Market Overview

The aircraft door market, based on a recent historical assessment, has experienced robust growth driven by increasing global air traffic and a rising demand for new and upgraded aircraft fleets. In 2025, the market is expected to reach a value of USD ~ billion, with factors such as technological advancements, increased safety standards, and rising demand for lightweight and more durable doors driving this growth. Airlines, both commercial and private, are investing heavily in advanced systems that meet stringent regulatory requirements and enhance operational efficiency.

Dominant regions in the aircraft door market include North America, Europe, and parts of Asia, with countries like the United States, Germany, and China leading the market. These regions benefit from established aircraft manufacturing industries, extensive infrastructure, and strong demand for both commercial and defense aircraft. Additionally, high levels of investment in research and development, along with technological innovations in the aerospace sector, further contribute to the dominance of these countries. The market in these regions continues to expand due to growing aviation sectors and increasing demand for more sophisticated and efficient aircraft doors.

Market Segmentation

By Product Type

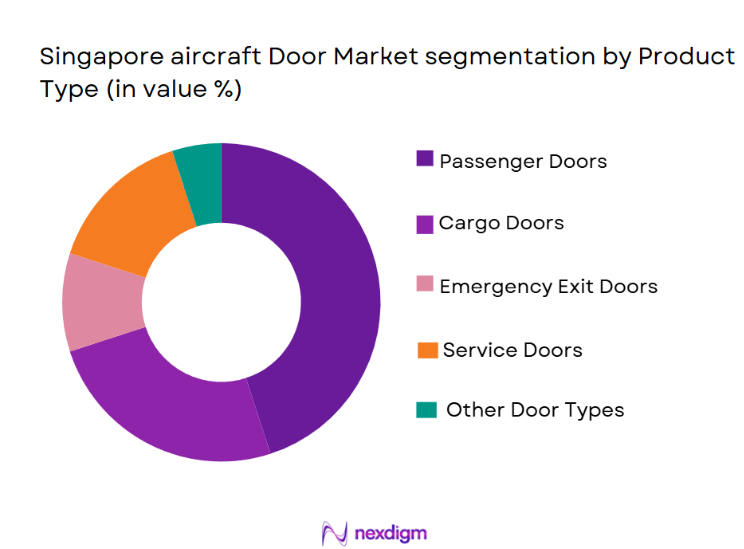

The aircraft door market is segmented by product type into passenger doors, cargo doors, emergency exit doors, service doors, and other door types. Recently, passenger doors have dominated the market share due to the increasing demand for air travel, which has driven airlines to invest in advanced systems for their aircraft. These doors not only provide easy access to passengers but are also integral in enhancing the overall safety and comfort of the aircraft. Additionally, airlines focus on improving operational efficiency, making passenger doors a critical component in the overall aircraft design.

By Platform Type

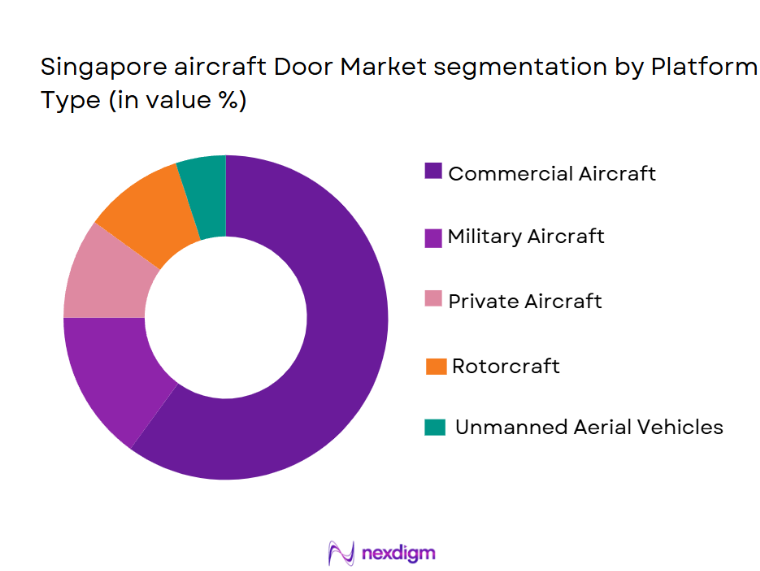

The aircraft door market is segmented by platform type into commercial aircraft, military aircraft, private aircraft, rotorcraft, and unmanned aerial vehicles (UAVs). Recently, commercial aircraft have dominated the market share due to the substantial growth in air travel and the increasing fleet expansion by major airlines. These aircraft typically require advanced door systems to accommodate large numbers of passengers, enhance safety features, and comply with regulatory standards, driving the demand for high-quality and reliable aircraft doors in the commercial sector.

