Market Overview

The Singapore Aircraft Fuel Cell Market is ~ million USD big and projected to reach a significant market size in 2025, driven by an increasing focus on sustainable aviation technologies. The demand for fuel-efficient and environmentally friendly alternatives in the aviation sector, particularly in aircraft propulsion systems, is contributing to the growth of fuel cells in the industry. Government support for green technologies, including subsidies for research and development, further accelerates this growth. With Singapore positioning itself as a leader in aerospace innovation and sustainability, the adoption of fuel cell technology is expected to grow considerably, especially as airlines and manufacturers strive to reduce their carbon footprint.

Singapore stands out as a dominant hub for the Aircraft Fuel Cell Market, largely due to its strategic location and strong aerospace sector. The city-state’s well-established aviation infrastructure, along with government-backed initiatives like the Singapore Green Plan, plays a vital role in fueling the adoption of clean technologies, including fuel cells in aviation. As a key player in the Southeast Asian aviation industry, Singapore continues to lead regional efforts in aerospace innovations. Other dominant regions include major aerospace centers in Europe and North America, where airlines and manufacturers are heavily investing in green aviation solutions.

Market Segmentation

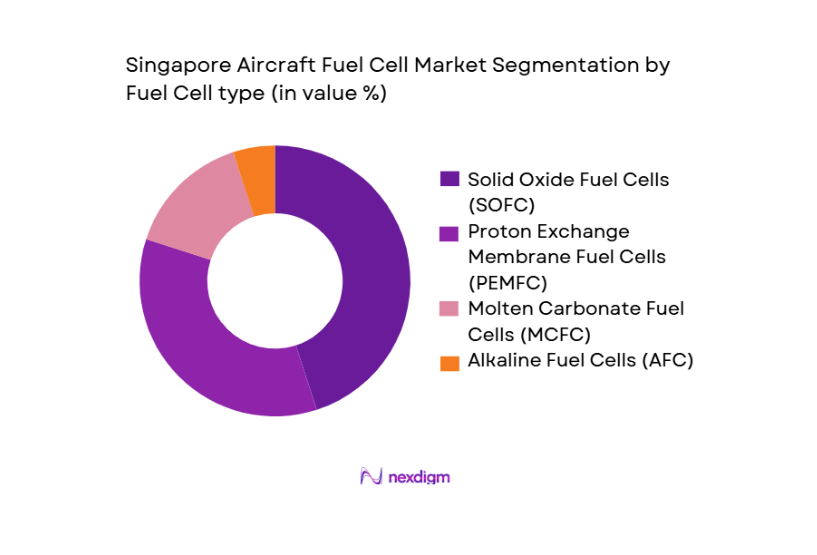

By Fuel Cell Type

The Aircraft Fuel Cell Market is segmented into several fuel cell types, including Solid Oxide Fuel Cells (SOFC), Proton Exchange Membrane Fuel Cells (PEMFC), Molten Carbonate Fuel Cells (MCFC), and Alkaline Fuel Cells (AFC). Among these, Proton Exchange Membrane Fuel Cells (PEMFC) dominate the market due to their high energy density, efficiency, and suitability for aircraft propulsion systems. These cells offer the best power-to-weight ratio, making them ideal for aviation applications. Additionally, PEMFCs are highly efficient and are rapidly gaining traction among commercial aircraft manufacturers focused on reducing emissions and fuel consumption. As airlines push for green solutions, PEMFC technology has become the preferred choice in the industry.

