Market Overview

he Singapore Aircraft Interface Devices market is valued at USD ~ billion, based on a comprehensive analysis of historical trends .The Singapore Aircraft Interface Devices Aid market is driven by the growing need for advanced aviation systems that enable better communication, data transfer, and management between aircraft systems and ground operations. The market size in 2024 is significant due to the ongoing developments in both the commercial and military aviation sectors, particularly in Southeast Asia. A key driver of this market is the surge in air traffic, spurring the demand for more sophisticated aircraft interface systems to ensure operational safety and efficiency.

Singapore remains a dominant player in the Aircraft Interface Devices Aid market, primarily due to its strategic location as a major aviation hub and a key player in the Asia-Pacific region. Other contributing countries include Japan and South Korea, which have heavily invested in their aviation infrastructure and technology. These nations maintain a high demand for advanced aviation systems due to their strong commercial airline fleets and military aviation needs, making them critical to market growth in this sector.

Market Segmentation

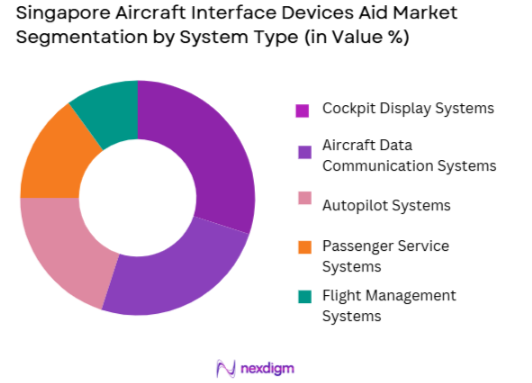

By System Type

The Singapore Aircraft Interface Devices Aid market is segmented by system type, which includes cockpit display systems, flight management systems, autopilot systems, passenger service systems, and aircraft data communication systems. Among these, cockpit display systems dominate the market share in 2024. The reason for this is the continuous advancements in cockpit technology, as they enhance pilot decision-making processes, improve communication between the aircraft and air traffic control, and ensure better in-flight safety.

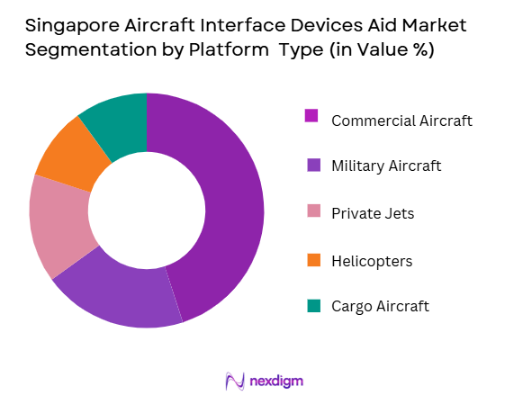

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, private jets, helicopters, and cargo aircraft. In 2024, commercial aircraft hold the largest market share in the Singapore Aircraft Interface Devices Aid market. This is due to the increasing demand for long-haul flights in Asia-Pacific, with airlines seeking to implement advanced systems to improve passenger experience, safety, and operational efficiency.

Competitive Landscape

The Singapore Aircraft Interface Devices Aid market is dominated by several leading players that provide a range of solutions tailored to aviation needs. These key players include global technology giants, as well as regional innovators who specialize in systems specific to Southeast Asia’s aviation requirements.The market is primarily dominated by players such as Honeywell International, Thales Group, and Collins Aerospace. These companies continue to lead due to their extensive technological expertise, established market presence, and continuous product innovation in the aircraft interface devices domain.

| Company | Establishment Year | Headquarters | Product Range | Market Penetration | Technological Innovation | Customer Support | Regulatory Compliance | Product Customization | Industry Partnerships | Workforce Size |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Interface Devices Aid Market Analysis

Growth Drivers

Urbanization

Urbanization plays a significant role in driving the demand for advanced aircraft interface devices. The rapid urban growth in Asia-Pacific, especially in Singapore, leads to an increase in air traffic. The United Nations reports that by 2026, nearly ~% of the global population will be living in urban areas, which directly correlates with increased flight demand and the need for advanced avionics and interface systems. This urban shift is fueling the aviation industry’s need to upgrade their systems, ensuring safety, efficiency, and better communication between aircraft and ground systems. Urbanization also encourages infrastructure growth, further driving demand for sophisticated aviation technologies.

Industrialization

The rise in industrialization, especially within the aviation sector, has led to an increased demand for complex aircraft interface devices. In Singapore, which serves as a manufacturing and logistics hub, the growth in industries like aerospace manufacturing directly influences the aviation market. According to the Singapore Economic Development Board (EDB), the aerospace industry in Singapore contributes around SGD ~billion to the economy, demonstrating a growth trajectory fueled by industrialization. This industrial expansion supports the integration of advanced systems, such as aircraft interface devices, that are vital to maintaining safety and operational efficiency.

Restraints

High Initial Costs

The high initial cost of implementing advanced aircraft interface devices is a significant restraint in the market. Aircraft manufacturers and airline operators face substantial upfront costs when adopting cutting-edge avionics systems. According to the International Air Transport Association (IATA), the average cost of equipping an aircraft with advanced avionics systems can exceed USD ~ million. This financial burden can delay upgrades, especially for smaller operators and regional carriers. Despite the long-term benefits, the initial capital investment required for these systems remains a barrier for many stakeholders in the aviation industry.

