Market Overview

The Singapore aircraft engine testbed market is poised for steady growth, valued at approximately USD ~ million in 2025. The market is driven by increasing demand for advanced engine testing capabilities due to the proliferation of new aircraft and engine models, which require extensive validation and certification processes. As manufacturers push for higher fuel efficiency, lower emissions, and quieter operations, aircraft engine testbeds play a crucial role in meeting regulatory standards. Furthermore, robust investments in aerospace infrastructure and defense sectors in Singapore are expected to foster growth in the coming years, making it a vital player in the global aviation market.

Singapore is a dominant player in the aircraft engine testbed market due to its strategic location, high level of investment in aerospace technology, and strong partnerships with global aerospace companies. The country’s strong regulatory framework and advanced research and development capabilities make it an attractive destination for aircraft engine testing. Additionally, Singapore’s extensive network of international airports and well-developed maintenance, repair, and overhaul (MRO) facilities enhance its role in supporting both commercial and military aviation sectors. The city-state’s government policies further incentivize the aerospace sector, providing a stable environment for innovation and growth.

Market Segmentation

By System Type

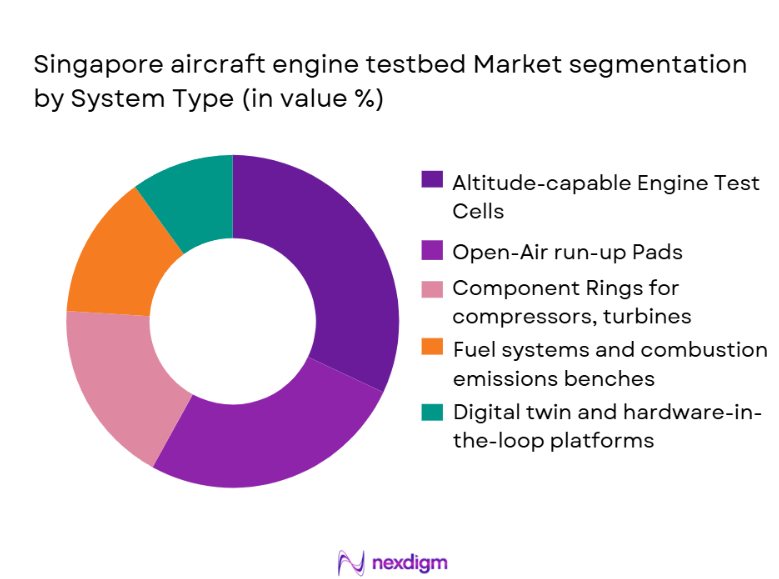

The Singapore aircraft engine testbed market is segmented by system type, which includes a wide range of specialized testbed solutions catering to different engine models and testing requirements. The major sub-segments within this category include altitude-capable engine test cells, open-air run-up pads, component rigs, fuel system and combustion emissions benches, and digital twin test platforms.

Altitude-capable engine test cells dominate this segment due to their essential role in simulating high-altitude conditions for engine testing. These systems are critical in meeting stringent regulatory requirements for commercial aircraft engines. Their prevalence is attributed to their ability to mimic real-world operating conditions, providing accurate and reliable data on engine performance. With increased demand for fuel-efficient engines and environmental regulations, these test cells have seen significant investments, ensuring their dominance in the market.

