Market Overview

The Singapore Aircraft Engine Blades market is valued at approximately USD ~ billion, based on a five-year historical analysis. This market is driven by the country’s robust aviation sector, highlighted by the continuous growth of Singapore Airlines, which operates a fleet of over 130 aircraft. The increasing focus on fuel efficiency and reduced emissions is pushing the demand for advanced engine blades that are lightweight and highly durable. With advancements in composite materials and the ongoing modernization of aircraft fleets in Singapore, the need for high-performance engine blades continues to grow, making it a key component of the aviation supply chain.

Singapore, as a global aviation hub, dominates the aircraft engine blades market in Southeast Asia. The city-state’s strategic geographical location allows for its dominance in regional and international air travel. Singapore Airlines, a significant player in the international aviation industry, contributes heavily to the demand for high-quality engine blades. Additionally, the government’s investments in the development of Changi Airport and the continual expansion of the aviation sector in Singapore help maintain its position as a leader in the market. The region benefits from a strong aviation infrastructure and regulatory support, reinforcing Singapore’s prominence in this market.

Market Segmentation

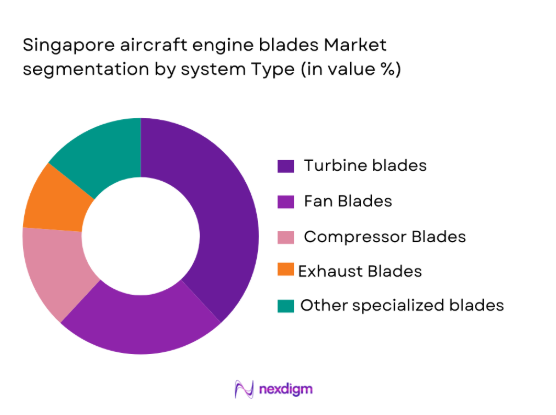

By System Type

The Singapore Aircraft Engine Blades market is segmented by system type into turbine blades, fan blades, compressor blades, exhaust blades, and other specialized blades. Among these, turbine blades dominate the market due to their critical role in engine performance. Turbine blades are designed to withstand extreme temperatures and pressure, making them essential for modern aircraft engines. The demand for turbine blades is further driven by advancements in materials such as ceramics and advanced alloys, which allow for improved efficiency and longer lifespan. This segment remains dominant in the market due to its significant role in enhancing fuel efficiency and engine performance.

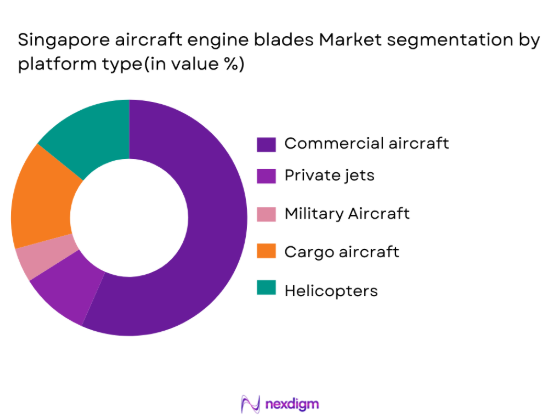

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private jets, military aircraft, cargo aircraft, and helicopters. Commercial aircraft hold the dominant share in the market, driven by the large fleet operated by Singapore Airlines and other regional airlines. The increasing number of international and domestic flights in Singapore has led to higher demand for advanced engine blades used in commercial aircraft. With the expansion of the commercial aviation fleet and the continued fleet upgrades, the commercial aircraft segment is expected to retain its dominant position in the market, further fueling the demand for efficient, high-performance engine blades.

