Market Overview

The Singapore Aircraft Engine Compressor market has witnessed significant growth in recent years, with the market size valued at USD ~ billion in 2025. This growth is primarily driven by an increase in air traffic, both commercial and military, alongside the demand for more efficient and high-performance engine components. Additionally, technological advancements in compressor systems, which improve fuel efficiency and reduce emissions, have propelled the market forward. These factors are expected to continue driving growth in the coming years.

The market is dominated by key cities and countries such as Singapore, Japan, and South Korea. Singapore’s strategic location as a global aviation hub, combined with its strong infrastructure and support from local authorities, positions it as a key player in the market. Furthermore, Singapore’s robust aerospace sector, with companies like ST Engineering and Singapore Technologies Aerospace, plays a major role in driving the demand for aircraft engine compressors in the region. The growing military investments in Southeast Asia also contribute to the dominance of these countries.

Market Segmentation

By Product Type

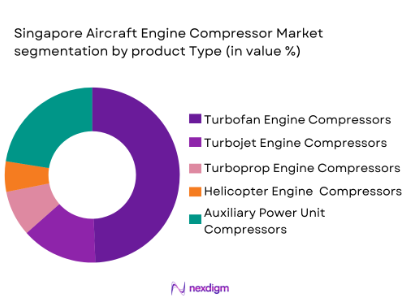

The Singapore Aircraft Engine Compressor market is segmented by product type into turbofan engine compressors, turbojet engine compressors, turboprop engine compressors, helicopter engine compressors, and auxiliary power unit (APU) compressors. Among these, turbofan engine compressors dominate the market due to their wide use in commercial aircraft and their advanced technological features, which provide better fuel efficiency and reliability. The constant demand for turbofan engines in the growing commercial aviation sector, along with manufacturers’ focus on improving engine performance, makes this segment the leader in the market.

By Platform Type

The Singapore Aircraft Engine Compressor market is further segmented by platform type into commercial aircraft, military aircraft, private aircraft, cargo aircraft, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds a dominant market share, driven by the steady increase in global air travel and the ongoing expansion of low-cost carriers. The demand for more fuel-efficient and environmentally friendly engine components in commercial aviation is a key factor for the continued growth of this segment.

Competitive Landscape

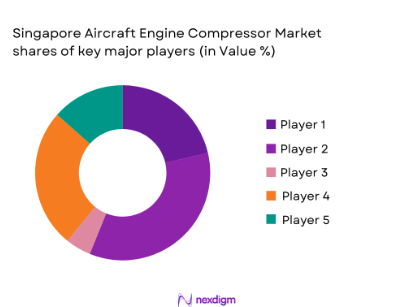

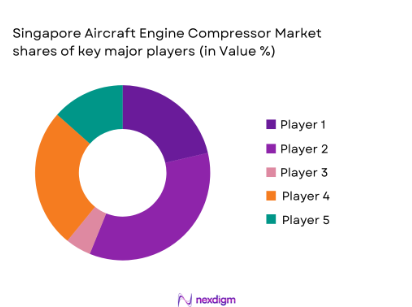

The Singapore Aircraft Engine Compressor market is highly competitive, with a few major players dominating the landscape. Key companies such as Rolls-Royce, General Electric, Pratt & Whitney, Honeywell Aerospace, and Safran are at the forefront of the market. These companies leverage their strong global presence, technological expertise, and robust R&D capabilities to maintain a competitive edge. With continuous advancements in compressor technology, these players are also focusing on fuel efficiency, low emissions, and enhancing the overall performance of aircraft engines.

| Company | Establishment Year | Headquarters | Technology Focus | Market Share Focus | Product Offerings | Global Presence |

| Rolls-Royce | 1904 | United Kingdom | – | – | – | – |

| General Electric | 1892 | United States | – | – | – | – |

| Pratt & Whitney | 1925 | United States | – | – | – | – |

| Honeywell Aerospace | 1962 | United States | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

Singapore Aircraft Engine Compressor Market Analysis

Growth Drivers

Expansion of the aviation industry in Southeast Asia

The expansion of the aviation industry in Southeast Asia is a key growth driver for the Singapore Aircraft Engine Compressor market. The International Air Transport Association (IATA) forecasts that air traffic in the Asia-Pacific region, including Southeast Asia, will grow by 4.7% annually until 2025. In Singapore, Changi Airport, one of the busiest in the world, recorded 62.2 million passengers in 2023, with significant growth in both domestic and international traffic. The increasing volume of passengers and cargo necessitates more advanced aircraft engines, boosting the demand for high-performance compressors in the region. The growing aviation fleet and expanding routes, especially to China, India, and other ASEAN countries, are expected to fuel the need for modern engine systems. This demand is particularly pronounced in the commercial aircraft sector, with airlines seeking efficient, durable compressors to meet operational needs.

