Market Overview

The Singapore aircraft gearbox market is valued at USD ~billion based on comprehensive historical data. The growth of the market is driven by several factors, including the expansion of the aviation sector in Singapore, which has become a prominent hub for both commercial and military aviation in the Asia-Pacific region. As Singapore continues to position itself as a key player in the global aviation supply chain, increasing aircraft fleet modernization, and a growing demand for efficient gearbox systems play a vital role in driving market growth. Additionally, innovations in gearbox technologies, such as lightweight and fuel-efficient designs, are further fueling the market demand.

Singapore dominates the aircraft gearbox market due to its strategic location as a leading aviation hub in Asia. The country’s state-of-the-art infrastructure, including Changi Airport, one of the busiest airports globally, facilitates high demand for aircraft maintenance, repair, and overhaul (MRO) services. Furthermore, Singapore’s strong defense sector and governmental initiatives to support aerospace and defense technologies significantly contribute to the dominance of the market. Additionally, partnerships with global manufacturers and continuous investments in the local aerospace industry reinforce its leading position in the market.

Market Segmentation

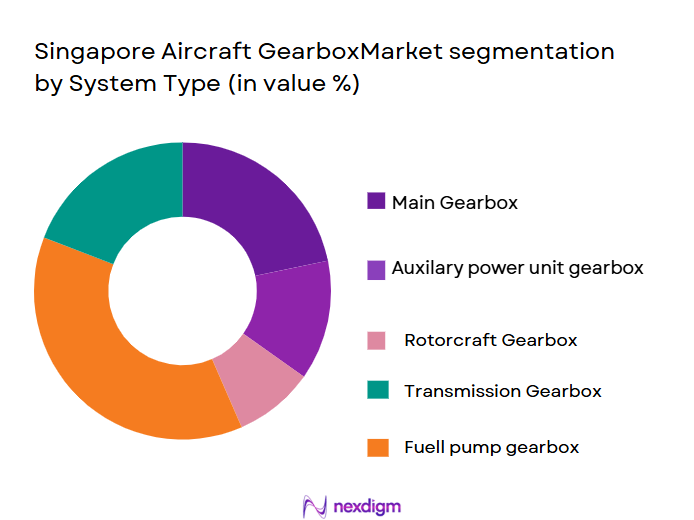

By System Type

The Singapore aircraft gearbox market is segmented by system type into main gearbox, auxiliary power unit (APU) gearbox, rotorcraft gearbox, transmission gearbox, and fuel pump gearbox. Among these, the main gearbox holds the dominant market share in Singapore. This is largely due to the widespread use of this system in commercial and military aircraft, which require efficient power distribution for optimal performance. Furthermore, the main gearbox is a critical component that ensures the smooth functioning of an aircraft’s engine, making it essential for aircraft manufacturers and MRO service providers.

In 2024, the main gearbox segment is expected to account for ~% of the market share, driven by the continued fleet expansion of commercial aircraft and the increasing adoption of next-generation aircraft engines that demand high-performance gearboxes. The market for APU gearboxes follows closely, primarily used in auxiliary systems of aircraft, contributing to better fuel efficiency and performance optimization.

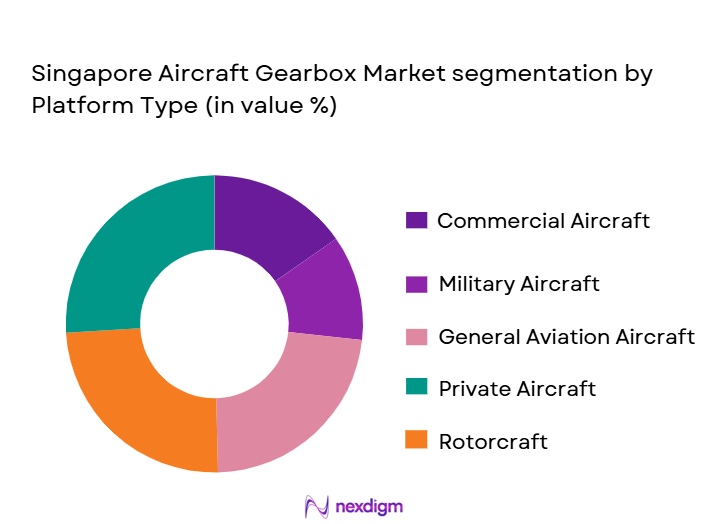

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, rotorcraft, unmanned aerial vehicles (UAVs), and private jets. Commercial aircraft account for the largest share of the market, contributing significantly to the demand for aircraft gearboxes in Singapore. This is attributed to the nation’s strategic role in international aviation, with a growing number of airlines expanding their fleets to meet increasing passenger demand, particularly in Southeast Asia and beyond.

In 2024, commercial aircraft will dominate the market with a share of 50%, driven by increasing air travel demand, the growth of low-cost carriers, and fleet modernization efforts. Additionally, military aircraft contribute to the growing market demand for gearboxes, as defense contracts continue to rise, with an emphasis on high-performance aircraft capable of meeting the region’s security needs.