By Platform Type

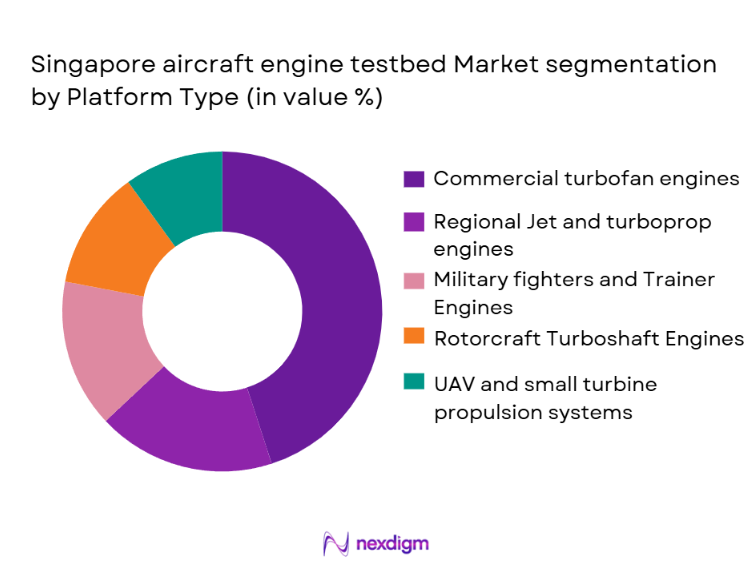

The market is also segmented by platform type, which includes commercial turbofan engines, regional jet and turboprop engines, military fighter and trainer engines, rotorcraft turboshaft engines, and UAV and small turbine propulsion systems.

Commercial turbofan engines dominate this segment due to their widespread use in commercial aviation, which is the backbone of the global airline industry. These engines require extensive testing to ensure they meet safety, performance, and regulatory standards. The demand for more fuel-efficient and eco-friendly commercial aircraft engines has driven significant investments into testing systems designed specifically for turbofan engines. This segment’s dominance is expected to continue due to the ongoing advancements in engine technologies and the need for rigorous testing procedures.

Competitive Landscape

The Singapore aircraft engine testbed market is dominated by a few key players, including global OEMs, MRO providers, and specialized testbed manufacturers. These players benefit from strong relationships with aircraft manufacturers and defense organizations, as well as from their established infrastructure in the region. The competitive landscape shows a blend of large multinational companies and regional leaders, who cater to the growing demand for engine testing solutions in the aerospace and defense sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Singapore AeroTech | 2005 | Singapore | ~ | ~

|

~

|

~

|

~

|

| AeroInnovate Solutions | 2010 | Singapore | ~

|

~

|

~

|

~

|

~

|

| JetEngine Experts | 2000 | Singapore | ~

|

~

|

~

|

~

|

~

|

| SkyTech Testbeds | 2015 | Singapore | ~

|

~

|

~

|

~

|

~

|

| AeroPrime Technologies | 2012 | Singapore | ~

|

~

|

~

|

~

|

~

|

Singapore Aircraft Engine Market Analysis

Growth Drivers

Advancements in Engine Technology

The ongoing development of more fuel-efficient, environmentally friendly, and quieter aircraft engines is driving the demand for more comprehensive and specialized testing solutions. As engine manufacturers push for better performance and compliance with stricter environmental regulations, the need for sophisticated engine testbeds has increased.

Expansion of Aerospace Infrastructure in Singapore

Singapore’s strategic investments in expanding its aerospace infrastructure, including new MRO facilities and advanced testing capabilities, have fueled the growth of the aircraft engine testbed market. This has attracted global players to set up or expand their testing facilities in the region, increasing market demand.

Market Challenges

High Capital Investment

The initial setup costs for aircraft engine testbeds are significant, as these systems require specialized equipment, infrastructure, and compliance with stringent safety and environmental standards. The high capital expenditure is a key barrier for new entrants and smaller players in the market.

Stringent Regulatory and Environmental Compliance

Testbeds must adhere to numerous regulatory standards, including noise reduction, emissions testing, and safety protocols. Navigating these complex regulatory requirements can delay projects and increase operational costs for companies, thus impacting profitability.

Opportunities

Hybrid and Electric Engine Testing

The growing interest in hybrid and electric propulsion systems offers an emerging opportunity for the aircraft engine testbed market. Testing capabilities that cater to these new technologies, including battery performance and fuel efficiency, are expected to see increasing demand in the coming years.

Digitalization and Remote Testing Capabilities

The integration of digital twin technologies and AI-powered testing solutions presents an opportunity for reducing costs and enhancing efficiency. Remote engine testing and data analytics can improve performance monitoring, troubleshooting, and predictive maintenance, making testbed operations more efficient and cost-effective.

Future Outlook

Over the next five years, the Singapore aircraft engine testbed market is expected to experience steady growth driven by advancements in engine technology, stricter environmental regulations, and increasing global air travel. The demand for new aircraft models with enhanced fuel efficiency and reduced emissions will require more comprehensive testing solutions. Additionally, the increasing focus on electric and hybrid engine testing and the expansion of Singapore’s aerospace infrastructure will further drive the market’s development.

