Market Overview

The Singapore aircraft flame retardant films market is expected to reach USD ~million by 2024, driven by increasing safety regulations and demand for lightweight, fire-resistant materials in aircraft interiors and exteriors. The market’s growth is heavily influenced by the expansion of the aviation industry, as Singapore continues to serve as a major hub in Southeast Asia for both commercial and military aircraft operations. As the aviation sector modernizes its fleets, the adoption of flame-retardant films is gaining traction due to stricter fire safety standards and technological advancements in material science, including the use of polyimide and polyester films. These innovations in fire safety and the drive for fuel-efficient, lightweight components are key contributors to the growth of the market.

Singapore, as a leading aviation hub, dominates the aircraft flame retardant films market in Southeast Asia. The city-state’s robust aviation infrastructure, highlighted by Changi Airport, which handled ~ million passengers in 2024, supports its strategic position in the aviation industry. The high volume of aircraft operations and maintenance activities in Singapore, coupled with its leadership in aerospace technology, directly contributes to the demand for advanced materials such as flame-retardant films. The region’s stringent fire safety regulations for both civil and military aircraft and its proactive approach to aircraft fleet modernization further solidify Singapore’s dominance in the market. Additionally, the strong government and private sector investment in aerospace technology also accelerates the market’s growth in the region.

Market Segmentation

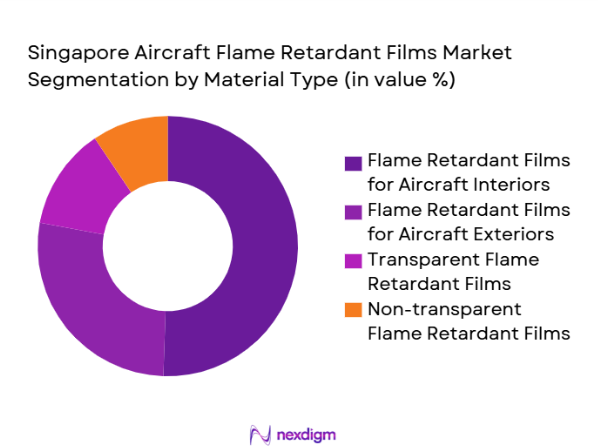

By Product Type

The aircraft flame retardant films market is primarily segmented into flame retardant films for aircraft interiors, exteriors, transparent films, and non-transparent films. Among these, flame retardant films for aircraft interiors dominate the market. This segment is driven by the increasing demand for fire-resistant materials in the construction of aircraft seating, cabin walls, and partitions. Stringent regulations, such as those mandated by the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), have raised the standards for fire safety in aircraft interiors, leading to a preference for advanced flame retardant films. These films ensure compliance with fire safety standards while also offering lightweight properties that help in reducing the overall weight of the aircraft, improving fuel efficiency. The growing trend of enhancing passenger comfort and safety in modern aircraft cabins, including better protection from fire hazards, further bolsters the demand for these films.

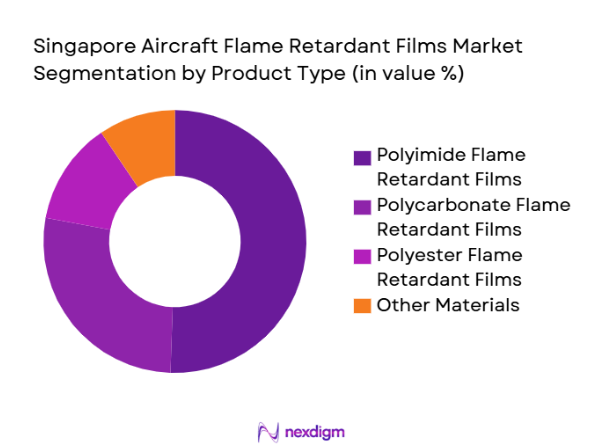

By Material Type

The market is segmented by material type into polyimide flame retardant films, polycarbonate flame retardant films, and polyester flame retardant films. Among these, polyimide flame retardant films hold the largest market share due to their superior fire resistance, high thermal stability, and excellent mechanical properties. Polyimide films are particularly used in high-performance applications where temperature extremes and mechanical stress are significant, such as in aircraft exteriors and critical components. Their ability to maintain structural integrity in extreme temperatures and conditions makes them the preferred choice for aircraft manufacturers. Furthermore, the material’s flexibility and ease of processing into various film grades, including transparent options, contribute to its dominance in the market. The increasing trend towards lightweight, high-performance materials in the aerospace industry ensures polyimide’s continued market leadership.

