Market Overview

The Singapore Aircraft Electrification market is valued at USD ~ billion, driven by the nation’s commitment to reducing carbon emissions and fostering sustainable technologies. The market growth is propelled by the government’s support for green initiatives, including electrification in aviation, and the increasing need for eco-friendly transportation solutions. Singapore’s strategic position as a global aviation hub and its highly developed infrastructure further contribute to the growth of the electrification market, with a growing demand for more energy-efficient and sustainable aircraft technologies.

Singapore is a leading market for aircraft electrification in Asia due to its advanced aviation industry and government policies prioritizing environmental sustainability. As one of the busiest aviation hubs globally, Singapore’s Changi Airport plays a crucial role in promoting the adoption of electric aircraft. The city-state’s ambitious climate goals, such as achieving net-zero emissions by 2050, along with its commitment to innovative solutions in aviation, has attracted significant investments in electric aircraft technologies. Additionally, other Southeast Asian nations, such as Malaysia and Indonesia, are showing growing interest in sustainable aviation practices, reinforcing Singapore’s position as a leader in the region.

Market Segmentation

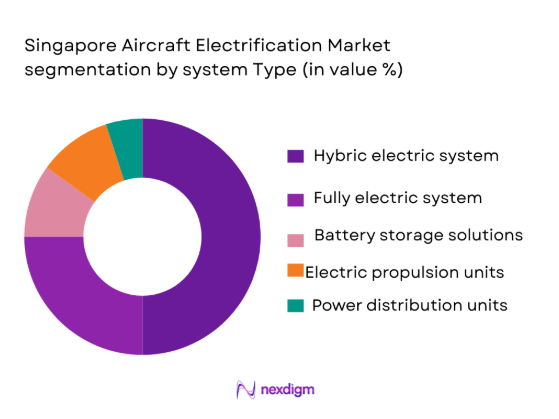

By System Type

The Singapore Aircraft Electrification market is segmented by system type, which includes hybrid electric systems, fully electric systems, battery storage solutions, electric propulsion units, and power distribution units. Among these, hybrid electric systems dominate the market, owing to their practical application in the early phases of electrification. Hybrid systems enable airlines to reduce fuel consumption while maintaining operational flexibility with traditional engines. These systems are the preferred choice for commercial airlines and aircraft manufacturers in Singapore, as they offer a balanced approach to reducing environmental impact while maintaining operational efficiency.

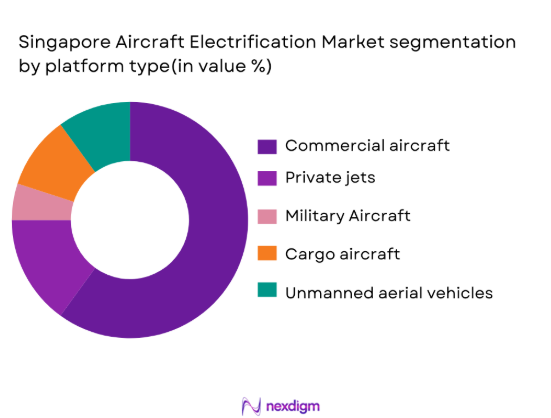

By Platform Type

The Singapore Aircraft Electrification market is also segmented by platform type, which includes commercial aircraft, private jets, military aircraft, cargo aircraft, and unmanned aerial vehicles (UAVs). Commercial aircraft hold the dominant market share in this segment, driven by the large number of airlines operating in Singapore and the strong focus on reducing emissions from commercial flights. Singapore Airlines, a key player in the region, is actively investing in hybrid-electric and fully electric aircraft technologies to achieve its sustainability goals, making commercial aircraft the most prominent platform type in the country.

Competitive Landscape

The Singapore Aircraft Electrification market is dominated by several major players with significant technological capabilities, including global aerospace companies like Boeing, Airbus, Rolls-Royce, and emerging electric aviation companies such as MagniX and Eviation Aircraft. These companies are focusing on developing innovative electric propulsion systems and establishing strategic partnerships with airlines in Singapore and the wider ASEAN region to advance electric aircraft technology. Their leadership in the market is reflected in their strong R&D investments, global reach, and focus on sustainable aviation solutions.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| Boeing | 1916 | USA | – | – | – | – |

| Airbus | 1970 | France | – | – | – | – |

| Rolls-Royce | 1906 | UK | – | – | – | – |

| MagniX | 2009 | USA | – | – | – | – |

| Eviation Aircraft | 2015 | USA | – | – | – | – |

Singapore Aircraft Electrification Market Dynamics

Growth Drivers

Increasing Demand for Sustainable Aviation Technologies

The demand for sustainable aviation technologies in Singapore is rapidly increasing, driven by both global and local environmental goals. Singapore has committed to achieving net-zero emissions by 2050, with the aviation sector being one of the primary areas for emissions reduction. The city-state has already initiated various green policies to meet these objectives, including investments in sustainable aviation solutions like electric aircraft. According to the Singapore Green Plan 2030, which allocates SGD 19 billion to green initiatives, a significant portion is directed toward transforming the aviation industry into a low-emission sector. These investments and regulations contribute to the growing demand for electric aircraft and propulsion systems.

Government Incentives and Funding for Green Technologies

Singapore’s government has heavily supported the development of green technologies, including aircraft electrification, through various funding schemes. The government’s continued commitment to decarbonization is evident in its investment in green technologies for aviation, including electric aircraft. As part of the Singapore Economic Development Board’s (EDB) plan, more than SGD 20 billion was allocated to technology and innovation in 2023. Furthermore, the Civil Aviation Authority of Singapore (CAAS) provides grants to companies developing sustainable aviation technologies, including electric propulsion. This support strengthens the ecosystem for electric aircraft development and accelerates market adoption.

