Market Overview

Based on a recent historical assessment, the Singapore Aircraft DC Converter market is expected to reach USD ~ billion by the mid-2020s, driven by a steady demand for reliable, energy-efficient power conversion systems in the aviation industry. This growth is primarily fueled by the increasing demand for modern, lightweight, and compact power solutions to meet the rising needs of both commercial and military aviation sectors. Additionally, advancements in power electronics and the push for more sustainable aircraft systems are accelerating the market’s development.

The market is dominated by key players and regions such as Singapore, which is strategically positioned as a major aviation hub in Southeast Asia, and countries with advanced aerospace industries like the United States and Europe. Singapore’s dominance is attributed to its robust infrastructure, regulatory support for aviation technologies, and its significant role in global aircraft maintenance and manufacturing. Additionally, cities with a strong presence of aerospace firms contribute significantly to the growth of this market.

Market Segmentation

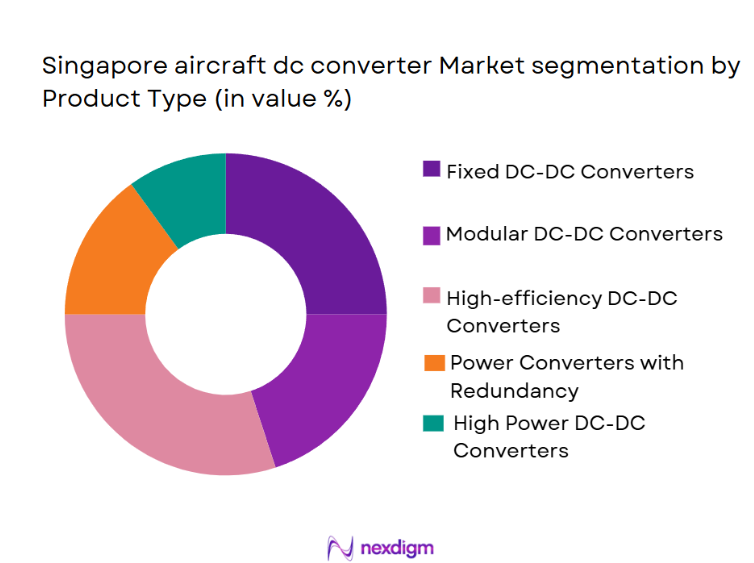

By Product Type

The Singapore Aircraft DC Converter market is segmented by product type into fixed DC-DC converters, modular DC-DC converters, high-efficiency DC-DC converters, power converters with redundancy, and high-power DC-DC converters. Recently, high-efficiency DC-DC converters have seen a dominant market share due to factors such as rising demand for energy-saving technologies, increasing regulatory pressures to reduce carbon emissions, and a growing preference for lighter, more compact solutions in aircraft systems. These converters are highly favored for their ability to deliver more efficient power conversion and their adaptability in various aircraft platforms.