Competitive Landscape

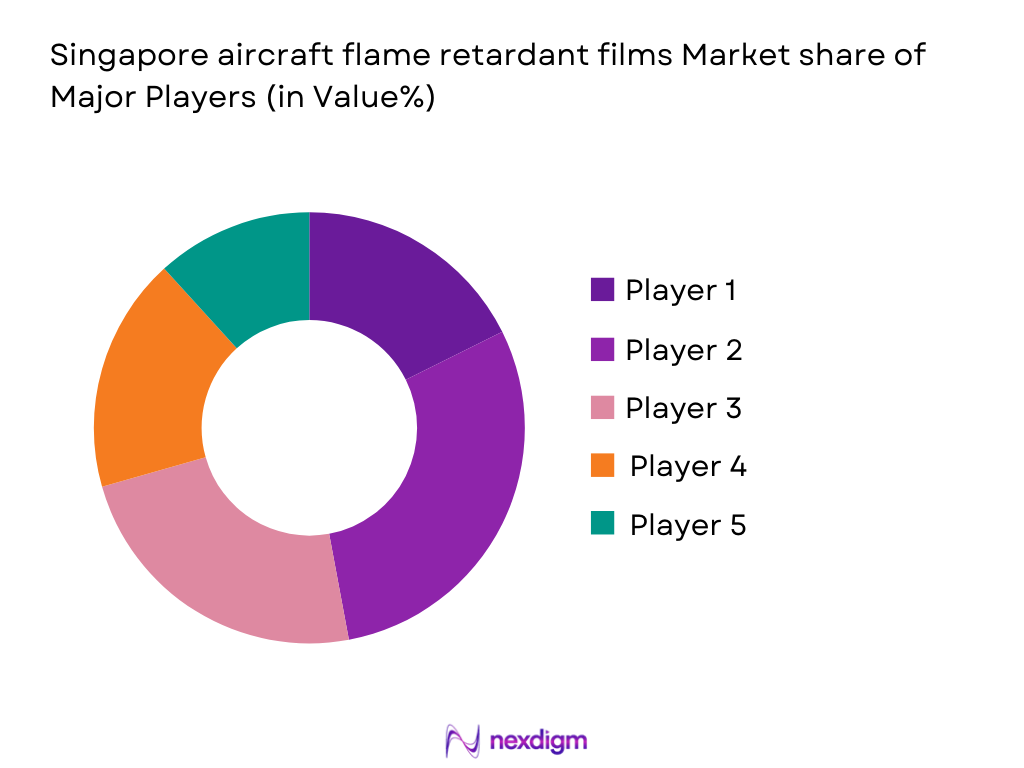

The Singapore aircraft flame retardant films market is dominated by a few key global players, including 3M, Covestro, DuPont, Solvay, and Teijin. These companies hold a significant share of the market due to their advanced technology in material sciences, vast distribution networks, and established relationships with leading aircraft manufacturers and maintenance providers. The competitive landscape is characterized by a high level of innovation, with these companies investing heavily in R&D to develop next-generation flame retardant films that meet increasingly stringent fire safety standards. Additionally, they are continuously expanding their product portfolios to cater to the specific needs of the aerospace sector, including lighter, more durable, and cost-effective film solutions for aircraft manufacturers and operators. This consolidation of market power highlights the influence these key players have in shaping industry standards and driving market growth.

| Company | Establishment Year | Headquarters | Revenue (2023) | Product Portfolio | Key Market | Technology Focus |

| 3M | 1902 | USA | ~ | ~ | ~ | ~ |

| Covestro | 2015 | Germany | ~ | ~ | ~ | ~ |

| DuPont | 1802 | USA | ~ | ~ | ~ | ~ |

| Solvay | 1863 | Belgium | ~ | ~ | ~ | ~ |

| Teijin | 1918 | Japan | ~ | ~ | ~ | ~ |

Singapore Aircraft Flame Retardant Films Market Analysis

Growth Drivers

Growth of Aviation and Aerospace Industry in Southeast Asia

The aviation industry in Southeast Asia continues to experience robust growth, with Singapore being a key player. According to the International Civil Aviation Organization (ICAO), the number of passengers in Southeast Asia is expected to exceed ~ million by 2025. Singapore’s Changi Airport saw over ~million passengers in 2024, and the nation’s aircraft fleet has been expanding steadily. The growth in air traffic directly fuels the demand for advanced materials like flame retardant films used in aircraft construction. With strong economic growth projections in Southeast Asia and Singapore, the aviation sector continues to witness significant investments in fleet expansion and technological upgrades, thereby increasing the demand for safety materials in aircraft interiors.

Regulatory Push for Enhanced Fire Safety Standards

Regulations surrounding fire safety in the aviation industry have been becoming stricter, with authorities pushing for higher standards in aircraft interior materials, including flame retardant films. The International Air Transport Association (IATA) and national aviation bodies like the Civil Aviation Authority of Singapore (CAAS) have set stringent fire safety norms. For instance, as per CAAS regulations, all materials used in aircraft must meet flammability standards under FAR ~. In 2024, the CAAS introduced new fire safety standards to enhance the protection of passengers and crew, which is expected to increase the demand for flame retardant films that meet these upgraded standards.

Market Challenges

Complexity of Compliance with International Standards

The complexity of complying with international standards for aircraft materials, including flame retardant films, presents a significant challenge for manufacturers. Various aviation safety organizations, such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA), have different requirements regarding the flammability, durability, and performance of these films. The ongoing updates and revisions of safety regulations, particularly the stricter standards under the European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) guidelines, add an extra layer of compliance burden. For example, as of 2024, the FAA’s requirements for flammability testing have become more rigorous, affecting the production process and increasing the time and cost of material certification. This ongoing complexity slows down the market’s pace of development.