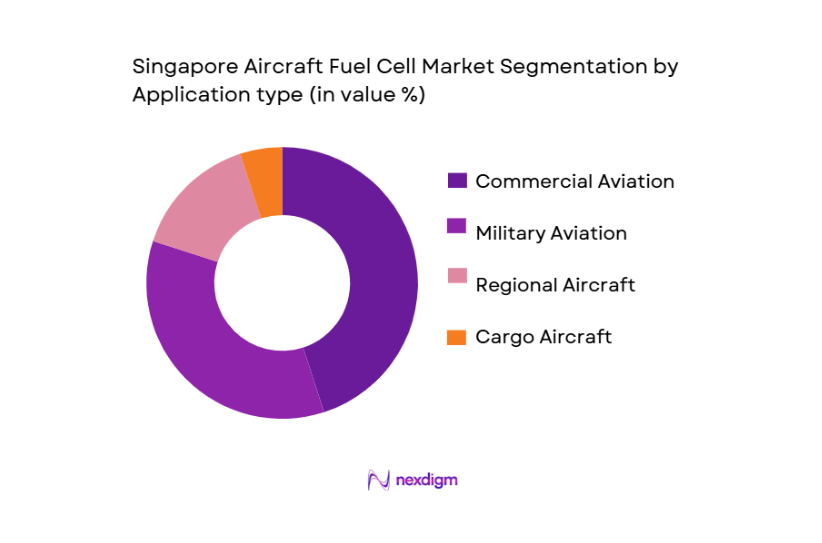

By Application

The market is segmented by application into Commercial Aviation, Military Aviation, Regional Aircraft, and Cargo Aircraft. Commercial aviation, particularly large commercial aircraft, dominates the market due to the significant adoption of fuel cell technology in this segment. The growing pressure on commercial airlines to reduce carbon emissions and increase fuel efficiency is propelling the demand for fuel cells in this sector. Airlines are prioritizing sustainable technology to meet global emissions reduction goals. Fuel cell integration into commercial aircraft offers a significant advantage by providing a cleaner alternative to conventional turbine engines, leading to an increased focus on this application.

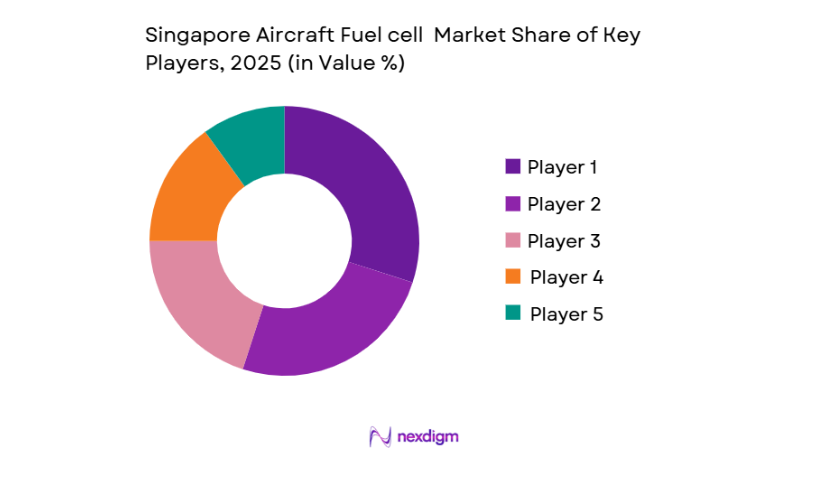

Competitive Landscape

The Aircraft Fuel Cell Market in Singapore is competitive and comprises both established aerospace giants and emerging clean technology players. The market is dominated by a mix of local innovators and global leaders in aerospace manufacturing, with each company investing heavily in R&D to develop more efficient and reliable fuel cell technologies. Major companies like Rolls-Royce, Honeywell Aerospace, and Ballard Power Systems are key players, with significant investments in fuel cell technology for aircraft. The competition is driven by technological advancements, regulatory support for sustainability, and partnerships with airlines and aircraft manufacturers.

| Company | Establishment Year | Headquarters | Technology Type | R&D Investment | Strategic Partnerships | Market Focus |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | USA | ~ | ~ | ~ | ~ |

| Ballard Power Systems | 1979 | Canada | ~ | ~ | ~ | ~ |

| Plug Power | 1997 | USA | ~ | ~ | ~ | ~ |

| Doosan Fuel Cell | 2000 | South Korea | ~ | ~ | ~ | ~ |

Singapore Aircraft Fuel Cell Market Analysis

Growth Drivers

Increase in Fuel Efficiency and Environmental Concerns

The aviation industry globally has intensified efforts to improve fuel efficiency due to rising concerns over environmental impact and operational costs. Singapore’s Changi Airport handled ~ million passengers and ~million tonnes of air cargo in 2024, marking strong air traffic growth which increases total fuel consumption in the sector. As modern aircraft are becoming up to ~ percent more fuel-efficient than previous models, adoption of technologies such as fuel cells that can reduce reliance on traditional jet fuels is gaining traction. This improved efficiency reduces fuel burn per flight and is aligned with global aviation’s decarbonisation initiatives. Fuel cells, known for higher energy efficiency and lower emissions, are thus increasingly relevant to aircraft operators striving to cut carbon emissions.