Competitive Landscape

The Singapore Aircraft Engine Blades market is highly competitive, with a mix of established global companies and regional players. Key players in the market include General Electric, Rolls-Royce, Pratt & Whitney, Safran, and Honeywell. These companies lead the market due to their technological innovations, established brand presence, and extensive distribution networks. Singapore Airlines’ continuous fleet upgrades contribute to the demand for high-quality engine blades, further solidifying the position of these major companies. Additionally, collaborations between engine manufacturers and aerospace parts suppliers enhance the supply chain efficiency in the market.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| General Electric | 1892 | USA | – | – | – | – |

| Rolls-Royce | 1906 | UK | – | – | – | – |

| Pratt & Whitney | 1925 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| Honeywell | 1906 | USA | – | – | – | – |

Singapore Aircraft Engine Blades Market Dynamics

Growth Drivers

Increasing Demand for High-Performance Engine Components

The demand for high-performance engine components in Singapore’s aviation sector is increasing due to the growing fleet of Singapore Airlines and other regional carriers. With an expanding fleet, especially of wide-body aircraft, the demand for advanced engine blades—especially turbine and fan blades—has surged. Singapore Airlines has consistently invested in modernizing its fleet, including Airbus A350 and Boeing 787 aircraft. In 2024, the fleet expansion plans and the need for engines with higher fuel efficiency and lower emissions contribute to the rising demand for engine blades. This trend aligns with the global aviation industry’s focus on reducing carbon footprints and increasing operational efficiency.

Strong Growth in Singapore’s Aviation Industry

Singapore’s aviation sector is experiencing strong growth, supported by a strategic location as a global aviation hub. With over 68 million passengers passing through Changi Airport in 2023, the country remains a key player in the Southeast Asia aviation market. The government continues to make significant investments in aviation infrastructure, boosting both domestic and international air travel. Singapore Airlines’ fleet, which includes new and modern aircraft, is expanding, increasing the demand for engine blades. The demand for high-performance and fuel-efficient engine blades will continue to rise with the increase in aircraft deliveries and the growing demand for air travel in the region.

Market Challenges

High Cost of Advanced Materials and Manufacturing Processes

The production of high-performance aircraft engine blades requires the use of expensive materials such as titanium alloys, ceramics, and nickel-based superalloys. These materials are critical for withstanding the extreme temperatures and mechanical stresses of modern aircraft engines. The cost of these materials is further increased by the need for specialized manufacturing processes such as precision casting, additive manufacturing, and coating techniques. These high costs present a challenge to the market in Singapore, where manufacturers need to balance material quality with cost-effective production methods to stay competitive in the global aerospace market.

Complexity of Integrating New Technologies with Existing Engines

The integration of new technologies, including advanced materials and innovative blade designs, into existing aircraft engines is a major challenge. Engine blades must meet stringent operational standards for durability, efficiency, and safety, and retrofitting older engines to accommodate these new technologies is a complex process. The high complexity of integrating composite materials, such as ceramic matrix composites, into current aircraft engines complicates the manufacturing process. This integration challenge requires substantial R&D investment and collaboration between manufacturers and airlines, adding time and cost to the development and deployment of new engine blades.

Market Opportunities

Rising Aircraft Fleet Expansions in Singapore and the Southeast Asia Region

Singapore’s aviation market is expanding rapidly, with fleet growth expected to continue as airlines seek to modernize and expand their operations. Singapore Airlines’ substantial order for Airbus A350 and Boeing 787 aircraft is a key driver of this growth. Additionally, the rising demand for air travel across Southeast Asia, particularly in markets like Indonesia, Thailand, and Malaysia, is increasing the need for new aircraft. This, in turn, creates a growing market for high-performance engine blades that are critical for powering new aircraft. The expansion of regional carriers and the demand for fuel-efficient engines further support the market for advanced aircraft components.

Technological Advancements in Composite Materials for Engine Blades

Technological advancements in composite materials are creating significant opportunities in the Singapore Aircraft Engine Blades market. Materials like ceramic matrix composites (CMC) and carbon fiber reinforced polymer (CFRP) are being used to manufacture engine blades that are not only lighter but also more durable and resistant to high temperatures. These advancements allow for greater fuel efficiency and longer engine life. The ongoing innovation in these materials presents an opportunity for manufacturers in Singapore to lead the way in producing next-generation engine blades. Airlines and manufacturers are increasingly adopting these technologies to meet sustainability goals and reduce operational costs.

