Market Overview

The Singapore Aircraft Gears market is valued at USD ~ billion in 2024, with growth driven by the increasing demand for aircraft modernization, retrofitting, and the rising air travel industry in Asia. The market’s growth is underpinned by the strategic focus on upgrading existing fleets and the continual development of next-generation aircraft. The key drivers include Singapore’s prominence as a global aviation hub, government support, and its growing aircraft maintenance, repair, and overhaul (MRO) sector. Furthermore, rising defense budgets in Southeast Asia and the increasing demand for military aircraft are additional growth drivers.

Singapore, being a major aviation hub in Southeast Asia, dominates the aircraft gears market. The country benefits from a strategic location in the Asia-Pacific region, allowing easy access to global aircraft fleets for maintenance and repair services. The presence of large MRO providers, such as SIA Engineering Company and ST Engineering, positions Singapore as a leading player in the aircraft gear market. Other notable countries contributing to the market’s dominance include Malaysia and Thailand, both of which are strengthening their defense and aviation sectors, further boosting demand for advanced aircraft components.

Market Segmentation

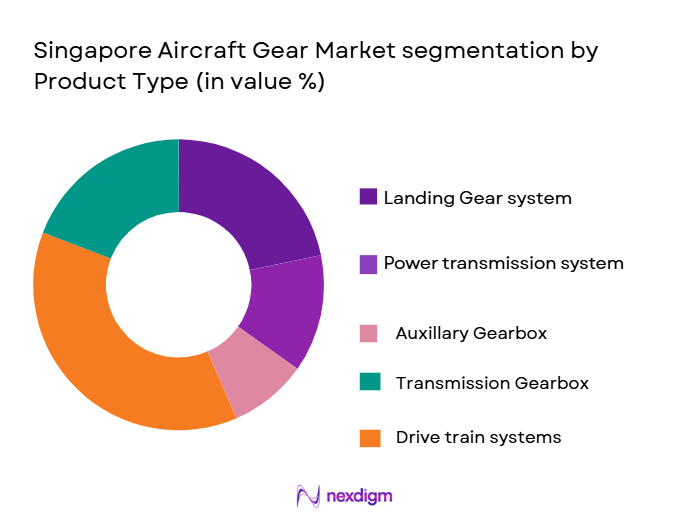

By Product Type

The Singapore Aircraft Gears market is segmented by product type into main gearboxes, auxiliary power units, actuation systems, landing gear systems, and flight control systems. Among these, the landing gear systems segment holds a dominant market share. The reason for its dominance stems from the essential nature of landing gears in the safety and functionality of all aircraft. The constant need for maintenance and replacement of landing gears, especially in aging aircraft fleets, drives the high demand. Moreover, advancements in landing gear technology that offer better weight optimization and efficiency contribute significantly to the market share.

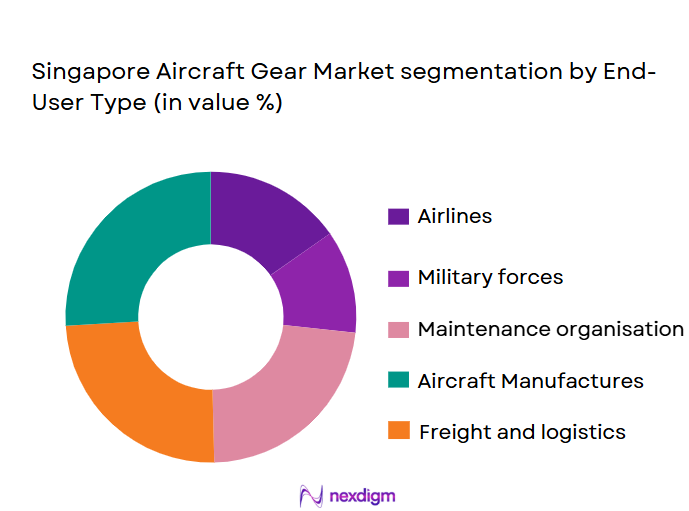

By End User Type

The market is also segmented by platform type into commercial aircraft, military aircraft, general aviation aircraft, cargo aircraft, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds the largest market share due to the high volume of passenger and cargo air traffic in the Asia-Pacific region. The growth of low-cost carriers, coupled with the expansion of international flight routes, increases the demand for aircraft gears in commercial aircraft. Additionally, the recovery of the airline industry post-pandemic has spurred the demand for new and replacement gears in commercial aircraft.

