Market Overview

The Singapore Aircraft Communication Systems market is valued at approximately USD ~ billion, driven by increasing air traffic and government spending on defense and aviation infrastructure. The market’s growth is largely influenced by advancements in communication technologies and the modernization of air fleets. With a strong demand for seamless in-flight connectivity and the rise of satellite communication systems, the market continues to expand. Government policies in Singapore have also played a pivotal role, particularly in terms of aviation regulations and defense contracts. As air traffic increases in Southeast Asia, the demand for advanced communication systems is expected to rise significantly, fostering further market growth.

Singapore stands out as a dominant player in the Aircraft Communication Systems market due to its strategic geographical location in Southeast Asia and its robust aviation infrastructure. As one of the leading air travel hubs, Singapore’s Changi Airport is a key catalyst for the demand for advanced communication systems. The country is also home to global aviation players and has a well-established regulatory framework that encourages investment in modern communication technologies. Additionally, Singapore’s significant military expenditure drives the demand for high-end communication systems, as the nation continually upgrades its air defense capabilities.

Market Segmentation

By System Type

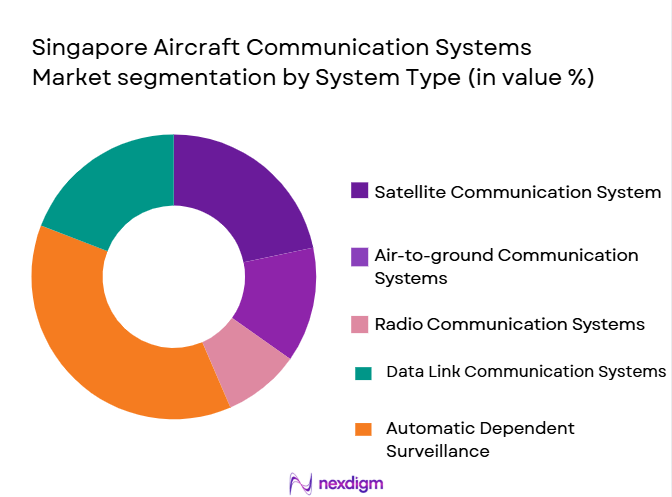

The Singapore Aircraft Communication Systems market is segmented into several system types, including Satellite Communication Systems, Air-to-Ground Communication Systems, Radio Communication Systems, Data Link Communication Systems, and Automatic Dependent Surveillance–Broadcast (ADS-B) Systems. Among these, Satellite Communication Systems dominate the market due to their ability to provide continuous and global communication capabilities, which is crucial for both military and commercial aviation. As airlines and military operators seek reliable and secure communication channels across vast distances, satellite systems have become increasingly essential. Furthermore, the integration of satellite communication into aircraft systems allows for enhanced passenger services, making them a preferred choice for airlines focused on improving in-flight experiences.

