Market Overview

The Singapore aircraft electrical systems market is projected to reach USD ~ billion by the end of the historical assessment period, driven by the increasing demand for more energy-efficient, lightweight, and reliable electrical systems in modern aircraft. As the aviation industry embraces next-generation aircraft with advanced electrical architectures, significant investments from government and private sectors to promote air mobility and reduce emissions are bolstering market growth. Furthermore, demand for aircraft modernization and MRO (Maintenance, Repair, and Overhaul) services is accelerating the integration of advanced electrical systems across both commercial and military aircraft fleets.

The market is dominated by key players in developed regions, particularly in cities like Singapore, which is emerging as a global aerospace hub due to its strategic location in Asia. The strong presence of aircraft manufacturers, MRO services, and regulatory bodies in the region contributes significantly to market growth. Singapore’s focus on sustainable aviation technologies, government-backed initiatives, and investments in airport and aerospace infrastructure have solidified its position as a leading player in the aircraft electrical systems market.

Market Segmentation

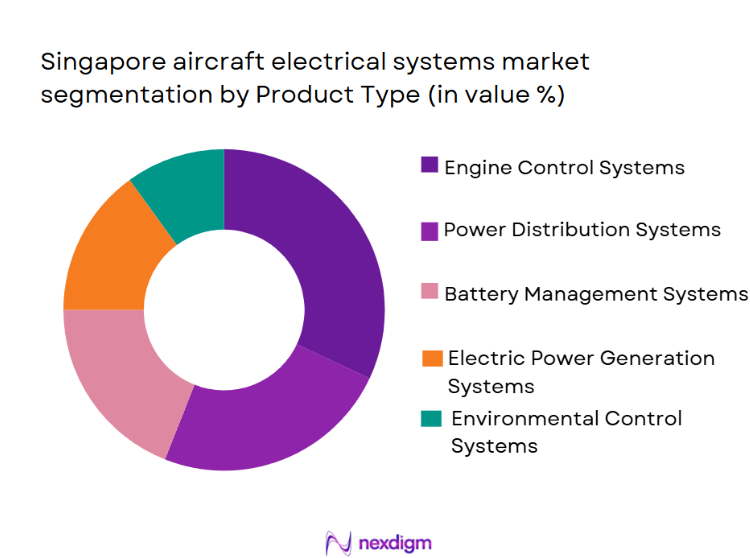

By Product Type

The Singapore aircraft electrical systems market is segmented by product type into engine control systems, power distribution units, battery management systems, electric power generation systems, and environmental control systems. Recently, engine control systems have been dominating the market share due to increasing demand for enhanced fuel efficiency, reduced emissions, and optimized aircraft performance. The rise of electric propulsion systems and the ongoing development of more sustainable aircraft have also contributed to the growth of this sub-segment, making it a vital component of modern aircraft designs.

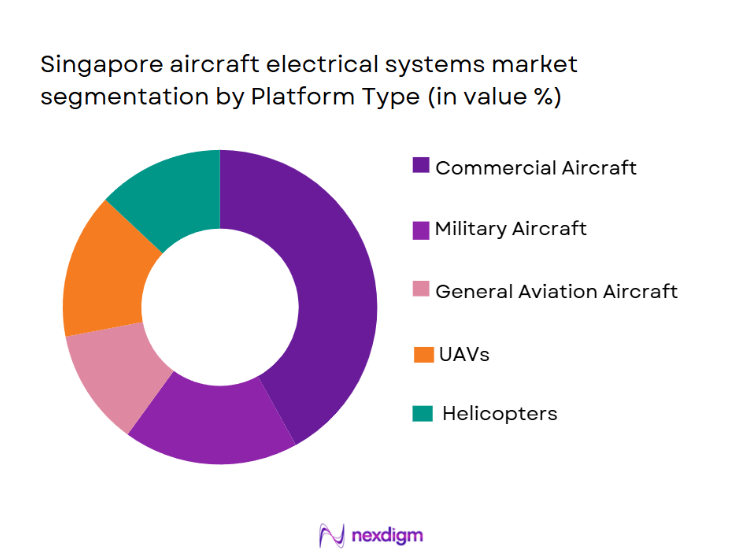

By Platform Type

The Singapore aircraft electrical systems market is segmented by platform type into commercial aircraft, military aircraft, general aviation aircraft, unmanned aerial vehicles (UAVs), and helicopters. The commercial aircraft sub-segment holds a dominant market share due to the rapid expansion of air travel and the growing demand for eco-friendly aircraft technologies. Increased investments by airlines in fleet upgrades and the global trend toward more energy-efficient commercial aircraft are expected to further boost this sub-segment, making it a cornerstone of the aircraft electrical systems market.

Competitive Landscape

The Singapore aircraft electrical systems market is highly competitive, with several large players leading innovation and setting industry standards. Consolidation is evident, as major aerospace companies collaborate with governments and startups to develop more energy-efficient and sustainable technologies. The presence of major global players and the emphasis on advanced technologies are shaping the competitive landscape. These players continue to dominate through mergers, partnerships, and strategic investments aimed at gaining an edge in this rapidly evolving market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Electrical & Power | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Electrical Systems Market Analysis

Growth Drivers

Advancements in Aircraft Electrification

The rise of electric aircraft and hybrid propulsion systems is driving the demand for specialized electrical systems. As airlines aim to reduce carbon emissions and improve fuel efficiency, the adoption of electrification technologies has increased, influencing the demand for next-generation electrical systems. This trend is expected to boost market growth, especially in the development of power management and distribution systems.

