Market Overview

The Singapore aircraft de-icing market is valued at USD ~million, driven by the nation’s status as a global aviation hub, particularly with the Changi Airport serving as a major transit point. The demand for de-icing solutions is spurred by Singapore’s tropical climate, where de-icing is vital for aircraft arriving from colder regions. The growth in international air travel, combined with safety regulations mandating de-icing during specific weather conditions, has propelled this market. Additionally, the rise in air traffic and the need for rapid turnaround times at busy airports, especially during peak periods, have further fuelled market expansion.

Singapore leads the aircraft de-icing market primarily due to its position as one of the busiest and most efficient international airports. Changi Airport’s high throughput of international and transit flights demands effective and rapid de-icing solutions to ensure safety and operational efficiency. While Singapore is primarily affected by temperature fluctuations from international arrivals rather than severe snow or ice, the increasing number of airlines flying into Singapore from colder regions mandates the need for efficient de-icing solutions. The aviation infrastructure, regulatory oversight by the Civil Aviation Authority of Singapore (CAAS), and strategic investments by key global players have reinforced the nation’s dominance in this sector.

Market Segmentation

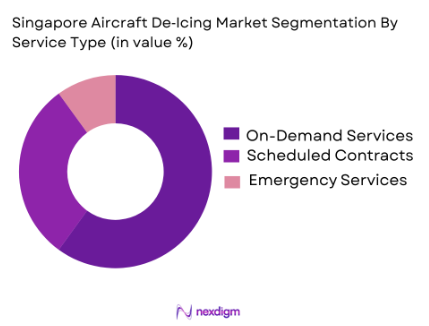

By Service Type

The Singapore aircraft de-icing market is segmented by service type into on-demand de-icing services, scheduled de-icing contracts, and emergency services. On-demand de-icing services dominate the market due to the unpredictable nature of de-icing requirements, especially during peak flight times or weather disruptions. Airlines prefer these services for flexibility in scheduling, ensuring that aircraft are cleared of ice before take-off in line with the strict safety regulations set by the Civil Aviation Authority of Singapore (CAAS). Additionally, scheduled contracts, often tied to specific airline fleets or seasonal requirements, continue to have a significant presence as airports aim to maintain operational efficiency year-round.

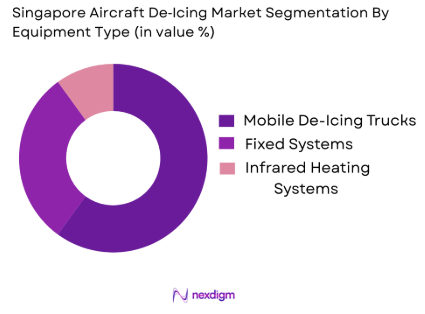

By Equipment Type

The market is also segmented by equipment type, with the key sub-segments being mobile de-icing trucks, fixed de-icing systems, and infrared heating systems. Mobile de-icing trucks dominate the market because of their versatility, enabling them to serve a wide range of aircraft types and airport configurations. These trucks can be deployed quickly for rapid turnaround times, making them indispensable during peak operational hours at Changi Airport. Fixed systems, while crucial for specific terminals or runway areas, hold a smaller share, as they require substantial infrastructure investment. Infrared heating systems are gaining traction for their environmentally friendly attributes, although they are still in the early adoption phase.

Competitive Landscape

The Singapore aircraft de-icing market is moderately consolidated, with key players including both global and regional firms. These players provide a combination of de-icing equipment, fluids, and related services, catering to Singapore’s specific climatic needs. The market is driven by a blend of long-established firms and newer entrants focused on eco-friendly, automated solutions.

| Company | Established | Headquarters | Fleet Size | Market Focus | Environmental Compliance | Technology Integration |

| Honeywell | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Vestergaard | 1957 | Denmark | ~ | ~ | ~ | ~ |

| Clariant | 1995 | Switzerland | ~ | ~ | ~ | ~ |

| JBT Corporation | 1964 | USA | ~ | ~ | ~ | ~ |

| Dow Chemical | 1897 | Midland, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft De-Icing Market Dynamics

Growth Drivers

Safety & Regulatory Compliance Requirements

The Civil Aviation Authority of Singapore (CAAS) has stringent regulations to ensure flight safety, including those relating to de-icing procedures. The CAAS mandates that all aircraft undergo de-icing during specific conditions, especially when arriving from colder climates where ice accumulation on aircraft surfaces is common. Furthermore, the International Civil Aviation Organization (ICAO) guidelines, updated in 2024, reinforce safety measures for winter operations, requiring effective de-icing prior to takeoff. These regulations are vital to maintaining the country’s reputation as a global aviation hub and ensuring passenger and flight safety, thus driving demand for de-icing services in Singapore.

