Market Overview

The Singapore Aircraft Engine MRO market is a robust sector primarily driven by the growth of the aviation industry and technological advancements in aircraft engines. In 2023, the market was valued at USD ~ billion, with strong demand stemming from a growing fleet of aircraft in Southeast Asia and increasing air travel. The market’s expansion is fueled by factors such as the rise in global air travel, regulatory requirements for frequent maintenance, and advancements in engine technologies that increase the need for specialized MRO services. The trend toward more sustainable and efficient engines is expected to continue driving market demand as airlines strive to improve fuel efficiency and reduce operational costs. As of 2024, the market is expected to reach USD ~ billion, reflecting steady growth supported by the demand for maintenance, repair, and overhaul services in both the commercial and military sectors.

Singapore remains a pivotal hub for the Aircraft Engine MRO market, owing to its strategic location as a key aviation gateway in Asia. The country’s established aviation infrastructure, including Changi Airport, and its reputation as a global logistics hub, make it an ideal base for engine MRO services. Singapore benefits from its advanced technological capabilities, skilled workforce, and strong regulatory frameworks, which contribute to its dominance in the region. Additionally, the presence of major players such as Singapore Technologies Aerospace and Pratt & Whitney ensures that the country maintains a leading position in the market. Other countries like Malaysia and Thailand also play key roles in the market due to their growing aviation sectors and the proximity to Singapore, benefiting from regional collaborations and supply chain linkages.

Market Segmentation

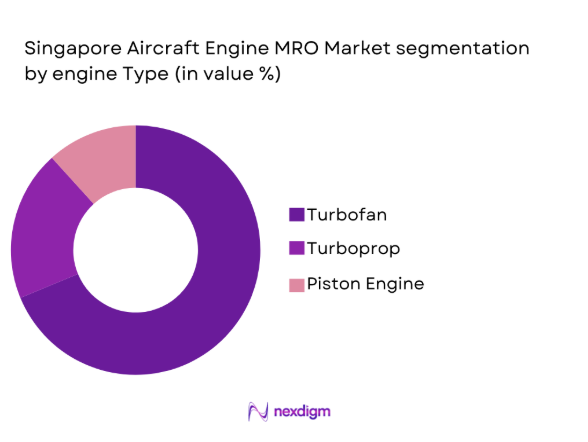

By Engine Type

The Aircraft Engine MRO market is segmented by engine type into turbofan, turboprop, and piston engines. The turbofan engine segment holds the largest market share, with turbofan engines being widely used in commercial aviation due to their efficiency and higher thrust capabilities. The rise in air travel, especially in Asia-Pacific, is increasing the demand for maintenance services for these engines. The segment is dominated by the need for regular overhauls and advanced maintenance services, driven by the longevity and complexity of turbofan engines. The demand for turbofan engine MRO services is particularly high in major aviation hubs such as Singapore, where airlines and aircraft operators rely on efficient and regular maintenance to ensure flight safety and operational reliability.

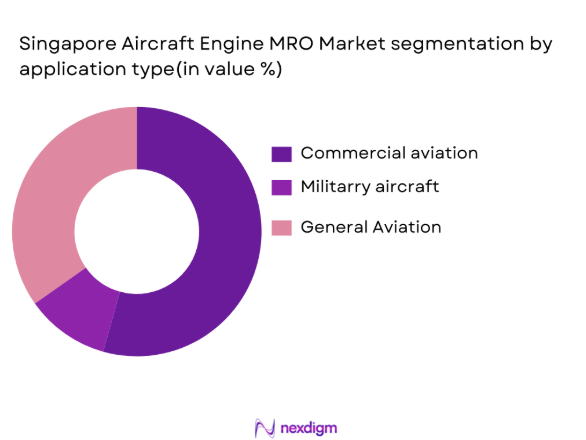

By Application

The Aircraft Engine MRO market is further segmented by application into commercial aviation, military aviation, and general aviation. Among these, the commercial aviation segment dominates the market. This is due to the exponential growth in air travel and the need for high-volume maintenance services for a vast fleet of commercial aircraft. Airlines typically operate large fleets of aircraft, which necessitates regular engine overhauls and replacements. The commercial aviation sector benefits from significant investments in maintenance infrastructure and has a more streamlined demand for MRO services. This segment is anticipated to continue its dominance with the expansion of low-cost carriers and major international airlines.