Expansion of Aviation Industry in Southeast Asia

Southeast Asia’s aviation activity continues robust expansion, directly benefiting Singapore’s aircraft fuel cell market demand. Changi Airport’s ~ aircraft movements in 2024, up ~ percent compared to 2024, reflect growing fleet utilization and increasing flight operations. Singapore’s aviation sector contributes about ~ percent to the nation’s GDP, underlining its economic importance and the resulting push for efficient and sustainable technologies. With air passenger and cargo volumes climbing, airlines and manufacturers are incentivised to explore alternative propulsion and energy systems—including fuel cell technologies—to support operational growth while addressing environmental targets.

Market Challenges

High Initial Investment and Research Costs

Advanced fuel cell technologies for aviation require significant upfront capital for research, development, and certification testing. The shift from conventional power systems to fuel cell systems involves complex engineering, prototype testing, and specialised components, requiring high R&D budgets. In Singapore and globally, aviation technology research has seen sustained investment, but funding these innovations remains a barrier, particularly when compared with existing jet engine efficiency improvements. With energy demand rising in Southeast Asia (accounting for ~ percent of global energy demand growth), industry players must allocate scarce capital between infrastructure and emerging tech like fuel cells, thereby slowing immediate adoption.

Regulatory Hurdles in Aircraft Certification

Integration of fuel cells into aircraft propulsion and auxiliary power systems must meet stringent safety and airworthiness standards governed by international and national authorities. In Singapore, the Civil Aviation Authority enforces compliance with internationally harmonized standards that demand rigorous testing before fuel cell systems can be certified for aviation use. Given the aviation sector’s safety-critical nature, regulators require extensive validation of novel fuel cell systems to ensure reliable thermal, electrical, and mechanical performance under all flight conditions. These obligatory certification processes increase time and cost before market entry, posing challenges for developers and slowing overall adoption rates.

Opportunities

Increasing Adoption of Green Technology by Airlines

Airlines worldwide are progressively transitioning to green technologies to reduce operational emissions and meet environmental commitments. In Asia-Pacific, production capacity for sustainable aviation fuels (SAF) reached ~million metric tons in 2024, indicating industry movement toward lower-carbon alternatives. While SAF uptake is still emerging, this momentum underscores airline interest in decarbonisation pathways. Fuel cells, offering clean energy potential with lower lifecycle emissions than traditional combustion systems, align with these sustainability goals. Airlines operating through Singapore’s busy network of ~ airlines connecting ~ cities are increasingly focused on innovations that enhance environmental performance, suggesting growing opportunity for aircraft fuel cell adoption.

Potential for Fuel Cell Integration in Urban Air Mobility

The emergence of urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) platforms presents a burgeoning opportunity for fuel cell technology integration. These lightweight, shortrange aircraft benefit from fuel cells’ favourable powertoweight characteristics and low emissions profile. In Southeast Asia’s growing aviation ecosystem—supporting millions of passengers annually through hubs like Singapore—investment in next generation air transport solutions like UAM is increasing. With rising energy demand in the region and a strong focus on cleaner transportation, fuel cells offer a viable power solution that can replace or supplement batteries, extending range and reducing charging infrastructure dependence. This positions fuel cell technology as a key enabler for future urban aviation systems and sustainable regional connectivity.

Future Outlook

Over the next several years, the Singapore Aircraft Fuel Cell Market is expected to experience significant growth, driven by continuous advancements in fuel cell technology, the global shift toward cleaner and more sustainable aviation solutions, and robust government support. With increasing regulatory pressures on airlines to reduce emissions and enhance fuel efficiency, fuel cell technology will continue to play a critical role in the transformation of the aviation sector. As major aerospace players adopt hydrogen-based fuel cell technologies, it is expected that more fuel-efficient, eco-friendly solutions will enter the market, positioning Singapore at the forefront of this global shift in aviation sustainability.

