Market Overview

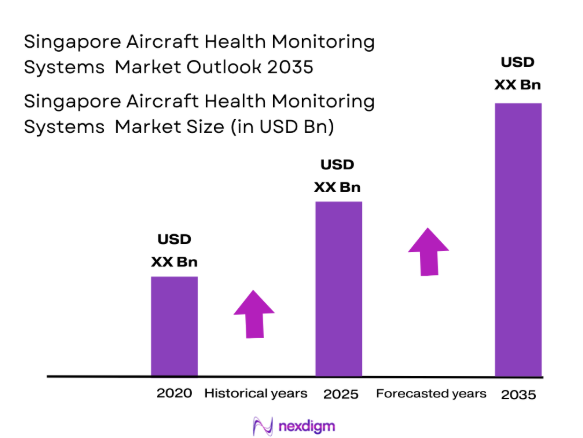

The Singapore Aircraft Health Monitoring Systems (AHMS) market is valued at approximately USD ~ million, based on recent industry reports. The market is driven primarily by the increasing demand for real-time data analytics to enhance the operational efficiency and safety of aircraft. This trend is further bolstered by the adoption of advanced technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) in aviation. Airlines and aerospace manufacturers are investing significantly in AHMS to reduce maintenance costs, avoid unscheduled downtimes, and improve fleet reliability. The growing focus on predictive maintenance solutions and the rise of the aviation industry in Asia-Pacific also contribute significantly to the market’s growth.

Singapore has emerged as a leading hub for the AHMS market due to its strategic location and robust aerospace infrastructure. The city-state is home to key aerospace manufacturers and service providers, making it a focal point for aviation innovation and maintenance solutions. Additionally, Singapore’s strong regulatory framework and government incentives for technology adoption in aviation contribute to the dominance of this market. Other major markets within the region, such as Japan and South Korea, also play a critical role in driving demand, primarily due to their advanced aviation sectors and commitment to operational excellence.

Market Segmentation

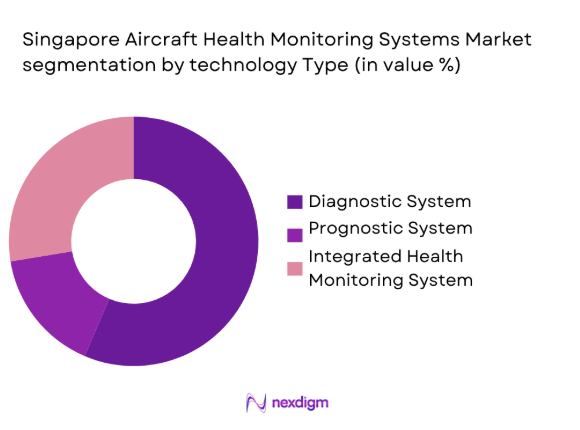

By Technology Type

The Singapore Aircraft Health Monitoring Systems market is segmented by technology type into diagnostic systems, prognostic systems, and integrated health monitoring systems. Among these, integrated health monitoring systems dominate the market due to their ability to provide real-time health status updates for various components within an aircraft. This integration reduces the complexity and cost of maintenance, enabling operators to predict failures before they occur, enhancing overall fleet reliability. Integrated systems are increasingly being favored by airlines and aircraft manufacturers for their holistic approach to maintaining the health of aircraft systems, further driving their market share.

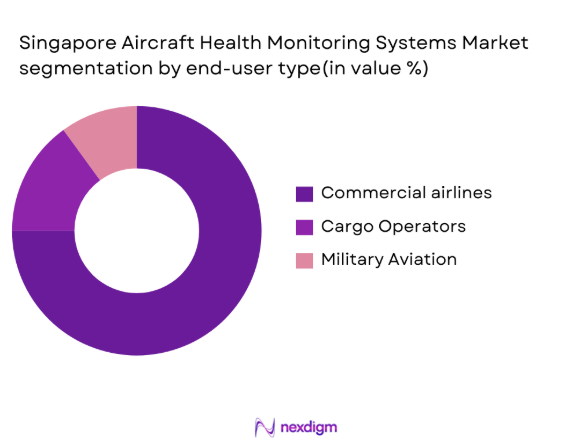

By End-User

The market is also segmented by end-user into commercial airlines, cargo operators, and military aviation. Among these, commercial airlines dominate the market share, owing to their large fleets and the increasing pressure to optimize operational costs and improve safety standards. Commercial airlines invest heavily in AHMS solutions to ensure the continued airworthiness of their aircraft and reduce unplanned maintenance, which can significantly affect profitability. The high operational costs associated with maintaining large fleets of aircraft further justify the investment in advanced health monitoring systems to maintain high operational uptime.

