Market Overview

The Singapore Aircraft Hydraulic Systems market is valued at USD ~ billion, driven by increasing air travel, airline fleet expansion, and growing defense spending in the region. The aviation sector in Singapore is expanding rapidly, with the number of commercial aircraft and military aviation activity rising significantly. Key drivers for this market include the demand for advanced hydraulic systems capable of improving aircraft performance and ensuring safety in demanding environments. Rising air traffic within Southeast Asia, coupled with technological advancements, further accelerates the growth of the hydraulic systems market.

Singapore stands as a dominant force in the aircraft hydraulic systems market due to its strategic geographical location as a global aviation hub. The country’s robust aviation industry is reinforced by its major international airport, Changi, and its position as a key player in the aviation sector. Additionally, countries like Malaysia and Thailand are growing in prominence as aviation hubs, spurred by expanding air routes, increasing airline fleets, and government support for aviation infrastructure development. Singapore’s regulatory framework and investments in military aviation further contribute to its market dominance.

Market Segmentation

By Product Type

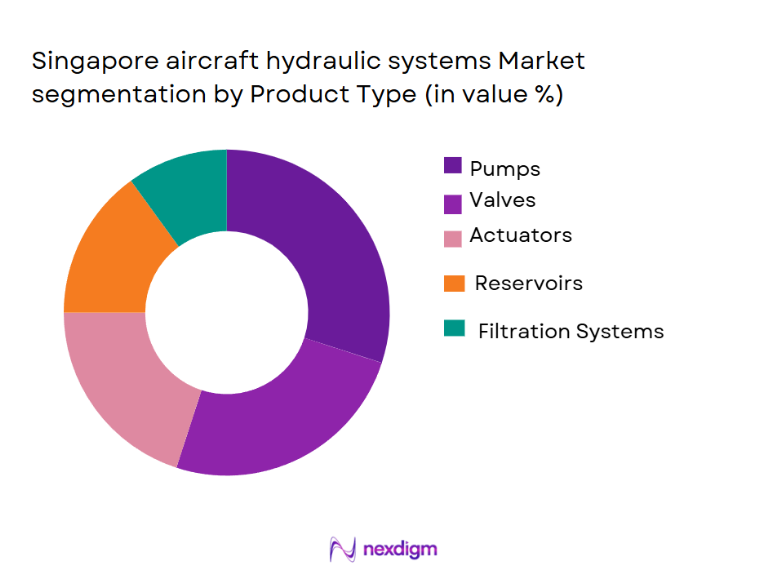

The Singapore Aircraft Hydraulic Systems market is segmented by product type into pumps, valves, actuators, reservoirs, and filtration systems. Among these, pumps hold the dominant market share. Pumps are essential in aircraft hydraulic systems as they generate the required power to operate systems such as landing gear, flight control, and braking systems. With the increasing demand for fuel-efficient aircraft, the necessity for high-performance pumps, which ensure smooth and efficient operation, becomes more critical. The dominance of this subsegment is driven by innovations in pump technologies, focusing on reducing weight and enhancing efficiency in aircraft systems.

By Platform Type

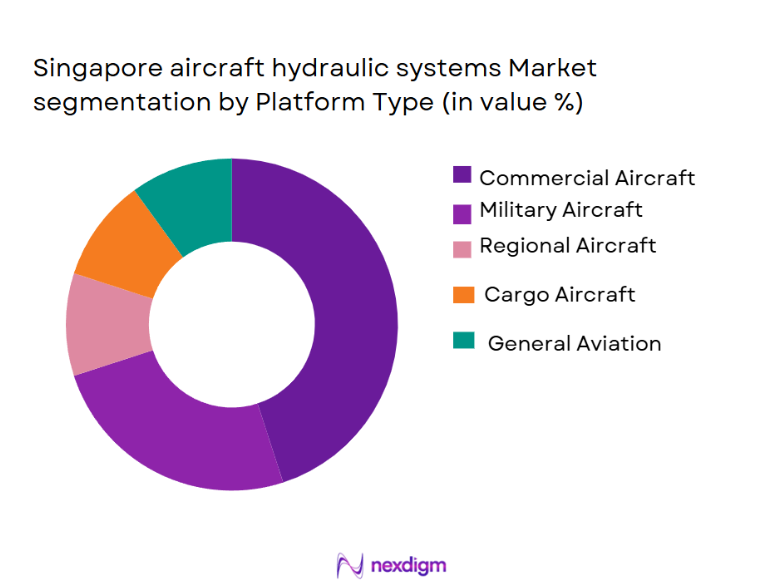

The market is also segmented by platform type, which includes commercial aircraft, military aircraft, regional aircraft, cargo aircraft, and general aviation aircraft. The commercial aircraft segment holds the largest market share due to the high volume of air travel within the Asia-Pacific region, which heavily influences the demand for hydraulic systems. With Singapore being a major hub for international airlines, the commercial aircraft sector remains the largest consumer of hydraulic systems. The increasing number of passenger aircraft and demand for more efficient systems further fuels this subsegment’s dominance.

