Market Overview

The Singapore Aircraft Cooling Systems market is valued at USD $~ million, driven primarily by the continuous growth in the aviation sector and the increasing number of aircraft deliveries. The demand for advanced and efficient cooling systems, essential for maintaining the performance and safety of modern aircraft, is key to this market’s expansion. This market growth is propelled by technological advancements in cooling systems, including the integration of electric and hybrid systems, as well as the push for sustainability and energy efficiency. Major airliners and OEMs have also bolstered the demand for these systems, given their importance in the aircraft’s overall performance and reliability.

Singapore remains a key player in the Southeast Asian aviation market due to its strategic geographical location and well-established aviation infrastructure. Major international airports, such as Singapore Changi Airport, serve as important hubs for both passenger and cargo flights, thereby influencing demand for advanced aircraft cooling systems. Furthermore, the country’s favorable policies and investment in the aerospace sector contribute to the dominance of Singapore in the market. The government’s focus on technological advancements and enhancing air travel infrastructure plays a crucial role in fostering market growth.

Market Segmentation

By System Type

The Singapore Aircraft Cooling Systems market is segmented by system type into Air Cycle Machines (ACM), Heat Exchangers, Environmental Control Systems (ECS), Electric Cooling Systems, and Recuperators. Among these, Air Cycle Machines (ACM) dominate the market share due to their widespread use in commercial and military aircraft. ACMs are integral to maintaining optimal temperature and pressure levels within an aircraft’s cabin, which directly impacts the comfort of passengers and operational efficiency. Additionally, the reliability and long-term cost-effectiveness of ACMs make them a preferred choice for manufacturers and MRO (Maintenance, Repair & Overhaul) providers, further solidifying their market dominance.

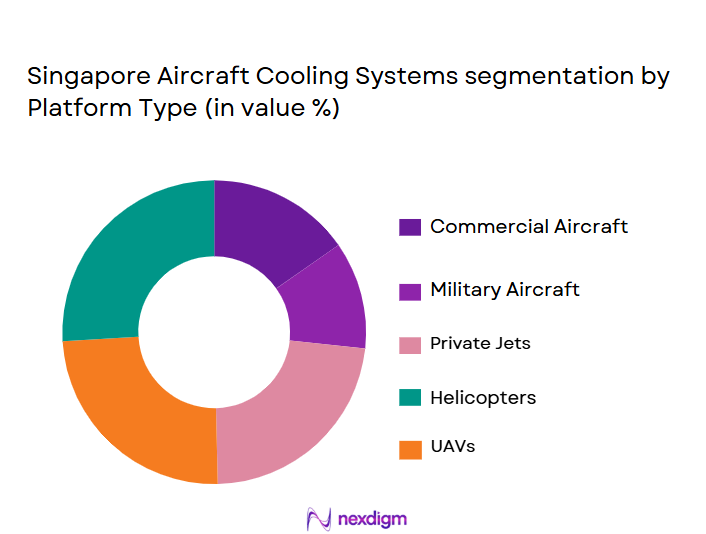

By Platform Type

The market is also segmented by platform type, including Commercial Aircraft, Military Aircraft, Private Jets, Unmanned Aerial Vehicles (UAVs), and Helicopters. The Commercial Aircraft segment holds the largest market share, primarily due to the high demand for air travel in the region and the need for advanced cooling systems in large aircraft. The continuous growth in passenger traffic, driven by both domestic and international air travel, necessitates the installation of advanced systems that ensure optimal cabin environments, which bolsters the demand for aircraft cooling systems.

Competitive Landscape

The Singapore Aircraft Cooling Systems market is dominated by a few key players, including global aerospace giants such as Collins Aerospace, Honeywell Aerospace, and Safran Aircraft Engines. These companies maintain a strong presence in the market due to their technological innovations, extensive product portfolios, and partnerships with major OEMs. Their dominance is also attributed to their ability to meet the stringent regulatory requirements set by aviation authorities worldwide, ensuring that their cooling systems are highly reliable and efficient. The market is further shaped by these players’ continuous investments in research and development, as they work to meet the growing demand for energy-efficient and sustainable solutions.

| Company Name | Year of Establishment | Headquarters | Technology Innovation | Customer Base | R&D Investment | Geographic Reach | Regulatory Compliance |

| Collins Aerospace | 1933 | United States | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Germany | ~ | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ | ~ |

Singapore aircraft cooling systems Market Dynamics

Growth Drivers

Increasing air travel demand in Asia

The demand for air travel in Asia, particularly in Southeast Asia, continues to rise due to economic growth, an expanding middle class, and increasing disposable income. This surge in passengers drives the need for more aircraft, subsequently increasing the demand for efficient cooling systems to maintain cabin comfort and ensure optimal operations for airlines and aircraft manufacturers. Breakthroughs in secure communication, real-time data transfer, and improved surveillance systems have become crucial for military operations, particularly in combat environments, further bolstering market growth.

Technological advancements in cooling systems

Innovations in aircraft cooling systems, such as the integration of electric and hybrid cooling technologies, contribute to increased system efficiency and lower operational costs. These advancements are being driven by the aviation industry’s push towards sustainability, energy efficiency, and meeting regulatory requirements for reduced emissions. These countries prioritize military modernization, which boosts the market for innovative electronics, enhancing communication, surveillance, and targeting capabilities.

