Market Overview

The Singapore Aircraft Computers market is valued at approximately USD ~ billion, with a strong growth trajectory supported by robust demand from the aviation sector. The market is primarily driven by factors such as advancements in aviation technology, the increasing need for automation in aircraft, and ongoing modernization programs in both commercial and military aircraft fleets. Technological advancements, such as the adoption of AI, machine learning, and data analytics, are crucial in driving the market forward. The demand for enhanced avionics and more efficient aircraft systems is evident in the growing number of aircraft deliveries, particularly in the Asia Pacific region, where Singapore serves as a key hub for aerospace innovation

Singapore is a dominant player in the aircraft computer market, due to its strategic location as a regional hub for aerospace technology and aviation. The country’s strong infrastructure, coupled with government support for aerospace innovations, has attracted several leading global aircraft manufacturers and suppliers. Additionally, Singapore’s highly developed aviation industry, with key players such as Singapore Airlines, and its focus on upgrading both commercial and military aircraft fleets, has made it a center of growth for the aircraft computer market in Southeast Asia. Its advanced research and development capabilities in avionics systems further contribute to its dominance in the market.

Singapore Aircraft Computers Market Segmentation

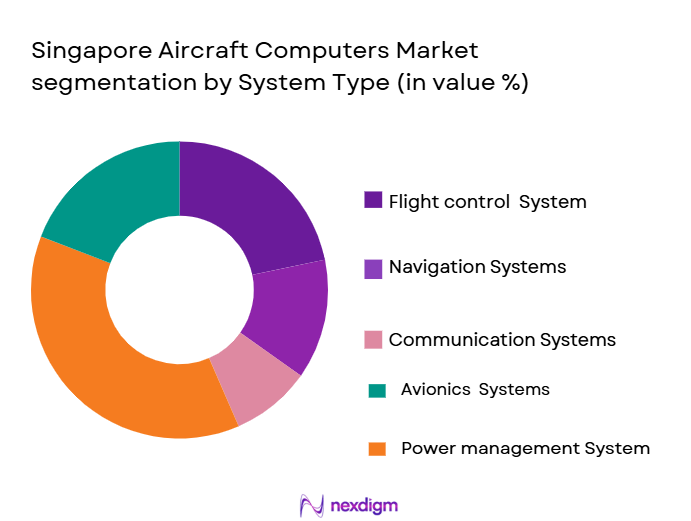

By System Type

The Singapore Aircraft Computers market is segmented by system type into Flight Management Systems (FMS), Navigation Systems, Communication Systems, Radar Systems, and Power Distribution Systems. Among these, Flight Management Systems (FMS) dominate the market share. This is due to the increasing adoption of integrated avionics solutions in both commercial and military aircraft, as airlines and defense contractors seek more efficient flight operations. FMS are essential for route planning, fuel management, and navigation, making them an indispensable component in modern aircraft. The rising demand for automation and the need for precise flight control systems continue to bolster the dominance of FMS in the market.

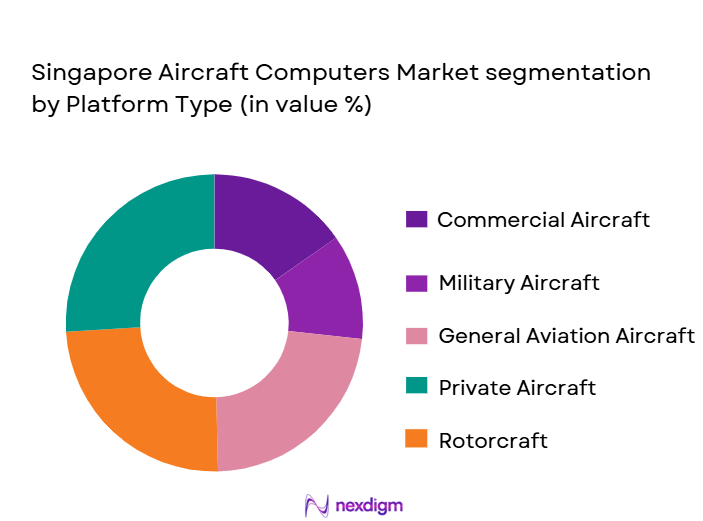

By Platform Type

The market is also segmented by platform type, including Commercial Aircraft, Military Aircraft, Unmanned Aerial Vehicles (UAVs), Regional Aircraft, and Helicopters. The Commercial Aircraft segment holds the largest market share, driven by the increasing air passenger traffic and the constant need for aircraft upgrades and fleet modernization. Airlines across the world, particularly in the Asia Pacific region, are investing heavily in new aircraft with advanced avionics to enhance operational efficiency and reduce costs. The increasing demand for long-haul flights and the growth of low-cost carriers also contribute to the dominance of the Commercial Aircraft segment in the aircraft computer market.