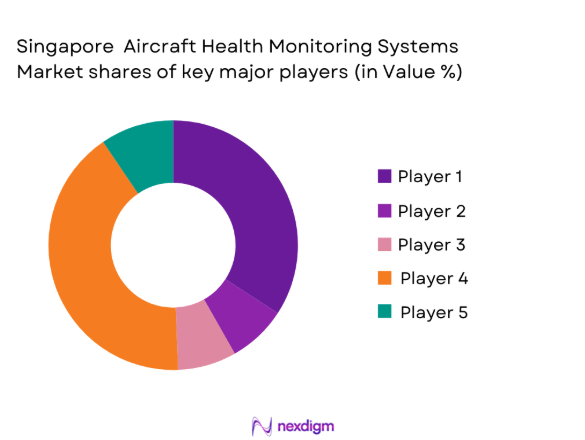

Competitive Landscape

The Singapore Aircraft Health Monitoring Systems market is competitive, with a blend of global players and regional specialists. Some of the leading players in the market include Honeywell International, Collins Aerospace, and Rolls-Royce, among others. These companies dominate the market due to their advanced technological capabilities, strong brand presence, and long-standing relationships with major airlines and aerospace manufacturers.

| Company | Establishment Year | Headquarters | Technology Expertise | Market Focus | Product Range | Key Partnerships |

| Honeywell International | 1906 | USA | – | – | – | – |

| Collins Aerospace | 2018 | USA | – | – | – | – |

| Rolls-Royce | 1906 | UK | – | – | – | – |

| GE Aviation | 1917 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

Singapore Aircraft Health Monitoring Systems Market Dynamics

Growth Drivers

Increased Demand for Real-Time Data in Aircraft Health Monitoring

The global demand for real-time data analytics in the aviation sector is accelerating, particularly within the Asia-Pacific region. This demand is driven by the need for enhanced operational efficiency, reduced downtime, and increased safety. According to the Civil Aviation Authority of Singapore (CAAS), the aviation industry in Singapore has seen consistent growth, with passenger numbers reaching 21.9 million in 2023. This increase in air traffic has significantly raised the demand for efficient fleet management solutions, especially for monitoring aircraft health in real time. Additionally, Singapore’s push towards digitalization in aviation is further promoting the adoption of health monitoring systems to maintain fleet performance and safety.

Rise in Adoption of Predictive Maintenance Technologies

The shift towards predictive maintenance technologies is an essential growth driver in the Aircraft Health Monitoring Systems market. As of 2022, the International Air Transport Association (IATA) reported that airlines are increasingly investing in predictive maintenance to reduce unexpected aircraft failures, which is vital for ensuring operational safety and efficiency. Airlines operating in Singapore, such as Singapore Airlines, have increasingly adopted AI-driven solutions for predictive maintenance, with the aim of reducing maintenance-related delays and operational disruptions. This shift aligns with Singapore’s broader strategy to incorporate advanced technologies into its aviation sector, supporting both economic growth and operational excellence.

Market Challenges

High Installation and Integration Costs of Health Monitoring Systems

While there is a growing interest in Aircraft Health Monitoring Systems, the high upfront costs associated with installation and integration remain a significant challenge. As of 2022, the cost of integrating advanced monitoring systems into existing fleets is estimated at approximately USD 100,000 per aircraft. The Singapore Ministry of Transport has highlighted that while the benefits of these systems in terms of cost savings and operational efficiency are clear, the initial investment can be prohibitive for smaller or budget airlines. The challenge is even more significant for aircraft fleets that were not originally equipped with such systems, as retrofitting older models is expensive and complex.

Complexity in Managing Large Amounts of Real-Time Data

The ability to process and manage the vast amounts of real-time data generated by Aircraft Health Monitoring Systems remains a significant hurdle. The International Civil Aviation Organization (ICAO) reported that airlines globally handle over 100 terabytes of data per day related to flight operations, with Singapore’s aviation sector contributing a significant portion of this. However, the challenge lies in integrating this data effectively into actionable insights. In particular, managing this data flow while maintaining compliance with safety standards and privacy regulations has proven difficult. This complexity limits the ability to fully leverage the potential of health monitoring systems, despite their technological advancements.

Market Opportunities

Growth in the Number of Commercial and Military Aircraft Fleets

Singapore is witnessing a steady increase in both commercial and military aircraft fleets, providing a significant growth opportunity for Aircraft Health Monitoring Systems. The Singapore Air Force, as of 2023, operates over 60 aircraft, while Singapore Airlines and its subsidiaries manage a fleet of over 130 aircraft. According to the Ministry of Defence of Singapore, the government is investing heavily in modernizing the military fleet with advanced technologies, including predictive maintenance solutions. This growing fleet of both commercial and military aircraft is a critical market opportunity for health monitoring systems providers, as these systems are essential for ensuring fleet readiness, minimizing unscheduled maintenance, and improving the longevity of aircraft.