Market Challenges

High Initial Cost of Electrification Technologies

The initial cost of electrification technologies remains one of the primary challenges for the aircraft electrification market in Singapore. The cost of electric propulsion systems and associated infrastructure is still significantly high, often exceeding the price of conventional aircraft. In 2023, the cost of electric engines for small to mid-sized aircraft was approximately USD 20 million, a major investment for airlines. This high initial cost poses a barrier to adoption, especially for smaller carriers and private jet operators. The government has acknowledged this issue, but the challenge remains significant until economies of scale are achieved in the production of these technologies.

Regulatory and Certification Barriers

Electric aircraft must meet stringent certification requirements from both the Civil Aviation Authority of Singapore (CAAS) and international bodies like the International Civil Aviation Organization (ICAO). In 2023, the certification process for electric propulsion systems was not fully established, creating uncertainty for manufacturers and operators. Despite these regulatory barriers, Singapore has been actively participating in international discussions to create standards for electric aircraft certification. However, the absence of a standardized global certification process and the lack of clear guidelines still pose a significant challenge to the widespread adoption of electric aircraft.

Market Opportunities

Emerging Markets for Electric Aircraft in Singapore and the ASEAN Region

The ASEAN region presents a significant opportunity for the Singapore Aircraft Electrification market. With growing interest in sustainable aviation, countries in Southeast Asia, including Malaysia and Thailand, are looking to adopt electric aircraft solutions as part of their sustainability initiatives. Singapore is well-positioned to lead the way in this transition, with its well-established infrastructure, regulatory support, and expertise in aviation technology. The government’s commitment to decarbonization and its investment in green technologies are setting the stage for significant market opportunities in the electric aircraft sector, which will likely expand throughout the ASEAN region.

Technological Collaboration Between Airlines and Electric System Providers

Collaboration between Singapore airlines and electric propulsion system manufacturers is expected to drive innovation and accelerate market growth. In 2023, Singapore Airlines announced its collaboration with global leaders in electric aviation systems, such as Rolls-Royce and Airbus, to test and integrate electric propulsion technologies into their fleets. Such collaborations are pivotal in improving the performance of electric aircraft systems, enhancing their viability in commercial aviation. These partnerships are expected to continue fostering innovation, making electric aircraft more feasible for both airlines and private operators in Singapore.

Future Outlook

Over the next decade, the Singapore Aircraft Electrification market is expected to show significant growth driven by government support, advancements in battery technology, and the increasing demand for sustainable aviation solutions. Singapore’s push towards achieving net-zero emissions by 2050, alongside the growing investment in green technologies, will likely encourage more airlines and aircraft manufacturers to adopt electric propulsion systems. Furthermore, the strong collaboration between local government bodies, aviation companies, and technology providers will accelerate the transition to electric aircraft in Singapore.

Major Players in the Market

- Boeing

- Airbus

- Rolls-Royce

- MagniX

- Eviation Aircraft

- GE Aviation

- Safran

- Honeywell

- Siemens

- Pipistrel

- Vertical Aerospace

- Lilium

- Embraer

- Thales

- Quantum Systems

Key Target Audience

- Airlines

- Private Aircraft Operators

- Military and Defense Contractors

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aviation Technology Manufacturers

- Aircraft Component Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map of all key stakeholders in the Singapore Aircraft Electrification Market. This includes identifying the variables that influence the market dynamics, such as government policies, technological advancements, and the adoption rate of electric aircraft. The research uses a combination of secondary research and proprietary databases to gather industry-level insights.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to understand market penetration, revenue generation, and market trends. The ratio of electric aircraft to traditional aircraft is analyzed, alongside service quality data. This helps evaluate the current state of the electrification market in Singapore and its future growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations with industry professionals, including representatives from aircraft manufacturers, airlines, and regulatory bodies. These consultations provide valuable operational insights that help refine the market data and ensure the validity of the research.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the findings from both primary and secondary research to create a comprehensive report. This includes gathering additional data from key industry players to validate market data and ensure accurate conclusions are drawn from the research.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Singapore Aircraft Electrification Overview

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for sustainable aviation technologies

Government incentives and funding for green technologies

Technological advancements in battery and power systems - Market Challenges

High initial cost of electrification technologies

Regulatory and certification barriers

Limited infrastructure for electric aircraft charging and maintenance - Market Opportunities

Emerging markets for electric aircraft in Singapore and the ASEAN region

Technological collaboration between airlines and electric system providers - Trends

Shift towards hybrid-electric and fully electric aircraft solutions

Growing investment in electric aircraft research and development

Increase in public and private partnerships for electric aircraft infrastructure

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Hybrid Electric Systems

Fully Electric Systems

Battery Storage Solutions

Electric Propulsion Units

Power Distribution Units - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

New Aircraft Production

Aircraft Retrofit

Modular Fitment

OEM Integration

Aftermarket Fitment - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

Cargo and Freight Operators

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers - By Procurement Channel (In Value%)

Direct OEM Sales

Third-party Vendors

Integrated Solutions Providers

Government Contracts

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Market share, Pricing models, Technological advancements, Customer satisfaction, Distribution channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company profiles

Airbus

Boeing

Rolls-Royce

GE Aviation

Safran

Honeywell

MagniX

Eviation Aircraft

Embraer

Thales

Siemens

Pipistrel

Vertical Aerospace

Lilium

Quantum Systems

- Airlines are increasingly adopting electrification for cost savings and regulatory compliance

- Private aircraft operators are exploring electric solutions for lower operational costs

- Military and defense sectors are exploring electric propulsion for efficiency and reduced emissions

- MRO providers are focusing on electric aircraft maintenance expertise.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035