Seasonal Efficiency Optimization & Turnaround Times

In Singapore, seasonal variations lead to fluctuating operational challenges that drive the demand for de-icing services. Despite the tropical climate, Singapore sees significant seasonal air traffic spikes, particularly in the peak travel seasons around the Chinese New Year and school holidays. The need to optimize turnaround times during these busy periods pushes airport authorities and airlines to invest in quick de-icing solutions. This is crucial for reducing ground time and ensuring planes are ready for takeoff within the scheduled time frame, thereby maximizing airport capacity during busy months. The efficiency of de-icing services directly impacts the overall operational effectiveness of Changi Airport, which handles over ~million passengers annually.

Market Challenges

Environmental Compliance & Chemical Runoff Regulations

Environmental concerns surrounding the use of de-icing fluids, particularly ethylene glycol and propylene glycol-based products, are a major challenge. The Singapore government has stringent regulations in place, which mandate the proper disposal and treatment of chemical runoff to prevent water pollution. The National Environment Agency (NEA) has been actively working to ensure that de-icing fluids used in Singapore are disposed of in a way that meets their environmental standards. The cost of complying with these environmental regulations adds pressure to the operational budgets of de-icing service providers, potentially impacting profitability. The NEA has set specific guidelines for runoff disposal from airports, which are closely monitored.

Skilled Workforce Shortages in Ground Ops

A growing shortage of skilled workers in the ground operations sector, including de-icing personnel, poses a challenge to maintaining efficiency in the de-icing process. Singapore’s aviation industry faces a labor shortage, particularly in roles requiring specialized skills such as de-icing. According to the Ministry of Manpower (MOM), there has been an ongoing shortage of workers in the aviation sector, with fewer qualified technicians entering the workforce. The shortage of trained ground handling staff, especially for de-icing services, is exacerbated by high turnover rates and increasing training costs, which affect overall operational efficiency and service delivery.

Market Opportunities

Digital/Automated De-Icing Solutions

With the rise of automation across the aviation sector, there is a significant opportunity for the integration of digital and automated de-icing solutions. The use of automated systems can help reduce turnaround times and human error, increasing operational efficiency. The implementation of automated de-icing technology, which includes sensor-based systems and infrared heaters, is gaining traction as a more efficient and environmentally friendly option. By reducing labor costs and improving precision in de-icing operations, airports and airlines in Singapore are expected to adopt these systems in response to growing demand for faster, safer, and greener airport services.

Strategic Partnerships with Airline Alliances

The formation of strategic partnerships between de-icing service providers and airline alliances presents a significant opportunity for growth in the Singapore market. Airlines, particularly those in large alliances, are increasingly opting for long-term, bundled service agreements that include de-icing, ground handling, and other related services. These partnerships can help service providers secure steady demand for de-icing services, especially during peak seasons. Additionally, such collaborations allow for more efficient operations and resource management, ensuring that airlines can rely on consistent and high-quality de-icing services for their fleets, thereby improving operational efficiency at Changi Airport.

Future Outlook

Over the next decade, the Singapore aircraft de-icing market is expected to see continued growth. The increasing demand for international air travel, coupled with the need for quick, efficient turnaround times during fluctuating weather conditions, will drive the market forward. The market will likely see further adoption of eco-friendly de-icing solutions, including the use of biodegradable de-icing fluids and infrared de-icing technology. Additionally, the government’s push for greener airport operations is likely to influence more airlines and airport authorities to invest in innovative de-icing technologies. These advancements will be crucial in ensuring operational efficiency while complying with sustainability goals set by local and international aviation authorities.

Major Players

- Honeywell

- Vestergaard

- Clariant

- JBT Corporation

- Dow Chemical

- Radiant Energy Corporation

- Kilfrost Ltd.

- De-icing Services Inc.

- Safran

- HeliTech International

- TLD Group

- Global Ground Support

- Teleflex Incorporated

- AeroTech Services

- Tronair Inc.

