Market Overview

The Singapore Aircraft Galley market is valued at approximately USD ~ million, driven by the growing aviation sector in Southeast Asia. As of 2023, Singapore Airlines has a fleet of over 140 aircraft, and the demand for advanced galley systems continues to rise with the expansion of its long-haul routes. Increasing air travel, particularly in the premium segment, has led to significant investments in onboard services, such as galley upgrades. Additionally, technological advancements in lightweight materials and modular designs are further fueling market growth.

Singapore is a dominant player in the global aircraft galley market, primarily due to its strategic location as a major aviation hub in Southeast Asia. The presence of Singapore Airlines, one of the world’s leading airlines, significantly contributes to the demand for high-quality aircraft galleys. Singapore’s status as a global transit point and its focus on infrastructure development, such as Changi Airport’s continuous expansion, further enhance its market dominance. The country’s commitment to innovation and high service standards in aviation also strengthens its position in the aircraft galley market

Market Segmentation

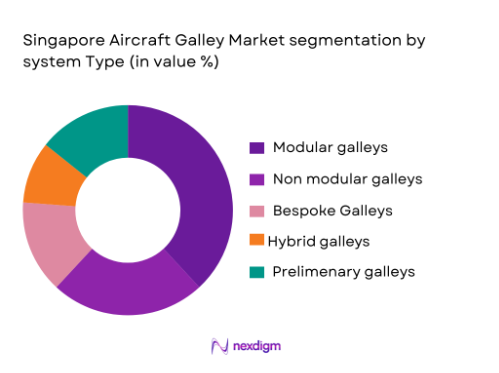

By System Type

The Singapore Aircraft Galley market is segmented by system type into modular galleys, non-modular galleys, bespoke galleys, hybrid galleys, and preliminary galleys. Among these, modular galleys dominate the market due to their adaptability and cost-effectiveness. Modular designs allow airlines like Singapore Airlines to customize galleys based on the specific needs of their diverse fleet, which includes both narrow-body and wide-body aircraft. These galleys are especially popular for their flexibility in configuration, making them ideal for various aircraft types. The modular galley systems also offer significant savings in terms of both installation time and maintenance costs, which further drives their demand in the market.

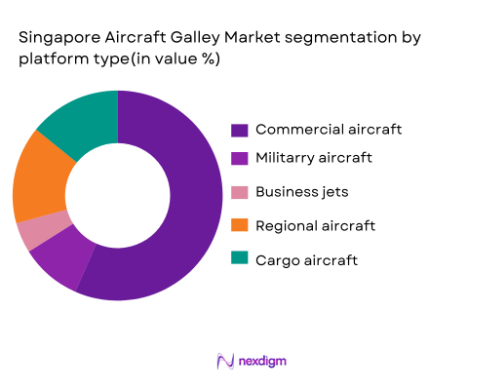

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, business jets, regional aircraft, and cargo aircraft. Commercial aircraft hold the dominant share of the market, primarily due to the increasing demand for air travel in Southeast Asia and the global expansion of airlines like Singapore Airlines. Commercial aircraft, including long-haul international flights, require advanced galley systems to meet the expectations of passengers in premium classes. As air travel grows, particularly in the Asia-Pacific region, airlines continue to prioritize the enhancement of in-flight services, thus driving the demand for sophisticated galley systems.

Competitive Landscape

The Singapore Aircraft Galley market is led by a few major players, including well-established companies such as Boeing, Airbus, Collins Aerospace, and Zodiac Aerospace. These companies dominate due to their expertise in producing high-quality, innovative galley systems that meet the evolving needs of the aviation sector. With a growing emphasis on improving passenger experience and operational efficiency, the competitive landscape remains dynamic, with both global and regional manufacturers vying for market share. Singapore Airlines’ continued expansion of its fleet also fosters intense competition among galley system manufacturers, as airlines look for customizable, modular, and lightweight solutions.

| Company | Establishment Year | Headquarters | Product Range | Technology Focus | Major Clients | Partnerships & Collaborations |

| Boeing | 1916 | Chicago, USA | – | – | – | – |

| Airbus | 1970 | Toulouse, France | – | – | – | – |

| Collins Aerospace | 2018 | Charlotte, USA | – | – | – | – |

| Zodiac Aerospace | 1896 | Paris, France | – | – | – | – |

| Jamco Corporation | 1955 | Tokyo, Japan | – | – | – | – |

Singapore Aircraft Galley Market Dynamics

Growth Drivers

Rising demand for air travel in Southeast Asia

The aviation sector in Southeast Asia has seen robust growth due to the increasing middle-class population, rising disposable incomes, and greater international connectivity. According to the International Air Transport Association (IATA), Southeast Asia’s passenger traffic is expected to surpass 200 million by 2025, up from 170 million in 2022. As air travel increases, airlines in Singapore and surrounding regions are expanding their fleets and upgrading onboard services, including galleys, to meet the needs of a growing number of premium passengers. The rising travel demand is thus creating a consistent need for advanced galley systems in both commercial and business jets.

Expansion of Singapore Airlines fleet and infrastructure

Singapore Airlines continues to expand its fleet, which is central to the growing demand for aircraft galleys. In 2023, Singapore Airlines received new deliveries of the Boeing 787 and Airbus A350, which are key players in the airline’s long-haul strategy. As the airline enhances its network, especially in premium markets, it requires galleys that provide efficiency and flexibility in delivering high-quality in-flight services. Additionally, Singapore’s aviation infrastructure, including Changi Airport, which serves over 68 million passengers annually, drives the need for increasingly sophisticated and efficient galley systems.