Competitive Landscape

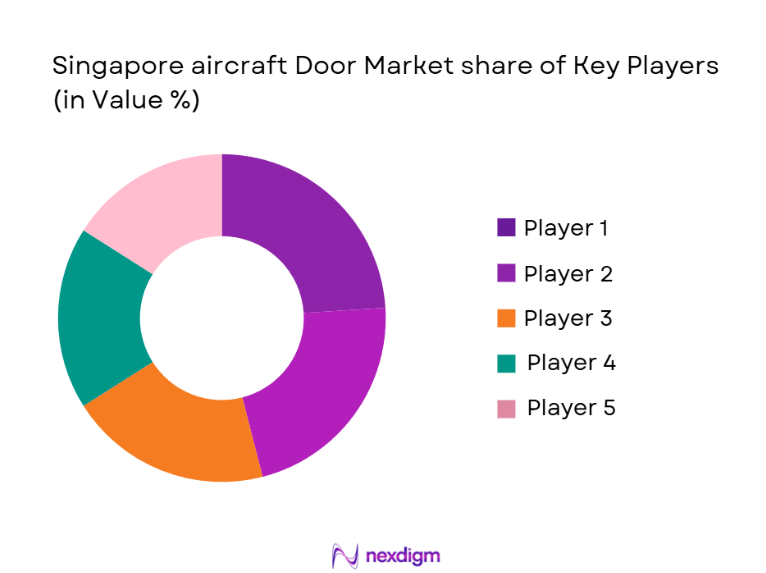

The aircraft door market is highly competitive, with major players striving to consolidate their positions through technological innovation, strategic partnerships, and mergers and acquisitions. Companies are investing in research and development to introduce lightweight, energy-efficient, and durable doors that cater to the growing demands of the aviation industry. The market sees a strong presence from large aerospace manufacturers that provide comprehensive solutions to airlines and military operators worldwide, thereby strengthening their influence across various market segments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Singapore Technologies Aerospace | 1979 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Safran Nacelles | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace | 2000 | UK | ~ | ~ | ~ | ~ | ~ |

| Hamilton Sundstrand | 1950 | USA | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Germany | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Door Market Analysis

Growth Drivers

Increase in Air Traffic

The rapid growth in global air traffic has significantly influenced the Singapore aircraft door market. With more passengers opting for air travel, the demand for new aircraft has risen. Consequently, airlines are expanding and modernizing their fleets, leading to increased demand for high-quality aircraft doors. The growing number of low-cost carriers and full-service airlines further strengthens the aviation sector, contributing to the overall market growth for aircraft doors.

Technological Advancements in Aircraft Safety

Innovations in materials, automation, and design have led to more advanced and secure aircraft doors. These developments are pushing the demand for newer aircraft doors that enhance passenger safety and operational efficiency. Aircraft manufacturers and MRO service providers are focusing on increasing the reliability of doors, which is driving significant growth in this sector.

Market Challenges

High Production and Maintenance Costs

The production and maintenance costs for aircraft doors are substantial, especially for specialized doors like those used in emergency exits and cargo holds. This affects the overall affordability for smaller airlines and new market entrants. In particular, the advanced technology required for safety and efficiency drives up costs. These high costs pose challenges to achieving sustainable market growth, particularly in the face of rising fuel prices and other external economic pressures.

Regulatory Compliance

The aircraft door market is heavily influenced by strict safety and regulatory standards that vary by country and region. Meeting these requirements demands substantial investment in R&D, which can delay product development and increase time-to-market for new innovations. This regulatory burden is a challenge for manufacturers and could limit market entry for new players, especially those with limited capital.