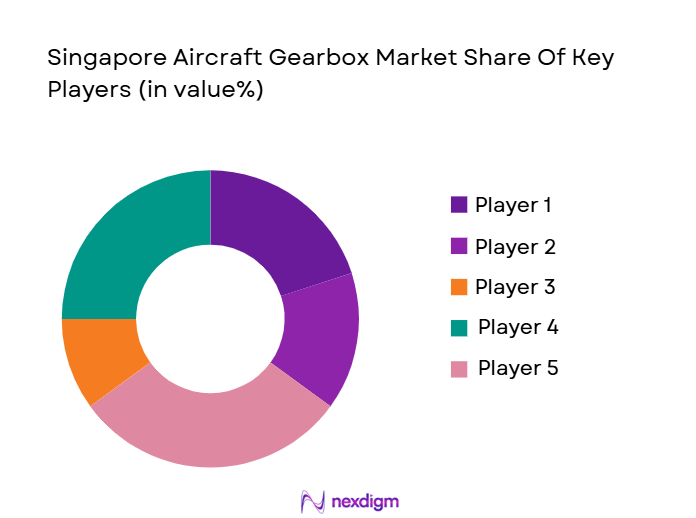

Competitive Landscape

The Singapore Aircraft Gearbox market is moderately consolidated and dominated by a limited number of global aerospace manufacturers with strong OEM relationships and long-term defense and commercial aviation contracts. These players benefit from advanced manufacturing capabilities, established MRO ecosystems in Singapore, and proximity to major airline customers in Asia-Pacific. Entry barriers remain high due to certification requirements, capital intensity, and the need for long-term airline and defense partnerships.

| Company | Establishment Year | Headquarters | R&D Investment | Technology Portfolio | Product Offerings | Global Reach | Customer Base | Strategic Focus |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| General Electric Aerospace | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1960 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Gearbox Market Dynamics

Growth Drivers

Increasing Demand for Fuel-Efficient Aircraft

The global demand for fuel-efficient aircraft has significantly risen, with the aviation industry striving to reduce carbon emissions while maintaining operational efficiency. In Singapore, the aviation sector’s growth contributes heavily to this trend. According to the International Air Transport Association (IATA), Asia-Pacific’s airline traffic is expected to grow by ~% annually through 2026, and this growth is pushing the need for more efficient, fuel-saving aircraft. The Singapore government is also driving initiatives for low-carbon technologies in aviation to meet global sustainability goals. In 2024, Singapore’s Civil Aviation Authority has targeted reducing aviation-related carbon emissions by ~ million tons by 2026, fostering demand for advanced fuel-efficient aircraft technologies and associated components such as gearboxes. These factors are driving the need for advanced gearboxes in aircraft to improve fuel efficiency and operational costs.

Advances in Aircraft Gearbox Technology

The technological advancements in aircraft gearbox design, materials, and manufacturing processes have been pivotal in transforming the industry. In 2024, ongoing innovations in gearbox technologies such as lightweight materials (e.g., composites), more robust power transmission designs, and improved lubrication systems are increasing operational efficiency. The Singapore aerospace industry is witnessing increased investment in R&D to improve the performance and durability of gearboxes, driven by global demands for more energy-efficient systems. As a result, the aircraft gearbox sector is becoming a crucial component for both commercial and defense aviation. For instance, the development of the geared turbofan (GTF) engine by Pratt & Whitney has revolutionized gearbox technology by reducing fuel consumption and CO2 emissions, which is directly impacting the gearbox demand in the region.

Market Challenges

High Cost of Maintenance and Repair Services

One of the major challenges facing the aircraft gearbox market is the high cost of maintenance, repair, and overhaul (MRO) services, particularly for commercial aircraft fleets in Singapore. The cost burden associated with regular maintenance of gearboxes is a significant issue for operators. According to the Singapore Economic Development Board (EDB), in 2024, MRO services account for over ~% of the overall operating costs for airlines. This high expenditure is driven by the need for specialized technicians and advanced equipment for gearbox repair, as well as the complexity involved in replacing and maintaining critical components in aircraft. Additionally, the cost of spare parts, especially advanced gearbox systems, remains elevated due to global supply chain challenges and limited production capacity for certain components, making the market more expensive to sustain airlines.

Complex Regulatory and Certification Processes

Aircraft gearboxes must meet stringent safety and regulatory standards set by authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). The complexity of certification processes for new gearbox technologies often delays production timelines and increases costs. In 2024, the FAA and EASA reported an increasing backlog of aircraft parts and component certifications due to rigorous testing and compliance requirements. Singapore’s position as a regulatory leader in the Asia-Pacific region means that the government closely follows these international standards, which can sometimes delay the introduction of new technologies to the market. The regulatory framework creates challenges for manufacturers looking to streamline operations and speed up time-to-market for new gearbox models.

