Market Overview

The Singapore Aircraft Engines market has demonstrated significant growth, driven by several factors including a highly developed aviation infrastructure and increasing air traffic in the Asia-Pacific region. The market is valued at USD ~ billion, supported by the country’s status as a major global aviation hub and its strategic position in Southeast Asia. The market is primarily driven by demand for advanced, fuel-efficient engines to cater to both commercial and military aircraft fleets. With a robust economy and government investments in aviation infrastructure, Singapore continues to lead in the development and deployment of high-tech aircraft engines, which has fostered significant market expansion.

Singapore’s dominance in the aircraft engine market can be attributed to its highly developed aerospace sector and the presence of key stakeholders such as Rolls-Royce, General Electric, and Pratt & Whitney. The country’s key position as a regional aviation hub facilitates the constant demand for aircraft engines, particularly from major international airlines, government defense agencies, and MRO (Maintenance, Repair, and Overhaul) providers. Additionally, Singapore’s well-established regulatory and certification frameworks, along with its strategic focus on technological advancements and innovation, make it a leader in the Asia-Pacific region.

Market Segmentation

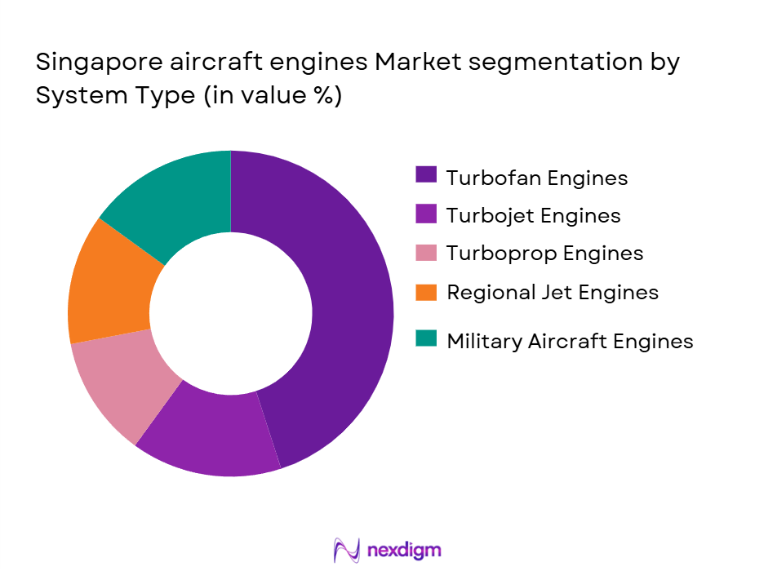

By System Type

The Singapore Aircraft Engines market is segmented by system type into turbofan engines, turbojet engines, turboprop engines, regional jet engines, and military aircraft engines. Among these, turbofan engines dominate the market, particularly due to the growing demand for fuel-efficient and high-performance engines for commercial aviation. The increasing need for quieter, more eco-friendly engines has fueled the dominance of turbofan engines. Airlines operating both domestic and international flights increasingly opt for these engines due to their efficiency and performance in long-haul flights. Companies like Rolls-Royce and General Electric have seen continued success in this segment due to their strong market presence and technological innovations.

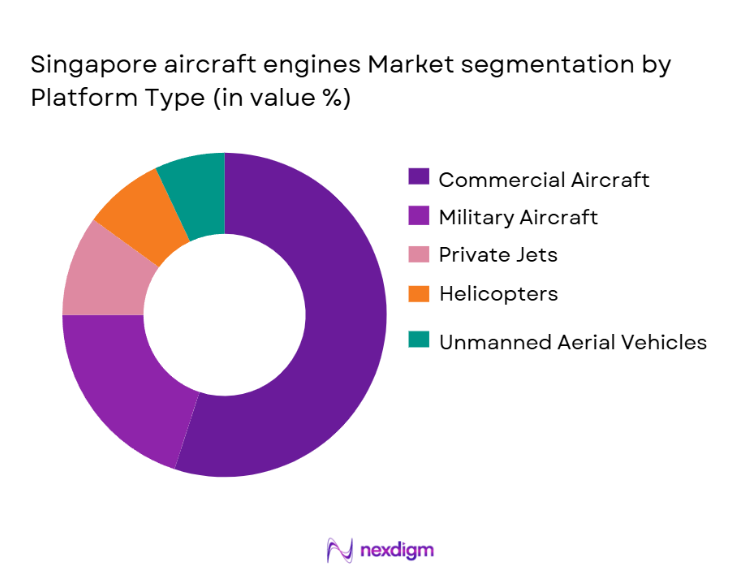

By Platform Type

The market is segmented by platform type into commercial aircraft, military aircraft, private jets, helicopters, and unmanned aerial vehicles (UAVs). The commercial aircraft segment takes the lead in terms of market share, driven by the increasing air travel demand and the expansion of airline fleets in the Asia-Pacific region. The need for new, more fuel-efficient engines has led to greater investments in commercial aircraft, thereby boosting the demand for advanced engines. Major airlines in Southeast Asia, including Singapore Airlines, are consistently upgrading their fleets with the latest models, driving the high demand for commercial aircraft engines.

Competitive Landscape

The Singapore Aircraft Engines market is dominated by a few major players, including multinational corporations and established OEMs (Original Equipment Manufacturers) such as Rolls-Royce, General Electric, and Pratt & Whitney. The presence of these key companies highlights the consolidated nature of the market, where technological advancements and a strong reputation for quality play pivotal roles. These companies focus on innovation, technological capabilities, and global partnerships to strengthen their market position. Additionally, the close collaboration with local airlines, military entities, and MRO service providers has ensured that these companies maintain a dominant foothold in the industry.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology | Geographical Reach | Strategic Initiatives |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ |

Singapore Aircraft Engines Market Analysis

Growth Drivers

Increasing Demand for Fuel-Efficient Engines

The rising focus on reducing carbon emissions and improving fuel efficiency in aviation is driving the demand for advanced aircraft engines. Airlines are opting for more eco-friendly and cost-efficient engines to lower operational costs and meet sustainability goals.

