Market Overview

The Singapore aircraft filters market is valued at approximately USD ~ in 2024, with growth attributed to several key factors including the recovery of global air travel, the increasing fleet size, and a shift towards more advanced filtration systems in the aviation sector. Technological advancements in filter efficiency, alongside stricter regulatory requirements for air quality and filtration, have also played a significant role in propelling the demand for high-performance filters. The rising focus on passenger health, especially in the aftermath of the COVID-19 pandemic, further boosts the market for cabin air filters, contributing to the steady increase in market size.

Singapore is at the forefront of the aircraft filters market due to its strategic location as a global aviation hub and its highly developed aviation infrastructure. As a major air traffic hub in Asia-Pacific, Singapore is home to Changi Airport, one of the busiest and most technologically advanced airports in the world, facilitating the demand for high-quality filtration systems in aircraft. The dominance of Singapore is further supported by its leading aerospace manufacturing and MRO (Maintenance, Repair, and Overhaul) services, which cater to both commercial and military aviation needs in the region.

Market Segmentation

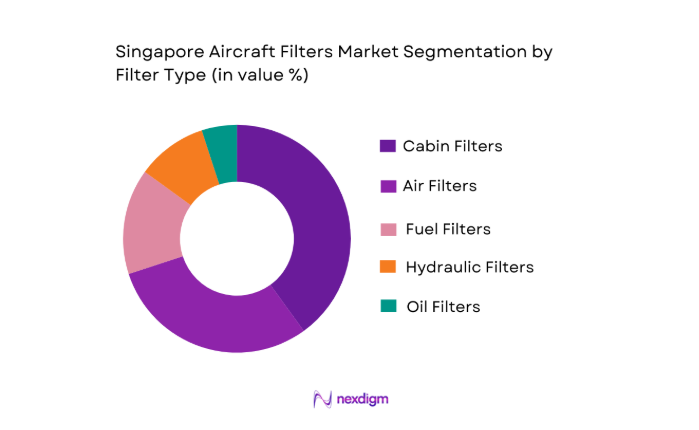

By Filter Type

The Singapore aircraft filters market is segmented by filter type into several categories, including air filters, fuel filters, hydraulic filters, oil filters, and cabin filters. Among these, the cabin air filters segment is the dominant market leader. This dominance can be attributed to growing concerns around air quality in commercial aviation and heightened passenger expectations for a safe and healthy flying environment. The increasing implementation of HEPA (High-Efficiency Particulate Air) filters in cabin air filtration systems is a significant factor driving the demand for cabin filters. The global shift towards air filtration systems that provide higher levels of protection against airborne pathogens, including viruses and bacteria, makes cabin air filters a critical area of focus for airlines.

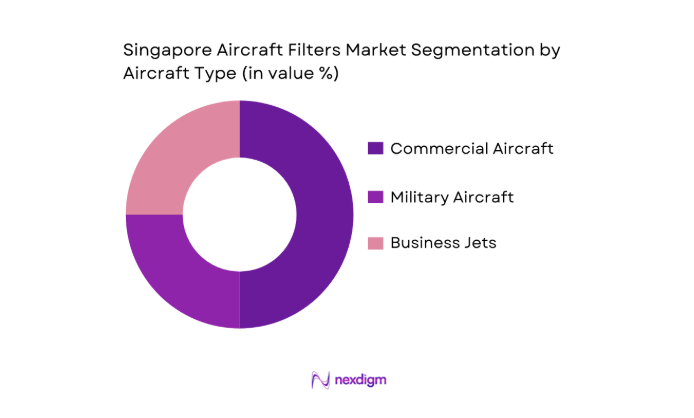

By Aircraft Type

Another key segmentation in the Singapore aircraft filters market is by aircraft type, which includes commercial aircraft, military aircraft, and business jets. Among these, the commercial aircraft segment is the dominant sub-segment due to the large number of commercial flights operating through Changi Airport and other regional airports. The increase in global air travel post-pandemic has further enhanced the demand for commercial aircraft filters. Furthermore, the continuous fleet modernization and the introduction of more fuel-efficient and environmentally friendly aircraft are expected to continue driving demand for filtration systems tailored to modern commercial aircraft.

