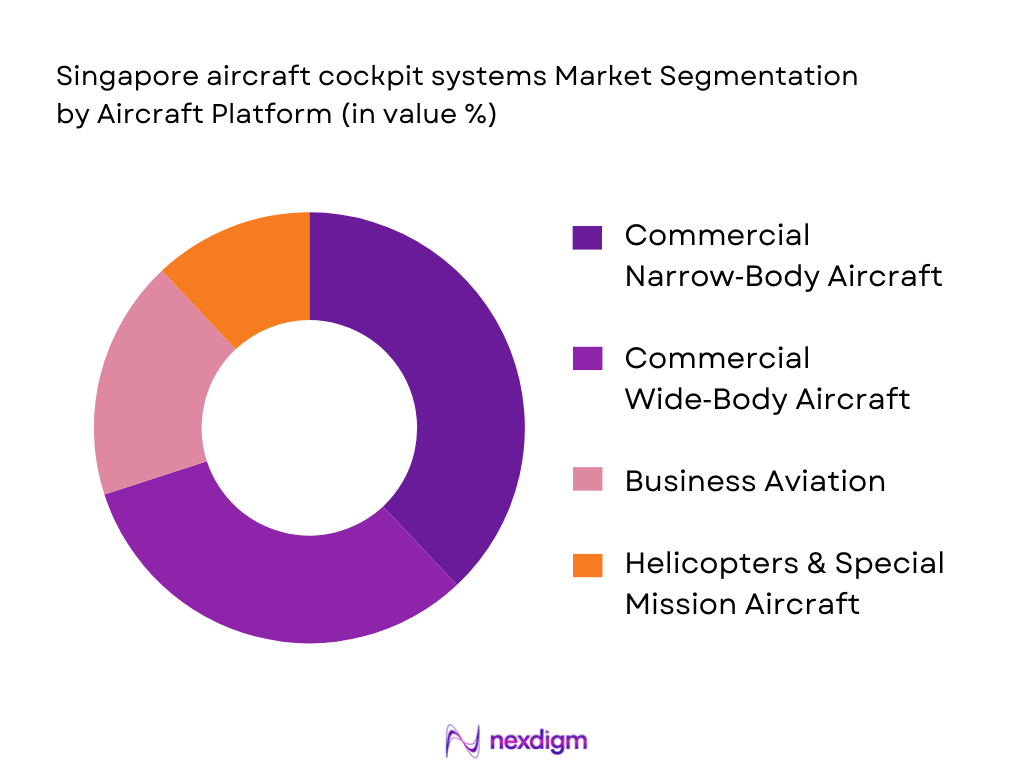

By Aircraft Platform

The market is segmented by aircraft platform into Commercial Narrow‑Body, Commercial Wide‑Body, Business Aviation, and Helicopters & Special Mission Aircraft. Among these, Commercial Narrow‑Body Aircraft lead the segment. These aircraft are widely used for regional flights and short-to-medium-haul routes. The demand for cockpit systems in narrow-body aircraft has risen significantly, driven by airlines upgrading their fleets with more efficient, next-gen cockpit technology to enhance safety and operational efficiency. Narrow-body aircraft are prevalent in Asia-Pacific, making this segment a dominant contributor to the region’s aviation infrastructure.