Technological Advancements in AI for Predictive Maintenance

Singapore’s push toward becoming a global aviation innovation hub is driving advancements in artificial intelligence (AI), which is significantly enhancing predictive maintenance technologies. Singapore’s aviation sector is expected to be a key beneficiary of the government’s investment in AI research and development, as seen in initiatives such as the AI Singapore program. The application of AI in health monitoring systems helps detect anomalies early, significantly reducing the risk of unexpected failures. This opportunity is underscored by the government’s ongoing support of digital transformation in aviation, making AI-powered predictive maintenance a primary focus. This technological progression is opening doors for advanced health monitoring systems that offer greater predictive capabilities and operational efficiencies.

Future Outlook

Over the next decade, the Singapore Aircraft Health Monitoring Systems market is poised for substantial growth driven by the increasing focus on predictive maintenance, advances in sensor technology, and the global push for operational cost reduction within the aviation sector. Continued innovations in AI, IoT, and big data analytics will likely lead to more integrated solutions that offer real-time monitoring and proactive maintenance recommendations. The ongoing growth of the aviation sector in Asia-Pacific, coupled with regulatory pushes for enhanced safety standards, will further fuel demand for these technologies.

Major Players in the Market

- Honeywell International

- Collins Aerospace

- Rolls-Royce

- GE Aviation

- Safran

- Airbus

- Boeing

- Thales Group

- UTC Aerospace Systems

- SITAONAIR

- Rockwell Collins

- Meggitt PLC

- MTU Aero Engines AG

- Lufthansa Technik

- Lockheed Martin

Key Target Audience

- Airlines and Aviation Operators

- Aerospace Manufacturers

- Aircraft Maintenance Providers

- Government and Regulatory Bodies

- Aviation Technology Investors

- OEMs

- Aircraft Fleet Management Companies

- Aviation Research and Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Aircraft Health Monitoring Systems market. This step includes gathering comprehensive industry-level information through secondary research and proprietary databases to identify key players, technologies, and market trends.

Step 2: Market Analysis and Construction

In this phase, historical data for the Singapore Aircraft Health Monitoring Systems market is analyzed. The focus will be on assessing market penetration, technology adoption rates, and the types of end-users adopting these systems. Data from various public and private sources will be used to create a comprehensive market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts and stakeholders. This includes conducting interviews with airlines, aircraft manufacturers, and service providers to gain insights into trends, pain points, and technological advancements in aircraft health monitoring.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings from expert interviews and secondary data. Detailed insights will be used to refine the market forecasts, ensuring a comprehensive understanding of the market dynamics. This phase also includes validating the data through follow-up consultations with key market players to ensure accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for real-time data in aircraft health monitoring

Rise in adoption of predictive maintenance technologies

Government and defense sector investments in military aircraft - Market Challenges

High installation and integration costs of health monitoring systems

Complexity in managing large amounts of real-time data

Regulatory challenges in meeting international aviation standards - Market Opportunities

Growth in the number of commercial and military aircraft fleets

Technological advancements in AI for predictive maintenance

Emerging demand for sustainability-driven aviation technologies - Trends

Growing adoption of IoT-based aircraft health monitoring systems

Increase in collaborative platforms for predictive maintenance

Integration of AI and machine learning for real-time diagnostics

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Health Monitoring Systems

Structural Health Monitoring Systems

Flight Control Health Monitoring Systems

Electrical System Health Monitoring Systems

Integrated Health Monitoring Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Regional Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Integrated System Fitment

Stand-Alone System Fitment - By End User Segment (In Value%)

Airlines

Military and Defense

Aircraft OEMs

MRO Providers

Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement from OEMs

Third-Party Suppliers

Distributors and Resellers

Online Platforms

Government and Military Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Integration, Technological Innovation, Cost Efficiency, Market Presence, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Rolls-Royce

Honeywell International

General Electric (GE)

Safran

Thales Group

Rockwell Collins

Pratt & Whitney

Airbus

Lufthansa Technik

MTU Aero Engines

Collins Aerospace

Mitsubishi Heavy Industries

Safran Aircraft Engines

Delta TechOps

IATA

- Increasing investments in aircraft fleet modernization

- Military adoption of advanced health monitoring technologies

- Rising demand for MRO services driven by fleet expansions

- Growing partnerships between OEMs and airlines for integrated health monitoring

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035