Competitive Landscape

The Singapore Aircraft Hydraulic Systems market is characterized by a strong presence of both global and local players. This consolidation is seen through key companies such as Parker Hannifin Corporation, Honeywell Aerospace, and Moog Inc., who maintain a dominant presence in the region. Their comprehensive portfolios, technological expertise, and strong distribution networks position them as key influencers in the market. Moreover, local players in Singapore benefit from proximity to the major aviation and military sectors, giving them a competitive edge.

| Company | Establishment Year | Headquarters | Revenue (USD bn) | Product Portfolio | Technological Advancements | Regional Market Share (%) |

| Parker Hannifin | 1917 | Cleveland, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Safran S.A. | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | Derby, UK | ~ | ~ | ~ | ~ |

Singapore Aircraft Hydraulic Systems Market Analysis

Growth Drivers

Increasing Air Traffic and Aircraft Production

The growth of air passenger traffic and the continuous expansion of airline fleets globally drive the demand for high-performance hydraulic systems in aircraft, as these systems are crucial for essential functions like flight control, landing gear, and braking systems.

Technological Advancements in Hydraulic Systems

Ongoing innovations in hydraulic technologies, such as lightweight materials and energy-efficient solutions, are enhancing the overall performance of aircraft, leading to increased adoption of modern hydraulic systems by aircraft manufacturers and maintenance organizations.

Market Challenges

High Maintenance Costs

Aircraft hydraulic systems require regular and expensive maintenance, which poses a financial challenge for airlines and aircraft operators, potentially affecting the overall profitability of fleet operations.

Complexity in Integration and Regulatory Compliance

The complexity involved in integrating hydraulic systems with aircraft components, coupled with stringent regulatory certifications and safety standards, presents a challenge for manufacturers and suppliers, leading to higher production costs and longer lead times.

Opportunities

Growing Demand for Fuel-Efficient Aircraft

As the aviation industry places more emphasis on reducing carbon emissions and improving fuel efficiency, the demand for lightweight and energy-efficient hydraulic systems is expected to increase, providing a growth opportunity for innovative hydraulic technology developers.

Modernization and Retrofit of Military and Commercial Aircraft

The increasing need to upgrade and retrofit existing aircraft fleets, both in the commercial and military sectors, opens a significant opportunity for suppliers of hydraulic systems, as older models require the integration of new hydraulic technologies to meet modern performance and safety standards.

Future Outlook

The Singapore Aircraft Hydraulic Systems market is expected to experience steady growth over the next five years, driven by technological advancements, rising air traffic, and increased demand for military and defense aircraft. The demand for more fuel-efficient and lighter hydraulic systems is anticipated to continue growing, along with increasing government investment in the defense sector. Furthermore, as the aviation industry recovers from recent global disruptions, the market is poised for a resurgence, particularly in the commercial and military segments.

Major Players

- Parker Hannifin Corporation

- Moog Inc.

- Honeywell Aerospace

- Safran S.A.

- Rolls-Royce

- Eaton Corporation

- UTC Aerospace Systems

- Meggitt PLC

- Woodward Inc.

- B/E Aerospace

- The Boeing Company

- Airbus S.A.S.

- Rockwell Collins

- Hamilton Sundstrand

- Leonardo S.p.A.

Key Target Audience

- Airlines and Fleet Operators

- Aircraft Manufacturers

- Defense Contractors

- Aerospace and Aviation Maintenance, Repair & Overhaul Companies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military and Defense Agencies

- Aircraft System Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of major stakeholders in the Singapore Aircraft Hydraulic Systems market. This is based on extensive desk research and secondary data collection, focusing on identifying the critical variables driving market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data concerning the market size, revenue, and sector growth trends will be analyzed. Market penetration and the relationship between component manufacturers and end-users will be examined to ensure accurate and reliable data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through expert interviews, particularly with industry professionals from key aviation, defense, and MRO companies. This will provide deeper insights into trends, challenges, and emerging opportunities in the hydraulic systems market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data into a comprehensive market analysis, ensuring that product performance, consumer preferences, and industry trends are adequately incorporated for a robust and well-validated final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air passenger traffic and aircraft production

Technological advancements in hydraulic systems

Rise in defense spending and military aircraft production - Market Challenges

High maintenance costs of hydraulic systems

Stringent regulatory requirements and certifications

Technological complexity and integration challenges - Market Opportunities

Growing demand for fuel-efficient and lightweight hydraulic systems

Expansion of the aviation sector in emerging markets

Increase in aircraft fleet renewal and retrofit programs - Trends

Integration of digital and smart hydraulic systems

Move towards sustainable and eco-friendly materials

Emergence of advanced hydraulic technologies in commercial aviation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Pumps

Valves

Actuators

Reservoirs

Filtration Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Regional Aircraft

Cargo Aircraft

General Aviation Aircraft - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket - By EndUser Segment (In Value%)

Aircraft Manufacturers

Airlines

MRO Service Providers

Defense Contractors

Fleet Operators - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Platforms

Government Contracts

Service Providers

- Market Share Analysis

- CrossComparison Parameters (Revenue, Market Share, Product Portfolio, Technological Advancements, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Hydraulic Systems Ltd.

Sikorsky Aircraft Corporation

Parker Hannifin Corporation

Safran S.A.

Honeywell Aerospace

Moog Inc.

United Technologies Corporation

GE Aviation

Boeing

Rolls-Royce

Rockwell Collins

Daimler AG

Airbus S.A.S.

Eaton Corporation

Curtiss-Wright Corporation

- Increased adoption of aircraft hydraulic systems in emerging aviation markets

- Growing focus on cost-effective solutions by airlines

- Demand for high-performance hydraulic systems from military end-users

- Increased need for reliable and durable hydraulic systems in MRO operations

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035