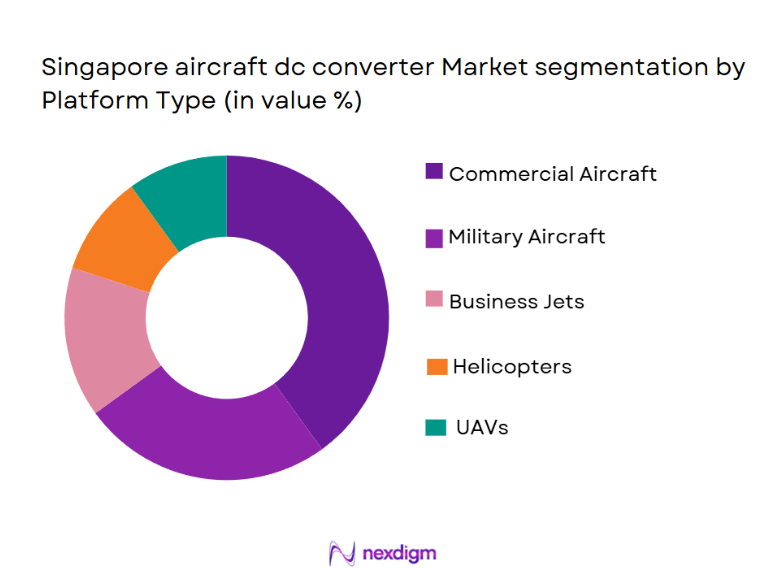

By Platform Type

The Singapore Aircraft DC Converter market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Recently, commercial aircraft have dominated the market share due to their growing fleet and the increasing need for efficient power systems to support next-generation aircraft designs. These aircraft platforms demand reliable power converters to maintain operational efficiency while minimizing weight, which makes DC-DC converters an ideal choice for modern aircraft systems that emphasize energy efficiency and sustainability.

Competitive Landscape

The competitive landscape of the Singapore Aircraft DC Converter market is highly consolidated, with several leading aerospace technology providers dominating the sector. Key players are focused on advancing technologies, particularly in the development of high-efficiency and modular DC converters, to cater to the growing demand for energy-efficient aircraft systems. These companies are leveraging innovations in power electronics and forming strategic alliances with aerospace manufacturers to maintain their competitive edge. The presence of well-established market players, combined with regulatory support for aviation technology, continues to influence the market dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | USA | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

Singapore Aircraft DC Converter Market Analysis

Growth Drivers

Rising Demand for Energy Efficiency

The increasing demand for fuel-efficientaircraft is one of the key drivers of the aircraft DC converter market. Aircraft manufacturers are under pressure to meet stricter environmental regulations and reduce operational costs. DC converters, by providing optimal power distribution systems, help reduce fuel consumption while supporting the smooth functioning of avionics and electrical systems. This drives market growth as the demand for greener, more efficient aircraft solutions grows worldwide.

Technological Advancements

Another growth driver is the continuous advancement in DC converter technology. New developments in power electronics, such as wide-bandgap semiconductors, are enhancing the efficiency, weight, and size of DC converters. These innovations are increasingly becoming integral to modernaircraft systems, especially in the context of reducing aircraft weight to improve fuel efficiency. As a result, manufacturers are prioritizing the incorporation of next-generation DC converters in their designs, further propelling the market.

Market Challenges

High Initial Cost of Advanced Technology

One of the challenges faced by theaircraft DC converter market is the high initial cost associated with advanced DC converter systems. Although these converters offer significant long-term operational savings due to increased efficiency and reduced fuel consumption, their high upfront costs can be a deterrent for some aircraft operators, especially in the general aviation sector. Manufacturers must find ways to make these systems more cost-effective to boost adoption across various aviation segments.

Complex Regulatory Environment

The market also faces challenges due to complex and stringent regulatory requirements in the aerospace industry. DC converter technologies must meet rigorous safety standards, which vary by region andaircraft type. Adapting to these regulatory frameworks can be time-consuming and expensive for manufacturers, delaying the development and deployment of new products. Additionally, compliance with evolving environmental regulations further adds to the complexity and cost of production.

Opportunities

Increase in Aircraft Electrification

The push for increased electrification inaircraft systems represents a significant opportunity for the aircraft DC converter market. As more aircraft systems shift from traditional hydraulic and pneumatic technologies to electric systems, the demand for DC converters capable of powering these systems will grow. This trend, coupled with the introduction of hybrid and fully electric aircraft, offers new avenues for market players to expand their product offerings.

Expansion of Commercial Aviation in Asia-Pacific

The growing air travel demand in the Asia-Pacific region presents a considerable opportunity for market expansion. As airlines in the region continue to invest in modernizing their fleets to meet growing passenger demands and environmental standards, the need for high-efficiency DC converters will increase. This trend is expected to drive significant market growth, particularly in countries like China, India, and Singapore, which are key players in the global aviation industry.

