Market Overview

The Singapore aircraft engine market is valued at approximately USD ~ billion, with steady growth driven by increasing demand for air travel and advancements in aviation technology. The market is primarily fueled by a rising number of aircraft in service and the continuous upgrade of existing fleets with more fuel-efficient and eco-friendly engines. Additionally, Singapore’s strategic location as a global aviation hub further supports the market’s expansion, with key players investing in the region to cater to the growing demands of commercial and military aviation sectors.

Singapore dominates the aircraft engine market in the Southeast Asian region, supported by its robust aviation infrastructure, including Changi Airport, one of the world’s busiest airports. The nation’s strong manufacturing capabilities and its strategic partnerships with international aircraft engine manufacturers contribute to its dominance. Singapore is also home to major aircraft engine maintenance, repair, and overhaul (MRO) facilities, which further solidify its position in the global aircraft engine market.

Market Segmentation

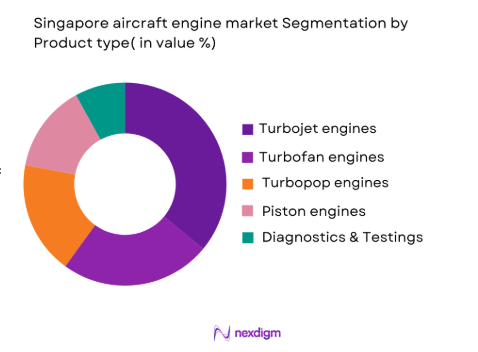

By Product Type

The Singapore aircraft engine market is segmented into turbojet engines, turbofan engines, turboprop engines, and piston engines. Among these, turbofan engines hold the largest market share, as they are primarily used in commercial and military aircraft due to their efficiency and superior performance at higher altitudes. The demand for these engines is fueled by their fuel efficiency, noise reduction features, and their ability to accommodate larger passenger aircraft, which are vital for airlines operating on long-haul flights. This segment’s dominance is further reinforced by the major aircraft manufacturers such as Boeing and Airbus, who favor turbofan engines for their widebody aircraft.

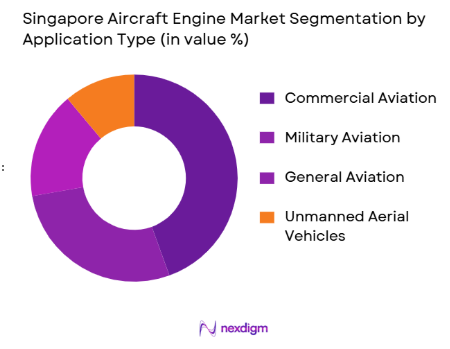

By Application

The market is also segmented based on application into commercial aviation, military aviation, general aviation, and unmanned aerial vehicles (UAVs). Commercial aviation holds a dominant share in this segmentation, driven by the ever-increasing demand for air travel globally. As commercial airlines continue to expand their fleets and upgrade their engines for fuel efficiency and reduced emissions, the commercial aviation sector’s growth is likely to continue leading the market. The rise in budget airlines and increasing air travel in Asia-Pacific further contributes to the commercial aviation segment’s dominance.

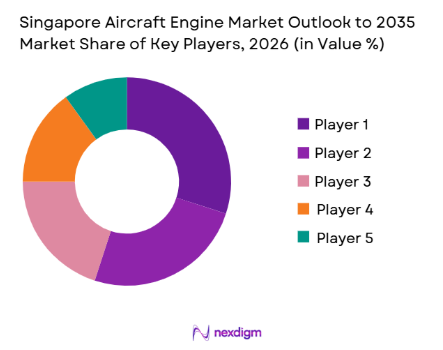

Competitive Landscape

The Singapore aircraft engine market is highly competitive, with several global players competing for market share. These include Rolls-Royce, GE Aviation, Safran Aircraft Engines, Pratt & Whitney, and Honeywell Aerospace. Each of these companies plays a crucial role in the development and supply of advanced aircraft engines, with a strong focus on research and development to meet growing demands for fuel-efficient and environmentally-friendly technologies. The dominance of these players highlights the competitive nature of the market, where innovation, product reliability, and aftersales service are key differentiators.

| Company | Establishment Year | Headquarters | R&D Investments | Production Capacity | Revenue by Region | Market Share by Application | Partnerships & Alliances |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | United States | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Engine Market Analysis

Growth Drivers

Urbanization

Singapore’s rapid urbanization continues to drive the growth of the aircraft engine market. Over~% of the population resides in urban areas, which increases demand for both domestic and international flights. The urban population growth has led to higher demand for commercial aircraft and their engines, with significant traffic passing through Changi Airport, one of the world’s busiest airports. This urban growth fuels the need for more aircraft fleets, thereby boosting the demand for advanced, fuel-efficient engines. The increased travel demand, both leisure and business, is directly linked to Singapore’s urban development and its status as a global aviation hub.

Industrialization

Singapore is a prominent industrial hub in Southeast Asia, and the manufacturing sector, contributing a substantial portion to the national GDP, plays a significant role in the demand for aircraft engines. The country’s aerospace industry has been growing steadily, driven by increased production and export of aircraft components. This industrial expansion necessitates advanced aircraft engine technologies, particularly for freight and commercial airliners. As more industries, such as aerospace manufacturing, electronics, and energy, continue to develop, the demand for efficient aircraft engines remains high. The nation’s well-established infrastructure supports the production and maintenance of these engines, positioning it as a leader in the sector.

