Market Overview

The Singapore Aircraft Control Surfaces market is valued at approximately USD ~ billion, driven by increasing demand for more advanced and efficient flight control technologies in the aviation sector. The market has witnessed consistent growth as commercial aviation continues to expand, and the aviation industry’s push for fuel efficiency and reduced emissions influences innovation in aircraft control systems. These systems, which include flight control surfaces, are integral in enhancing the operational safety and performance of both commercial and military aircraft. The market is further fueled by rising air travel demand, the introduction of new aircraft models, and a growing emphasis on aircraft upgrades and retrofits.

Singapore is a dominant player in the Asia-Pacific aircraft control surfaces market due to its strategic position as a global aviation hub. The country is home to a strong aerospace and defense sector, bolstered by government initiatives such as the Singapore Aerospace Program, which promotes the development of aviation technologies. Additionally, neighboring countries with significant military and civil aviation sectors, including Malaysia and Indonesia, also contribute to the regional dominance. Singapore’s role as a key maintenance, repair, and overhaul (MRO) center and its growing aerospace manufacturing capabilities solidify its prominence in the market.

Market Segmentation

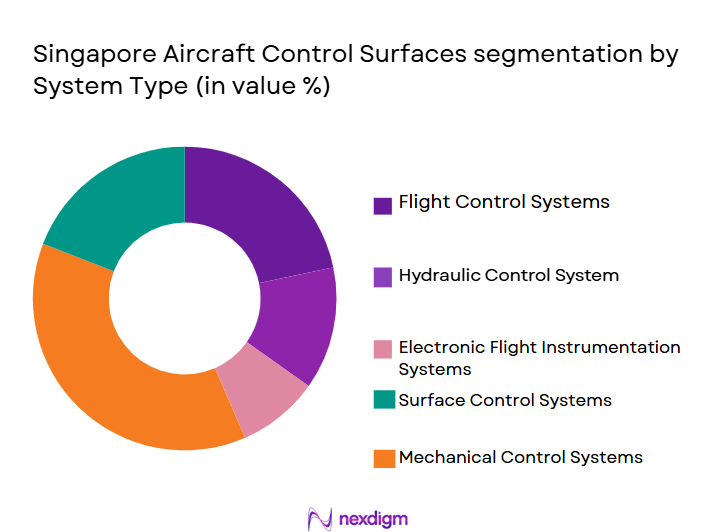

By System Type

The Singapore Aircraft Control Surfaces market is segmented by system type, which includes categories such as flight control systems, hydraulic control systems, electronic flight instrumentation systems, surface control systems, and mechanical control systems. Among these, flight control systems hold the largest market share due to their critical role in aircraft safety and performance. These systems are integral to managing the aerodynamic forces acting on the aircraft, ensuring stability and maneuverability. As newer aircraft models are introduced, the demand for advanced, more reliable flight control systems continues to rise, especially in commercial and military applications.

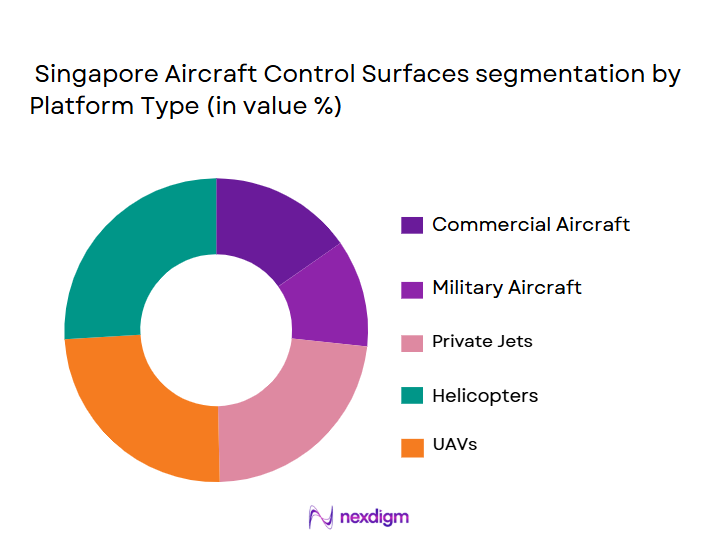

By Platform Type

In the Singapore Aircraft Control Surfaces market, platform type is a crucial segment, divided into commercial aircraft, military aircraft, private aircraft, regional aircraft, and unmanned aircraft systems (UAS). Commercial aircraft dominate this segment due to the global expansion of air travel and the need for new, fuel-efficient, and safer aircraft. With airlines operating newer fleets of wide-body and narrow-body aircraft, the demand for advanced control surfaces has surged. Military aircraft are also a significant contributor, driven by defense budgets and the modernization of existing fleets.

Competitive Landscape

The Singapore Aircraft Control Surfaces market is dominated by a few major players, which include global aerospace companies and specialized manufacturers. These players focus on innovation and technological advancements to capture a larger share of the market. Key players such as Rolls-Royce and Safran have established strong positions in both the commercial and military aircraft sectors. They leverage their advanced R&D capabilities to provide high-performance and reliable aircraft control surfaces. Additionally, the market has seen increased collaboration between local manufacturers and global aerospace firms, enhancing technological expertise and production capabilities.

| Company | Establishment Year | Headquarters | Annual Revenue | Market Focus | Key Products | R&D Investment | Global Presence | Production Facilities |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore aircraft control surfaces Market Dynamics

Growth Drivers

Increasing Aircraft Fleet Size and Demand for Air Travel

The expanding size of the global aircraft fleet and the rising demand for air travel are major drivers for the aircraft control surfaces market. Airlines are constantly upgrading and expanding their fleets to meet growing passenger and cargo demand, requiring advanced flight control systems, including control surfaces, to ensure safety, performance, and efficiency during operations.