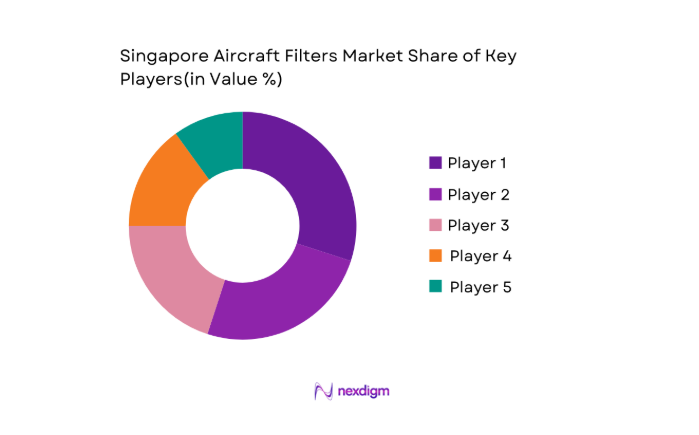

Competitive Landscape

The Singapore aircraft filters market is highly competitive, with several global and regional players dominating the market. Companies such as Donaldson Company, Inc., Parker‑Hannifin Corporation, and Honeywell International Inc. play a significant role in providing high-quality filtration systems for the aviation industry. These major players compete based on technological innovation, regulatory compliance, and the ability to meet the growing demand for sustainable and efficient air filtration solutions. The consolidation in the market is driven by the increasing demand for advanced filter technologies and maintenance services.

| Company | Establishment Year | Headquarters | Product Offering | Filter Technology | Certifications | Market Position | R&D Investment |

| Donaldson Company, Inc. | 1915 | Minneapolis, USA | ~ | ~ | ~ | ~ | ~ |

| Parker‑Hannifin Corporation | 1917 | Cleveland, USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ |

| Safran Filtration Systems | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Mann+Hummel GmbH | 1941 | Ludwigsburg, Germany | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Filters Market Analysis

Growth Drivers

Air Travel Recovery

The recovery of global air travel is one of the primary drivers of the aircraft filters market. According to the International Air Transport Association (IATA), global passenger traffic rebounded significantly in 2024, surpassing pre-pandemic levels. In 2023, global air passenger numbers reached ~, a ~ increase from 2022. This recovery is projected to continue in 2024 with global passenger traffic estimated to grow by 6.3% from 2023 levels. This resurgence in air travel is driving the demand for high-efficiency aircraft filters, particularly in commercial aviation, where clean cabin air is becoming a priority for airlines and passengers. As more flights take off, the need for advanced filtration systems, such as HEPA filters, continues to rise. Additionally, the forecasted 2024 global GDP growth of ~ by the World Bank supports the continuing economic recovery, which will further support air travel demand.

Fleet Expansion

Fleet expansion plays a significant role in the growth of the aircraft filters market. The International Civil Aviation Organization (ICAO) reported that the number of commercial aircraft in service globally is expected to increase steadily, reaching over ~ aircraft in 2024, with growth driven by airlines replacing aging fleets and the introduction of new models. The expansion of fleets is directly linked to the rising demand for aircraft filters as new aircraft require high-performance filtration systems. Moreover, the Boeing Commercial Market Outlook (2024) predicts the delivery of more than 16,000 new commercial aircraft over the next 20 years. This expansion will continue to necessitate efficient and effective filters across different aircraft platforms. Supporting this expansion, the International Air Transport Association (IATA) reported in 2024 that air cargo and passenger fleets are gradually increasing, contributing to further growth in maintenance, repair, and replacement of aircraft filters.

Market Challenges

Certification Rigor

The stringent certification processes for aircraft filters represent a major challenge in the market. The certification of new filtration systems is a complex and lengthy process, requiring compliance with international safety and regulatory standards such as those set by the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). In 2025, the FAA continued to enforce strict guidelines on filter performance, particularly concerning the protection against airborne pathogens. These certifications are often time-consuming, leading to delays in the introduction of new filter technologies. Furthermore, certification costs remain high, with airlines and filter manufacturers needing to invest significant resources to ensure compliance with safety standards. The global demand for high-quality filtration solutions thus faces a challenge due to these rigorous and costly certification processes.

High Entry Barriers

The aircraft filter market is characterized by high entry barriers, especially for new players. The complex and technical nature of aviation filters requires significant expertise in engineering, materials science, and manufacturing. In addition, new companies must navigate stringent regulatory approvals and certifications, which demand a substantial investment in research and development (R&D). The capital-intensive nature of the market, combined with the need for advanced manufacturing facilities, further limits the entry of new competitors. According to the World Bank, industries like aerospace are highly capitalized and require long-term investments, thus making it difficult for smaller players to break into the market. With leading players like Honeywell and Donaldson Company already having established networks, new entrants face a tough battle to compete on quality, cost, and supply chain logistics.

Opportunities

Smart Filters

The shift towards smart filters is creating significant growth opportunities in the aircraft filters market. Smart filters equipped with sensors and IoT technologies enable real-time monitoring of filter performance and contamination levels. This innovation allows airlines and maintenance service providers to predict when filters need to be replaced, reducing downtime and maintenance costs. According to a report by the International Air Transport Association (IATA), the aviation industry is increasingly investing in digital technologies, including IoT-based systems for aircraft maintenance. Smart filters can contribute to reducing operational costs and improving overall efficiency. The global aerospace industry’s investment in digitalization and predictive maintenance solutions is expected to further boost the demand for these advanced filtration systems. As of 2024, the increasing integration of IoT technologies into aviation systems, including smart filters, is expected to transform maintenance strategies and enhance aircraft reliability.