Market Opportunities

Rise in Aircraft Fleet Modernization Programs

One of the major opportunities for growth in the aircraft gearbox market is the increasing focus on aircraft fleet modernization programs. In Singapore, the government and private sector continue to invest in the modernization of aircraft fleets to meet environmental and efficiency goals. The Singapore Airlines Group, for example, has been investing heavily in the fleet renewal strategy, with the aim to replace older models with more efficient aircraft. This trend is expected to create significant opportunities for the gearbox market, as newer models require state-of-the-art gearboxes that can handle more demanding engine specifications. Furthermore, global governments are aligning their military defense capabilities by introducing new, more advanced aircraft, which drives the need for high-performance gearboxes. The rise in fleet modernization programs in both commercial and military sectors is expected to have a direct impact on the demand for advanced gearbox systems in the market.

Growth in the Number of Air Travel Passengers in Asia

The demand for air travel in the Asia-Pacific region, particularly in Southeast Asia, continues to rise, which presents an opportunity for the Singapore aircraft gearbox market. In 2024, the International Air Transport Association (IATA) forecasts that Asia-Pacific will account for ~% of global air traffic, significantly contributing to increased demand for aircraft and, consequently, gearboxes. This growth in air travel passengers is expected to fuel the need for new aircraft deliveries, fleet expansions, and replacements, driving demand for gearbox systems. Singapore, as a regional aviation hub, stands to benefit from this growth, with major airlines ordering new aircraft, which requires advanced gearboxes. As the region’s airlines expand their fleets to accommodate growing passenger numbers, the demand for efficient and reliable gearboxes will continue to rise.

Future Outlook

Over the next decade, the Singapore aircraft gearbox market is poised to witness significant growth, fueled by advancements in aircraft technology, continued fleet expansion, and rising demand for more fuel-efficient and lightweight gearboxes. Furthermore, the growing military and defense sector in Singapore, along with increasing collaborations between local and global players, is expected to drive substantial growth in the market. The need for innovation in gearbox designs, particularly in reducing weight and improving efficiency, will likely become a key driver of market dynamics.

With continuous government support, investments in aviation infrastructure, and technological advancements, the aircraft gearbox market in Singapore is projected to maintain a strong growth trajectory through 2035. Companies will focus on developing next-generation gearboxes capable of meeting the demands of emerging aircraft types, such as electric and hybrid propulsion systems.

Major Players in the Market

• General Electric Aerospace

• Pratt & Whitney

• Safran

• Liebherr Aerospace

• Honeywell Aerospace

• Collins Aerospace

• MTU Aero Engines

• Eaton Aerospace

• Moog Inc.

• Leonardo S.p.A.

• Triumph Group

• Kawasaki Heavy Industries

• Avicopter

• Magellan Aerospace

Key Target Audience

• Aircraft engine and gearbox OEMs

• Airlines and fleet operators

• Aircraft leasing companies

• Defense aviation procurement units (Singapore Ministry of Defence – MINDEF)

• Government and regulatory bodies (Civil Aviation Authority of Singapore – CAAS)

• Investments and venture capitalist firms

• Aerospace MRO service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Aircraft Gearbox Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Singapore Aircraft Gearbox Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aircraft gearbox manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Singapore Aircraft Gearbox Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for fuel-efficient aircraft

Advances in aircraft gearbox technology

Expansion of the aviation sector in Asia-Pacific - Market Challenges

High cost of maintenance and repair services

Complex regulatory and certification processes

Dependency on high-quality manufacturing standards - Market Opportunities

Rise in aircraft fleet modernization programs

Growth in the number of air travel passengers in Asia

Technological advancements in gearbox materials and designs

- Trends

Shift toward lightweight gearboxes for improved fuel efficiency

Adoption of additive manufacturing (3D printing) in gearbox production

Growing preference for hybrid and electric propulsion systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Gearbox

Auxiliary Power Unit Gearbox

Rotorcraft Gearbox

Transmission Gearbox

Fuel Pump Gearbox - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Rotorcraft

Unmanned Aerial Vehicles (UAVs)

Private Jets - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Replacement Fitment

Maintenance Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Military & Defense

Private Aircraft Owners

Aircraft Leasing Companies

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement through Distributors

Online Procurement Platforms

Government Procurement

Third-party Service Providers

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Innovation, Customer Base, Manufacturing Capabilities, Regulatory Compliance) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

General Electric

Honeywell Aerospace

Safran

Pratt & Whitney

Schaeffler Group

Moog Inc.

Boeing

Liebherr Aerospace

Magellan Aerospace

Eaton Corporation

Collins Aerospace

Zodiac Aerospace

MTU Aero Engines

Avicopter

- Growing demand for aircraft in the military and defense sector

- Increasing importance of aftermarket services in aircraft ownership

- Expanding role of leasing companies in the regional aircraft market

- Private jet demand driving the need for specialized gearboxes

- Forecast Market Value, 2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035