Market Overview

The Singapore Aircraft Emergency Systems market is valued at approximately USD ~ billion, based on a five-year historical analysis. This market is primarily driven by the country’s expanding aviation industry, the rising number of air passengers, and the increasing demand for advanced safety systems. Singapore Airlines, a key player in the region, continues to modernize its fleet with enhanced safety and emergency systems to ensure compliance with global aviation regulations. Additionally, regulatory pressure from agencies such as the Civil Aviation Authority of Singapore (CAAS) to maintain high safety standards is another contributing factor to the market’s growth.

Singapore is a dominant market for aircraft emergency systems due to its strategic location as a global aviation hub. With Singapore Airlines operating a large and modern fleet, the demand for advanced emergency systems has grown significantly. The country’s progressive regulatory framework and its active participation in international aviation safety initiatives, such as the International Civil Aviation Organization (ICAO), strengthen its position in the market. Furthermore, the continuous development of Changi Airport into a world-class transportation hub enhances the country’s dominance in this sector.

Market Segmentation

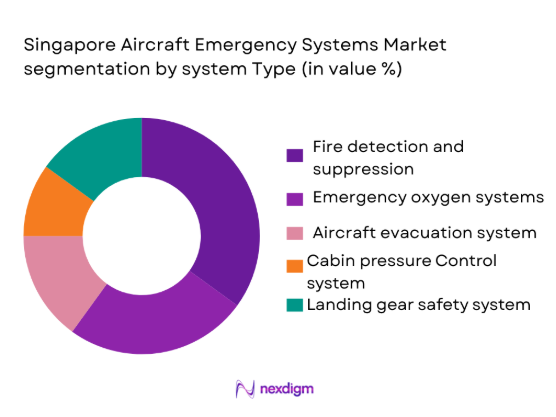

By System Type

The Singapore Aircraft Emergency Systems market is segmented into fire detection and suppression systems, emergency oxygen systems, aircraft evacuation systems, cabin pressure control systems, and landing gear safety systems. Fire detection and suppression systems dominate the market due to the high priority placed on fire safety in aviation. International aviation regulations mandate advanced fire detection systems in commercial aircraft, which has led to the widespread adoption of these systems across Singapore’s fleet, including Singapore Airlines. The regulatory push for heightened fire safety and the implementation of newer fire suppression technologies, such as Halon-free systems, also contribute to the dominance of this segment.

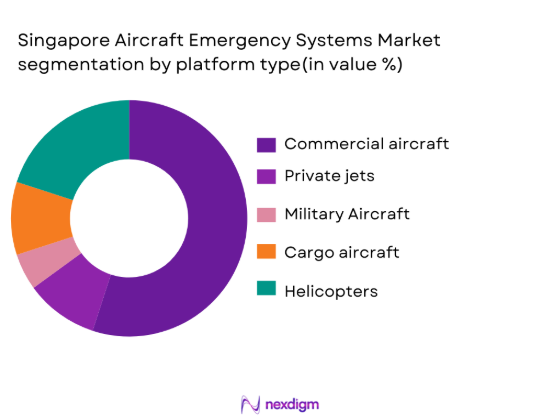

By Platform Type

The market is also segmented by platform type, including commercial aircraft, private jets, military aircraft, cargo aircraft, and helicopters. The commercial aircraft segment holds the largest market share, driven by Singapore Airlines’ large fleet and the country’s growing air traffic. Commercial airlines are required to meet stringent international safety standards, increasing the demand for reliable and high-performance emergency systems. The increasing number of international flights and expanding airport infrastructure, such as Changi Airport, also contribute to the dominance of this segment.

