Market Overview

The Singapore Aircraft Electric Motors market is expected to reach a market size of USD ~ billion by a recent historical assessment. The growth of the market is driven by increasing government support for sustainable aviation technologies, including substantial investments in electric propulsion systems and initiatives promoting greener alternatives to traditional fossil fuel-based aircraft. Moreover, advancements in battery efficiency and energy storage technologies have enhanced the performance of electric motors, fueling demand from both commercial and private aviation sectors.

Singapore has emerged as a significant hub for the development and adoption of aircraft electric motors, with its progressive aviation industry and governmental incentives fostering an environment ripe for innovation. The country’s strategic geographical location, coupled with its well-established aviation infrastructure, has positioned it as a key player in the Asia-Pacific region. This dominance is further supported by strong partnerships between industry leaders, local authorities, and research institutions, driving forward sustainable aviation technologies.

Market Segmentation

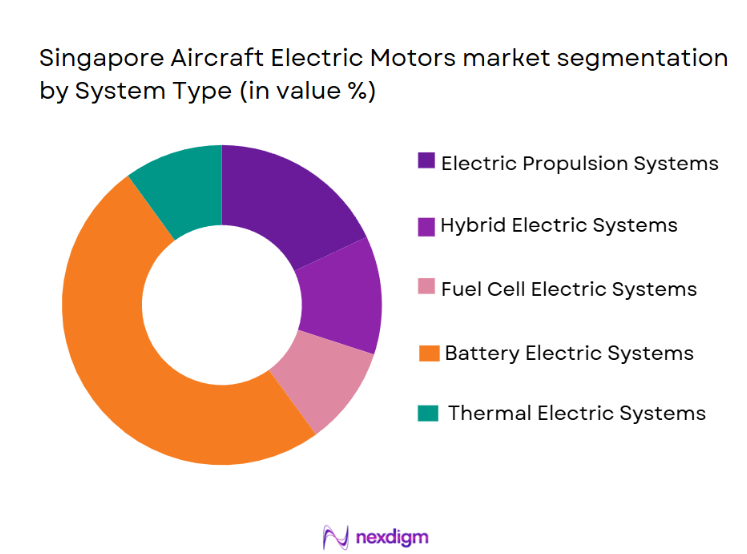

By System Type

The Singapore Aircraft Electric Motors market is segmented by system type into electric propulsion systems, hybrid electric systems, fuel cell electric systems, battery electric systems, and thermal electric systems. Recently, the battery electric systems sub-segment has seen a dominant market share due to factors such as advancements in battery technologies, increased focus on zero-emission aircraft, and greater cost-effectiveness in comparison to other power systems. The development of high-efficiency batteries with enhanced energy densities and shorter charging times has been a driving force for battery electric aircraft adoption, especially in urban air mobility.

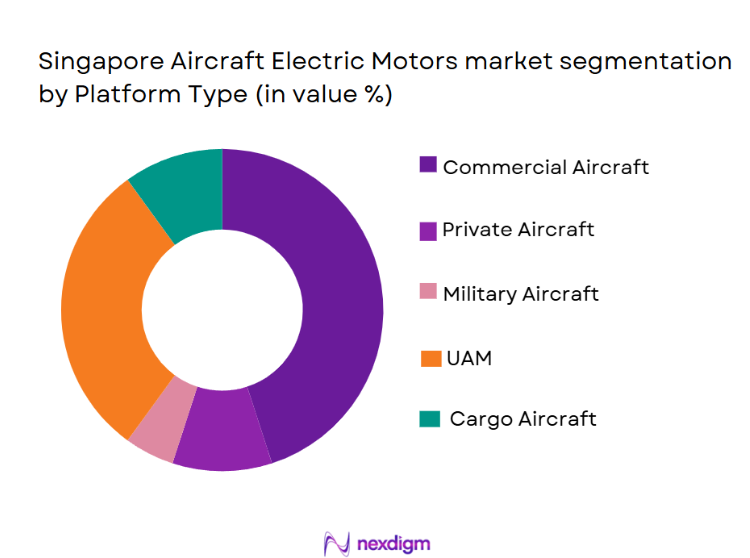

By Platform Type

The market is segmented by platform type into commercial aircraft, private aircraft, military aircraft, urban air mobility (UAM), and cargo aircraft. The commercial aircraft sub-segment has emerged as the dominant market segment due to the rapid adoption of electric propulsion systems in small and regional aircraft, aligned with global efforts to reduce carbon emissions in aviation. These efforts are further bolstered by growing consumer preference for environmentally friendly travel options and strong regulatory incentives supporting sustainable aviation technologies.

Competitive Landscape

The Singapore Aircraft Electric Motors market is marked by intense competition, with key players striving for technological advancements and strategic partnerships to gain a competitive edge. The market is characterized by consolidation, with leading companies forming joint ventures, collaborations, and mergers to scale their innovations. The presence of large multinational corporations alongside regional startups creates a dynamic competitive environment, with players focusing on system efficiency, cost reduction, and sustainability.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Rolls-Royce | 1904 | UK | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| MagniX | 2009 | USA | ~ | ~ | ~ | ~ |

| Siemens | 1847 | Germany | ~ | ~ | ~ | ~ |

Singapore Aircraft Electric Motors Market Analysis

Growth Drivers

Technological Advancements

The rapid pace of technological innovation in electric propulsion systems and battery technologies is a primary growth driver for the aircraft electric motors market. Advancements in energy density, battery management systems, and electric motor efficiency are enabling longer flight ranges and better performance. This is making electric aircraft more viable for commercial and regional aviation, significantly expanding the market’s potential.

