Market Overview

The Singapore Aircraft Heat Exchanger market is valued at approximately USD ~ million in 2025, driven by a strong demand for high-performance aircraft components from both commercial and military sectors. The growth is fueled by Singapore’s strategic location as an aviation hub, with its flagship airline, Singapore Airlines, continuing to expand its fleet. Additionally, the government’s emphasis on technological innovation and sustainability in aviation drives the adoption of advanced heat exchanger systems, crucial for energy efficiency and operational reliability in aircraft. The market is expected to grow steadily as Singapore Airlines and other regional players modernize their fleets.

Singapore dominates the aircraft heat exchanger market in Southeast Asia due to its well-established position in the global aviation industry. As a hub for aviation and aerospace services, the city-state’s extensive aviation infrastructure supports the growth of commercial airlines and military aircraft fleets. Furthermore, the Singapore Airshow, one of the largest aerospace exhibitions in Asia, showcases the importance of the nation’s aerospace sector. Neighboring countries such as Malaysia and Thailand also contribute to the region’s demand, but Singapore leads due to its significant investment in both military and commercial aviation technology.

Market Segmentation

By System Type

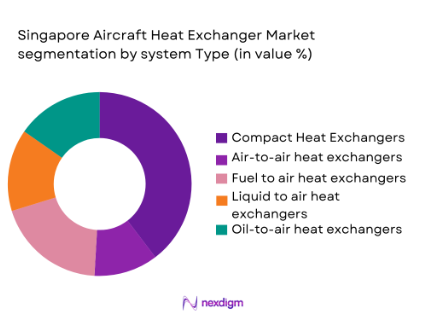

The Singapore Aircraft Heat Exchanger market is segmented by system type into compact heat exchangers, air-to-air heat exchangers, fuel-to-air heat exchangers, liquid-to-air heat exchangers, and oil-to-air heat exchangers. Compact heat exchangers hold a dominant position in the market due to their lightweight and high-efficiency features, which are critical for modern aircraft. With airlines and manufacturers increasingly focusing on fuel efficiency, compact heat exchangers are favored for their ability to reduce weight and optimize thermal management, which is essential for long-haul flights. Additionally, compact designs allow for better integration into the overall aircraft structure, further driving their demand.

By Platform Type

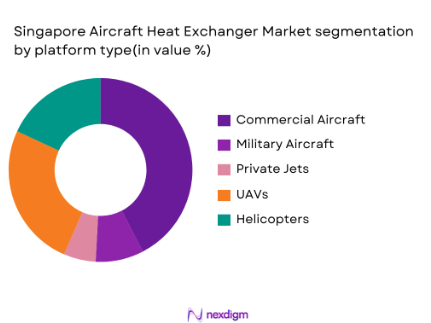

The market is also segmented by platform type into commercial aircraft, military aircraft, private jets, unmanned aerial vehicles (UAVs), and helicopters. The commercial aircraft segment dominates the market due to the significant expansion of airlines like Singapore Airlines and the growing number of international and regional air travel routes. Commercial aircraft fleets require advanced heat exchangers for efficient operation over long distances, where fuel savings and operational reliability are paramount. The increasing demand for fuel-efficient aircraft further propels the adoption of high-performance heat exchangers in this segment.

Competitive Landscape

The Singapore Aircraft Heat Exchanger market is competitive, with a blend of local and global players. The market is dominated by a few key players, including Honeywell, Collins Aerospace, and Safran, who have a strong presence due to their technological expertise and long-standing relationships with major aircraft manufacturers and airlines. These companies are focusing on innovations in heat exchanger materials and designs to meet the growing demand for energy-efficient and lightweight systems that enhance the performance of modern aircraft.

| Company | Establishment Year | Headquarters | Technology Expertise | Product Range | Key Partnerships | Market Focus |

| Honeywell | 1906 | USA | – | – | – | – |

| Collins Aerospace | 2018 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| Airbus | 1970 | France | – | – | – | – |

| Boeing | 1916 | USA | – | – | – | – |

Singapore Aircraft Heat Exchanger Market Dynamics

Growth Drivers

Rising Air Traffic in the Asia-Pacific Region Driving Demand for Aircraft Components