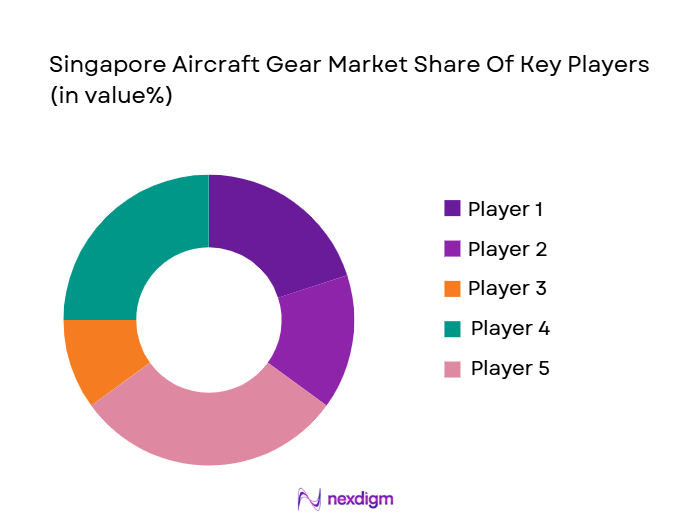

Competitive Landscape

The Singapore Aircraft Gears market is dominated by a few major players, both local and global. Key players include global giants like Rolls-Royce, Safran, and GE Aviation, as well as Singaporean companies such as ST Engineering and SIA Engineering. These companies are recognized for their extensive R&D capabilities, robust supply chains, and strong partnerships with airlines and aircraft manufacturers. This consolidation of major players indicates a highly competitive landscape, where innovation and service capabilities significantly influence market positioning.

| Company | Establishment Year | Headquarters | Product Range | Revenue (USD) | R&D Investments | Key Clients | Global Presence |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | Ohio, USA | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ | ~ |

| SIA Engineering Company | 1982 | Singapore | ~ | ~ | ~ | ~ | ~ |

Singapore aircraft gears Market Analysis

Growth Drivers

Increase in Air Travel Demand

The steady rise in global air travel, particularly in the Asia-Pacific region, significantly contributes to the demand for aircraft gears. With an estimated growth of 6.1% in air passenger traffic annually in the region, the need for new and retrofitted aircraft is driving demand for high-performance gears. Airlines are investing in fleet upgrades, and as air traffic increases, so does the demand for maintenance and replacement of critical components such as aircraft gears. This growing aviation activity continues to fuel the aircraft gears market in Singapore and the surrounding regions.

Technological Advancements in Aircraft Systems

Continuous innovations in aircraft systems, including lightweight materials, fuel efficiency, and improved performance, are key growth drivers. The incorporation of advanced materials in aircraft gears, such as titanium and carbon composites, allows for lighter, more efficient, and durable components. With advancements in manufacturing technologies, such as 3D printing and automation, aircraft gear manufacturers can offer cost-effective, custom-designed solutions, leading to growth in both the OEM and aftermarket segments. The adoption of these cutting-edge technologies is expected to continue fueling market demand over the coming years.

Market Challenges

High Manufacturing and Maintenance Costs

Aircraft gears are complex, high-precision systems, which makes their manufacturing cost-intensive. The costs associated with materials, labor, and stringent certification processes contribute to the high overall cost of aircraft gears. Additionally, the maintenance of these systems, especially for aging fleets, requires specialized knowledge and parts, leading to further costs. With airlines focused on reducing operating expenses, the high price tag of advanced gears and their maintenance is a significant challenge. Airlines may struggle with the financial burden of retrofitting older fleets with modern gear systems, impacting overall market growth.

Regulatory and Certification Barriers

The regulatory environment governing the design, production, and operation of aircraft gears is stringent, with compliance to international standards such as those from the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Certification processes for aircraft components are time-consuming and expensive, causing delays in the introduction of new technologies to the market. Additionally, changing regulatory requirements across different regions further complicate the development and deployment of new aircraft gear systems. Manufacturers face challenges in adhering to these regulations, which can hinder innovation and increase costs.

Opportunities

Expanding MRO Market in Southeast Asia

The growing fleet size and increasing air traffic in Southeast Asia are driving the demand for aircraft maintenance, repair, and overhaul (MRO) services, providing significant opportunities for the aircraft gears market. As airlines and aircraft operators strive to extend the life of their fleets, the need for regular gear maintenance and component replacements grows. With Singapore’s well-established MRO infrastructure and its strategic location, the country is poised to become a regional hub for MRO services. This expansion in the MRO market offers manufacturers a lucrative opportunity to supply gear systems and related services to a broad customer base.

