Market Overview

The Singapore Aircraft Fuel Systems Market is USD ~ million big and is significantly growing, supported by the expanding aviation industry, with Singapore Airlines consistently modernizing its fleet. The market’s current size is influenced by increasing air traffic, as Changi Airport handled ~ million passengers in 2024, reflecting robust demand for air travel. Additionally, efforts to reduce fuel consumption and enhance fuel efficiency drive the need for innovative aircraft fuel systems. The market size is further supported by increased government initiatives focused on sustainability, as the Singaporean government continues to emphasize greener technologies in aviation

Singapore is a dominant player in the aircraft fuel systems market in Southeast Asia, supported by its strategic position as a key global aviation hub. Changi Airport is one of the world’s busiest airports, contributing to the significant demand for fuel systems. The country’s commitment to sustainability and technological advancements, such as the Singapore Green Plan 2030, ensures a continued focus on efficient fuel management. This is reinforced by the increasing demand from Singapore Airlines, which operates a fleet of over ~ aircraft, including long-haul flights requiring advanced fuel systems to meet operational and environmental goals.

Market Segmentation

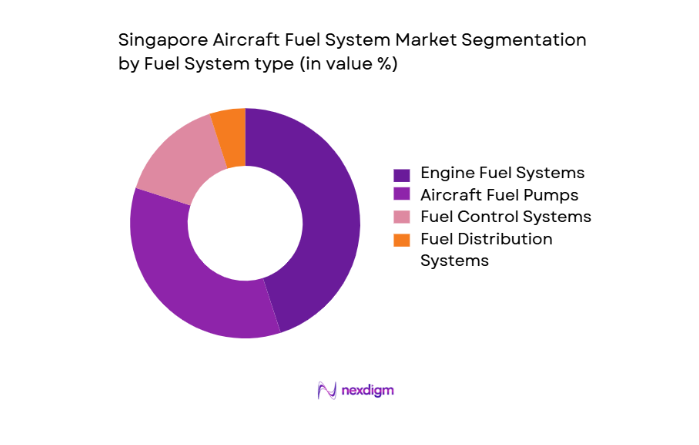

By Fuel System Type

The Singapore Aircraft Fuel Systems Market is segmented by fuel system types, including Engine Fuel Systems, Aircraft Fuel Pumps, Fuel Control Systems, and Fuel Distribution Systems. Among these, Engine Fuel Systems dominate due to the increasing demand for high-efficiency engines, such as those used in wide-body aircraft. These systems are vital for managing fuel flow and distribution, ensuring optimal fuel efficiency. Aircraft operators, particularly Singapore Airlines, are investing heavily in fuel-efficient engine technologies that require advanced fuel system integration, thus increasing the demand for robust, high-performance engine fuel systems.

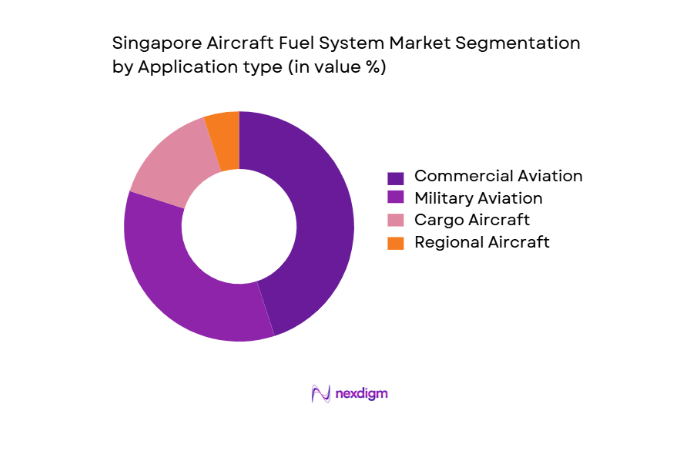

By Application

The market is also segmented based on application, including Commercial Aviation, Military Aviation, Cargo Aircraft, and Regional Aircraft. The Commercial Aviation segment is the dominant market share holder, largely driven by Singapore Airlines, which continues to modernize its fleet with advanced fuel-efficient aircraft. The airline’s focus on global connectivity with long-haul flights increases the demand for high-performance fuel systems. Additionally, Singapore’s role as a transit hub for international flights continues to fuel demand for advanced fuel systems, ensuring that commercial aviation remains the primary growth driver in this sector.