Competitive Landscape

The Singapore Aircraft Emergency Systems market is highly competitive, with global players such as Honeywell, Collins Aerospace, and Safran leading the industry. These companies provide advanced systems for fire detection, oxygen supply, aircraft evacuation, and landing gear safety, aligning with the high safety standards required by Singapore Airlines and other local carriers. These key players have strong partnerships with airlines, government agencies, and airport authorities, enabling them to remain dominant in the market. Their continuous innovations in emergency system automation and integration also ensure their competitive edge.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| Honeywell | 1906 | USA | – | – | – | – |

| Collins Aerospace | 2018 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| UTC Aerospace Systems | 1934 | USA | – | – | – | – |

| L3 Technologies | 1997 | USA | – | – | – | – |

Singapore Aircraft Emergency Systems Market Dynamics

Growth Drivers

Increasing Demand for Enhanced Safety Protocols in Aviation

As global aviation standards evolve, the demand for enhanced safety protocols has increased in Singapore. The Singaporean government has continually updated safety regulations to align with international standards. For instance, in 2023, the Civil Aviation Authority of Singapore (CAAS) reported a significant push towards more advanced safety protocols following international safety audits. This regulatory push has resulted in the adoption of next-generation emergency systems, such as more efficient fire suppression and emergency oxygen systems, which have been mandated for new aircraft models. These improvements are driven by a growing awareness of safety needs and the country’s aviation aspirations.

Growing Focus on Aircraft Safety and Emergency Preparedness

Singapore’s growing focus on aircraft safety is underpinned by both local regulations and global trends in aviation. In 2023, the Singapore government announced new funding initiatives to advance aviation safety, including enhanced emergency systems on aircraft. As part of this focus, Singapore Airlines has been updating its fleet with the latest emergency systems to ensure compliance with both local and international aviation safety standards. Furthermore, Singapore’s active participation in international safety standards, including the International Civil Aviation Organization (ICAO) guidelines, reinforces its commitment to robust emergency preparedness, ensuring that aircraft operating in and out of the country meet stringent safety criteria.

Market Challenges

High Cost of Advanced Emergency Systems

The high cost of advanced emergency systems remains a major challenge in the Singapore aircraft emergency systems market. The implementation of fire detection, evacuation systems, and emergency oxygen systems involves significant financial investment. For instance, the integration of a complete suite of emergency systems in a commercial aircraft can exceed USD 10 million. This cost is a major hurdle for smaller operators and new entrants looking to meet the high standards set by regulatory bodies. Despite government incentives to adopt cutting-edge technologies, the high cost remains a barrier for rapid industry-wide implementation, particularly in the private jet sector.

Stringent Regulatory and Certification Processes

The regulatory and certification processes for aircraft emergency systems are highly stringent in Singapore, leading to delays and added costs. In 2023, the Civil Aviation Authority of Singapore (CAAS) worked in collaboration with ICAO to ensure that emergency systems meet exacting international safety standards. Aircraft manufacturers and system integrators must pass rigorous tests before being certified for use, which can take several years. These processes, while essential for ensuring safety, slow down the time-to-market for new technologies, creating an additional challenge for companies looking to capitalize on innovations in emergency systems.

Market Opportunities

Growing Demand for Advanced Safety Systems in Singapore’s Aviation Industry

The ongoing expansion of Singapore’s aviation sector presents a significant opportunity for the aircraft emergency systems market. With increased air traffic and the government’s focus on becoming a global aviation hub, there is a heightened demand for state-of-the-art safety systems. Singapore Airlines, which continues to grow its fleet, is actively investing in next-gen emergency systems to meet evolving safety regulations. These investments reflect a broader trend in the region where airlines are striving to maintain the highest levels of passenger safety. Additionally, the government’s initiatives to enhance airport safety and infrastructure add to the overall demand for emergency systems across all aviation platforms.

Technological Advancements in Emergency System Automation

Technological advancements in emergency system automation present an exciting opportunity for growth in the Singapore aircraft emergency systems market. The development of AI-powered evacuation systems, predictive maintenance for emergency equipment, and automated fire detection systems are all set to transform aviation safety standards. In 2023, the International Air Transport Association (IATA) highlighted the potential of automation to improve emergency responses, which is increasingly reflected in the fleet modernization strategies of airlines operating in Singapore. These technologies promise not only to enhance safety but also to streamline operational processes, improve cost-effectiveness, and reliability.

