Market Overview

The Singapore aircraft curtains market is projected to reach a market size of approximately USD ~ million based on a recent historical assessment. This growth is driven by the increasing demand for comfortable and aesthetically appealing aircraft interiors, particularly in the commercial and private aviation sectors. Technological advancements, such as the integration of smart textiles in aircraft interiors, and the growing emphasis on luxury private jet fittings further fuel market growth. Additionally, rising air travel across the Asia-Pacific region and the expansion of fleet sizes are contributing to a heightened demand for premium and customized aircraft curtains.

Singapore, a key aviation hub in Asia, leads the market, driven by its strategic location, advanced airport infrastructure, and high levels of international air traffic. The presence of key aviation players, such as Singapore Airlines and Jetstar Asia, has further solidified the country’s dominance. With a significant number of private jets and corporate aircraft operating from Singapore, the demand for high-end interior fittings, including aircraft curtains, continues to rise. The market in neighboring Southeast Asian countries is also expanding due to increasing disposable incomes and a growing interest in private aviation.

Market Segmentation

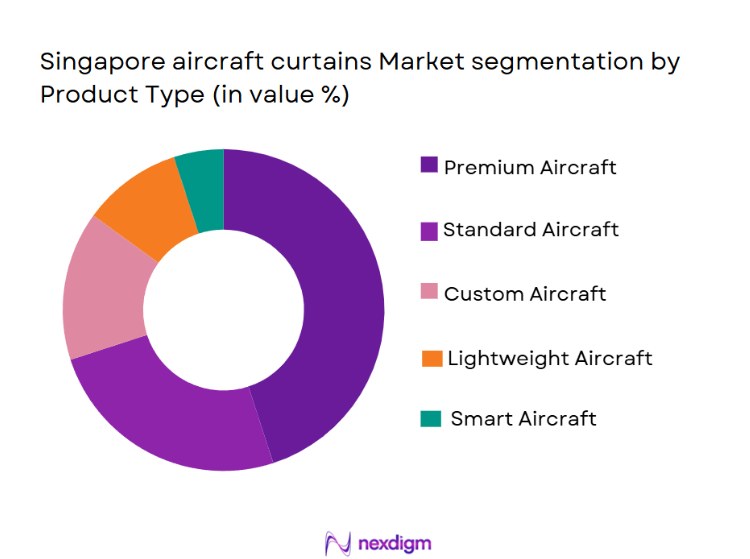

By Product Type

The Singapore aircraft curtains market is segmented by product type into premium aircraft curtains, standard aircraft curtains, custom aircraft curtains, lightweight aircraft curtains, and smart aircraft curtains. Recently, premium aircraft curtains have gained a dominant market share due to factors such as high demand for luxurious and tailored interior solutions, the growing trend of personalization in aviation interiors, and the rising affluence in Southeast Asia. Airlines and private jet owners increasingly seek premium curtain products for both aesthetic and functional reasons, including privacy and comfort.