Competitive Landscape

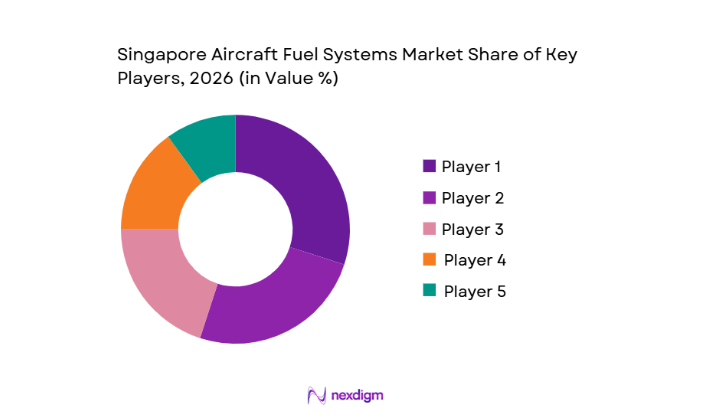

The Singapore Aircraft Fuel Systems Market is competitive, dominated by global aerospace leaders. Key players such as Honeywell Aerospace, GE Aviation, Rolls-Royce, and Safran Aircraft Engines are significant contributors to the market. These companies have a strong presence in Singapore, with partnerships that enable the integration of fuel systems into modern aircraft. The increasing demand for fuel efficiency and sustainable aviation solutions further boosts the competitiveness of these players, ensuring that these companies maintain substantial market influence.

| Company | Establishment Year | Headquarters | Technology Focus | R&D Investment | Strategic Partnerships | Market Focus |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ |

Singapore Aircraft Fuel Systems Market Analysis

Growth Drivers

Increase in Air Traffic and Fleet Modernization

Singapore’s aviation ecosystem has witnessed strong increases in air traffic, which directly reinforces demand for advanced aircraft fuel systems capable of supporting high operational activity. Singapore’s principal aviation hub, Changi Airport, handled ~ million passengers in 2024, up from prior years, while recording ~ aircraft movements, reflecting intensified flight operations and fleet utilization across carrier fleets. Singapore Airlines alone operates a fleet of ~ aircraft spanning widebody and narrowbody models that require sophisticated fuel systems for efficient long-haul and regional flights. The surge in passenger kilometers, as Singapore’s air traffic reached ~ million passenger km, underscores intensifying aircraft utilization that necessitates fuel system upgrades, fleet modernization, and enhanced fuel performance capabilities to maintain operational reliability and cost efficiency in a competitive regional environment.

Focus on Fuel Efficiency and Environmental Regulations

As Singapore’s aviation sector recovers strongly, discussions around fuel efficiency have moved to the forefront. Singapore’s aviation contributes around ~ percent of the nation’s GDP, highlighting aviation’s economic weight and the imperative to improve operational sustainability. Given high fuel costs and environmental pressures, airlines serving Changi Airport—which connects to over ~international destinations—are optimizing fuel systems to reduce consumption and emissions. Regulatory advocacy by global bodies like the International Civil Aviation Organization (ICAO) calls for aviation emissions mitigation through practices like sustainable aviation fuel (SAF) use and operations optimization, underpinning investments in fuel systems capable of handling diverse fuel profiles and improved distribution efficiency. Advanced fuel systems thus play a central role in meeting both operational demand and regulatory expectations for lower carbon intensity in air transport, especially in a major hub like Singapore where environmental integration and aviation growth go hand in hand.