Competitive Landscape

The Singapore Aircraft Engine MRO market is dominated by a few key players, each playing a significant role in the market’s growth. Major players in the industry include global entities and local champions that bring a wealth of technical expertise, advanced equipment, and a robust service network. The dominance of these players reflects the high capital intensity and specialized skill sets required to perform MRO services, as well as the large-scale collaborations between aircraft manufacturers, airlines, and MRO providers. Some of the dominant players in the market include Rolls-Royce, Singapore Technologies Aerospace, General Electric Aviation, and Pratt & Whitney. These companies benefit from long-standing relationships with aircraft operators and strong regional support, which enables them to maintain a competitive edge.

| Company | Year Established | Headquarters | Revenue | Service Offered | Key Clients | Aircraft Types Supported | Technological Capabilities |

| Rolls-Royce | 1904 | United Kingdom | – | – | – | – | – |

| Singapore Technologies Aerospace | 1975 | Singapore | – | – | – | – | – |

| General Electric Aviation | 1892 | United States | – | – | – | – | – |

| Pratt & Whitney | 1925 | United States | – | – | – | – | – |

| Lufthansa Technik | 1995 | Germany | – | – | – | – | – |

Singapore aircraft engine mro Market Analysis

Growth Drivers

Expansion of the Aviation Industry in Southeast Asia

Southeast Asia’s aviation industry is rapidly expanding due to increased air travel demand, primarily driven by growing middle-class populations and rising disposable incomes in the region. The International Air Transport Association (IATA) reported that the region’s air passenger traffic increased by 6.5% in 2022. As the number of aircraft in operation continues to rise, so does the need for aircraft engine maintenance, repair, and overhaul (MRO) services. The rapid growth of key aviation hubs such as Singapore, Thailand, and Malaysia is directly fueling the demand for MRO services in the region. According to the World Bank, Southeast Asia’s GDP growth is forecasted to reach 4.9% in 2024, which is expected to further boost aviation sector growth. This rise in air travel and fleet expansion directly impacts the MRO market in Singapore.

Increased Demand for Fuel-Efficient and Low-Emission Engines

There is an increasing global demand for fuel-efficient and low-emission engines, driven by stricter environmental regulations and the aviation industry’s efforts to reduce its carbon footprint. The International Civil Aviation Organization (ICAO) has set ambitious goals for reducing greenhouse gas emissions from aviation, with a 50% reduction in carbon emissions by 2050 compared to 2005 levels. The demand for next-generation engines, which offer higher fuel efficiency and lower emissions, is contributing significantly to the need for MRO services to support these advanced systems. The transition to more efficient engines is also evident in the rising demand for aftermarket services, as airlines seek to optimize their fleet operations. The rise of more efficient and low-emission engines is directly influencing MRO requirements, particularly for high-performance turbofan engines.

Market Challenges

High Cost of MRO Services and Components

The high cost of MRO services and components poses a significant challenge for the growth of the Singapore Aircraft Engine MRO market. The Aviation Week Network highlights that engine maintenance, including parts and labor, can account for as much as 25-30% of an airline’s total operating costs. The price of engine components has risen substantially in recent years due to factors such as supply chain disruptions and inflationary pressures, particularly following the COVID-19 pandemic. In Singapore, the cost of aircraft engine maintenance has seen an upward trend due to these factors, impacting profitability for MRO providers and airline operators alike. Despite this, the demand for MRO services remains high, driven by the growing fleet of aircraft in the region.

Regulatory and Certification Complexities in the Aviation Sector

The regulatory environment in the aviation sector is complex, and this adds to the challenge of MRO operations in Singapore. The Civil Aviation Authority of Singapore (CAAS) enforces stringent regulations that MRO service providers must adhere to in order to ensure safety and quality. As aircraft technology evolves, so too do the standards and certifications required to maintain compliance. The introduction of new technologies, such as advanced engines and materials, has further complicated the certification process, requiring specialized skills and equipment. With the ongoing developments in airworthiness directives and maintenance practices, MRO providers face the challenge of constantly adapting to these regulatory changes while ensuring operational efficiency.

Market Opportunities

Growth of the Commercial Aviation Sector in Singapore

Singapore remains a pivotal hub for commercial aviation in Southeast Asia, supported by its strategic geographical location and state-of-the-art aviation infrastructure. As of 2023, Changi Airport has ranked as one of the world’s busiest airports, handling over 60 million passengers annually. With the rise in international and regional air travel, particularly as global economies recover from the pandemic, the commercial aviation sector in Singapore is set to expand significantly. The Singapore government has made heavy investments in airport infrastructure and digital innovation to accommodate this growth. As the commercial fleet grows, the demand for MRO services, particularly in engine repair and overhaul, will continue to rise. Singapore’s push for smart aviation technologies further supports future growth prospects in this sector.