Rise in Unmanned Aerial Vehicles (UAVs)

The adoption of unmanned aerial vehicles (UAVs) for both commercial and defense applications presents a unique opportunity for the aircraft gears market. UAVs, which require specialized gear systems for propulsion and control, are being increasingly integrated into both military and civilian aviation operations. In Singapore, defense initiatives and the growing demand for UAVs in logistics, surveillance, and communication sectors are expected to drive demand for specialized gears tailored to UAV requirements. As UAV technology continues to advance, the need for robust and efficient gears to ensure the operational reliability of these systems will create new growth avenues.

Future Outlook

Over the next decade, the Singapore Aircraft Gears market is poised for substantial growth. Driven by advancements in aircraft design, regulatory changes, and the need for aircraft modernization, the market is expected to expand significantly. Additionally, the rise in demand for military aircraft and UAVs in the region will further fuel growth. The market will benefit from increased investments in MRO services, with Singapore continuing to play a key role as an aviation hub in Asia. This growth is supported by robust infrastructure and government policies that encourage the development of the aviation industry.

Major Players

- Rolls-Royce

- Safran

- GE Aviation

- ST Engineering

- SIA Engineering Company

- Boeing

- Airbus

- Liebherr Aerospace

- Honeywell Aerospace

- Collins Aerospace

- MTU Aero Engines

- Curtiss-Wright

- Heroux-Devtek

- Raytheon Technologies

- United Technologies

Key Target Audience

- Aircraft Manufacturers

- Airlines

- Defense Contractors

- MRO Service Providers

- Aerospace Component Suppliers

- OEMs (Original Equipment Manufacturers)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the scope of the Singapore Aircraft Gears Market. This step includes conducting desk research using a combination of secondary and proprietary databases to gather industry-level data. The goal is to identify critical market variables that influence demand, growth, and competition within the market.

Step 2: Market Analysis and Construction

In this phase, historical data and trends are compiled and analyzed. This includes assessing market penetration, growth drivers, and market segmentation to forecast revenue generation for the market. Statistical analysis ensures the reliability of revenue estimates, while service quality evaluations provide insight into market potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from diverse companies within the aerospace and aviation sectors. These interviews help refine assumptions and provide operational insights directly from practitioners in the field, allowing for a better understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing all gathered data, performing cross-sectional analysis, and refining forecasts. Direct engagement with manufacturers and component suppliers ensures that the final output reflects accurate market predictions and consumer trends for the Singapore Aircraft Gears Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for aircraft upgrades and retrofits in the Asia-Pacific region

Increased military aircraft procurement in Singapore

Advancements in lightweight materials and gear design - Market Challenges

High cost of aircraft gear systems and maintenance

Stringent regulatory and certification requirements for aircraft gears

Complexities in the supply chain for aircraft components - Market Opportunities

Growth in unmanned aerial vehicle (UAV) adoption

Emerging markets for aircraft MRO services in Southeast Asia

Technological innovations in aircraft gear materials and manufacturing processes - Trends

Shift towards digitalization in aircraft component manufacturing

Sustainability initiatives in aircraft gear production

Integration of AI and automation in the design and maintenance of aircraft gears

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Gearboxes

Auxiliary Power Units

Actuation Systems

Landing Gear Systems

Flight Control Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

MRO (Maintenance, Repair, and Overhaul)

Retrofit

Upgrades - By EndUser Segment (In Value%)

Commercial Airlines

Defense Contractors

Aircraft Manufacturers

Maintenance Facilities

OEM Suppliers - By Procurement Channel (In Value%)

Direct Purchases

Distributors

E-commerce

Government Contracts

Third-party Suppliers

- Market Share Analysis

- Cross Comparison Parameters

(Product Innovation, Market Penetration, Production Capacity, Pricing Strategy, Geographic Reach) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

Honeywell International

GE Aviation

Safran

MTU Aero Engines

Boeing

Airbus

Collins Aerospace

Curtiss-Wright

Liebherr Aerospace

United Technologies

Raytheon Technologies

Heroux-Devtek

Harris Corporation

Aero Gear

- Increased demand from commercial airlines for advanced, fuel-efficient aircraft gears

- Expanding defense budgets fueling growth in military aircraft procurement

- Surge in demand for retrofitting older aircraft fleets with modern gear systems

- Emerging MRO hubs in the Asia-Pacific driving end-user demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035