Sustainable Materials

The growing focus on sustainability in the aviation sector is driving demand for filters made from sustainable and eco-friendly materials. In 2025, airlines and filter manufacturers are increasingly adopting recyclable and biodegradable materials in the production of filters to reduce the environmental impact of the aviation industry. According to the European Commission, the aviation sector is focusing on reducing carbon emissions and adopting more sustainable practices, which has led to the development of eco-friendly filtration materials. The demand for sustainable materials in the aerospace sector is further reinforced by government regulations, such as the European Union’s Green Deal, which sets stricter environmental targets for the aviation industry. The shift towards sustainable materials in aviation filters is expected to open new opportunities for manufacturers who specialize in green technologies, thereby contributing to the market’s long-term growth.

Future Outlook

The aircraft filters market in Singapore is set to see substantial growth in the coming years. The rising demand for efficient filtration systems driven by growing air travel, new aircraft fleet orders, and the increasing focus on passenger health and safety are expected to support market expansion. The market will likely benefit from technological advancements in filter materials, such as the incorporation of nanofiber and advanced composite materials, which offer enhanced filtration efficiency. Additionally, the integration of IoT and sensor-based technologies in aircraft filters for predictive maintenance is expected to shape the future of this market, presenting new opportunities for both established players and new entrants.

Major Players

- Donaldson Company, Inc.

- Parker‑Hannifin Corporation

- Honeywell International Inc.

- Safran Filtration Systems

- Mann+Hummel GmbH

- Filtration Group Corporation

- Eaton Corporation plc

- Champion Aerospace LLC

- Purolator Facet Inc

- Recco Products Inc.

- Porvair PLC

- UTC Aerospace Systems

- Aerospace Filtration Systems

- SIA Engineering Company

- Local/Regional OEM Suppliers

Key Target Audience

- Airlines

- Aircraft OEMs

- MRO Providers

- Aircraft Part Manufacturers

- Aerospace Regulatory Authorities

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Aircraft Filtration Technology Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables that influence the Singapore aircraft filters market. This step will utilize secondary data sources, including industry reports and historical data, alongside interviews with stakeholders such as aircraft operators, OEMs, and filter suppliers.

Step 2: Market Analysis and Construction

This phase includes analyzing the historical performance of the aircraft filters market, assessing demand across various filter types and aircraft types. Data will be validated through expert consultations to ensure accuracy in assessing the market size and identifying growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through in-depth consultations with industry experts, including manufacturers, regulators, and market analysts. These expert opinions will help refine the market outlook and provide insights into emerging trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing the gathered data into a comprehensive analysis. Detailed reports and forecasts will be compiled, taking into account market drivers, challenges, and technological developments, to deliver actionable insights to industry professionals and stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Air Travel Recovery

Fleet Expansion

Advanced Filter Technologies - Market Challenges

Certification Rigor

High Entry Barriers

Aftermarket Complexities - Opportunities

Smart Filters

Sustainable Materials

APAC Aftermarket Expansion - Trends

Rise of HEPA

Cabin Health Emphasis

Digital Maintenance Analytics - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020‑2025

- By volume, 2020‑2025

- By average price, 2020‑2025

- By Filter Type (In Value %)

Cabin Air Filters

Engine Air Intake Filters

Fuel Filters

Hydraulic System Filters - By Material (In Value %)

Synthetic Fiber

Metal Mesh

Glass Fiber - By End Use (In Value %)

Commercial Aviation

Military Aviation

General & Business Aviation - By Distribution Channel (In Value %)

OEM Direct

Independent MRO Channels

Aftermarket Distributors - By Technology Integration (In Value %)

Standard Filtration

Smart/IoT‑Enabled Filter Monitoring

Predictive Maintenance Integrated Filtration

- Market Share of Major Players

- Cross‑Comparison Parameters (Filter Efficiency Ratings, Product Portfolio Breadth, Certification Compliance, Local APAC MRO Integration Capability, Aftermarket Service Footprint, Smart/Connected Filtration Tech Adoption, Sustainable/Green Material Development)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

Donaldson Company, Inc.

Parker‑Hannifin Corporation

Honeywell International Inc.

Mann+Hummel GmbH

Filtration Group Corporation

Eaton Corporation plc

Safran Filtration Systems

Champion Aerospace LLC

Purolator Facet Inc

Recco Products Inc.

Porvair PLC

UTC Aerospace Systems

Aerospace Filtration Systems

SIA Engineering Company

Local/Regional OEM Suppliers

- Operational Reliability & Certification Standards

- Total Cost of Ownership

- Retrofit Compatibility across Aircraft Fleets

- Aftermarket Service/Support & Local MRO Capabilities

- By Value, 2026‑2035

- By volume, 2026‑2035

- By average price, 2026‑2035