Technological Advancements in Flight Control Systems

Ongoing innovations in flight control systems, such as fly-by-wire technology and more efficient aerodynamic designs, are enhancing the performance of control surfaces. These advancements allow for better handling, reduced fuel consumption, and improved safety, thus increasing the adoption of advanced control surfaces across new and retrofitted aircraft.

Market Challenges

High Manufacturing and Installation Costs

The high costs associated with the manufacturing and installation of advanced aircraft control surfaces can be a significant barrier for airlines, especially for smaller operators. These components require precise engineering, quality materials, and rigorous testing, contributing to the overall expense of aircraft production and maintenance.

Complexity in Meeting International Regulatory Standards

The stringent international regulatory standards for aircraft control systems can create challenges for manufacturers. Compliance with these standards, particularly in safety, durability, and performance, requires significant investment in testing, certification, and quality control processes, potentially slowing down the development and approval of new systems.

Market Opportunities

Growth of Unmanned Aerial Systems (UAS)

The rapid growth of unmanned aerial systems (UAS) presents a significant opportunity for the aircraft control surfaces market. UAS, including drones and military UAVs, require advanced control surfaces to ensure stability and maneuverability, driving demand for specialized control systems tailored to these platforms.

Expansion of the Asia-Pacific Aviation Industry

The Asia-Pacific region is witnessing significant growth in aviation, with increasing air traffic and infrastructure development. This expansion is leading to greater demand for advanced aircraft control surfaces to equip both commercial and military aircraft, offering substantial opportunities for market growth in this rapidly developing region.

Future Outlook

Over the next decade, the Singapore Aircraft Control Surfaces market is expected to show significant growth, driven by the continuous demand for more advanced, fuel-efficient, and environmentally friendly aircraft. Key factors include ongoing advancements in aerodynamics, new aircraft technologies, and growing military and defense budgets across the Asia-Pacific region. Furthermore, the shift towards unmanned aircraft systems (UAS) and advancements in AI and digital systems integration are expected to present new growth avenues. These trends, along with an increase in global air travel, will propel the market to new heights.

Major Players in the Market

- Rolls-Royce

- Safran

- Honeywell Aerospace

- Moog Inc.

- BAE Systems

- Collins Aerospace

- Spirit AeroSystems

- Raytheon Technologies

- Liebherr-Aerospace

- Kongsberg Gruppen

- United Technologies Corporation

- Parker Hannifin

- Mitsubishi Heavy Industries

- Thales Group

- Lockheed Martin

Key Target Audience

- Airlines and Aircraft Operators

- Aerospace Manufacturers

- Military and Defense Forces (e.g., Singapore Ministry of Defense)

- Aircraft Maintenance, Repair & Overhaul (MRO) Providers

- Aviation Regulatory Bodies (e.g., Civil Aviation Authority of Singapore)

- Aerospace Research and Development Institutes

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that identifies key stakeholders such as aircraft manufacturers, MRO service providers, and regulatory bodies. Secondary research is used to collect data from industry reports and databases, and market drivers and challenges are analyzed. This step aims to establish the critical variables affecting the Singapore Aircraft Control Surfaces market.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on the market’s size and performance. Data on the number of installed aircraft and components are assessed, along with the impact of market dynamics such as regulations, technological advancements, and customer preferences. This step focuses on validating historical trends to predict future growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through expert interviews and consultations with industry professionals. This includes gathering insights from key players in the aerospace sector and analysts to validate assumptions regarding future trends, customer needs, and the competitive landscape.

Step 4: Research Synthesis and Final Output

The final phase includes gathering real-time insights from aircraft manufacturers and suppliers regarding their product development, technological innovations, and market strategies. This step ensures that the research methodology is comprehensive, leveraging both qualitative and quantitative data sources to deliver accurate market forecasts.

- Executive Summary

- Singapore Aircraft Control Surfaces Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing aircraft fleet size and demand for air travel

Technological advancements in flight control systems

Government regulations and defense spending on military aircraft - Market Challenges

High manufacturing and installation costs

Complexity in meeting international regulatory standards

Supply chain disruptions due to geopolitical factors - Market Opportunities

Growth of unmanned aerial systems (UAS)

Expansion of the Asia-Pacific aviation industry

Adoption of advanced materials and lightweight components in aircraft control surfaces - Trends

Integration of Artificial Intelligence (AI) in aircraft control systems

Shift toward electric and hybrid aircraft platforms

Growth in demand for integrated avionics and flight control systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Control Systems

Hydraulic Control Systems

Electronic Flight Instrumentation Systems

Surface Control Systems

Mechanical Control Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Regional Aircraft

Unmanned Aircraft Systems (UAS) - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Maintenance, Repair & Overhaul (MRO) Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Aircraft Manufacturers

MRO Service Providers

Military and Defense Forces

Private Aircraft Operators

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Distributor Procurement

Online Procurement

Auction Procurement

Third-Party Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share by Platform, Market Share by Fitment Type, Market Share by Procurement Channel, Average System Price by Fitment Type, Installed Units by End User Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

Safran

Honeywell Aerospace

Collins Aerospace

Moog Inc.

Liebherr-Aerospace

Parker Hannifin

BAE Systems

Spirit AeroSystems

Raytheon Technologies

The Boeing Company

Airbus Group

Kongsberg Gruppen

General Electric Aviation

United Technologies Corporation

- Rising demand for advanced flight control technologies in commercial aviation

- Increased focus on military aircraft upgrades and modernization

- Expanding role of MRO service providers in aircraft maintenance

- Growth in private and regional aircraft demand driven by emerging markets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035