Market Overview

The Singapore Aircraft Fire Protection Systems market is currently valued at ~, with a robust growth trajectory. The market is primarily driven by the stringent safety regulations imposed by the Civil Aviation Authority of Singapore (CAAS) and international organizations such as the International Civil Aviation Organization (ICAO). Additionally, the increasing number of commercial aircraft and defense fleets in Singapore has contributed significantly to the growing demand for advanced fire protection systems, including fire detection and suppression technologies. This market growth is also supported by technological advancements in aircraft fire protection systems, ensuring greater reliability, ease of maintenance, and lower operational costs.

Singapore is one of the leading hubs for aircraft fire protection systems in Southeast Asia due to its strategic geographic location, a robust aviation sector, and high standards for safety compliance. As an aviation and aerospace hub, the country dominates the market due to its world-class Changi Airport, which is a key driver of demand for these systems. Furthermore, Singapore’s proactive regulatory framework and its constant focus on enhancing air safety standards have made it a dominant player in the Southeast Asian market. In addition, its regional influence on the aerospace industry enables its market to capture the growing aviation infrastructure in neighboring countries.

Market Segmentation

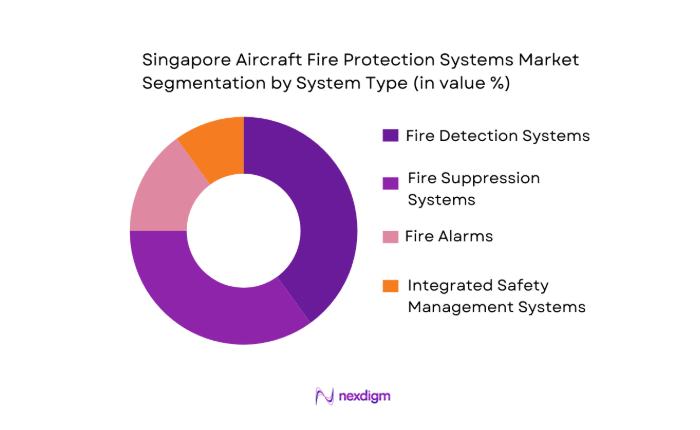

By System Type

The Singapore Aircraft Fire Protection Systems market is segmented by system type into fire detection systems, fire suppression systems, fire alarms, and integrated safety management systems. The fire detection systems segment has a dominant market share, driven by the increasing demand for early fire detection in both commercial and military aircraft. Modern fire detection technologies, such as infrared (IR) sensors, optical sensors, and smoke detection systems, have gained traction due to their high sensitivity and low false alarm rates. As the aviation industry increasingly focuses on safety and reliability, advanced fire detection systems are becoming a critical requirement.

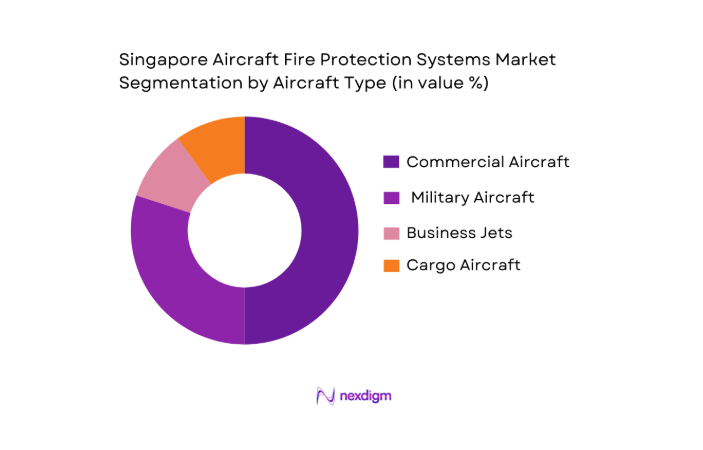

By Aircraft Type

By Aircraft Type

In terms of aircraft types, the commercial aircraft segment holds the largest market share, followed by military aircraft. This dominance is attributed to the ever-growing fleet of commercial airlines in Singapore and the Southeast Asia region, as well as the constant emphasis on safety and compliance with international aviation safety standards. Commercial aircraft operators prioritize advanced fire protection systems to ensure passenger and crew safety, as well as to maintain aircraft operational integrity. Meanwhile, military aircraft also contribute significantly to this market due to stringent defense standards for fire safety.