The Asia-Pacific region has seen consistent growth in air traffic, with passenger traffic in the region reaching 210 million in 2025, according to the International Air Transport Association (IATA). Singapore, as a major aviation hub in the region, plays a significant role in this growth, primarily driven by Singapore Airlines and its expanding fleet. This increase in air travel directly influences the demand for aircraft components such as heat exchangers, which are crucial for maintaining operational efficiency, cooling systems, and fuel efficiency. The rising demand for air travel is expected to continue, reinforcing the need for advanced aircraft systems.

Increased Demand for Fuel-Efficient Aircraft Leading to Adoption of Advanced Heat Exchanger Systems

The demand for fuel-efficient aircraft is being driven by both environmental regulations and economic considerations. According to the International Civil Aviation Organization (ICAO), the aviation sector is responsible for nearly 2-3% of global CO2 emissions. In response, airlines, including Singapore Airlines, are increasingly adopting advanced technologies, such as heat exchangers, to reduce fuel consumption and optimize performance. These systems play a vital role in maintaining the efficiency of modern aircraft, where minimizing energy loss and improving thermal management is critical to meeting sustainability goals. This trend is expected to drive further adoption of advanced heat exchangers across the industry.

Market Challenges

High Cost of Advanced Heat Exchanger Systems and Materials

The cost of advanced heat exchangers remains a significant challenge in the aviation sector, driven by the high prices of specialized materials such as titanium, aluminum, and high-strength alloys. In 2022, the price of titanium was approximately USD 5,000 per ton, which is substantially higher than other metals used in aircraft manufacturing. These materials are essential for manufacturing heat exchangers that can withstand extreme operational conditions, but their cost increases the overall price of the systems. The high cost of these systems is a barrier, especially for smaller airlines or retrofit projects.

Challenges in Integrating New Heat Exchanger Technologies into Existing Aircraft Designs

Integrating advanced heat exchanger technologies into existing aircraft fleets is a complex process that presents challenges in terms of compatibility and system integration. As new heat exchanger designs are optimized for efficiency, they require modifications to aircraft systems that may not be compatible with older models. According to the Singapore Ministry of Transport, retrofitting existing aircraft fleets with modern systems can result in significant downtime and high modification costs. This presents a challenge for airlines seeking to modernize their fleets without facing prohibitive costs or operational disruptions.

Market Opportunities

Growing Demand for Environmentally Sustainable Aircraft Technologies in Singapore

The Singapore government has committed to reducing its carbon emissions by 25% by 2030 as part of its climate action plan, which directly influences the aviation sector. Singapore Airlines, for example, has set a target to reduce its carbon intensity by 50% by 2050, which aligns with global aviation sustainability trends. As part of these efforts, there is increasing demand for environmentally sustainable technologies in aircraft, including advanced heat exchangers that improve fuel efficiency and reduce the environmental footprint. This shift toward sustainability is creating significant opportunities for the market to develop and adopt greener, more efficient technologies.

Increase in the Number of Aircraft Fleets in the Asia-Pacific Region Expanding the Market for Heat Exchangers

The Asia-Pacific region is expected to see continued growth in its aircraft fleets, particularly in countries like Singapore, China, and India. In 2023, the region had approximately 9,000 commercial aircraft in operation, and this number is expected to grow as airlines expand their fleets to meet the rising demand for air travel. This increase in fleet size is driving the demand for aircraft components such as heat exchangers, as airlines look to incorporate the latest technologies into their new aircraft. With Singapore serving as a regional hub, the country is well-positioned to benefit from this regional growth.