Technical Challenges

Technical challenges in system integration and compatibility with older aircraft models remain significant hurdles for the widespread adoption of advanced aircraft interface devices. The integration of new interface systems with legacy avionics often requires costly and time-consuming modifications. The European Union Aviation Safety Agency (EASA) reports that around ~% of legacy aircraft in Europe have faced delays in upgrades due to technical integration challenges. This makes it difficult for airlines to maintain operational efficiency and meet safety standards, limiting the market for modernized aircraft interface systems.

Opportunities

Technological Advancements

Technological advancements in artificial intelligence (AI), machine learning (ML), and connectivity provide significant opportunities for growth in the Singapore Aircraft Interface Devices Aid market. In 2024, Singapore’s investment in 5G infrastructure supports advancements in real-time data processing and communication systems for aircraft. As more aircraft integrate these technologies, they will require upgraded interface devices to support the complex data exchange. The development of next-gen technologies like AI-powered predictive maintenance and autonomous flight systems will create new opportunities for integrating cutting-edge interface solutions into the market.

International Collaborations

International collaborations between governments and aerospace companies present significant opportunities for the Singapore Aircraft Interface Devices Aid market. As countries like the United States, Japan, and members of the European Union continue to push for improved aviation safety standards, partnerships between these nations and Singapore will drive demand for advanced aircraft systems. The collaboration between Singapore Airlines and global aviation giants such as Boeing and Airbus is a prime example, resulting in the introduction of advanced aircraft interface systems tailored for international air travel and operational safety.

Future Outlook

Over the next decade, the Singapore Aircraft Interface Devices Aid market is expected to experience substantial growth driven by several factors. These include advancements in avionics systems, growing demand for improved safety features, and the rising number of air travel passengers, particularly in the Asia-Pacific region. Additionally, the expansion of military aviation capabilities and the introduction of innovative technologies such as AI and automation will further fuel market growth.

Major Players

- Honeywell International

- Thales Group

- Collins Aerospace

- Garmin Ltd.

- L3 Technologies

- Rockwell Collins

- Safran Electronics & Defense

- Panasonic Avionics Corporation

- Astronautics Corporation of America

- Moog Inc.

- Cobham PLC

- GE Aviation

- SITAONAIR

- Rheinmetall AG

- Esterline Technologies

Key Target Audience

- Government and regulatory bodies

- Airlines and aviation operators

- Military and defense agencies

- Aerospace manufacturers

- Aerospace research organizations

- System integrators in aviation

- Aviation technology firms

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

In this step, key variables such as system type, platform type, and procurement channels will be identified. Extensive desk research will be conducted using secondary and proprietary databases to gather information. This will help define the critical factors influencing the market dynamics of the Singapore Aircraft Interface Devices Aid market.

Step 2: Market Analysis and Construction

Historical data will be compiled, and the market landscape will be analyzed. This will include assessing market penetration, analyzing product categories, and evaluating their market share in the overall market. The goal is to accurately estimate the size and growth potential of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses derived from secondary research will be validated through consultations with industry experts. These will include representatives from key manufacturers, aviation operators, and regulatory bodies. Their insights will provide critical operational data, allowing for more accurate market modeling.

Step 4: Research Synthesis and Final Output

The final phase involves compiling and synthesizing all gathered data to create a comprehensive report. Feedback and data from industry stakeholders will be analyzed to validate forecasts, ensuring that the final report reflects the most accurate and reliable insights into the Singapore Aircraft Interface Devices Aid market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for advanced avionics systems

Increasing focus on passenger experience improvements

Growth in commercial aviation sector in Asia-Pacific - Market Challenges

High initial investment costs

Regulatory complexity across multiple jurisdictions

Technological obsolescence and system integration challenges - Trends

Adoption of AI and machine learning in aircraft systems

Integration of 5G technology for improved connectivity

Rising demand for eco-friendly and energy-efficient systems

- Market Opportunities

Expansion of commercial airports in Southeast Asia

Growing demand for enhanced military aircraft systems

Technological advancements in wireless communication for aircraft systems - Government regulations

New certification standards for aircraft systems

Stricter safety regulations for aircraft electronics

Mandatory adoption of flight data monitoring systems - SWOT analysis

- Porters 5 forces

Bargaining power of suppliers: High due to few key suppliers of avionics systems

Bargaining power of buyers: Moderate, due to niche requirements of aircraft systems

Threat of new entrants: Low, owing to high entry barriers in aviation technology

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cockpit Display Systems

Aircraft Data Communication Systems

Autopilot Systems

Passenger Service Systems

Flight Management Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Helicopters

Cargo Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Line Fit

Retrofit

Systems Integration

- By EndUser Segment (In Value%)

Airlines

Military Forces

Private Jet Operators

Cargo Operators

Maintenance, Repair, and Overhaul (MRO) Providers - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Platforms

Contract-Based Procurement

Bidding Tenders

- Market Share Analysis

- CrossComparison Parameters(Market Share, Technological Innovation, Customer Support, Product Range, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rockwell Collins

Honeywell International

Thales Group

Garmin Ltd.

L3 Technologies

Collins Aerospace

Safran Electronics & Defense

Astronautics Corporation of America

Esterline Technologies

GE Aviation

SITAONAIR

Rheinmetall AG

Panasonic Avionics Corporation

Moog Inc.

Cobham PLC

- Airlines seeking to upgrade cockpit and cabin interfaces

- Military seeking enhanced communication systems

- Private jet owners requiring customized avionics solutions

- MRO providers adapting to advanced system repairs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035