Major Players

- Rolls-Royce

- Honeywell Aerospace

- Ballard Power Systems

- Plug Power

- Doosan Fuel Cell

- UTC Aerospace Systems

- PowerCell Sweden AB

- Toyota Industries Corporation

- Airbus

- Boeing

- GE Aviation

- Safran Aircraft Engines

- Mitsubishi Heavy Industries

- Embraer

- Zero Avia

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft Manufacturers

- Fuel Cell Technology Providers

- Aerospace Equipment Suppliers

- Airline Operators

- Environmental Agencies

- Aviation Sustainability Advocates

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key drivers of the Aircraft Fuel Cell Market, including technological advancements, regulatory frameworks, and industry trends. Extensive secondary research from credible sources like government agencies, international aviation bodies, and industry reports is used to gather foundational data.

Step 2: Market Analysis and Construction

In this phase, historical market data is collected and analyzed, with a focus on identifying key segments, such as fuel cell types and aircraft applications. Market trends and key developments in the aviation and fuel cell industries are analyzed to forecast future growth.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the field, including aerospace engineers and fuel cell technology specialists, are consulted through in-depth interviews to validate hypotheses and refine market projections. These consultations provide valuable operational and technical insights.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings into a comprehensive analysis. Direct engagements with manufacturers and stakeholders help validate and cross-check data, ensuring that the final report accurately reflects the market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis of Aircraft Fuel Cells in Singapore

- Timeline of Key Market Developments

- Business Cycle and Market Evolution

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Fuel Efficiency and Environmental Concerns

Expansion of Aviation Industry in Southeast Asia

Government Initiatives on Sustainable Aviation Technologies - Market Challenges

High Initial Investment and Research Costs

Regulatory Hurdles in Aircraft Certification - Opportunities

Increasing Adoption of Green Technology by Airlines

Potential for Fuel Cell Integration in Urban Air Mobility - Trends

Advancements in Fuel Cell Efficiency and Durability

Focus on Lightweight and Sustainable Materials

Safety Standards for Aircraft Fuel Cells - SWOT Analysis

- Government Regulatory Bodies

- Porter’s Five Forces

- Market Value, 2020-2025

- Market Volume, 2020-2025

- Average Price Trends, 2020-2025

- By Fuel Cell Type (In Value %)

Solid Oxide Fuel Cells

Proton Exchange Membrane Fuel Cells

Molten Carbonate Fuel Cells

Alkaline Fuel Cells - By Applications Type (In Value %)

Commercial Aviation

Military Aviation

Reigonal Aircraft

Cargo Aircraft - By Distribution Channel (In Value %)

Direct OEM Partnerships

Authorized Distributors/Agents

Aftermarket and Maintenance Providers

System Integrators / Engineering Consultancies - By Region (In Value %)

Eastern Region

Central Region

Western Region

Southern Region

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Strengths, Weaknesses, Revenue Breakdown, Production Capacities, Distribution Channels, Technological Developments, Fuel Cell Technology Innovations)

- SWOT Analysis

- Pricing Analysis

- Detailed Profiles of Major Companies

Rolls-Royce

Honeywell Aerospace

Ballard Power Systems

Plug Power

Doosan Fuel Cell

UTC Aerospace Systems

PowerCell Sweden AB

Toyota Industries Corporation

Airbus

Boeing

GE Aviation

Safran Aircraft Engines

Mitsubishi Heavy Industries

Embraer

ZeroAvia

- Market Demand and Utilization in Civil Aviation Sector

- Budget Allocation for Fuel Cell Development in Airlines

- Regulatory Compliance for Fuel Cell Integration in Aircraft

- Needs, Desires, and Pain Points of Airlines and Aerospace Manufacturers

- Decision-Making Process for Adoption of Fuel Cells in Aircraft

- Projected Market Value, 2026-2035

- Projected Market Volume, 2026-2035

- Projected Average Price Trends, 2026-2035