Increased demand for fuel-efficient, low-emission compressors

The shift toward fuel-efficient and low-emission aircraft is another major driver of the Singapore Aircraft Engine Compressor market. The aviation industry is under increasing pressure to reduce its carbon footprint, with global initiatives such as the International Civil Aviation Organization’s (ICAO) CORSIA program targeting a 50% reduction in carbon emissions by 2050. In Singapore, the Civil Aviation Authority of Singapore (CAAS) has launched several initiatives promoting sustainable aviation technologies, including the use of more efficient engine systems. Fuel-efficient engines not only reduce operating costs but also contribute to compliance with environmental regulations. The Singapore government has been proactive in supporting green aviation technologies, leading to investments in low-emission aircraft and engines, including the adoption of advanced compressor systems that align with sustainability goals. [Source: Civil Aviation Authority of Singapore (CAAS), ICAO].

Market Challenges

High costs of advanced compressor technologies

One of the primary challenges faced by the Singapore Aircraft Engine Compressor market is the high cost of advanced compressor technologies. The development of next-generation aircraft engine compressors involves significant investments in research, development, and testing. These compressors are designed to meet stringent environmental and performance standards, which requires cutting-edge materials and engineering processes. For instance, the development of titanium and composite materials used in compressor blades significantly raises manufacturing costs. In addition, the need for precision engineering and advanced manufacturing techniques drives up the cost of production. The rising cost of raw materials, such as rare metals used in the aerospace industry, also adds to the overall expense. The World Bank estimates that the price of raw materials used in aerospace manufacturing has risen by 4.5% year-over-year due to global supply chain disruptions, putting further pressure on compressor manufacturers.

Stringent regulatory and certification requirements

Another challenge hindering the growth of the Singapore Aircraft Engine Compressor market is the stringent regulatory and certification requirements imposed on manufacturers. The Civil Aviation Authority of Singapore (CAAS) adheres to strict safety and environmental regulations, which are in line with global standards set by bodies like the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) in the U.S. Manufacturers must ensure that their compressors meet rigorous safety, efficiency, and emissions standards before they can be certified for use. This process involves several stages of testing, validation, and approval, which can significantly delay product launches and increase operational costs. Compliance with these regulations also demands substantial investments in quality control and testing infrastructure. The high cost and long timelines associated with regulatory approval remain a significant barrier for both new and established players in the market.

Market Opportunities

Growth in the commercial aviation sector in Singapore

The commercial aviation sector in Singapore presents significant growth opportunities for the aircraft engine compressor market. Singapore’s position as a global aviation hub is reinforced by the ongoing development of Changi Airport, which has a projected capacity of handling over 85 million passengers annually by 2025. Furthermore, Singapore Airlines continues to expand its fleet, with a focus on increasing the number of wide-body aircraft, which typically require more advanced engine systems. The Singapore government has committed to supporting the aviation sector through infrastructure development and sustainable aviation initiatives. This growth is expected to result in a higher demand for fuel-efficient, low-emission aircraft engines, driving the need for modern aircraft engine compressors. The establishment of the Singapore Airshow as a key industry event further enhances the city-state’s prominence in the global aviation market, attracting investments and fostering collaborations that fuel the growth of aerospace technologies.

Technological advancements in compressor efficiency

Technological advancements in compressor efficiency present a prime opportunity for growth in the Singapore Aircraft Engine Compressor market. Compressor manufacturers are increasingly focused on innovations that improve fuel efficiency, reduce emissions, and enhance overall engine performance. For instance, advancements in additive manufacturing (3D printing) allow for the production of lightweight and high-performance compressor components, resulting in more efficient engines. Additionally, the integration of smart technologies, such as artificial intelligence (AI) and machine learning, is helping to optimize compressor performance by predicting maintenance needs and improving operational efficiency. These technological innovations are expected to significantly reduce operating costs for airlines and other aviation operators, creating a high demand for next-generation compressors. Singapore’s aerospace sector, known for its focus on innovation, continues to invest in such advancements, positioning it as a key player in the global market for efficient aircraft engines.