Future Outlook

Over the next several years, the Singapore Aircraft Engine Blades market is expected to experience steady growth, driven by the continuous fleet expansions from Singapore Airlines and other regional airlines. The demand for fuel-efficient and high-performance engine blades will remain strong as airlines seek to enhance operational efficiency and reduce environmental impact. The ongoing development of lightweight materials and improved manufacturing technologies, such as additive manufacturing for engine parts, will also contribute to market growth. Additionally, Singapore’s position as a key player in global aviation, along with its robust regulatory environment, will support the continued demand for advanced engine components.

Major Players in the Market

- General Electric

- Rolls-Royce

- Pratt & Whitney

- Safran

- Honeywell

- MTU Aero Engines

- IHI Corporation

- GKN Aerospace

- Magellan Aerospace

- Chromalloy

- Turbomeca

- Liebherr Aerospace

- Rockwell Collins

- AeroVironment

- Mitsubishi Heavy Industries

Key Target Audience

- Airlines

- Military and Defense Contractors

- Aircraft Engine Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aircraft Component Suppliers

- Government and Regulatory Bodies

- Aerospace Materials Suppliers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and defining the key variables that influence the Singapore Aircraft Engine Blades market. This includes understanding demand drivers such as fleet expansion, safety regulations, and technological advancements. The research relies on secondary sources and proprietary databases to gather critical information regarding these factors.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data is analyzed to understand market trends and the impact of various factors on market growth. This includes assessing the adoption rate of advanced engine blades, the evolution of Singapore Airlines’ fleet, and other regional factors that affect demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including engine manufacturers, airline representatives, and regulatory bodies. These consultations help refine the assumptions and ensure that the findings are based on practical, real-world insights.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research data into a detailed report, validating findings with primary sources. The report will provide a comprehensive overview of the Singapore Aircraft Engine Blades market, offering insights into current trends, challenges, growth opportunities, and market projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for high-performance engine components

Strong growth in Singapore’s aviation industry

Government support for the aerospace sector - Market Challenges

High cost of advanced materials and manufacturing processes

Complexity of integrating new technologies with existing engines

Regulatory and certification hurdles for new engine blades - Market Opportunities

Rising aircraft fleet expansions in Singapore and the Southeast Asia region

Technological advancements in composite materials for engine blades - Trends

Advancements in lightweight and composite materials for engine blades

Increased emphasis on fuel-efficient and durable engine parts

Automation and AI-driven technologies in aircraft engine blade manufacturing

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engine Blades

Turbojet Engine Blades

Turboprop Engine Blades

Variable Fan Blades

Composite Engine Blades - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM) Fitment

Aftermarket Fitment

Retrofit Installations

Modular Installations

System Upgrades - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

Engine Manufacturers - By Procurement Channel (In Value%)

Direct OEM Sales

Third-party Vendors

Government Contracts

Integrated Solutions Providers

Leasing Companies

- Market Share Analysis

Cross Comparison Parameters (Technological innovations, Supply chain efficiency, Manufacturing capabilities, Product quality, Customer satisfaction) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

General Electric

Rolls-Royce

Pratt & Whitney

Safran

MTU Aero Engines

Honeywell Aerospace

Airbus

Boeing

GKN Aerospace

Magellan Aerospace

Chromalloy

IHI Corporation

Turbomeca

Liebherr Aerospace

Rockwell Collins

- Airlines investing in new and efficient engine blade technologies

- Military contractors adopting advanced materials for defense aviation

- MRO providers increasingly focusing on the repair and overhaul of advanced engine components

- Engine manufacturers enhancing the efficiency of production for turbine blades

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035