Market Overview

The Singapore Aircraft Exhaust Systems market has seen steady growth driven by the increasing demand for aviation services and technological advancements. The market is valued at approximately USD ~ million in 2025, with growth fuelled by both the increasing fleet size in the region and the rising trend of fuel-efficient aircraft designs. Additionally, the growing demand for improved exhaust systems due to the heightened focus on reducing carbon emissions has played a crucial role. This expansion is supported by strong governmental policies, as well as the continuous technological innovations in the aerospace industry, making exhaust systems more efficient and environmentally friendly.

Singapore, as a central hub for Southeast Asian aviation, dominates the aircraft exhaust systems market. The country’s strategic position in global aviation, coupled with its well-established aerospace infrastructure, makes it a key player in the industry. Furthermore, the government’s proactive investment in aviation technology and infrastructure has contributed significantly to Singapore’s position in the market. Other key countries that support the growth of this market include Japan, China, and India, with their rapidly expanding aviation sectors and increased investments in both commercial and defense aircraft.

Market Segmentation

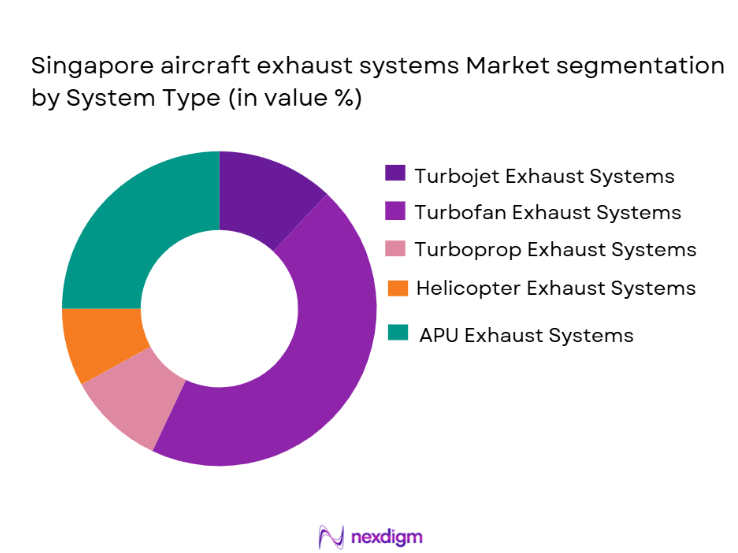

By System Type

The Singapore Aircraft Exhaust Systems market is segmented by system type into turbojet exhaust systems, turbofan exhaust systems, turboprop exhaust systems, helicopter exhaust systems, and auxiliary power unit (APU) exhaust systems. Among these, the turbofan exhaust systems segment holds the largest market share. This is primarily due to the dominance of commercial aviation in the region, where turbofan engines are the preferred choice for large commercial aircraft, such as those used by Singapore Airlines. Additionally, turbofan exhaust systems are favored for their efficiency, performance, and ability to meet environmental regulations for noise and emissions.

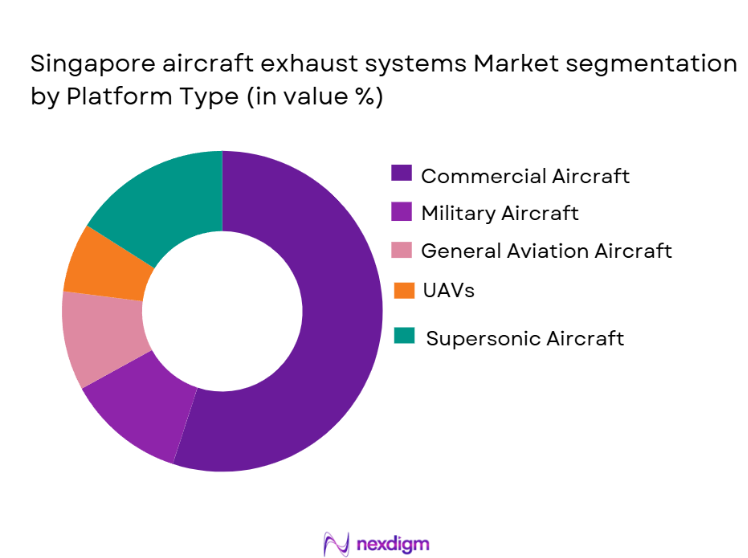

By Platform Type

The platform type segment includes commercial aircraft, military aircraft, general aviation aircraft, unmanned aerial vehicles (UAVs), and supersonic aircraft. The commercial aircraft segment is the leading subsegment in the market. This is attributed to the strong aviation sector in Singapore and the overall expansion of commercial aviation in Southeast Asia. As air travel demand continues to grow, commercial aircraft fleets require efficient exhaust systems, driving the demand for these components. Additionally, ongoing innovations to reduce noise and improve fuel efficiency in commercial aircraft further bolster this segment’s market dominance.