Market Challenges

High customization costs for luxury galleys

Luxury aircraft galleys, which are increasingly in demand for premium cabins, come with high customization costs. These galleys require specialized designs, materials, and components to ensure a high level of service. In 2023, Singapore Airlines began upgrading its premium cabins, incorporating advanced galleys that require bespoke designs. These custom solutions, tailored for comfort and efficiency, can add significant costs to aircraft procurement, impacting the airline’s overall capital expenditure. As airlines continue to prioritize premium services, these high customization costs pose a challenge to cost-effective fleet expansion.

Strict aviation regulations and certifications for galley systems

Aircraft galleys must comply with strict regulatory requirements set by authorities such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). These regulations govern the safety, fire resistance, and environmental impact of galley systems. Airlines like Singapore Airlines must ensure that all new galley installations comply with these rigorous standards, which can increase both lead times and costs. In 2023, updates to regulations for in-flight safety and sustainability are expected to further increase the complexity of certifying galley systems, challenging manufacturers to stay ahead of regulatory changes.

Market Opportunities

Growth in regional air travel driving demand for galleys

Southeast Asia is experiencing a surge in regional air travel as the demand for short- and medium-haul flights increases. In 2023, regional air traffic in Southeast Asia was expected to reach 170 million passengers, with markets like Singapore, Malaysia, and Indonesia leading the charge. This growth is fueling the demand for smaller and mid-sized aircraft, which require efficient and customizable galley systems. Airlines in the region are investing in these systems to ensure faster service delivery, catering to the needs of increasing numbers of passengers. This expansion offers substantial growth opportunities for galley system manufacturers.

Increase in procurement of military aircraft in Southeast Asia

The defense sector in Southeast Asia is undergoing significant growth, with countries like Singapore increasing military aircraft procurement. In 2023, Singapore announced an expansion of its military fleet, including advanced fighter jets and transport aircraft, which require specialized galley systems for personnel and crew. As defense budgets grow across the region, demand for military-grade galley systems will rise. These systems are crucial for ensuring the operational efficiency and comfort of military personnel during long flights. This shift presents a growing opportunity for galley manufacturers to cater to the evolving defense needs in Southeast Asia.

Future Outlook

Over the next decade, the Singapore Aircraft Galley market is expected to experience substantial growth, driven by the increasing demand for air travel and the expansion of Singapore Airlines’ fleet. As Southeast Asia becomes a central hub for international air traffic, the demand for high-quality galleys that can serve a range of aircraft types is expected to rise. Technological advancements in modular and lightweight galley systems will continue to play a pivotal role, as airlines prioritize operational efficiency, fuel savings, and passenger satisfaction. Furthermore, growing competition among regional carriers in Southeast Asia will encourage further investments in advanced galley systems.

Major Players in the Market

- Boeing

- Airbus

- Collins Aerospace

- Zodiac Aerospace

- Jamco Corporation

- Lufthansa Technik

- Rockwell Collins

- FACC

- GKN Aerospace

- Aviointeriors

- Diehl Aerospace

- Austrian Aircraft Interior

- Safran

- AeroDesigns

- Tapis Corporation

Key Target Audience

- Airlines & Aircraft Operators

- Aircraft Manufacturers

- Aviation Equipment Suppliers

- Aviation MRO Providers

- Government & Regulatory Bodies

- OEMs

- Investors and Venture Capitalist Firms

- Aerospace Industry Associations

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the major variables driving the Singapore Aircraft Galley market. Desk research and secondary data collection are employed to map the ecosystem, focusing on key players, technological advancements, and consumer preferences. The goal is to understand the factors impacting the market’s growth trajectory.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to assess market size, segment performance, and growth trends. Detailed analysis of installed units, system complexity, and procurement trends helps build a comprehensive market structure, while data verification ensures the accuracy of estimates.

Step 3: Hypothesis and Expert Consultation

Market hypotheses will be tested and validated through interviews with industry experts, including manufacturers, airline operators, and regulatory bodies. Insights from these consultations will refine the data and improve the accuracy of the forecasts.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the insights from the previous steps and presenting a comprehensive analysis of the market. This will include validated forecasts, strategic recommendations, and detailed profiles of the key players involved in the Singapore Aircraft Galley market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for air travel in Southeast Asia

Expansion of Singapore Airlines fleet and infrastructure

Technological advancements in galley design and materials - Market Challenges

High customization costs for luxury galleys

Strict aviation regulations and certifications for galley systems

Long lead times for galley manufacturing and installation - Market Opportunities

Growth in regional air travel driving demand for galleys

Increase in procurement of military aircraft in Southeast Asia

Development of eco-friendly galley solutions for sustainable aviation - Trends

Shift towards modular and adaptable galley designs

Incorporation of lightweight composite materials in galleys

Rising adoption of automation and digital technology in galley systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Modular Galleys

Non-modular Galleys

Bespoke Galleys

Hybrid Galleys

Preliminary Galleys - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Regional Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Refurbishment Fitment

Retrofitting

Custom Fitment - By End User Segment (In Value%)

Airlines

Government & Military

Aircraft Manufacturers

Private Jet Operators

Freight Carriers - By Procurement Channel (In Value%)

Direct Sales

OEM Contracts

Distributors

Third-party Procurement

Online Channels

- Market Share Analysis

- Cross Comparison Parameters (Price, Innovation, Market Penetration, Customer Service, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

Collins Aerospace

Zodiac Aerospace

Jamco Corporation

Lufthansa Technik

Rockwell Collins

FACC

GKN Aerospace

Aviointeriors

Diehl Aerospace

Austrian Aircraft Interior

Safran

AeroDesigns

Tapis Corporation

- Airlines expanding service offerings in premium cabins

- Government and military forces seeking customized galley solutions

- Aircraft manufacturers innovating in cabin designs and galley systems

- Private jet operators demanding luxury galley features

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035