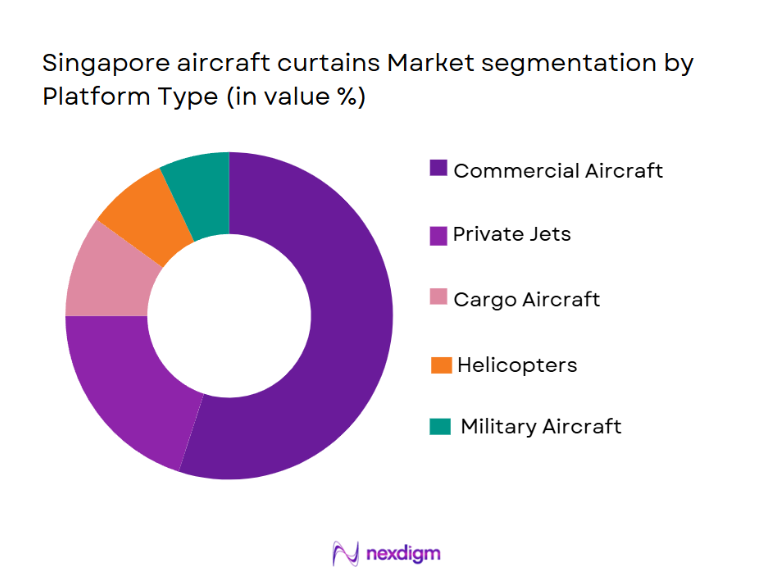

By Platform Type

The Singapore aircraft curtains market is segmented by platform type into commercial aircraft, private jets, cargo aircraft, helicopters, and military aircraft. Recently, commercial aircraft have dominated the market share due to the large volume of air travel, including both budget and luxury travel sectors. Airlines operating out of Singapore, including Singapore Airlines and SilkAir, require customized and high-quality curtain solutions for their passenger cabins, contributing to a higher demand for premium and durable materials.

Competitive Landscape

The competitive landscape of the Singapore aircraft curtains market is moderately fragmented, with key players ranging from large multinational corporations to regional manufacturers. Major players are constantly innovating to offer high-quality, customized products, and there is significant competition in terms of brand presence, technology, and supply chain networks. As the market is growing, consolidation is expected, especially in the premium and custom curtain segments. Several global players are expanding their presence in Southeast Asia to cater to the growing demand from airlines and private jet owners.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| B/E Aerospace | 1958 | USA | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 2000 | France | ~ | ~ | ~ | ~ |

| Diehl Aviation | 1902 | Germany | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1983 | Japan | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Curtains Market Analysis

Growth Drivers

Increasing Air Travel Demand

The surge in global air traffic, particularly in the Asia-Pacific region, is a major growth driver for the Singapore aircraft curtains market. As more passengers board flights, airlines are upgrading their interiors to enhance the overall travel experience. Airlines in Singapore are expected to continue investing in their fleets, leading to a rising demand for high-quality curtains that complement the aesthetic and comfort of the aircraft cabins. This is expected to fuel market growth, particularly for commercial aircraft, as Singapore maintains its position as a leading aviation hub.

Technological Advancements in Materials

The adoption of advanced materials that are both durable and eco-friendly has become an important growth driver for the market. Sustainable fabrics and curtains with energy-saving properties are becoming more prevalent in response to growing environmental concerns and regulatory pressure. Airlines and manufacturers are increasingly using these materials to not only meet sustainability goals but also enhance the overall passenger experience by offering lightweight, durable, and easy-to-maintain solutions.

Market Challenges

High Costs of Customization

One of the major challenges facing the market is the high costs associated with customizing aircraft curtains. Airlines often require bespoke designs and materials to meet specific branding requirements and functional needs, which can significantly increase costs. Smaller airlines and less financially stable carriers may struggle to allocate budgets for such premium offerings. Despite this, the demand for premium and custom-designed curtains is strong among leading global airlines.

Regulatory Constraints

Compliance with aviation regulations is a significant challenge for aircraft curtain manufacturers. These regulations often require specific fire resistance standards and durability specifications, which can complicate product design and production processes. Manufacturers must continuously adapt to evolving safety standards to ensure their products meet regulatory requirements, leading to additional research and development costs that could potentially hinder market growth.

Opportunities

Rising Demand for Sustainable Solutions

With increasing awareness of environmental issues and a focus on sustainability, there is an opportunity for manufacturers to innovate by offering environmentally friendly curtain solutions. Airlines are increasingly prioritizing sustainability, and the use of eco-friendly materials in aircraft interiors, including curtains, presents a growing market opportunity. By developing curtains that are both sustainable and aesthetically pleasing, manufacturers can tap into this trend and cater to the needs of environmentally conscious consumers and businesses.

Expansion of Low-Cost Carriers

The expansion of low-cost carriers in the Asia-Pacific region presents a unique opportunity for the aircraft curtains market. As more low-cost airlines emerge, there is a growing need for cost-effective yet durable interior solutions, including curtains. Manufacturers can capitalize on this opportunity by offering affordable and high-quality products tailored to the budgets of low-cost carriers, thus expanding their customer base.