Major Players

- Rolls-Royce Singapore

- Pratt & Whitney

- GE Aerospace

- Safran Aircraft Engines

- MTU Aero Engines

- IAI Bedek Aviation Group

- Lufthansa Technik

- SIA Engineering Company

- Jacobs Engineering

- Triumph Group

- Honeywell Aerospace

- KBR

- HCL Technologies

- Bosch Rexroth

- AFI KLM E&M

Key Target Audience

- Engine OEMs and Manufacturers

- Aerospace and Defense Contractors

- MRO Providers

- Government Agencies

- Aerospace R&D Organizations

- Airlines and Aircraft Operators

- Investment and Venture Capitalist Firms

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore aircraft engine testbed market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore aircraft engine testbed market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple engine manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore aircraft engine testbed market.

- Executive Summary

- Singapore aircraft engine testbed Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising regional engine MRO throughput driving demand for higher-capacity run and acceptance testing

Next-generation propulsion validation needs including higher bypass ratios, advanced materials, and tighter emissions limits

Singapore’s aerospace infrastructure investments supporting expanded test capability and faster certification cycles - Market Challenges

High capex and long lead times for acoustics, foundations, utilities, and safety systems required for compliant test operations

Stringent permitting, noise constraints, and environmental compliance requirements limiting siting and operating windows

Shortage of specialized test engineers and calibration expertise for advanced instrumentation and data integrity - Market Opportunities

Hybrid-electric and SAF readiness testing expansions including fuel compatibility, combustor tuning, and emissions measurement

Digitalization and remote operations for test automation, predictive maintenance, and faster troubleshooting

Regional hub services offering third-party testing for ASEAN operators, leasing companies, and new propulsion entrants - Trends

Greater adoption of high-fidelity sensing and real-time analytics for faster engine health assessment during runs

Testbed modularization to switch between engine families with reduced downtime and requalification effort

Emissions, noise, and fuel-burn characterization becoming standard deliverables alongside performance and endurance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Altitude-capable engine test cells and chambers

Open-air run-up pads with noise abatement

Component rigs for compressors, turbines, combustors

Fuel system and combustion emissions benches

Digital twin and hardware-in-the-loop test platforms - By Platform Type (In Value%)

Commercial turbofan engines

Regional jet and turboprop engines

Military fighter and trainer engines

Rotorcraft turboshaft engines

UAV and small turbine propulsion systems - By Fitment Type (In Value%)

New-build greenfield testbed installations

Testbed upgrades and retrofits

Relocation and requalification of existing testbeds

Temporary or modular testbed deployments

Multi-engine adaptable testbed configurations - By EndUser Segment (In Value%)

Engine OEM engineering and validation centers

MRO engine shops and overhaul facilities

Defense research and sustainment organizations

Aerospace labs and university propulsion centers

Certification, compliance, and independent test houses - By Procurement Channel (In Value%)

Direct OEM and EPC contracting

Systems integrators and turnkey testbed providers

Government tenders and defense procurement

Framework agreements and multi-year service contracts

Aftermarket upgrade kits and managed services sourcing

- Market Share Analysis

- CrossComparison Parameters (Installed thrust capability and envelope, Noise attenuation performance, Instrumentation accuracy and bandwidth, Emissions measurement capability and standards compliance, Automation and digital control maturity, Turnaround time and service support model)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

ST Engineering Aerospace

Rolls-Royce Singapore

Pratt & Whitney Global Services Partners

GE Aerospace

Safran Aircraft Engines

MTU Aero Engines

Lufthansa Technik

SIA Engineering Company

IAI Bedek Aviation Group

Triumph Group

KBR

Jacobs

AFRY

Vibro-Meter (Meggitt)

HBK (Hottinger Brüel & Kjær)

- Engine OEM users prioritize repeatability, high data bandwidth, and rapid configuration changes across development programs

- MRO end users emphasize throughput, acceptance test turnaround time, and cost-per-run optimization

- Defense and government users focus on security, controlled access, and mission-profile endurance testing

- Independent labs and certification-oriented users value accredited procedures, traceability, and compliance documentation

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035