Expanding Air Traffic in the Asia-Pacific Region

As air traffic continues to grow, especially in the Asia-Pacific region, the need for modern and high-performance aircraft engines is increasing. This growth is driven by the rapid economic development in countries like China, India, and Singapore, contributing to the rising demand for both commercial and military aircraft engines.

Market Challenges

High Manufacturing Costs

The development and manufacturing of advanced aircraft engines involve high capital investment, research and development costs, and stringent regulatory standards. These factors make it difficult for manufacturers to reduce costs while maintaining high performance and safety standards.

Global Supply Chain Disruptions

The aircraft engine manufacturing industry faces challenges related to global supply chain disruptions, such as shortages of critical raw materials, which can lead to delays in production and delivery of engines.

Opportunities

Technological Advancements in Hybrid and Electric Propulsion

The growing focus on reducing aviation’s environmental impact presents opportunities for developing hybrid and electric aircraft engines. These innovations promise to meet both regulatory requirements and consumer demand for cleaner, more sustainable aviation solutions.

Government Investments in Aerospace Infrastructure

Increased government investments in aerospace and defense sectors present opportunities for aircraft engine manufacturers. Strategic partnerships with governments and defense agencies to supply engines for military aircraft provide lucrative growth avenues for key players in the market.

Future Outlook

Over the next 5 years, the Singapore Aircraft Engines market is expected to show significant growth, driven by advancements in engine technology, increasing demand for fuel-efficient and environmentally friendly aircraft, and a rise in global air traffic. The ongoing investments in aerospace technology and the focus on sustainability will continue to shape the industry, particularly with the development of hybrid and electric propulsion systems. With the support of government policies and regulatory frameworks that favor innovation, the market will see a steady rise in both commercial and military aviation sectors, making Singapore a continued leader in aircraft engine development and supply.

Major Players

- Rolls-Royce

- General Electric

- Pratt & Whitney

- Safran Aircraft Engines

- MTU Aero Engines

- IHI Corporation

- CFM International

- Honeywell Aerospace

- United Technologies

- Avio Aero

- GKN Aerospace

- Turbojet International

- Rolls-Royce & Associates

- Siemens Energy

- Mitsubishi Heavy Industries

Key Target Audience

- Airlines operating in the Asia-Pacific region

- Military and defense agencies

- Aircraft OEMs

- MRO service providers

- Government and regulatory bodies

- Private aircraft owners and operators

- Investments and venture capitalist firms

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map that identifies the major stakeholders in the Singapore Aircraft Engines market. Extensive desk research is conducted, leveraging secondary data sources and proprietary industry databases to gather accurate and comprehensive information on the market. This phase focuses on identifying critical variables such as market size, key players, technology trends, and regional dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, focusing on market penetration rates, system types, and platform categories. Key parameters such as pricing trends, installation rates, and technology adoption are thoroughly assessed to provide accurate insights into the market structure and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth drivers are validated through computer-assisted telephone interviews (CATI) with industry experts. These consultations allow for the collection of operational and financial insights from key practitioners, which refine and validate the hypotheses made in earlier research phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key players in the market, including aircraft engine manufacturers, MRO service providers, and OEMs. This phase ensures that the data derived from previous phases is corroborated and refined, producing a robust, accurate, and comprehensive analysis of the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for fuel-efficient aircraft

Expansion of the aviation sector in Asia-Pacific

Government investments in defense and aerospace technologies - Market Challenges

High cost of aircraft engine manufacturing

Stringent regulatory standards

Global supply chain disruptions - Market Opportunities

Technological advancements in engine efficiency

Rising demand for electric aircraft engines

Increasing focus on sustainable aviation fuels (SAFs) - Trends

Shift towards more electric and hybrid propulsion systems

Rise in aircraft engine leasing services

Growing focus on reducing carbon emissions in aviation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan engines

Turbojet engines

Turboprop engines

Regional jet engines

Military aircraft engines - By Platform Type (In Value%)

Commercial aircraft

Military aircraft

Private jets

Helicopters

Unmanned aerial vehicles (UAVs) - By Fitment Type (In Value%)

Linefit engines

Retrofit engines

Aftermarket engines

Engine parts

Engine maintenance services - By EndUser Segment (In Value%)

Airlines

Military forces

Private aircraft owners

Maintenance, repair, and overhaul (MRO) service providers

Aircraft manufacturers - By Procurement Channel (In Value%)

Direct purchases from OEMs

Third-party distributors

MRO service providers

Military procurement

Government contracts

- Market Share Analysis

- CrossComparison Parameters (Market Share, Technology Innovation, Geographical Reach, Customer Base, Aftermarket Services)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

General Electric

Pratt & Whitney

Safran Aircraft Engines

Honeywell Aerospace

MTU Aero Engines

IHI Corporation

CFM International

United Technologies

Avio Aero

Airbus

Boeing

Airbus Safran Launchers

GKN Aerospace

Turkish Engine Industries

- Airlines are focusing on fleet modernization to improve fuel efficiency

- Private aircraft owners are investing in advanced engines for greater performance

- MRO service providers are expanding their services to cater to more aircraft types

- Military forces are investing heavily in next-generation aircraft engine technology

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035