Market Challenges

High cost of advanced cooling systems

The cost of cutting-edge cooling systems, particularly electric and hybrid technologies, remains high. This financial burden is a significant challenge for airlines and MRO providers, especially in the face of fluctuating fuel prices and tightening budgets. The high initial investment may delay widespread adoption of these systems.

Regulatory compliance complexity

The aviation industry’s regulatory environment is highly stringent, with different standards set by bodies such as the FAA and EASA. These regulations require cooling systems to meet specific performance and safety criteria, which can complicate the development, certification, and maintenance processes, leading to higher costs and longer time-to-market.

Market Opportunities

Integration of green and sustainable cooling technologies

As environmental concerns become more prominent, there is an opportunity for integrating sustainable and green technologies into aircraft cooling systems. Eco-friendly refrigerants, energy-efficient designs, and systems that reduce carbon emissions are becoming increasingly important, offering market players the chance to innovate and align with global sustainability trends.

Expansion of MRO services in Asia

With the increase in aircraft fleet size in Asia, particularly in Southeast Asia, there is a growing need for Maintenance, Repair, and Overhaul (MRO) services. This expansion creates an opportunity for aircraft cooling system providers to offer replacement, upgrading, and servicing solutions, driving market growth for cooling system maintenance and aftermarket services in the region.

Future Outlook

Over the next decade, the Singapore Aircraft Cooling Systems market is expected to show robust growth, driven by the ongoing advancement of aircraft cooling technologies and the rising demand for air travel across Asia. This growth will be supported by the increasing need for energy-efficient and environmentally friendly systems in response to regulatory pressures and growing sustainability trends. Additionally, with continued expansion in both commercial aviation and the increasing development of unmanned aerial vehicles (UAVs), the demand for reliable and innovative cooling systems will significantly contribute to market growth during this period.

Major Players in the Market

- Collins Aerospace

- Honeywell Aerospace

- Safran Aircraft Engines

- Liebherr Aerospace

- MTU Aero Engines

- United Technologies Corporation

- Parker Hannifin

- Raytheon Technologies

- GKN Aerospace

- AeroVironment

- Denso Corporation

- Woodward Inc.

- Thales Group

- Korean Aerospace Industries

- Boeing

Key Target Audience

- Aircraft Manufacturers

- Airlines

- Maintenance, Repair & Overhaul (MRO) Providers

- Government and Regulatory Bodies (e.g., FAA, EASA)

- Investment and Venture Capitalist Firms

- Aerospace OEMs

- Aircraft Component Suppliers

- Aviation Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying all key variables affecting the Singapore Aircraft Cooling Systems market, including stakeholders like aircraft manufacturers, MRO providers, and component suppliers. This is achieved through secondary research utilizing industry reports, databases, and expert opinions.

Step 2: Market Analysis and Construction

This phase involves the analysis of historical data and market trends to build a comprehensive market structure, taking into account the adoption rates of cooling systems in different aircraft types and platforms, and estimating revenue generation based on system complexity.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts via interviews and surveys. These consultations provide valuable insights on technological innovations and regulatory frameworks, which help refine market estimates and forecasts.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered data, including direct interactions with key stakeholders, to verify and complement the information. This comprehensive approach ensures an accurate representation of the Singapore Aircraft Cooling Systems market.

- Executive Summary

- Singapore Aircraft Cooling Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air travel demand in Asia

Technological advancements in cooling systems

Growing aircraft fleet in the Southeast Asia region - Market Challenges

High cost of advanced cooling systems

Regulatory compliance complexity

Supply chain disruptions affecting component availability - Market Opportunities

Integration of green and sustainable cooling technologies

Expansion of MRO services in Asia

Demand for advanced cooling solutions in electric aircraft - Trends

Shift towards electric and hybrid-electric aircraft

Adoption of sustainable and eco-friendly materials in cooling systems

Growing focus on system miniaturization and weight reduction

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air Cycle Machines

Heat Exchangers

Environmental Control Systems

Electric Cooling Systems

Recuperators - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

Line Fit

Retrofit

OEM

Aftermarket

Customization - By EndUser Segment (In Value%)

OEM Manufacturers

Maintenance, Repair & Overhaul (MRO) Providers

Aircraft Operators

Government & Defense

Private Aviation - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Suppliers

OEM Channels

Online Procurement

Aftermarket Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technology Adoption, Product Portfolio, Geographic Reach, Customer Base Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

SATAIR

Collins Aerospace

Parker Hannifin

Safran Aircraft Engines

Honeywell Aerospace

United Technologies Corporation

Liebherr Aerospace

Thales Group

MTU Aero Engines

AeroVironment

Woodward Inc.

Denso Corporation

GKN Aerospace

Korean Aerospace Industries

Raytheon Technologies

- Increase in demand for customized solutions for aircraft types

- Growing collaboration between aircraft operators and MRO providers

- Strategic alliances between OEMs and cooling system suppliers

- Increase in government defense spending affecting cooling system demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035