Competitive Landscape

The Singapore Aircraft Computers market is highly competitive, with a blend of local and international players. Major global players, such as Thales Group, Honeywell Aerospace, Rockwell Collins, and Safran Electronics & Defense, dominate the market due to their established expertise in avionics and integrated systems. Their strong presence in both commercial and military sectors, coupled with ongoing research and development investments, places them at the forefront of the market. Additionally, local manufacturers and service providers contribute significantly to the market, offering customized solutions tailored to the specific needs of Southeast Asian airlines and defense contractors.

| Company | Establishment Year | Headquarters | R&D Investment | Technological Capabilities | Product Portfolio | Market Reach | Strategic Partnerships |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| General Electric Aviation | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Computers Market Dynamics

Growth Drivers

Increasing demand for automation and advanced avionics in aircraft

In 2024, global air passenger traffic reached approximately ~ billion passengers, surpassing pre‑pandemic levels, reflecting intensified aircraft operations and demand for automation systems onboard to handle higher traffic and safety requirements. Airlines and airports recorded record traffic and load factors of ~ % seat capacity utilization, necessitating advanced flight management computers and avionics upgrades to improve efficiency and reliability. This growth in traffic and utilization directly strengthens the demand for digital avionics, onboard automation, and flight control computing systems that support complex schedules and high‑density operations.

Rising air passenger traffic and demand for new aircraft

Singapore’s aviation ecosystem is part of a larger Asia‑Pacific traffic surge with Asia Pacific carriers carrying ~ million international passengers in 2024, a substantial number reflecting expansion of international routes and airline operations. In addition, Singapore’s flag carrier group (Singapore Airlines and Scoot) transported ~ million passengers in FY2024/25, the highest in its history, reflecting strong growth in both short‑haul and long‑haul traffic. The volume of passengers directly escalates fleet utilization, accelerating aircraft procurement and retrofits that integrate modern onboard computers and avionics to handle increased operational complexity.

Government and military investments in advanced aviation technologies

In 2024, total military spending in Asia and Oceania reached $~ billion, of which a substantial portion enabled acquisition and modernization of advanced aircraft and systems. Japan alone allocated over ¥ ~ billion (≈ $~ million) in procurement budgets for F‑35 fighter aircraft in 2024, indicating sustained government investments into technologically advanced platforms that require highly integrated onboard computer and avionics systems. Singapore’s strategic focus on defense modernization, including exercises involving over~ aircraft from multiple nations in exercises like Exercise Tarang Shakti, signals regional defense collaboration and capability upgrades that depend on advanced avionics and computing systems.

Market Challenges

High initial cost of advanced aircraft computer systems

Deploying state‑of‑the‑art computing and avionics platforms involves high entry costs, often correlated with the number of flight hours and utilization of intensities. For example, airlines globally filled ~ % of available seats in 2024, necessitating reliable and sophisticated avionics and flight management systems to sustain operations at this utilization level without increasing delays or safety risks. While enhanced onboard computers improve performance, the financial burden on airline operators is magnified by the requirement to budget for these systems alongside fuel and crew costs under tight profit margins, especially in a year where global traffic was ~% above 2023 levels.

Complexity in integrating advanced systems with legacy aircraft

The resurgence to ~ billion passengers globally in 2024 means airlines operate mixed fleets of legacy and modern aircraft. Integrating advanced flight computers with older platforms presents technical challenges because older electrical architectures were not designed for high‑bandwidth avionics integration. This complexity extends to certification requirements, extensive retrofits, and extended aircraft downtime, especially given the diverse fleet compositions among carriers serving Asia‑Pacific hubs like Singapore.

Market Opportunities

Growth in demand for electric and hybrid aircraft

The global more electric aircraft segment was valued at USD ~ billion in 2024, underscoring tangible commercial interest in electrical propulsion integration that demands advanced onboard computing systems to manage power distribution, diagnostics, and control architecture. Singapore’s strategic position as a regional aviation hub, combined with this global electrification trend, suggests potential opportunities for avionics suppliers to support next‑generation hybrid/electric platforms that improve fuel efficiency and reduce emissions while enhancing digital flight control capabilities.

Opportunities in Asia Pacific for military aircraft upgrades

Asia‑Pacific continues to be a priority region for military investments, with total regional defense spending reaching $~ billion in 2024, indicating strong fiscal support for advanced aircraft acquisition and upgrades. As nations replace aging fleets with modern fixed‑wing and multirole platforms, Singapore’s aerospace ecosystem can capture opportunities to provide integrated avionics and aircraft computing systems tailored to regional defense requirements, including interoperability, situational awareness, and networked operations.