Growing Air Travel Demand

The continuous expansion of the global aviation industry, driven by a rising middle class, growing tourism, and increased international travel, has led to a higher demand for commercialaircraft. This demand has resulted in the need for improved aircraft systems, including electrical solutions for enhanced fuel efficiency, passenger comfort, and safety, fostering growth in the aircraft electrical systems market.

Market Challenges

High Development and Maintenance Costs

Aircraft electrical systems require substantial investment in research, development, and maintenance. The complexity of integrating advanced electrical systems with other aircraft systems further increases costs. Small and medium-sized players may find it difficult to compete with established players due to the high capital required to innovate and maintain these systems, hindering market entry and growth.

Regulatory Challenges

Stringent regulations imposed by aviation authorities, such as the FAA and EASA, can pose challenges in terms of certification and compliance. Adhering to these regulations requiressignificant time and financial investments, particularly for new technologies like electric and hybrid propulsion systems. Meeting these regulatory standards can delay the introduction of innovative electrical systems into the market.

Opportunities

Sustainability and Green Aircraft Initiatives

The increasing focus on environmental sustainability presents a significant opportunity for the aircraft electrical systems market. With rising pressure on the aviation industry to reduce emissions, there is a growing demand for environmentally friendly aircraft. The development of energy-efficient electrical systems that support electric propulsion and reduce weight can offer significant advantages in meeting sustainability targets, thus opening new avenues for growth.

Smart Aircraft Systems

The introduction of smartaircraft systems that integrate advanced electrical components for automation, data management, and operational efficiency offers an exciting opportunity. The increasing integration of IoT (Internet of Things) in aviation is transforming how electrical systems are utilized. Innovations in smart electrical components will enhance system reliability, safety, and fuel efficiency, fostering the market’s expansion.

Future Outlook

The aircraft electrical systems market is expected to witness strong growth in the coming years, driven by advancements in technology, particularly in electrification and sustainable aviation. As the industry embraces next-generation aircraft, including electric and hybrid models, the demand for modern electrical systems is anticipated to surge. Governments worldwide are increasingly focusing on sustainability, with regulations supporting the development of green aviation technologies. Additionally, the ongoing recovery of the global aviation industry, particularly in Asia-Pacific, is set to further drive demand for advanced electrical systems.

Major Players

- Honeywell Aerospace

- Safran Electrical & Power

- Collins Aerospace

- Thales Group

- Moog Inc.

- UTC Aerospace Systems

- GE Aviation

- Zodiac Aerospace

- Diehl Aviation

- Liebherr Aerospace

- Boeing

- Airbus

- Rockwell Collins

- Parker Hannifin

- AeroVironment

Key Target Audience

- Airlines

- Aircraft Manufacturers

- MRO Service Providers

- Government and Regulatory Bodies

- Investors and Venture Capitalist Firms

- Aircraft Component Suppliers

- OEMs (Original Equipment Manufacturers)

- Private Aircraft Owners

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that impact the market, including demand trends, technology adoption, and regulatory frameworks. These variables are crucial for the overall analysis and understanding of the market.

Step 2: Market Analysis and Construction

Market segmentation is performed based on various factors such as product type, platform type, and fitment type. This step builds the foundation for understanding market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses are validated through consultations with industry experts, stakeholders, and major players to ensure the accuracy and relevance of the findings.

Step 4: Research Synthesis and Final Output

The final research synthesis consolidates all collected data and insights into a cohesive report. The output is designed to provide actionable insights for stakeholders and decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Aircraft Production

Technological Advancements in Electrical Systems

Rise in Air Travel Demand - Market Challenges

High Cost of Advanced Electrical Systems

Complexity of Integration in Existing Aircraft

Regulatory Compliance Issues - Market Opportunities

Growth in Electrification of Aircraft

Government Initiatives to Promote Green Aviation

Increased Investment in Aircraft Modernization - Trends

Shift Toward More Efficient Power Systems

Integration of IoT and AI in Aircraft Electrical Systems

Focus on Sustainable and Green Aviation Technologies - Government Regulations

Compliance with ICAO Standards

Local Certification Requirements

Government Policies Supporting Sustainable Aviation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Control Systems

Power Distribution Units

Battery Management Systems

Electric Power Generation Systems

Environmental Control Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Unmanned Aerial Vehicles

Helicopters - By Fitment Type (In Value%)

Linefit

Retrofit

OEM

Aftermarket

Upgrades - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

MRO Services

Government & Military

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Distributors

Third-Party Integrators

OEM Channels

- Market Share Analysis

- CrossComparison Parameters (Market Value, Installed Units, System Complexity, Fitment Type, Growth Drivers)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell Aerospace

Safran Electrical & Power

Collins Aerospace

Thales Group

Moog Inc.

UTC Aerospace Systems

GE Aviation

Zodiac Aerospace

Diehl Aviation

Liebherr Aerospace

Boeing

Airbus

Rockwell Collins

Parker Hannifin

AeroVironment

- Airline Fleet Expansion

- Increased Demand for MRO Services

- Government and Military Contracts

- Private Sector Demand for Advanced Aircraft Features

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035