Technological Advancements in Engine Diagnostics and Predictive Maintenance

The increasing reliance on technological advancements in engine diagnostics and predictive maintenance offers significant opportunities for the Singapore Aircraft Engine MRO market. The aviation industry is adopting digital solutions, such as machine learning and AI-driven diagnostics, which allow for predictive maintenance and early detection of engine issues. This shift helps airlines optimize engine performance and reduce downtime, thus driving demand for more sophisticated MRO services. In Singapore, several MRO providers are already investing in digital technologies to improve maintenance efficiency and reliability. The use of advanced diagnostic tools and predictive analytics can potentially reduce the cost of repairs and enhance the overall operational efficiency of the aviation industry.

Future Outlook

Over the next decade, the Singapore Aircraft Engine MRO market is expected to see considerable growth driven by the increasing fleet size, ongoing technological advancements in aircraft engines, and rising air traffic in Asia-Pacific. Furthermore, the expansion of low-cost carriers in the region and the growing focus on engine efficiency and sustainability will support demand for MRO services. Airlines and maintenance providers will continue to invest in state-of-the-art technologies and efficient repair procedures to meet the growing demand for reliable and cost-effective solutions. The emergence of hybrid and electric propulsion systems could also introduce new challenges and opportunities for the MRO market, necessitating new expertise and infrastructure in the years to come.

Major Players

- Rolls-Royce

- Singapore Technologies Aerospace

- General Electric Aviation

- Pratt & Whitney

- Lufthansa Technik

- Safran Aircraft Engines

- MTU Aero Engines

- Air France Industries KLM Engineering & Maintenance

- IAE International Aero Engines

- Honeywell Aerospace

- Delta TechOps

- Aeroman

- AAR Corporation

- ST Engineering Aerospace

- ANA Aerospace

Key Target Audience

- Aircraft operators and airlines

- Aircraft manufacturers

- Engine manufacturers

- Maintenance service providers

- Investment and venture capital firms

- Government and regulatory bodies

- Aircraft leasing companies

- Military and defense agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map that includes all major stakeholders in the Singapore Aircraft Engine MRO market. Secondary and proprietary databases are utilized for gathering extensive industry-level data. The objective is to identify and define the key variables influencing market dynamics, such as technological advancements, regulatory policies, and air traffic trends.

Step 2: Market Analysis and Construction

In this phase, historical data for the Singapore Aircraft Engine MRO market is compiled and analyzed. This includes assessing the growth rate of air traffic, the number of aircraft in operation, and the market size of MRO services. The resulting data helps estimate future market demands and trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry experts representing manufacturers, airlines, and MRO service providers. These consultations help validate the hypotheses and provide insights into operational and financial aspects of the market, assisting in refining market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data obtained from primary and secondary sources. This data is corroborated by direct engagement with MRO service providers to verify product segments, sales performance, and consumer preferences. The insights gained are used to ensure the accuracy and reliability of the market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of the aviation industry in Southeast Asia

Increased demand for fuel-efficient and low-emission engines - Market Challenges

High cost of MRO services and components

Regulatory and certification complexities in the aviation sector - Market Opportunities

Growth of the commercial aviation sector in Singapore

Technological advancements in engine diagnostics and predictive maintenance - Trends

Digitalization and automation in MRO services

Growing demand for sustainable and eco-friendly engine technologies

Emergence of AI and machine learning for predictive maintenance - Singapore Aircraft Engine MRO End User Analysis

High demand for MRO services from Singapore Airlines

Increasing fleet sizes for both commercial and cargo airlines

Rising demand for private jet MRO services

Military aircraft MRO growth due to increasing defense budgets in Southeast Asia

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engine MRO

Turbojet Engine MRO

Turboprop Engine MRO

Helicopter Engine MRO

Auxiliary Power Unit (APU) MRO - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) MRO

Replacement MRO

Aftermarket MRO

Upgrade MRO

Refurbished MRO - By End User Segment (In Value%)

Aircraft Manufacturers

Maintenance, Repair, and Overhaul (MRO) Service Providers

Airlines and Fleet Operators

Military Organizations

Private and Corporate Jet Operators - By Procurement Channel (In Value%)

Direct Sales

Third-Party Distributors

Online Procurement

OEM Partnerships

MRO Service Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Region, Technology Adoption, Innovation Rate, Pricing Strategy, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Rolls-Royce

General Electric

Pratt & Whitney

Honeywell Aerospace

Safran Aircraft Engines

MTU Aero Engines

Liebherr Aerospace

Raytheon Technologies

Boeing Commercial Airplanes

Embraer

Airbus

Comac

Korean Air Aerospace Division

IHI Corporation

Mitsubishi Heavy Industries

- High demand for MRO services from Singapore Airlines

- Increasing fleet sizes for both commercial and cargo airlines

- Rising demand for private jet MRO services

- Military aircraft MRO growth due to increasing defense budgets in Southeast Asia

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035