Future Outlook

The aircraft curtains market is expected to experience steady growth over the next five years, driven by the increasing demand for luxury air travel and advancements in sustainable materials. The adoption of smart textiles and the integration of IoT into aircraft interiors will drive innovation in the product offerings. With growing regulatory support for eco-friendly products, the demand for sustainable and customizable aircraft curtains is projected to rise. In addition, the booming private aviation sector in the Asia-Pacific region will contribute significantly to market expansion.

Major Players

- B/E Aerospace

- Zodiac Aerospace

- Diehl Aviation

- Jamco Corporation

- Collins Aerospace

- Aviointeriors S.p.A

- Aircraft Interior Products

- Recaro Aircraft Seating

- GKN Aerospace

- Pexco Aerospace

- Tapis Corporation

- Airbus Interiors

- Safran Cabin

- Acro Aircraft Seating

- Embraer Aircraft Interiors

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Aircraft manufacturers

- Private jet owners

- Aircraft leasing companies

- Maintenance, repair, and overhaul (MRO) service providers

- Airlines cabin interior suppliers

Research Methodology

Step 1: Identification of Key Variables

The key variables impacting the aircraft curtains market, such as demand trends, technological developments, and regulatory influences, are identified and prioritized. These variables are assessed to provide insights into the market’s dynamics.

Step 2: Market Analysis and Construction

Market data is analyzed to segment the market based on product types, platform types, and end-user segments. The construction of market size estimates and future forecasts follows a detailed analysis of historical trends, primary research, and secondary data sources.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and hypothesis validation ensure that the research findings are reliable and aligned with market realities. Key industry experts, including manufacturers, airlines, and regulators, are interviewed to validate assumptions and refine projections.

Step 4: Research Synthesis and Final Output

The collected data and expert insights are synthesized into the final report, providing actionable insights and forecasts for stakeholders in the aircraft curtains market. The output includes a detailed assessment of market trends, dynamics, and future opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air travel demand

Rising focus on aircraft interior aesthetics

Growth in demand for custom and lightweight aircraft curtains - Market Challenges

High costs of premium materials

Complexity in regulatory certifications

Limited availability of specialized fitments for certain aircraft models - Market Opportunities

Emergence of eco-friendly aircraft curtain materials

Technological innovations in smart curtains

Expansion of private jet fleets in Asia-Pacific - Trends

Shift towards sustainable materials

Integration of IoT in aircraft interiors

Customizability as a key demand factor in premium segments - Government Regulations

Regulations on fire-resistant materials

Certification requirements for aircraft interior accessories

Environmental regulations impacting material selection

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Premium Aircraft Curtains

Standard Aircraft Curtains

Custom Aircraft Curtains

Lightweight Aircraft Curtains

Smart Aircraft Curtains - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Cargo Aircraft

Helicopters

Military Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Custom Fitments

Semi-custom Fitments - By EndUser Segment (In Value%)

Airlines

Private Jet Owners

Military and Defense Contractors

Aircraft Leasing Companies

Maintenance, Repair, and Overhaul (MRO) Service Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Distributor/Reseller Procurement

OEM Procurement

Aftermarket Procurement

Online Procurement Channels

- Market Share Analysis

- CrossComparison Parameters (Material Durability, Fitment Precision, Certification Compliance, Customization Options, Cost-Effectiveness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

B/E Aerospace

Zodiac Aerospace

Diehl Aviation

Safran Cabin

Jamco Corporation

Collins Aerospace

Sotera Aircraft Interiors

Aircraft Interior Products

Aviointeriors S.p.A

Acro Aircraft Seating

Recaro Aircraft Seating

GKN Aerospace

Pexco Aerospace

Airbus Interiors

Tapis Corporation

- Demand trends by airline operators

- Private jet owners’ preference for customization

- Military requirements for durable and specialized curtains

- Role of MRO service providers in the aftermarket segment

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035