Future Outlook

The future of the Singapore Aircraft DC Converter market over the next five years is expected to witness significant growth, driven by technological advancements in power electronics and increasing demand for fuel-efficient aircraft. With regulatory frameworks supporting green aviation, manufacturers will continue to innovate and produce high-performance converters that cater to both commercial and military applications. Moreover, the rise of electric and hybrid aircraft platforms will further boost the need for advanced DC-DC converters, ensuring that the market remains on an upward trajectory. This period will also see an expansion in market opportunities as emerging economies invest in modern aviation technologies.

Major Players

- Honeywell Aerospace

- Thales Group

- Raytheon Technologies

- Collins Aerospace

- Safran

- Curtiss-Wright Corporation

- MTU Aero Engines

- Diehl Aviation

- Boeing

- GE Aviation

- Rockwell Collins

- Textron

- L3 Technologies

- Northrop Grumman

- Airbus

Key Target Audience

- Aircraft Manufacturers

- Aerospace Suppliers

- Airlines and Operators

- Government and Regulatory Bodies

- Maintenance, Repair, and Overhaul (MRO) Providers

- Aviation Technology Investors

- Aerospace Component Distributors

- Original Equipment Manufacturers (OEMs)

Research Methodology

Step 1: Identification of Key Variables

Key variables such as technological advancements, regulatory impacts, and consumer preferences are identified to provide a detailed market understanding. This step sets the foundation for in-depth market analysis.

Step 2: Market Analysis and Construction

Market trends, historical data, and current demand are analyzed to construct a comprehensive overview of the market. Factors such as market size, growth rates, and technological adoption are considered.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions and consultations with industry leaders validate market hypotheses, ensuring that all findings are grounded in real-world insights.

Step 4: Research Synthesis and Final Output

The collected data and insights are synthesized into a final report, providing actionable recommendations for stakeholders. The final output also includes market forecasts and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Efficient Power Systems

Growth in Commercial and Military Aviation

Technological Advancements in DC Converter Systems - Market Challenges

High Initial Costs

Complex Certification and Regulatory Requirements

Supply Chain Constraints - Market Opportunities

Growth in Electric Aircraft Technologies

Rising Demand for Sustainable Aviation Solutions

Opportunities in Emerging Markets - Trends

Increased Adoption of Modular and Scalable Systems

Focus on Reduced Weight and Power Loss

Integration with Hybrid and Electric Propulsion Systems - Government Regulations

Aerospace Safety Standards and Certification

Environmental Regulations for Aircraft Power Systems

Government Initiatives for Green Aviation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fixed DC-DC Converters

Modular DC-DC Converters

High Efficiency DC-DC Converters

Power Converters with Redundancy

High Power DC-DC Converters - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

UAVs (Unmanned Aerial Vehicles) - By Fitment Type (In Value%)

Linefit

Retrofit

Aftermarket Components

OEM Fitment

Upgraded Systems - By EndUser Segment (In Value%)

Aircraft Manufacturers

Aerospace Suppliers

Airlines and Operators

Government and Military

Maintenance, Repair, and Overhaul (MRO) Providers - By Procurement Channel (In Value%)

Direct Procurement

Online Procurement

OEM Channels

Third-Party Distributors

Aftermarket Suppliers

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, End-User Demand, Procurement Channel, Market Value Growth)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell Aerospace

Thales Group

Raytheon Technologies

Collins Aerospace

Curtiss-Wright Corporation

Aerospace Component Systems, Inc.

MTU Aero Engines

Diehl Aviation

Boeing

Safran

GE Aviation

Rockwell Collins

Textron

L3 Technologies

Northrop Grumman

- Aircraft Manufacturers’ Demand for Advanced DC Converters

- Military Aircraft Fitment Requirements

- Trends in Airlines’ Retrofit Programs

- Aerospace MRO Sector’s Need for DC Converter Replacements

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035