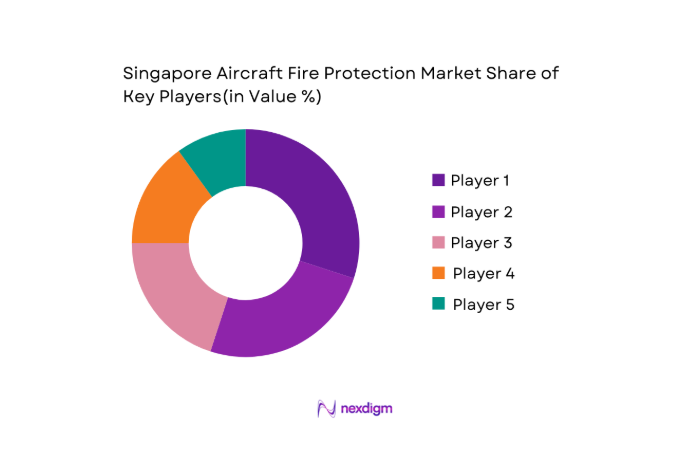

Competitive Landscape

The Singapore Aircraft Fire Protection Systems market is highly competitive, dominated by a few global players with specialized solutions for both civil and military aviation needs. Companies such as Meggitt PLC, Honeywell International, and RTX Corporation offer advanced, integrated solutions catering to fire detection and suppression needs across the aviation sector. These companies have established themselves as leaders due to their technological innovation, strong brand reputation, and compliance with stringent regulatory standards. Moreover, these players benefit from long-term contracts with airlines and defense agencies in Singapore and the wider Southeast Asian region.

| Company | Establishment Year | Headquarters | Technology Focus | Revenue (USD) | Market Position | Regulatory Compliance | After-Sales Support | R&D Investment |

| Meggitt PLC | 1947 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX Corporation | 2003 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Fire System Services Ltd. | 1998 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| Janus Fire Systems | 1990 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Fire Protection Systems Market Analysis

Growth Drivers

Rising Safety Regulations & Safety Compliance Costs

As air travel continues to grow in Singapore and Southeast Asia, the enforcement of stricter safety regulations has become a key growth driver for the Aircraft Fire Protection Systems market. For instance, the Civil Aviation Authority of Singapore imposes stringent regulations regarding the maintenance and inspection of fire detection and suppression systems in aircraft. In 2024, Singapore’s aviation safety spending increased to ~, as part of efforts to maintain the highest standards for flight safety. These regulations require airlines to invest in advanced fire protection systems, increasing overall safety compliance costs. Furthermore, ICAO’s safety audits and ongoing revisions in global standards also spur further investments in fire safety solutions.

Fleet Expansion in Singapore & SEA

The growth of Singapore as an aviation hub, with its Changi Airport serving as a crucial regional gateway, has led to the rapid expansion of both commercial and military aircraft fleets. The Singapore Airlines Group, for instance, added 12 new aircraft to its fleet in 2024 and plans to expand its operations across Southeast Asia, which includes replacing older fleets with advanced aircraft equipped with state-of-the-art fire protection systems. The expansion of fleets in neighboring Southeast Asian nations like Malaysia and Thailand is also contributing to increased demand for fire safety equipment. By 2025, Southeast Asia’s aircraft fleet is expected to reach 2,100, marking a significant rise from 1,800 in 2020. This expansion pushes for the adoption of advanced fire protection systems, propelling market growth.

Market Challenges

High R&D and Certification Cost

Aircraft fire protection systems demand cutting-edge technologies, driving high research and development (R&D) and certification costs. Manufacturers must comply with regulatory standards set by bodies such as the International Civil Aviation Organization (ICAO) and the Civil Aviation Authority of Singapore (CAAS), which require extensive testing and certification of new systems. As of 2024, the average cost of certifying a new fire suppression system for aircraft is estimated to be between USD ~ and USD ~. These costs add to the financial burden of system manufacturers, creating challenges in market penetration for new players. Furthermore, maintaining compliance with evolving global standards, such as new environmental guidelines for suppression agents, only adds to these expenses.

Skilled Technician & Integration Constraints

Another challenge faced by the Aircraft Fire Protection Systems market is the shortage of skilled technicians required for the installation, maintenance, and integration of advanced fire protection systems. This shortage is more pronounced in emerging economies in Southeast Asia, where skilled labor is in high demand across multiple sectors. According to Singapore’s Ministry of Manpower, the aviation industry has witnessed a 6% annual rise in demand for certified aviation technicians, which often exceeds supply. Additionally, the integration of these systems into diverse aircraft models requires highly specialized expertise, which further constrains market growth. As of 2024, only ~ of Singapore’s aviation workforce holds the necessary certifications for advanced fire protection systems, causing delays in aircraft refitting and retrofitting programs.

Market Opportunities

IoT & AI‑Enabled Fire Safety Platforms

The growing trend of IoT and AI-enabled fire safety platforms presents a significant opportunity for the Aircraft Fire Protection Systems market. As airlines and operators look for ways to enhance safety, reduce operational costs, and improve efficiency, there is a rising demand for integrated fire safety solutions that leverage data analytics and machine learning. These platforms enable real-time monitoring of fire detection systems, predictive maintenance, and early detection of anomalies before they escalate into full-scale emergencies. As of 2024, ~ of commercial airlines operating in Singapore are incorporating smart technologies into their aircraft systems, including fire safety platforms. This digital transformation is projected to grow exponentially in the coming years, offering immense growth opportunities for fire protection system providers.