Future Outlook

Over the next decade, the Singapore Aircraft Computers market is poised for substantial growth. The increase in aircraft production, the rising number of air travelers, and the continuous demand for modern, energy-efficient avionics systems will drive the market forward. Furthermore, advancements in artificial intelligence (AI) and machine learning will play a pivotal role in enhancing the capabilities of aircraft computers. As countries in the Asia-Pacific region focus on upgrading their military fleets and aviation infrastructure, Singapore’s strategic position will continue to fuel its leadership in the market. By 2035, the market is expected to reach a much larger valuation, with significant innovations in avionics technology transforming the landscape of aviation

Major Players

- Thales Group

- Honeywell Aerospace

- Rockwell Collins

- Safran Electronics & Defense

- General Electric Aviation

- Garmin Ltd.

- Boeing

- L3 Technologies

- Cobham PLC

- Sierra Nevada Corporation

- Bae Systems

- Esterline Technologies

- Rheinmetall

- Curtiss-Wright

- United Technologies Corporation

Key Target Audience

- Airlines and Aircraft Operators

- Defense Contractors (e.g., Singapore Ministry of Defense)

- Original Equipment Manufacturers (OEMs)

- Aviation Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

- Government and Regulatory Bodies (e.g., Ministry of Transport)

- Aerospace & Defense Technology Providers

- Investments and Venture Capitalist Firms

- Aircraft Fleet Maintenance Service Providers

Research Methodology: Singapore Aircraft Computers Market

Step 1: Identification of Key Variables

In this phase, an ecosystem map will be created, including all significant stakeholders in the Singapore Aircraft Computers market. Secondary research will be performed using proprietary databases to gather comprehensive information, focusing on technological trends, aircraft fleet size, and government policies influencing the market.

Step 2: Market Analysis and Construction

We will compile and analyze historical data for the aircraft computers market in Singapore, evaluating key market drivers such as aircraft production rates, fleet upgrades, and aviation industry regulations. Our analysis will incorporate data on aircraft deliveries, avionics system trends, and the competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts, including executives from leading aerospace companies, aviation authorities, and manufacturers. This step will ensure the accuracy of the data, particularly regarding market growth and the role of technological innovation in the sector.

Step 4: Research Synthesis and Final Output

The final phase will involve collaboration with aviation manufacturers and other stakeholders to gain detailed insights into product segment performance, consumer preferences, and market dynamics. This will ensure the most accurate and comprehensive final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for automation and advanced avionics in aircraft

Rising air passenger traffic and demand for new aircraft

Government and military investments in advanced aviation technologies - Market Challenges

High initial cost of advanced aircraft computer systems

Complexity in integrating advanced systems with legacy aircraft

Regulatory challenges in aircraft certification and system compliance - Market Opportunities

Growth in demand for electric and hybrid aircraft

Opportunities in Asia Pacific for military aircraft upgrades

Development of AI-based systems for enhanced aircraft performance - Trends

Adoption of machine learning and AI in aircraft systems

Growth of unmanned aircraft systems (UAS) and drone markets

Shift towards environmentally sustainable aviation technologies

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Management Systems

Navigation Systems

Communication Systems

Radar Systems

Power Distribution Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Unmanned Aerial Vehicles (UAVs)

Regional Aircraft

Helicopters - By Fitment Type (In Value%)

Linefit

Retrofit

OEM

Aftermarket

MRO (Maintenance, Repair, and Overhaul) - By EndUser Segment (In Value%)

Airlines

Defense Contractors

OEM Manufacturers

Aerospace & Aviation Service Providers

Government and Regulatory Bodies - By Procurement Channel (In Value%)

Direct Purchase

Indirect Purchase

Online Procurement

Third-Party Suppliers

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (System complexity, fitment type, market value, platform type, procurement channel Product Certification & Regulatory Compliance Level, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

Honeywell Aerospace

Rockwell Collins

Safran Electronics & Defense

General Electric Aviation

Garmin Ltd.

Boeing

L3 Technologies

Cobham PLC

Sierra Nevada Corporation

Bae Systems

Esterline Technologies

Rheinmetall

Curtiss-Wright

United Technologies Corporation

- Airlines investing in next-generation avionics systems for efficiency

- Defense contractors focusing on upgrading military aircraft computers

- OEM manufacturers emphasizing integration of cutting-edge avionics technologies

- Aerospace service providers seeking cost-effective systems for fleet maintenance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System, Tier 2026-2035

- Future Demand by Platform, 2026-2035