Competitive Landscape

The Singapore Aircraft Exhaust Systems market is dominated by a few global players, including Rolls-Royce, Honeywell Aerospace, and Pratt & Whitney. These companies have established strong market positions through extensive research and development, ensuring the availability of high-quality exhaust systems that meet stringent regulatory requirements. The market’s competitive nature is further amplified by the continuous advancements in technology aimed at improving system performance, reducing fuel consumption, and minimizing environmental impact.

| Company | Establishment Year | Headquarters | Product Range | Technology Focus | Market Reach | Partnerships |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | United States | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ |

Singapore Aircraft Exhaust Systems Market Analysis

Growth Drivers

Increase in Commercial Air Traffic

The growing demand for air travel across Southeast Asia and globally has led to a rise in the number of commercial aircraft. This drives the need for efficient and high-performance aircraft exhaust systems to meet stringent environmental and operational standards.

Technological Advancements in Aircraft Exhaust Systems

Innovations such as noise reduction technologies, fuel efficiency improvements, and more eco-friendly materials are propelling the demand for advanced aircraft exhaust systems. These developments help reduce carbon emissions and operating costs, aligning with industry sustainability goals.

Market Challenges

High Development and Production Costs

The cost of designing and manufacturing advanced aircraft exhaust systems remains high due to the complexity of the technology and materials used. This can limit market accessibility, especially for smaller manufacturers or operators with budget constraints.

Stringent Regulatory Requirements

With increasing pressure from regulatory bodies to reduce emissions and improve noise reduction, manufacturers face significant challenges in adhering to these standards while maintaining system performance and reliability. This results in higher costs and development time for new systems.

Opportunities

Growing Demand for Fuel-Efficient and Eco-Friendly Aircraft

As airlines and aerospace companies prioritize sustainability, the market for aircraft exhaust systems designed to improve fuel efficiency and reduce environmental impact is expected to grow. Innovations in materials and design could further tap into this growing market.

Expanding Aviation Infrastructure in Asia-Pacific

The rapid expansion of aviation infrastructure in regions like Southeast Asia offers significant growth potential. As airports, aircraft fleets, and air travel services expand, the demand for advanced exhaust systems to power these aircraft will likely increase.

Future Outlook

Over the next six years, the Singapore Aircraft Exhaust Systems market is expected to show substantial growth, driven by the rising demand for fuel-efficient, environmentally friendly aircraft systems. Innovations in aircraft exhaust systems, such as noise reduction and improved emissions performance, are anticipated to be key drivers of this growth. The market will also benefit from the ongoing infrastructure development in Southeast Asia’s aviation sector, coupled with supportive government policies promoting aviation growth and sustainability.

Major Players

- Rolls-Royce

- Honeywell Aerospace

- Pratt & Whitney

- Safran Aircraft Engines

- MTU Aero Engines

- General Electric

- Boeing

- Airbus

- Thales Group

- Nexcelle

- AeroEngine Corporation

- Zodiac Aerospace

- Williams International

- Raytheon Technologies

- Lufthansa Technik

Key Target Audience

- Aircraft manufacturers

- Airlines

- Defense and aerospace agencies

- Aircraft maintenance organizations

- Regulatory bodies

- Aircraft exhaust system suppliers

- Investors and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical factors affecting the Singapore Aircraft Exhaust Systems market, including key market drivers, customer preferences, and technological developments. A comprehensive ecosystem map will be developed using secondary data sources such as industry reports and market intelligence.

Step 2: Market Analysis and Construction

In this phase, historical data related to market performance, consumer demand, and technological advancements will be collected. The aim is to construct a model reflecting market trends and dynamics, including price volatility, demand patterns, and future growth prospects.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed in earlier steps will be validated through interviews with industry experts and manufacturers of aircraft exhaust systems. Insights from operational professionals will offer detailed market dynamics and help refine the initial models.

Step 4: Research Synthesis and Final Output

The final research output will synthesize insights gathered from manufacturers, industry reports, and primary research, ensuring a thorough understanding of the market’s current state and potential developments. This process will involve detailed analysis of product segments, technological trends, and market demands.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of aviation industry in Southeast Asia

Increasing demand for fuel-efficient aircraft

Technological advancements in exhaust system design - Market Challenges

High cost of aircraft exhaust systems

Stringent environmental regulations

Supply chain disruptions - Market Opportunities

Growth in air travel across Asia-Pacific

Advancements in noise reduction technologies

Emerging trends in supersonic travel - Trends

Shift towards sustainable and eco-friendly materials

Integration of advanced sensor technologies

Development of quieter exhaust systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbojet Exhaust Systems

Turbofan Exhaust Systems

Turboprop Exhaust Systems

Helicopter Exhaust Systems

Auxiliary Power Unit (APU) Exhaust Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Unmanned Aerial Vehicles (UAVs)

Supersonic Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Upgraded Systems

Replacement Parts - By EndUser Segment (In Value%)

Airlines

Defense Organizations

Private Aviation

Aerospace Manufacturers

Maintenance, Repair, and Overhaul (MRO) Services - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Channels

Partnerships & Collaborations

Government Contracts

- Market Share Analysis

- CrossComparison Parameters (Market Share, Product Portfolio, R&D Investment, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

Honeywell Aerospace

Safran Aircraft Engines

Pratt & Whitney

General Electric

MTU Aero Engines

Lufthansa Technik

Boeing

Airbus

Thales Group

Nexcelle

AeroEngine Corporation

Zodiac Aerospace

Williams International

Raytheon Technologies

- Growth in commercial aviation demand across Asia

- Rising military aircraft modernization programs

- Increasing number of private aircraft owners

- Enhanced demand for MRO services due to older fleet

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035