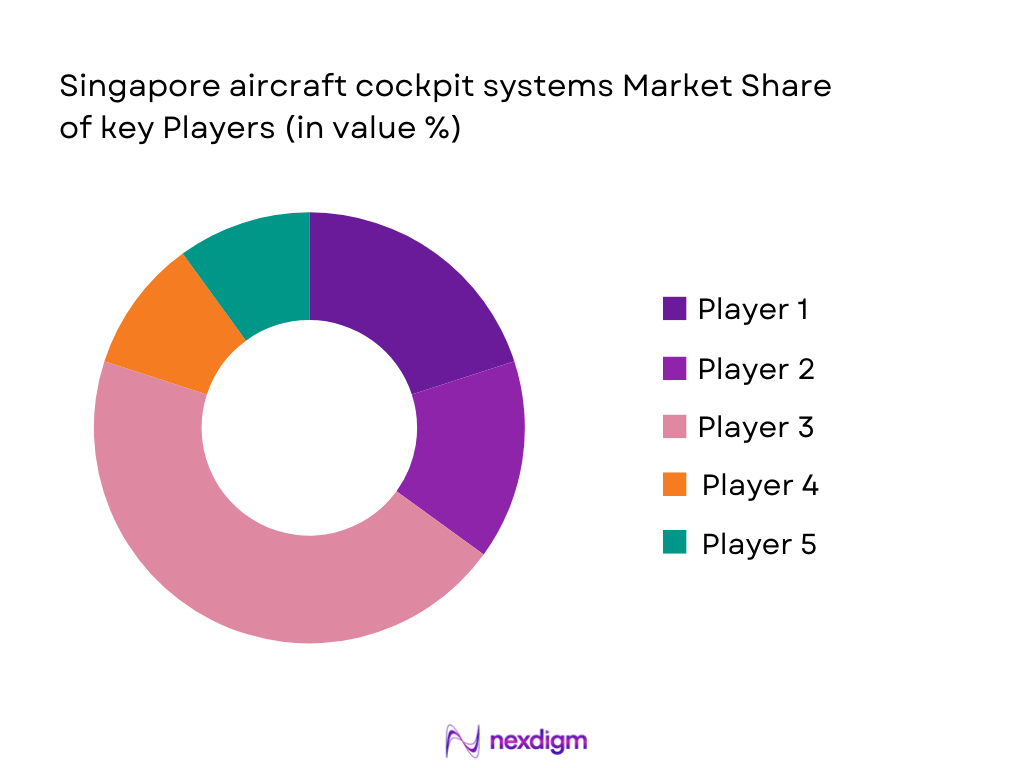

Competitive Landscape

The Singapore Aircraft Cockpit Systems market is competitive, with a few key players dominating the industry. Major global companies, including Honeywell, Collins Aerospace, and Thales, have a significant presence in the market. These players are engaged in continuous product innovation and system integration to meet the evolving needs of the aviation sector. The market also sees a strong local presence in the form of MRO providers and smaller system integrators, further fueling competition.

| Company | Year Established | Headquarters | Technological Expertise | R&D Investment | Market Presence | Revenue |

| Honeywell Aerospace | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1933 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Olathe, USA | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | Melbourne, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Cockpit Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in Singapore continues to fuel aviation demand, indirectly supporting the cockpit systems market through increased air traffic and aircraft utilization. Singapore’s population is approximately ~, with an annual population growth rate of ~ %. An expanding urban population stimulates higher demand for air connectivity, as seen with ~ million passenger movements at Changi Airport, up from~ million. This rise in passenger volumes escalates aircraft flight cycles and fleet utilization, reinforcing demand for advanced, reliable cockpit avionics systems to support operational efficiency and safety in one of the world’s busiest air transport hubs.

Industrialization

Industrialization in Singapore significantly underpins aviation infrastructure development, benefiting cockpit systems demand through mature aerospace and logistics capabilities. Singapore’s aviation industry sustains considerable economic importance, contributing about ~ % of the nation’s GDP, supported by world-class facilities linking to ~ cities with more than ~ weekly flights. Changi Airport processed 2 million tonnes of cargo in 2025, signaling strong industrialized logistics and cargo systems activity. Industrial growth boosts demand for aircraft operations, increasing avionics system adoption, including cockpit upgrades and retrofits to ensure efficient navigation, communication, and flight management across expanding commercial and freight routes.

Restraints

High Initial Costs

High initial costs of advanced cockpit systems restrain rapid adoption among smaller operators, especially within Singapore’s aviation ecosystem. Modern avionics suites often incorporate sophisticated displays, cameras, and integrated flight systems, each requiring extensive certification and testing before deployment. These systems demand significant upfront capital, which can be burdensome for carriers and MRO firms with limited financial flexibility. For example, large airports such as Changi saw ~ million passengers in 2025, increasing operational tempo and necessitating high reliability from avionics—but also higher corresponding investment for upgrades and lifecycle support.

Technical Challenges

Technical challenges in integrating advanced cockpit systems pose a meaningful restraint in the Singapore aviation market. As Singapore’s aviation sector recovers and expands—evident in Changi Airport’s ~ aircraft movements in 2025—airlines and MRO service providers must manage system interoperability across diverse aircraft platforms. Each avionics suite upgrade requires precise calibration with existing aircraft systems, extensive testing, thorough certification through bodies like CAAS, and alignment with global safety standards.

Opportunities

Technological Advancements

Technological advancements present a major opportunity for the Singapore Aircraft Cockpit Systems market as airlines and MRO providers adopt next‑generation avionics solutions. The broader Asia Pacific aerospace avionics market is valued at USD ~ billion in 2025, with increasing integration of systems such as flight management, navigation, and communication technologies—components critical to cockpit systems. These technologies improve flight safety, situational awareness, and operational efficiency, directly aligning with Singapore’s aviation requirements as a global connectivity hub.