Market Challenges

High Initial Costs

The high upfront costs associated with purchasing and maintaining advanced aircraft engines are a significant barrier to market growth. Aircraft engines, especially the next-generation models used in wide-body commercial aircraft, involve substantial capital investment. The initial cost of these engines can run into tens of millions of dollars, which is particularly challenging for budget airlines and smaller carriers. This high capital investment, coupled with the expensive maintenance required for modern engines, poses a financial challenge, especially for airlines operating in highly competitive markets. The financial burden restricts the ability of certain players to upgrade their fleets, potentially limiting market growth.

Technical Challenges

Aircraft engine technologies are becoming increasingly complex, and maintaining these engines requires specialized skills and equipment. The technical challenges involved in ensuring engine reliability, as well as the high degree of precision needed for maintenance and operation, make it a challenging aspect for the market. The need for highly trained technicians and the frequent advancements in engine technologies means that airlines and service providers need to continually adapt. In addition, sourcing specific spare parts for newer engines can present logistical challenges, further complicating the maintenance process. These technical barriers can delay engine performance optimizations and disrupt overall fleet operations.

Opportunities

Technological Advancements

Technological innovations in aircraft engine design present significant opportunities for the market. The development of more efficient turbofan engines, which offer better fuel consumption and lower emissions, is driving the demand for next-generation engines in Singapore. Additionally, the increasing adoption of sustainable aviation fuel (SAF) technologies, which contribute to reduced carbon footprints, is likely to shape the market’s future. Singapore’s emphasis on sustainability, coupled with the push towards greener aviation solutions, provides a promising opportunity for market players to capitalize on these advancements. Furthermore, the integration of IoT in engine monitoring systems offers operational efficiencies and predictive maintenance capabilities, opening up more opportunities for growth.

International Collaborations

Singapore’s position as a leading global aviation hub provides ample opportunities for international partnerships in the aircraft engine market. Collaborative efforts between local aerospace companies and global giants such as Rolls-Royce and GE Aviation have led to innovations in engine technologies and helped establish Singapore as a center for aerospace manufacturing and research. These international collaborations not only enhance the country’s technological capabilities but also foster the introduction of cutting-edge technologies into the market. As global aviation demands increase, Singapore’s strategic location and international connections will continue to offer significant growth opportunities for the aircraft engine market.

Future Outlook

Over the next five years, the Singapore aircraft engine market is expected to experience substantial growth, driven by advancements in engine technology, increasing air travel, and the focus on reducing carbon emissions. Continuous government support, such as the development of sustainable aviation fuel (SAF) initiatives and the promotion of green technologies, will further accelerate market growth. Additionally, the shift towards more fuel-efficient and environmentally-friendly engines will encourage increased investment in R&D and collaboration between aviation stakeholders.

Major Players

- Rolls-Royce

- GE Aviation

- Safran Aircraft Engines

- Pratt & Whitney

- Honeywell Aerospace

- CFM International

- MTU Aero Engines

- International Aero Engines

- Collins Aerospace

- Leonardo

- Embraer

- Textron Aviation

- United Technologies Aerospace Systems

- Aero Vodochody

- Rolls-Royce North America

Key Target Audience

- Aircraft OEMs

- Airlines and Air Operators

- Aviation and Aerospace Industry Investors and Venture Capitalist Firms

- Aircraft Engine MRO Providers

- Government and Regulatory Bodies

- Aircraft Component Suppliers

- Aircraft Leasing Companies

- Aerospace Research Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore aircraft engine market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Singapore aircraft engine market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aircraft engine manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Singapore aircraft engine market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Air Travel Demand

Advances in Fuel Efficiency and Environmental Regulations

Rising Military Aviation Spending

- Market Challenges

Raw Material Price Fluctuations

High Initial Cost of Aircraft Engines

- Opportunities

Growing Demand for Sustainable Aviation

Rise in Air Cargo Traffic and Regional Connectivity

- Trends

Technological Advancements

Shift Toward Digitalization and IoT in Engine Monitoring

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Turbojet Engines

Turbofan Engines

Turboprop Engines

Piston Engines

Other Engine Types - By Application, (In Value %)

Commercial Aviation

Military Aviation

General Aviation

Unmanned Aerial Vehicles - By Engine Size, (In Value %)

Small Engines

Medium Engines

Large Engines - By Engine Material, (In Value %)

Composite Materials

Titanium Alloys

Nickel Alloys

Steel Alloys - By End User, (In Value %)

OEMs

Aftermarket

End-Use Manufacturers

- Market Share (Value/Volume)

- Cross Comparison Parameters (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Engine Types

- Porter’s Five Forces

- Detailed Profiles

Rolls-Royce

GE Aviation

Pratt & Whitney

Safran Aircraft Engines

Honeywell Aerospace

CFM International

MTU Aero Engines

IAE

Collins Aerospace

Leonardo

Textron Aviation

Embraer

United Technologies Aerospace Systems

Aero Vodochody

Rolls-Royce North America

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035