By Platform Type

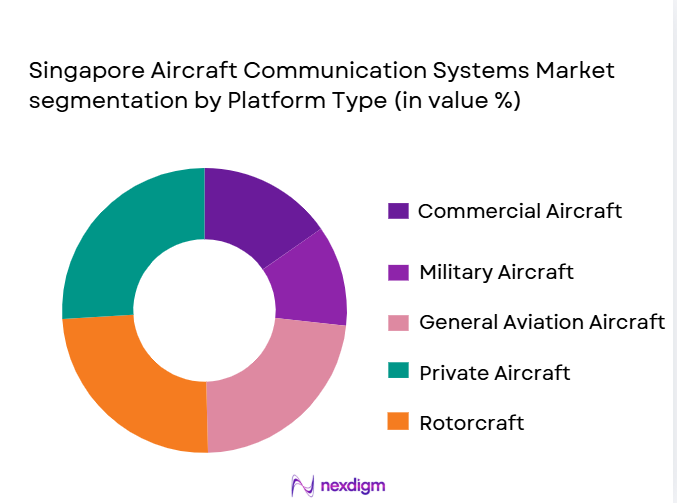

The market is segmented by platform type into Commercial Aircraft, Military Aircraft, Cargo Aircraft, Helicopters, and Drones. Among these, Commercial Aircraft holds the dominant market share, driven by the constant growth in passenger air traffic and the need for reliable communication systems to ensure safety, efficiency, and enhanced passenger experiences. As airlines focus on upgrading their fleets to meet modern safety standards and offer better services, communication systems for commercial aircraft are continuously evolving to include technologies such as satellite communication and data link systems. Additionally, global connectivity demands and regulatory requirements for real-time communication systems further contribute to the dominance of this segment in the market.

Competitive Landscape

The Singapore Aircraft Communication Systems market is dominated by a few key players, including multinational companies like Honeywell Aerospace, Rockwell Collins, and Thales Group, as well as regional players who cater to local defense and aviation needs. The market is characterized by high barriers to entry, with significant investment required for research and development and long sales cycles due to the complex integration of communication systems into aircraft. The consolidation of industry leaders and their strong partnerships with aircraft manufacturers has cemented their position as dominant players. Companies are competing to innovate by providing more advanced communication systems, such as satellite-based connectivity and data exchange platforms that enable real-time information sharing.

| Company Name | Establishment Year | Headquarters | R&D Investment | Technological Leadership | Market Presence | Key Products | Global Reach |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 2002 | United States | ~ | ~ | ~ | ~ | ~ |

| Cobham | 1934 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Communication Systems Market Analysis

Growth Drivers

Increased defense spending by Israel and allied nations

Israel’s significant investment in defense, coupled with the growing defense budgets of allied nations, directly fuels the demand for advanced man-portable military electronics. These countries prioritize military modernization, which boosts the market for innovative electronics, enhancing communication, surveillance, and targeting capabilities.

Technological advancements in communication and surveillance systems

Continuous advancements in communication and surveillance technologies drive the demand for more sophisticated man-portable military electronics. Breakthroughs in secure communication, real-time data transfer, and improved surveillance systems have become crucial for military operations, particularly in combat environments, further bolstering market growth.

Market Challenges

High cost of advanced systems and integration complexity

The high price of cutting-edge man-portable military electronics, coupled with the complexity of system integration, poses a significant challenge. These systems require specialized components and technologies, which increases costs and complicates the integration process within existing military infrastructures, limiting broader adoption.

Regulatory and certification challenges for new technologies

New technologies in military electronics face stringent regulatory requirements and lengthy certification processes, which can delay market entry. The need for compliance with international defense standards and certifications creates barriers, slowing the pace at which advanced systems can be deployed by military forces.

Market Opportunities

Adoption of AI and machine learning for system enhancements

The integration of artificial intelligence (AI) and machine learning (ML) into man-portable military electronics presents opportunities for significant system enhancements. These technologies can improve operational efficiency, enable predictive maintenance, and enhance real-time decision-making, offering a competitive edge in modern military operations.

Expansion of portable systems for emerging markets

The expansion of portable military systems into emerging markets presents a growth opportunity. As these regions increase defense spending, the demand for cost-effective, portable military solutions that provide versatility and mobility in varied combat situations is growing, opening new avenues for market penetration.

Future Outlook

Over the next decade, the Singapore Aircraft Communication Systems market is expected to experience steady growth, primarily driven by the increasing demand for advanced in-flight connectivity and communication solutions in both commercial and military sectors. Continuous technological advancements, such as high-speed satellite communication, real-time data transmission, and the integration of artificial intelligence in communication systems, will be key factors influencing the market’s development. Furthermore, the modernization of aircraft fleets, both commercial and military, and rising air traffic in the Asia-Pacific region will continue to push the demand for sophisticated communication systems. Additionally, government initiatives aimed at enhancing defense capabilities in Singapore will further stimulate growth in the defense segment of the market.