Eco‑friendly Suppression Agents

The rising demand for eco-friendly suppression agents is another opportunity driving the market. As global aviation regulators tighten environmental regulations, there is an increasing shift towards using Halon-free and inert gas-based suppression systems. In 2024, the Singapore government has announced new initiatives to reduce the carbon footprint of the aviation industry, encouraging the adoption of environmentally friendly fire suppression agents. This has resulted in a growing interest in Novec 1230, an eco-friendly alternative to Halon, which has gained regulatory approval in several countries, including Singapore. As of 2024, the global market for Halon alternatives is projected to grow by 15% annually, spurred by regulatory pressures and consumer demand for sustainable solutions.

Future Outlook

Over the next 5-10 years, the Singapore Aircraft Fire Protection Systems market is expected to continue its growth trajectory, driven by advancements in fire protection technology, regulatory requirements, and the expansion of both commercial and military aviation fleets. The shift towards eco-friendly fire suppression agents, such as Inergen and Novec 1230, combined with the rise in smart fire detection systems, will play a critical role in shaping the future of the market. Additionally, the increasing trend of retrofitting older fleets with advanced fire protection systems is expected to fuel market growth. With continued support from the government and global regulatory bodies, the market is poised for sustained innovation and robust expansion.

Major Players

- Meggitt PLC

- Honeywell International

- RTX Corporation

- Fire System Services Ltd.

- Janus Fire Systems

- Siemens AG

- AMETEK Inc.

- Curtiss-Wright Corporation

- Gielle Industries

- Ventura Aerospace Inc.

- H3R Aviation Inc.

- The Chemours Company

- Southern Electronics Pvt. Ltd.

- Halma plc/Fireresistant Systems

- Firex Fire Systems

Key Target Audience

- Aerospace Manufacturers

- Airline Operators

- Investments and Venture Capitalist Firms

- Government Agencies

- OEMs

- Fire Safety Equipment Integrators

- Aviation Safety Inspectors

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining key variables such as the number of commercial and military aircraft operating in Singapore, fire protection system types, and regulatory guidelines. Comprehensive desk research using secondary data sources such as industry reports and company filings will be conducted to map the ecosystem of fire protection systems.

Step 2: Market Analysis and Construction

We analyze the historical growth of the Singapore Aircraft Fire Protection Systems market by studying installed base data and evaluating system types. This will include revenue generation by system type and aircraft type, ensuring a complete understanding of the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses will be validated through consultations with industry experts from aerospace companies, regulatory bodies, and safety system manufacturers. These interviews will provide deep insights into the latest developments in fire protection technologies and market dynamics.

Step 4: Research Synthesis and Final Output

The final stage will include engagement with fire protection system manufacturers to validate system specifications, evaluate future trends, and finalize market data. This process ensures that all market variables are fully integrated, delivering an accurate and comprehensive analysis of the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising Safety Regulations & Safety Compliance Costs

Fleet Expansion in Singapore & SEA

Demand for High‑Reliability, Low False‑Alarm Systems - Market Challenges

High R&D and Certification Cost

Skilled Technician & Integration Constraints

Competitive Pricing Pressures & Supply Chain Vulnerabilities - Market Opportunities

IoT & AI‑Enabled Fire Safety Platforms

Eco‑friendly Suppression Agents

Retrofit Upgrades Across Aging Fleets - Market Trends

Adaptive Suppression Technologies

Telecom & Data‑Backed System Diagnostics

Defense & Dual‑Use Innovation - Government Regulatory & Standards Analysis

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By System Type (In Value %)

Fire Detection Systems

Fire Suppression Systems

Alarm, Warning & Control Units

Integrated Safety Management Platforms - By Aircraft Type (In Value %)

Commercial Passenger Jets

Cargo Aircraft

Business & Private Jets

Military Fixed Wing

Military Rotary Wing - By Fitment Type (In Value %)

OEM Line‑fit

Aftermarket Retrofit - By Technology Integration (In Value %)

IoT / Predictive Analytics Enabled Systems

Traditional Threshold Alert Systems

Redundant Safety Architecture - By Application Zone (In Value %)

Engines & APUs

Cargo Holds

Cabins & Lavatories

Cockpits & Avionics Bays

- Revenue Share of Major Players in Singapore

- Cross‑Comparison Parameters (System Reliability, False Alarm Suppression Rate, Fire Detection Sensitivity, Suppression Time Performance, Certification & Compliance Score, Weight & Space Efficiency, Retrofit Compatibility Index)

- SWOT Analysis of Key Players

- Pricing Analysis by Platform and System Type

- Company Profiles of Major Competitors

Meggitt PLC

RTX Corporation

Siemens AG

Honeywell International Inc.

AMETEK Inc.

Curtiss‑Wright Corporation

Gielle Industries

Ventura Aerospace Inc.

Fire System Services Ltd.

Janus Fire Systems

Vulcan Fire Systems Inc.

H3R Aviation Inc.

The Chemours Company

Southern Electronics Pvt. Ltd

Halma plc/Fireresistant Systems

- Safety Certification Compliance Costs

- Lifecycle TCO

- Reliability Metrics

- Supplier Support & Integration Services

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035