Key Target Audience

- Airline Fleet Operators

- Airport Authorities

- Ground Handling Companies

- De-Icing Equipment Manufacturers

- De-Icing Fluid Suppliers

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Aviation Industry Analysts

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining the critical stakeholders and variables that affect the Singapore aircraft de-icing market. This is achieved by conducting in-depth desk research, including secondary research using proprietary databases to assess market penetration, de-icing fluid consumption, and equipment deployment in major Singapore airports.

Step 2: Market Analysis and Construction

The second step involves compiling historical market data from various stakeholders, including airports and airlines, and analysing it to estimate the demand for de-icing services. This includes assessing consumption trends, pricing models, and the regulatory environment. Market forecasts are constructed through these insights to project future market growth.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, key industry experts are consulted via interviews and surveys. These include ground handling service providers, airport operators, and equipment suppliers. Expert feedback is used to validate our hypotheses regarding market trends, challenges, and opportunities. This step is crucial for refining and ensuring the accuracy of the collected data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all findings into a comprehensive market report. Key industry players and stakeholders are contacted for direct insights into emerging market dynamics. This step ensures the final report includes actionable insights based on a blend of quantitative analysis and qualitative input from industry experts.

- Executive Summary

- Research Methodology (Market Definitions, Assumptions & Boundaries, Estimation Models, Top‑down & Bottom‑up Integration, Primary vs. Secondary Validation, Confidence Scoring, Data Normalization, Geographic Calibration for Singapore)

- Market Definition & Boundaries

- Operational Context in Singapore Aviation Ecosystem

- Role of Changi & Other Singapore Airports in De‑Icing Demand

- Regulatory and Safety Framework

- Value Chain & Operational Workflow

- Growth Drivers

Air Traffic Growth & New Flight Routes

Safety & Regulatory Compliance Requirements

Seasonal Efficiency Optimization & Turnaround Times - Market Challenges

Capital Intensity of De‑Icing Fleet Acquisition

Environmental Compliance & Chemical Runoff Regulations

Skilled Workforce Shortages in Ground Ops - Market Opportunities

Adoption of Eco‑Friendly De‑Icing Fluids

Digital/Automated De‑Icing Solutions

Strategic Partnerships with Airline Alliances - Trends & Innovation

Electrification & Sensor‑Based De‑Icing Technologies

Real‑Time Monitoring & Aircraft Condition Analytics

Fluids Reclamation & Waste Minimization

- By Revenue, 2020-2025

- By Volume, 2020-2025

- By Equipment Installed Base, 2020-2025

- Pricing Benchmarks, 2020-2025

- By Service Type (In Value%)

On‑Demand Airport De‑Icing Services

Scheduled De‑Icing Contracts

Emergency & Peak Season Surge Services - By Equipment Type (In Value%)

De‑icing Trucks

Fixed Bay De‑icing Systems

Infrared & Heated Pad Systems

Hybrid & Automated De‑Icing Platforms - By Consumable Type (In Value%)

Type I Fluids

Type II Fluids

Type III Fluids

Environmental / Low‑Impact Fluids - By End‑User Category (In Value%)

Commercial Airlines

Cargo Operators

Military & Government Aviation

General / Private Aviation - By Deployment Model (In Value%)

In‑House Airport Handling

Third‑Party Ground Handling Providers

Outsourced Turnkey De‑Icing Services

- Market Share & Revenue Contribution – Key Providers

- Cross‑Comparison Parameters (Local Presence, Service Coverage, Fleet Size, De‑icing Throughput (Ops/Day), Contract Footprint, Fleet Modernization Index, Safety & Environmental Compliance Scores, CAPEX Intensity, Adoption of Automated Technologies, Local R&D Investment, Strategic Alliances)

- Detailed Company Profiles

Collins Aerospace

JBT Corporation

Clariant AG

BASF SE

Dow Chemical Company

Vestergaard Company

Honeywell International Inc.

Global Ground Support LLC

Kilfrost Ltd.

Radiant Energy Corp

Kelly Aerospace Inc.

Tronair Inc.

Air T Inc.

AeroTech Services

Airborne Maintenance & Engineering Services

- Usage Patterns by Airline Segment

- Seasonal & Weather Correlation Analysis

- Runway Throughput vs. De‑Icing Throughput

- Cost to Serve Analysis

- Revenue Growth Forecast, 2026-2035

- Fleet & Operations Forecast, 2026-2035

- Consumables Demand Forecast, 2026-2035

- Scenario Planning, 2026-2035