Major Players

- Honeywell Aerospace

- Rockwell Collins

- Thales Group

- L3 Technologies

- Cobham

- Garmin

- Satcom Direct

- Raytheon Technologies

- Inmarsat

- Viasat

- Airbus

- Boeing

- Radiosistemi

- Elbit Systems

- SITA

Key Target Audience

- Aircraft Manufacturers (e.g., Boeing, Airbus)

- Airlines and Airline Operators

- Military Defense Agencies (e.g., Singapore Ministry of Defense)

- Aviation Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

- Investment and Venture Capitalist Firms

- Government Agencies (e.g., Singapore Civil Aviation Authority, Ministry of Defense)

- Defense Contractors (e.g., Lockheed Martin, Northrop Grumman)

- Airport Authorities (e.g., Changi Airport Group)

Research Methodology

Step 1: Identification of Key Variables

The first step of the research methodology involves creating an ecosystem map that identifies the primary stakeholders within the Singapore Aircraft Communication Systems market. This process combines secondary data analysis with proprietary databases to gather detailed information on key market drivers, challenges, and segmentation variables.

Step 2: Market Analysis and Construction

During this phase, historical data relating to the market’s growth, regional demand, and technological trends will be assessed. An analysis of the communication system adoption rate among commercial and military platforms will be conducted, focusing on key suppliers and the competitive landscape to derive insights that will shape market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated based on secondary research and expert insights. These hypotheses will then be validated through consultations with industry professionals via in-depth interviews and surveys with key stakeholders, such as aircraft manufacturers and military decision-makers.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing all gathered data and analyzing the validated hypotheses to generate a comprehensive report. This will include an assessment of future market trends, technological advancements, and the influence of regulatory frameworks on market dynamics. All data will be cross-checked for accuracy and reliability before the final output is produced.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of commercial aviation in Asia-Pacific

Technological advancements in in-flight communication systems

Government initiatives for modernization of military aircraft - Market Challenges

High cost of advanced communication systems

Regulatory complexities and compliance issues

Limited infrastructure for supporting advanced systems in emerging regions - Market Opportunities

Increased demand for in-flight connectivity services

Emerging markets adoption of advanced communication systems

Growing trend of aircraft fleet modernization - Trends

Shift toward integrated communication systems for air traffic control

Increasing integration of satellite and air-to-ground communication

Adoption of autonomous communication systems in aircraft

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2019-2025

- By Installed Units, 2019-2025

- By Average System Price, 2019-2025

- By System Complexity Tier, 2019-2025

- By System Type (In Value%)

Satellite Communication Systems

Air-to-ground Communication Systems

Radio Communication Systems

Data Link Communication Systems

Automatic Dependent Surveillance–Broadcast (ADS-B) Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Cargo Aircraft

Helicopters

Drones - By Fitment Type (In Value%)

Retrofit Systems

Linefit Systems

OEM Systems

Custom Installations

Standard Installations - By EndUser Segment (In Value%)

Airlines

Government/Military

Airports

Private Operators

Aerospace & Defense Contractors - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Procurement via Third-party Integrators

Government/Defense Procurement

OEM Partnerships

Aftermarket Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, System Type, Procurement Channel, Regional Demand, Platform Type Product Certification & Regulatory Compliance Level, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Rockwell Collins

Thales Group

L3 Technologies

Garmin

Satcom Direct

Raytheon Technologies

Cobham

SITA

Viasat

Inmarsat

Airbus

Boeing

Radiosistemi

Elbit Systems

- Rising demand for real-time communication in military operations

- Airlines investing in advanced passenger connectivity systems

- Private operators seeking cost-effective communication solutions

- Growth in airport communication infrastructure to support expansion

- Forecast Market Value, 2026-2030

- Forecast Installed Units, 2026-2030

- Price Forecast by System Tier, 2026-2030

- Future Demand by Platform, 2026-2030