Future Outlook

The Singapore Aircraft Heat Exchanger market is expected to show steady growth over the next decade, driven by the ongoing expansion of Singapore’s aviation sector. With increasing emphasis on fuel efficiency and sustainability, airlines and aircraft manufacturers will continue to prioritize advanced heat exchanger systems that reduce weight and improve operational performance. Additionally, technological advancements in materials and integration of digital monitoring systems in heat exchangers will support the growth of this market, especially as new aircraft models are introduced. The government’s support for aviation innovation is also expected to foster continued development in this sector.

Major Players

- Honeywell

- Collins Aerospace

- Safran

- Airbus

- Boeing

- Raytheon Technologies

- United Technologies Corporation (UTC)

- Parker Hannifin

- Meggitt PLC

- Eaton Corporation

- Thales Group

- Ametek Inc.

- Rolls-Royce

- GE Aviation

- Liebherr Aerospace

Key Target Audience

- Airlines and Aviation Operators

- Aerospace Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Private Aircraft Owners

- Government and Regulatory Bodies

- Aircraft Component Suppliers

- Military and Defense Contractors

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify and define the key stakeholders within the Singapore Aircraft Heat Exchanger market. This includes mapping out the major players, technologies, and market trends. Desk research and industry databases are used to gather relevant data on the components, market dynamics, and growth drivers that affect the market.

Step 2: Market Analysis and Construction

In this phase, we collect historical data regarding the growth patterns and trends within the Singapore Aircraft Heat Exchanger market. This involves studying market penetration, adoption rates of heat exchanger technologies, and analyzing past performance data for major industry players.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through consultations with industry experts, such as engineers and aerospace manufacturers. These interviews provide insights into the latest trends, challenges, and technological innovations impacting the aircraft heat exchanger market, helping refine and validate the data.

Step 4: Research Synthesis and Final Output

The final phase combines all data sources, including secondary research and expert interviews, to develop a comprehensive outlook for the market. The report integrates key trends, forecasts, and strategic insights, providing a validated analysis of the Singapore Aircraft Heat Exchanger market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air traffic in the Asia-Pacific region driving demand for aircraft components

Increased demand for fuel-efficient aircraft leading to adoption of advanced heat exchanger systems

Technological advancements in heat exchanger materials and designs enhancing performance - Market Challenges

High cost of advanced heat exchanger systems and materials

Challenges in integrating new heat exchanger technologies into existing aircraft designs

Regulatory and certification hurdles for new heat exchanger systems - Market Opportunities

Growing demand for environmentally sustainable aircraft technologies in Singapore

Increase in the number of aircraft fleets in the Asia-Pacific region expanding the market for heat

exchangers

Opportunities in retrofitting older aircraft with advanced heat exchangers - Trends

Shift towards lightweight and compact heat exchanger designs to improve fuel efficiency

Integration of digital sensors and IoT in heat exchangers for real-time performance tracking

Increasing demand for high-performance heat exchangers in defense and military aircraft

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Compact Heat Exchanger

Air-to-Air Heat Exchanger

Fuel-to-Air Heat Exchanger

Liquid-to-Air Heat Exchanger

Oil-to-Air Heat Exchanger - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Aftermarket Fitment

Maintenance Fitment - By End User Segment (In Value%)

Airlines

Aircraft Manufacturers

Military and Defense Contractors

MRO Providers

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

OEM Procurement

Online Sales

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Technological Integration, Regulatory Compliance, Pricing Strategy, After-Sales Service)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

GE Aviation

Honeywell International

Collins Aerospace

Safran

Airbus

Boeing

Raytheon Technologies

Diehl Aerospace

United Technologies Corporation (UTC)

Parker Hannifin

Airbus Defence and Space

Eaton Corporation

Lufthansa Technik

Meggitt PLC

Ametek Inc.

- Growing number of commercial airlines in Singapore boosting demand for heat exchangers

- Military demand for advanced heat exchangers in defense aircraft

- Rapid growth in private aviation in Singapore creating demand for efficient aircraft systems

- Maintenance, repair, and overhaul (MRO) services expanding due to aging aircraft fleets

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035