Future Outlook

Over the next decade, the Singapore Aircraft Emergency Systems market is set to experience continued growth, driven by the expansion of Singapore Airlines’ fleet, the ongoing development of Changi Airport, and increased passenger traffic. With the global push for greener aviation solutions, new technologies such as Halon-free fire suppression systems, advanced emergency evacuation systems, and automated emergency systems are expected to become more prevalent. Furthermore, Singapore’s position as a leader in aviation safety and its continued investment in state-of-the-art infrastructure will further boost demand for advanced emergency systems.

Major Players in the Market

- Honeywell

- Collins Aerospace

- Safran

- UTC Aerospace Systems

- L3 Technologies

- BAE Systems

- Airbus

- Boeing

- Rockwell Collins

- GE Aviation

- Thales

- Meggitt

- Esterline Technologies

- Moog

- Trelleborg

Key Target Audience

- Airlines (including Singapore Airlines)

- Private Aircraft Operators

- Military and Defense Contractors

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aviation Technology Manufacturers

- Aircraft Component Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying and understanding the primary factors affecting the Singapore Aircraft Emergency Systems market. This includes examining regulatory trends, safety standards, technological advancements, and the growing demand for more reliable emergency systems in aviation. Secondary data sources and market reports will be analyzed to create an ecosystem map of all major stakeholders.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data will be collected to analyze the market’s growth and penetration over the past five years. This includes evaluating the growth of Singapore Airlines, the number of new aircraft deliveries, and the adoption of advanced emergency systems across the region. It will help in understanding the patterns of market evolution and inform future projections.

Step 3: Hypothesis Validation and Expert Consultation

The research hypotheses regarding growth drivers, challenges, and future opportunities will be tested through consultations with industry experts. These consultations will include discussions with manufacturers, airlines, and government authorities to validate assumptions and ensure the accuracy of the market data.

Step 4: Research Synthesis and Final Output

In the final phase, the research findings will be synthesized into a comprehensive report. This will involve gathering insights from industry leaders, validating the data through primary research, and ensuring that all relevant market dynamics are addressed to produce a well-rounded analysis of the Singapore Aircraft Emergency Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for enhanced safety protocols in aviation

Growing focus on aircraft safety and emergency preparedness

Rising number of air passengers and flights - Market Challenges

High cost of advanced emergency systems

Stringent regulatory and certification processes

Technological complexity and integration challenges - Market Opportunities

Growing demand for advanced safety systems in Singapore’s aviation industry

Technological advancements in emergency system automation

Expansion of Singapore’s aviation industry with new airports and airlines - Trends

Technological innovations in emergency evacuation systems

Increased investments in safety features by Singapore-based airlines

Emphasis on real-time monitoring of emergency system performance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fire Detection and Suppression Systems

Emergency Oxygen Systems

Aircraft Evacuation Systems

Cabin Pressure Control Systems

Landing Gear Safety Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM) Fitment

Aftermarket Fitment

Retrofit Installations

Modular Installations

System Upgrades - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

Government and Regulatory Bodies - By Procurement Channel (In Value%)

Direct OEM Sales

Third-party Vendors

Government Contracts

Integrated Solutions Providers

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Technological innovations, Pricing strategies, Market penetration, Customer satisfaction, Distribution channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Honeywell

UTC Aerospace Systems

L3 Technologies

Safran

B/E Aerospace

Collins Aerospace

Esterline

Moog Inc.

Airbus

Boeing

General Electric

SABCA

GKN Aerospace

Liebherr Aerospace

Rockwell Collins

- Airlines are investing heavily in next-gen emergency systems for enhanced safety standards

- Private aircraft operators are adopting advanced emergency systems for compliance and safety

- MRO providers are seeing increased demand for emergency system upgrades and maintenance

- Government and regulatory bodies are focusing on tightening safety regulations and compliance.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035