Future Outlook

Over the next decade, the Singapore Aircraft Engine Compressor market is expected to experience substantial growth. Factors such as increasing air traffic, expanding aviation fleets, and the push for environmentally friendly aviation solutions will continue to drive the market. Technological advancements, particularly in turbine efficiency and materials that reduce weight and enhance performance, will play a significant role in shaping the market. The growing demand for low-emission aircraft and the rising focus on reducing fuel consumption will further fuel the market’s expansion during the forecasted period.

15 Major Players in the Market

- Rolls-Royce

- General Electric

- Pratt & Whitney

- Honeywell Aerospace

- Safran

- MTU Aero Engines

- Liebherr Aerospace

- Raytheon Technologies

- Boeing Commercial Airplanes

- Embraer

- Airbus

- Comac

- Korean Air Aerospace Division

- IHI Corporation

- Mitsubishi Heavy Industries

Key Target Audience

- Aircraft Manufacturers

- Military and Defense Organizations (Singapore Ministry of Defence)

- Aerospace and Aviation Technology Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore)

- Airlines and Fleet Operators

- Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aircraft Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying critical factors that impact the Singapore Aircraft Engine Compressor market, such as technological advancements, government policies, and global trends in aviation. This is accomplished through an extensive review of industry reports, company filings, and interviews with key stakeholders.

Step 2: Market Analysis and Construction

In this phase, we gather historical market data to analyze trends and forecast future growth. Market dynamics such as technological innovations and industry-specific challenges are assessed. The analysis includes examining regional and global factors that influence the market’s development.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations, including interviews with leading players in the aircraft engine compressor industry, validate the hypotheses formed during the analysis. These consultations provide deeper insights into product innovations, market strategies, and future trends.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating all gathered data into a comprehensive report. Insights from interviews, surveys, and secondary research are combined to ensure the report provides a reliable, actionable market overview, along with forecast data for the future.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of the aviation industry in Southeast Asia

Increased demand for fuel-efficient, low-emission compressors

Rising aircraft fleet modernization and replacement needs - Market Challenges

High costs of advanced compressor technologies

Stringent regulatory and certification requirements

Fluctuating fuel prices impacting operational budgets - Market Opportunities

Growth in the commercial aviation sector in Singapore

Technological advancements in compressor efficiency

Increasing military and defense sector investments in aircraft - Trends

Adoption of AI and IoT technologies for predictive maintenance

Shift toward electric propulsion systems and hybrid technologies

Increase in demand for quieter and more eco-friendly aircraft engines.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engine Compressors

Turbojet Engine Compressors

Turboprop Engine Compressors

Helicopter Engine Compressors

Auxiliary Power Unit (APU) Compressors - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Compressors

Replacement Compressors

Aftermarket Compressors

Upgrade Compressors

Refurbished Compressors - By End User Segment (In Value%)

Aircraft Manufacturers

Maintenance, Repair, and Overhaul (MRO) Service Providers

Airlines and Fleet Operators

Military Organizations

Private and Corporate Jet Operators - By Procurement Channel (In Value%)

Direct Sales

Third-Party Distributors

Online Procurement

OEM Partnerships

MRO Service Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Region, Technology Adoption, Innovation Rate, Pricing Strategy, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Rolls-Royce

General Electric

Pratt & Whitney

Honeywell Aerospace

Safran Aircraft Engines

MTU Aero Engines

Liebherr Aerospace

Raytheon Technologies

Boeing Commercial Airplanes

Embraer

Airbus

Comac

Korean Air Aerospace Division

IHI Corporation

Mitsubishi Heavy Industries

- Growing need for advanced compressor systems in regional commercial airlines

- Rising demand for military-grade compressors in defense aviation

Focus on reducing aircraft downtime through efficient MRO solutions - Technological upgrades driven by global airline sustainability initiatives

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035