Market Challenges

High Initial Investment in Fuel System Technologies

High initial capital requirements for advanced aircraft fuel system technologies present a significant hurdle for stakeholders in Singapore’s aviation industry. Cutting edge components—such as highprecision fuel pumps, digital fuel metering units, and integrated fuel management systems—demand substantial engineering investment before deployment. Aircraft manufacturers servicing Singapore airlines and maintenance providers need to justify such capital allocation amid other operational expenditures like crew costs and airport charges.

For example, Singapore’s aerospace sector output grew by ~ percent in early 2024, fueled by demand for parts and services, yet this growth also reflects the cost burdens of integrating advanced systems. The financial burden is further exacerbated as airlines seek to comply with tighter fuelefficiency and emissions standards, compelling them to consider new technology readiness and longterm returns on investment. These upfront capital demands can delay adoption and scaleup of sophisticated fuel system technologies, particularly for smaller regional carriers that operate within Singapore’s network.

Regulatory Hurdles in Certification of Fuel Systems

Aircraft fuel systems must meet rigorous certification criteria enforced by aviation authorities before they can be adopted in operational fleets. In Singapore, systems must conform to standards set by the Civil Aviation Authority of Singapore (CAAS) and align with international benchmarks like ICAO’s safety requirements for fuel supply, system redundancy, and fire resistance. These regulatory compliance processes involve extensive testing, documentation, and long lead times, which can delay technology integration and increase development costs.

Given the critical nature of fuel system safety, regulators require proof of performance under varied environmental and operational conditions, necessitating repeated validation cycles that elongate certification timelines. This complexity can create barriers for both OEMs and aftermarket suppliers to introduce innovations quickly, especially those related to alternative fuels and hybrid technologies, where additional safety protocols come into play. Regulatory rigidity thus remains a persistent challenge in maintaining pace with technological advancements in fuel systems.

Opportunities

Advancement in Hybrid and Electric Aircraft Fuel Systems

Emerging propulsion technologies, including hybrid electric systems, present compelling opportunities for Singapore’s aircraft fuel systems market as the aviation industry explores ways to lower fuel consumption and emissions. Singapore is positioned as an aerospace innovation hub with over 130 aerospace companies in R&D, manufacturing, and MRO sectors, indicating a supportive ecosystem for testing and integrating new fuel system technologies that align with hybrid and electric propulsion.

Hybrid aircraft architectures combine conventional fuel systems with battery or electric motor support to enhance fuel savings, particularly on regional routes. Fuel systems for these configurations must be versatile, robust, and capable of managing novel integration between liquid fuels and electric power sources. Singapore’s aerospace community and airlines can leverage this trend to pilot fuel systems tailored for next generation aircraft, paving the way for expanded operations in intra Asia routes where fuel efficiency drives competitiveness and environmental compliance.

Increasing Focus on Sustainable Aviation Technologies

The growing emphasis on sustainable aviation—evidenced by global commitments to lower carbon emissions and the scaling of sustainable aviation fuel (SAF) production—creates opportunities for fuel system innovations that support greener fuel types. Southeast Asia accounts for a significant portion of global jet fuel demand, making Singapore a strategic node for adopting sustainable aviation technologies. Fuel systems that can handle SAF and improve fuel management to reduce waste are in increasing focus as airlines seek to match global environmental best practices.

Singapore’s aviation sector is actively progressing in sustainable fuel adoption and infrastructure readiness, which requires advanced fuel system capabilities for safe storage, transfer, and monitoring of diverse fuel mixes. These evolving requirements stimulate demand for fuel systems designed for flexibility, environmental performance tracking, and compatibility with both conventional and sustainable fuels—thereby positioning Singapore at the forefront of aviation sustainability advancements in the region.