International Collaborations

International collaborations offer significant opportunities for expanding cockpit systems capabilities within Singapore’s aviation ecosystem. Partnerships between Singaporean entities like BOC Aviation and global OEMs highlight such strategic cooperation; BOC Aviation manages ~ aircraft and has ordered~ new aircraft from Boeing and Airbus to expand its global footprint. These collaborative engagements enhance technical transfer, resource sharing, and joint development of cockpit technologies that meet diverse regulatory and operational requirements.

Future Outlook

Over the next five years, the Singapore Aircraft Cockpit Systems market is poised for steady growth. This is driven by the continuous modernization of commercial and defense aircraft fleets, increasing demand for integrated avionics solutions, and the rising adoption of digital cockpit technologies, such as glass cockpits and AI-enhanced avionics systems. Additionally, the growing emphasis on safety and situational awareness, combined with advancements in communication and navigation technologies, will further fuel the demand for cockpit systems in the region.

Major Players in the Market

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Garmin Ltd.

- L3Harris Technologies

- Rockwell Collins

- Safran

- Elbit Systems

- Northrop Grumman

- Raytheon Technologies

- Panasonic Avionics

- Lockheed Martin

- BAE Systems

- Airbus Avionics

Boeing Avionics Solutions

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore [CAAS], Ministry of Defence Singapore)

- Airline Fleet Operators

- Defense and Military Aviation Authorities

- Original Equipment Manufacturers (OEMs)

- MRO Service Providers

- Aerospace Component Suppliers

- Aircraft Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables influencing the Aircraft Cockpit Systems Market in Singapore, including technological advancements in avionics, demand drivers from commercial and military aviation, and regulatory changes. Data is sourced through secondary research using industry reports, regulatory guidelines, and proprietary databases.

Step 2: Market Analysis and Construction

This step focuses on analyzing historical data, such as past market trends, adoption rates of new cockpit technologies, and historical sales. We gather insights on OEM sales volumes, MRO activities, and product integration to assess the market’s growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the future direction of cockpit systems adoption and key technological trends are validated through consultations with industry experts, including representatives from aircraft manufacturers, cockpit system suppliers, and MRO specialists.

Step 4: Research Synthesis and Final Output

The final phase involves compiling and synthesizing all collected data, including expert insights and validated data points, to create an accurate and comprehensive market analysis. We cross-reference findings from primary and secondary research to ensure a robust and reliable report.

- Executive Summary

- Research Methodology (Market Definitions & Scope (cockpit systems, avionics subsystems), Data Sources (flight‑operations data, OEM sales, civil and military aviation fleet data), Abbreviation Index, Research & Forecasting Framework (quantitative + qualitative triangulation), Primary & Secondary Research Protocols, Data Validation & Confidence Levels)

- Industry Definition & Cockpit Systems Scope

- Singapore Aviation Ecosystem Overview

- Value Chain & Supply Network (OEMs → Tier‑1 suppliers → MRO channels)

- Regulatory & Certification Landscape (CAAS, EASA, FAA relevance)

- Technology Maturity & Ecosystem Dynamics (glass cockpits, integrated avionics)

- Growth Drivers

Fleet modernization & avionics lifecycle upgrades

Demand for situational awareness & safety enhancement

Singapore as a regional MRO hub

- Challenges

High certification & integration costs

Complex interoperability requirements

Cybersecurity and avionics data integrity compliance

- Opportunities

AI/ML cockpit algorithm adoption

Aftermarket services & predictive health monitoring

Component localization & aerospace clusters

- Trends

Glass cockpit standardization

Integrated flight decks

Digital twin & simulator‑linked avionics testing

- Porter’s Five Forces

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- Market Shares – Cockpit Systems Revenue & Installed Base

- Cross‑Company Comparative Parameters (Revenue by cockpit segment (displays, FMS, nav/comm), Installed base (units across Singapore fleets), Certification & compliance footprint, R&D & integration capability, Aftermarket & MRO service network, Preferred OEM relationships (airlines & defense), Interoperability standards supported, Cybersecurity & avionics resilience scores)

- Company SWOT Profiles

- Cockpit System Pricing Benchmarks

- Detailed Competitive Profiles

Honeywell Aerospace (Avionics & Integrated Systems)

Collins Aerospace (RTX)

Thales Group

Garmin Ltd.

Safran (Optics & Displays)

L3Harris Technologies

Panasonic Avionics

Elbit Systems

Northrop Grumman

Cobham (CAE Avionics)

Rockwell Collins (UTC legacy)

Boeing Avionics Solutions

Airbus Avionics Division

Spectrum Avionics Solutions

Singapore local/ regional integrators & MRO avionics specialists

- Fleet avionics demand profiles by airline type

- Budgeting & procurement cycles (retrofitting vs new build)

- Decision drivers & pain point analysis

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035