Opportunities

Expansion of Commercial Aviation

The growing number of commercial airlines in Southeast Asia presents a significant opportunity for the aircraft door market. As regional airports develop and more international routes are introduced, airlines are likely to invest in upgrading their fleets with new aircraft. This will increase the demand for modern, reliable aircraft doors.

Growing MRO Market

With the expanding fleet of commercial airlines in Southeast Asia, the demand for maintenance, repair, and overhaul (MRO) services is also on the rise. Aircraft door replacement and maintenance are a key part of this sector. As airlines increasingly focus on maintaining older aircraft, the MRO market presents a significant opportunity for aircraft door manufacturers and service providers.

Future Outlook

The aircraft door market is poised for significant growth over the next five years, driven by advancements in materials, safety features, and technological integration. The increasing global demand for air travel will continue to fuel the need for efficient, lightweight, and durable aircraft doors. Technological innovations, such as the use of automation and smart systems, will further shape the market, while regulatory support and safety standards will drive industry-wide improvements. As emerging markets expand their aviation sectors, the demand for new aircraft doors will be substantial.

Major Players

- Singapore Technologies Aerospace

- Safran Nacelles

- GKN Aerospace

- Hamilton Sundstrand

- Liebherr Aerospace

- UTC Aerospace Systems

- Magellan Aerospace

- Esterline Technologies

- Honeywell Aerospace

- Collins Aerospace

- Boeing Commercial Airplanes

- Airbus

- Boeing Defense, Space & Security

- Daimler AG

- Lockheed Martin

Key Target Audience

- Airlines

- Aircraft Manufacturers

- MRO Service Providers

- Government and Regulatory Bodies

- Aerospace Component Suppliers

- Aircraft Door Manufacturers

- Investment and Venture Capitalist Firms

- Aviation Consulting Firms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the aircraft door market, such as technological advancements, market size, and regional demand. Market drivers and barriers are also examined to understand their impact on market growth.

Step 2: Market Analysis and Construction

Market data is collected from both primary and secondary sources, including industry reports, company filings, and interviews with market experts. Data is then structured and analyzed to construct a comprehensive view of the market’s current state and future trends.

Step 3: Hypothesis Validation and Expert Consultation

The formulated hypotheses are validated through consultations with industry experts, key stakeholders, and decision-makers to ensure the accuracy and reliability of the findings.

Step 4: Research Synthesis and Final Output

The final research output is synthesized to provide actionable insights and strategic recommendations. The final report includes detailed analyses, market forecasts, and strategic insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Passenger Traffic

Rising Demand for Aircraft Fleet Upgrades

Advancements in Aircraft Door Technology - Market Challenges

High Initial Cost of Aircraft Doors

Complex Regulatory and Certification Requirements

Supply Chain and Component Shortages - Market Opportunities

Emerging Markets Demand for New Aircraft

Technological Innovations in Lightweight Materials

Growth of Regional Aviation - Trends

Increased Focus on Automation and Smart Doors

Sustainability in Manufacturing Materials

Integration of Advanced Safety Features - Government Regulations

FAA and EASA Certification Requirements

Compliance with ICAO Safety Standards

Environmental Regulations on Emissions and Materials

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Passenger Doors

Cargo Doors

Emergency Exit Doors

Service Doors

Other Door Types - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Rotorcraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Maintenance, Repair, and Overhaul (MRO)

Parts & Components - By EndUser Segment (In Value%)

Commercial Airlines

Government & Military

Private Aircraft Operators

Cargo Operators

MRO Service Providers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Third-party Distributors

Online Platforms

OEM Partnerships

Aftermarket Resellers

- Market Share Analysis

- CrossComparison Parameters (Revenue, Installed Units, Market Share, Product Innovation, Geographic Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Singapore Technologies Aerospace

Tata Advanced Systems

Safran Nacelles

UTC Aerospace Systems

Liebherr Aerospace

Hamilton Sundstrand

Magellan Aerospace

GKN Aerospace

Esterline Technologies

Honeywell Aerospace

Collins Aerospace

Boeing Commercial Airplanes

Airbus

Boeing Defense, Space & Security

Daimler AG

- Commercial Airlines’ Growing Fleet Needs

- Military Demand for Specialized Aircraft Doors

- Private Aviation’s Focus on Luxury and Customization

- Cargo Operators’ Efficiency Requirements

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035