High Material Costs

The cost of producing aircraft flame retardant films has been rising due to the high prices of raw materials, such as specialized polymers and fire-retardant additives. The inflationary pressure in global supply chains has particularly affected the cost of essential chemicals used in these films, such as brominated compounds, which are known for their flame-retardant properties. In 2024, the prices of flame retardant chemicals increased by ~% due to global supply chain disruptions. This increase in raw material costs has been a major challenge for manufacturers in Singapore, where labor and operational costs have also risen due to inflationary pressures. This situation has led to increased production costs, which could potentially slow down market expansion.

Opportunities

Expansion of Aircraft Fleet in Southeast Asia

Southeast Asia is seeing an expansion in its aircraft fleet, particularly in countries like Singapore. In 2024, Singapore Airlines added ~new aircraft to its fleet, and regional airlines like AirAsia have also committed to adding more planes in the coming years. According to the International Air Transport Association (IATA), Southeast Asia will need over~ new aircraft by 2030 to meet the growing demand for air travel. This expansion of the fleet presents a strong opportunity for the aircraft flame retardant films market as the need for advanced safety materials to meet regulatory standards increases with the expansion of the fleet.

Increasing Demand for Sustainable and Lightweight Materials

There is a rising trend in the demand for sustainable and lightweight materials in the aviation industry. Aircraft manufacturers are increasingly adopting materials that reduce fuel consumption and are environmentally friendly. According to the International Air Transport Association (IATA), airlines are aiming to reduce their carbon footprint by using lightweight materials that contribute to fuel efficiency. Aircraft flame retardant films that are both lightweight and sustainable have become increasingly important as airlines in Southeast Asia, including Singapore Airlines, aim to reduce their carbon emissions. This trend is expected to drive growth in the flame retardant films market, as more manufacturers shift to environmentally friendly materials.

Future Outlook

The Singapore aircraft flame retardant films market is expected to witness steady growth driven by the continued expansion of the aviation industry in Southeast Asia and increasing regulatory requirements for fire safety standards. Over the next few years, the demand for high-performance, lightweight, and durable flame retardant materials will increase as airlines and aerospace manufacturers look to meet both safety regulations and operational efficiency goals. Innovations in film technology, including the development of bio-based and recyclable flame retardant films, are expected to further enhance the market’s growth potential, as companies push towards sustainable practices in aircraft manufacturing. With Singapore’s position as a leading aviation hub, it is well-positioned to benefit from the growing demand for flame retardant films in the aerospace sector, particularly as new technologies in fire safety and material science continue to evolve.

Major Players

- 3M

- Covestro

- DuPont

- Solvay

- Teijin

- SABIC

- Mitsubishi Chemical

- Arkema

- Honeywell Aerospace

- Toray Industries

- Zyvex Labs

- Aec Group

- Hexcel Corporation

- Saint-Gobain

- Toray Industries

Key Target Audience

- OEMs

- MRO Providers

- Aircraft Operators

- Military & Defense Sectors

- Aerospace Component Suppliers

- Aircraft Leasing Companies

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore aircraft flame retardant films market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore aircraft flame retardant films market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aircraft manufacturers and materials suppliers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Singapore aircraft flame retardant films market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through InDepth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Growth of Aviation and Aerospace Industry in Southeast Asia

Regulatory Push for Enhanced Fire Safety Standards

Technological Advancements in Flame Retardant Films - Market Challenges

High Material Costs

Complexity of Compliance with International Standards - Opportunities

Expansion of Aircraft Fleet in Southeast Asia

Increasing Demand for Sustainable and Lightweight Materials - Trends

Rise of Composite Materials in Aircraft Interiors

Integration of Flame Retardant Films with Smart Materials

Focus on Predictive Maintenance - Government Regulation

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Flame Retardant Films for Aircraft Interiors

Flame Retardant Films for Aircraft Exteriors

Transparent Flame Retardant Films

Non-transparent Flame Retardant Films - By Material Type (In Value %)

Polyimide Flame Retardant Films

Polycarbonate Flame Retardant Films

Polyester Flame Retardant Films

Other Material Types - By End User (In Value %)

OEMs

MRO Providers

Aircraft Operators

Military & Defense Sectors - By Application (In Value %)

Aircraft Seating and Upholstery

Cabin Walls and Partitions

Aircraft Windows and Glazing

Other Applications - By Region (In Value %)

Southeast Asia

East Asia

South Asia

Oceania

- Market Share of Major Players on the Basis of Value/Volume

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Flame Retardant Film, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

3M

Dow Chemical

SABIC

Solvay

Covestro

DuPont

Teijin

Mitsubishi Chemical Corporation

Arkema

Toray Industries

Saint-Gobain

Honeywell Aerospace

Zyvex Labs

Aec Group

Hexcel Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035