Government Regulations and Incentives

Governments worldwide, including in Singapore, are introducing stringent regulations to reduce aviation’s carbon footprint, coupled with incentives to support the transition to electric propulsion. These regulatory policies are promoting the development and adoption of electricaircraft, accelerating market growth. Initiatives such as subsidies, tax credits, and research grants are fostering the growth of the electric aviation industry.

Market Challenges

High Initial Investment

One of the major challenges for the aircraft electric motors market is the high initial investment required for the development of electric propulsion systems. The cost of advanced electric motors and battery technology is significant, especially for manufacturers entering the electric aviation sector. This can be a barrier for smaller companies or those seeking to develop cost-effective solutions, slowing the adoption of electric motors in aircraft.

Battery Technology Limitations

While significant progress has been made in electric motor development, the limitations of current battery technologies remain a key challenge. Battery weight, energy density, and charging time still pose significant obstacles to the widespread adoption of electric propulsion in commercial aviation. Further breakthroughs in battery technology are needed to meet the operational requirements for long-distance flights and ensure the market’s sustained growth.

Opportunities

Urban Air Mobility (UAM) Solutions

The increasing demand for electric vertical takeoff and landing (eVTOL) aircraft presents a significant opportunity for the aircraft electric motors market. UAM is poised to revolutionize urban transportation, offering eco-friendly and efficient solutions for air taxis, cargo drones, and other applications. As investment in UAM solutions rises, the demand for aircraft electric motors will continue to grow, creating a high-value opportunity for market participants.

Expansion in Asia-Pacific Region

The Asia-Pacific region, particularly Singapore, presents a substantial growth opportunity for theaircraftelectric motors market. With its thriving aerospace sector, government support, and a growing emphasis on sustainability, the region is poised to see increased demand for electric aircraft. The development of regional electric aircraft and urban air mobility solutions will drive market expansion, creating opportunities for companies involved in electric propulsion systems.

Future Outlook

The future of the Singapore Aircraft Electric Motors market looks promising, with expected growth driven by ongoing technological advancements in battery efficiency, electric propulsion systems, and government incentives for reducing aviation’s carbon footprint. Over the next five years, the market will witness increased integration of electric systems in both commercial and private aircraft. The rise of urban air mobility and the regulatory push toward zero-emissions will also stimulate demand. The ongoing advancements in energy storage technologies and the establishment of electric aircraft charging infrastructure will continue to fuel this expansion.

Major Players

- Rolls-Royce

- Honeywell International

- Safran

- MagniX

- Siemens

- GE Aviation

- Lilium

- Eviation Aircraft

- Vertical Aerospace

- Bye Aerospace

- AeroVironment

- PowerCell Sweden AB

- Mitsubishi Electric

- Embraer

- Ballard Power Systems

Key Target Audience

- Government and regulatory bodies

- Investments and venture capitalist firms

- Aerospace manufacturers

- Aircraft leasing companies

- Airline operators

- Airport authorities

- Electric vehicle infrastructure providers

- Electric propulsion system developers

Research Methodology

Step 1: Identification of Key Variables

We begin by identifying the key drivers, challenges, and opportunities impacting the market. This includes understanding technological advancements, regulatory shifts, and market dynamics.

Step 2: Market Analysis and Construction

We analyze historical data, industry reports, and trends to construct a reliable model for forecasting future growth in the market. We also segment the market by product, platform, and end-users.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, regulatory bodies, and key players are consulted to validate assumptions, adjust projections, and refine market dynamics for accuracy.

Step 4: Research Synthesis and Final Output

The final output is synthesized from the analyzed data, expert consultations, and market projections. The final report is then validated and compiled to offer a comprehensive view of the market’s potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Focus on Sustainability and Carbon Emissions Reduction

Government Incentives for Electric Aviation

Technological Advancements in Battery Efficiency - Market Challenges

High Initial Investment Costs

Technological Barriers in Energy Density and Charging Infrastructure

Regulatory Challenges and Certification Processes - Market Opportunities

Emerging Markets for Urban Air Mobility (UAM)

Advancements in Battery Management Systems

Partnerships for Electrification in Commercial Aviation - Trends

Growth in Electric Aircraft Prototypes and Test Flights

Electrification in General Aviation

Advances in Electric Vertical Take-Off and Landing (eVTOL) Technologies - Government Regulations

Electric Aircraft Certification Standards

Environmental Regulations on Carbon Emissions

Incentive Programs for Aircraft Electrification

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electric Propulsion Systems

Hybrid Electric Systems

Fuel Cell Electric Systems

Battery Electric Systems

Thermal Electric Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Urban Air Mobility (UAM)

Cargo Aircraft - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Aftermarket Fitment

Upgrade/Replacement Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Owners

Air Charter Services

Defense Contractors

Air Freight & Logistics Providers - By Procurement Channel (In Value%)

Direct Procurement

Distributor/Reseller

OEM Supply Chain

Government Contracts

Third-Party Service Providers

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rolls-Royce

Honeywell International

Safran

MagniX

General Electric Aviation

Siemens

Meggitt

Lilium

Eviation Aircraft

Vertical Aerospace

Bye Aerospace

Mitsubishi Electric

AeroVironment

PowerCell Sweden AB

Embraer

- Commercial Airlines’ Shift Toward Green Aircraft

- Private Jet Owners Embracing Electric Technology

- Defense Contractors Investing in Hybrid Electric Aircraft

- Growth in Air Freight Providers Switching to Electric Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035