Future Outlook

Over the next several years, the Singapore Aircraft Fuel Systems Market is expected to grow significantly, driven by the ongoing expansion of Singapore’s aviation sector and increasing efforts to integrate sustainable technologies. As Singapore Airlines continues to modernize its fleet and introduce newer, more fuel-efficient models, the demand for cutting-edge fuel systems will rise. Additionally, stricter environmental regulations globally will push more airlines and manufacturers to invest in advanced fuel systems capable of supporting sustainable aviation technologies, ensuring steady growth in the market.

Major Players

- Embraer

- Boeing

- Mitsubishi Heavy Industries

- UTC Aerospace Systems

- PowerCell Sweden AB

- Ballard Power Systems

- Plug Power

- Doosan Fuel Cell

- Toyota Industries Corporation

- Airbus

- ZeroAvia

- Honeywell Aerospace

- GE Aviation

- Rolls-Royce

- Safran Aircraft Engines

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft Manufacturers

- Fuel System Technology Providers

- Aerospace Equipment Suppliers

- Airline Operators

- Environmental Agencies

- Aviation Sustainability Advocates

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map is constructed that includes stakeholders such as airlines, regulatory bodies, technology providers, and end-users. Secondary research is conducted through a variety of credible sources to identify critical market variables such as technological advancements, regulatory requirements, and market trends.

Step 2: Market Analysis and Construction

Historical data is compiled to understand market penetration, technology adoption, and the influence of market drivers. This includes assessing past growth trends and identifying emerging opportunities within the aircraft fuel systems market in Singapore.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market are validated through interviews with industry experts, including key stakeholders from aircraft manufacturers, airlines, and technology providers. These consultations provide a deeper understanding of the operational and financial factors influencing the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data and expert insights into a comprehensive market analysis. Interaction with various stakeholders is key to ensuring that the final report reflects the most accurate and up-to-date market projections and trends.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis of Singapore Aircraft Fuel Systems Market

- Timeline of Major Players

- Business Cycle and Market Evolution

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Air Traffic and Fleet Modernization

Focus on Fuel Efficiency and Environmental Regulations - Market Challenges

High Initial Investment in Fuel System Technologies

Regulatory Hurdles in Certification of Fuel Systems - Opportunities

Advancement in Hybrid and Electric Aircraft Fuel Systems

Increasing Focus on Sustainable Aviation Technologies - Trends

Shift Towards Smart and Autonomous Fuel Management Systems

Adoption of Green Aviation Fuel Systems - Government Regulation

- SWOT Analysis

- Porter’s Five Forces

- Market Value, 2020-2025

- Market Volume, 2020-2025

- Average Price Trends, 2020-2025

- By Fuel System Type (In Value %)

Engine Fuel Systems

Aircraft Fuel Pumps

Fuel Control Systems

Fuel Distribution Systems - By Application Type (In value %)

Commercial Aviation

Military Aviation

Cargo Aircraft

Regional Aircraft - By Component (In Value %)

Fuel Pumps

Valves

Filters

Pipes

Fuel Tanks - By Distribution Channel (In Value %)

OEMs

Aftermarket - By Region (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenues by Type, Number of Touchpoints, Distribution Channels, Margins, Production Plants, Capacity, Unique Value Offering)

- SWOT Analysis

- Pricing Analysis

- Detailed Profiles of Major Companies

Honeywell Aerospace

GE Aviation

Rolls-Royce

Safran Aircraft Engines

Embraer

Boeing

Mitsubishi Heavy Industries

UTC Aerospace Systems

PowerCell Sweden AB

Ballard Power Systems

Plug Power

Doosan Fuel Cell

Toyota Industries Corporation

Airbus

ZeroAvia

- Market Demand and Utilization in Civil Aviation

- Budget Allocations for Fuel System Development in Airlines

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Projected Market Value, 2026-2035

- Projected Market Volume, 2026-2035

- Projected Average Price Trends, 2026-2035