Market Overview

The Singapore Aircraft Interiors market has shown a steady and significant growth trajectory, driven by the expanding air travel demand and rising investments in technological advancements. In 2023, the market was valued at approximately USD ~billion, with major growth coming from the increasing adoption of high-tech, customizable, and eco-friendly aircraft interiors. The market size in 2024 is expected to reach USD ~billion, supported by strong demand for premium seating and cabin management systems. Factors such as airlines’ focus on enhancing passenger comfort and eco-consciousness are driving this growth, while ongoing research and development in sustainable materials and energy-efficient technologies play a pivotal role.

The market is dominated by several key regions, with Singapore emerging as a hub for aircraft interior innovation due to its strategic position as a global aviation center. The nation’s well-established airline industry, advanced infrastructure, and strong regulatory framework foster significant demand for aircraft interiors. Singapore’s proximity to major aviation hubs in Southeast Asia, along with its growing fleet of both commercial and business aircraft, cements its role as a leader in the aircraft interiors market. The government’s support for aerospace technologies and its focus on sustainability also contribute to the market’s leadership.

Market Segmentation

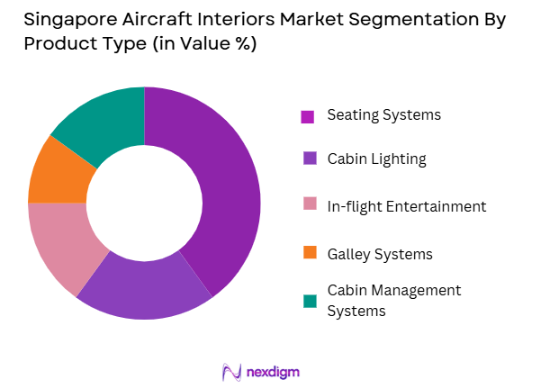

By Product Type:

The Singapore Aircraft Interiors market is segmented by product type into seating systems, cabin lighting, in-flight entertainment (IFE), galley systems, and cabin management systems. Among these, seating systems hold the dominant market share, driven by airlines’ continuous efforts to enhance passenger comfort, especially in business and first-class cabins. Airlines such as Singapore Airlines have pioneered the trend of luxury cabin designs, offering fully lie-flat beds, improved ergonomics, and personalized seating options, which have set new standards in the industry. This increased demand for innovative, customizable, and premium seating options contributes to the dominance of seating systems in the market.

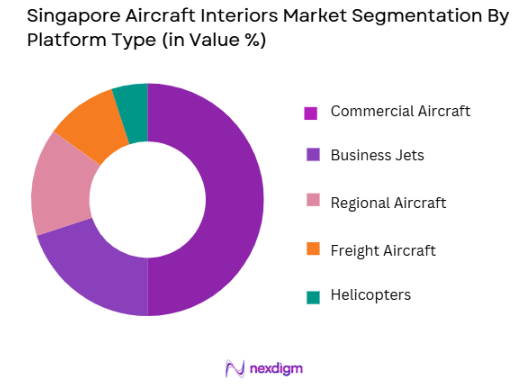

By Platform Type:

The market is further segmented by platform type into commercial aircraft, business jets, regional aircraft, freight aircraft, and helicopters. Commercial aircraft have the largest share in the Singapore Aircraft Interiors market due to the ongoing fleet expansion and retrofitting programs by airlines in the region. Airlines operating long-haul flights increasingly prioritize passenger comfort with state-of-the-art interiors, driving demand for aircraft interiors in this segment. Furthermore, the ongoing trend of improving in-flight services, such as Wi-Fi connectivity, entertainment options, and business-class seating, is expected to maintain the dominance of commercial aircraft interiors.

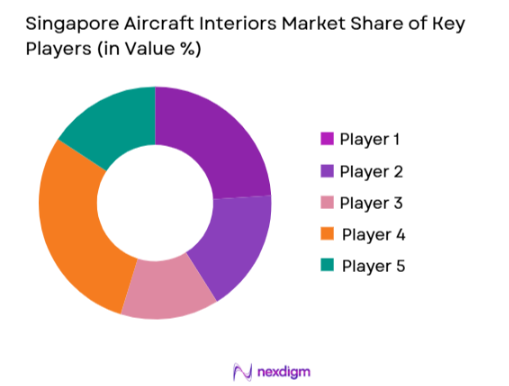

Competitive Landscape

The Singapore Aircraft Interiors market is highly competitive, with a mix of global players and regional companies leading the market. Key companies include Collins Aerospace, Safran, and Zodiac Aerospace, all of which offer a broad range of products from seating systems to in-flight entertainment and cabin management solutions. These players dominate the market due to their strong global presence, continuous technological innovations, and deep expertise in delivering tailored solutions to airlines. The market has seen a consolidation of these key players, who leverage their expansive manufacturing capabilities and partnerships with airlines to maintain their dominance.

| Company Name | Establishment Year | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1987 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft interiors Market Analysis

Growth Drivers

Urbanization

Urbanization continues to be a significant growth driver for the Singapore aircraft interiors market. Singapore, with its rapidly developing urban infrastructure, has seen a steady increase in urban population, currently standing at approximately ~ million people in 2024. The rise in urban populations directly influences air travel demand, as more people from urban areas engage in both business and leisure travel. This growth in passenger numbers increases the demand for advanced aircraft interiors, including seating, in-flight entertainment, and cabin systems. The Singapore government’s investments in transport infrastructure and urban planning further support the growing demand for modern, sophisticated air travel. This, in turn, spurs growth in the aircraft interiors market.

Industrialization

The ongoing industrialization in Singapore is driving growth in the aircraft interiors market. Industrial activities in aerospace, electronics, and manufacturing sectors have seen a boost with Singapore’s policies encouraging technological innovation and infrastructure development. In 2024, Singapore’s manufacturing sector contributes to about ~% of the nation’s GDP, with a significant portion allocated to the aerospace sector. This creates opportunities for the aircraft interiors market to thrive, especially as more airlines seek to modernize their fleets with high-quality, durable interior systems. The industrialization of key sectors, such as aviation, directly impacts the demand for premium interiors in both commercial and private aircrafts, driving the need for advanced materials and components.

Restraints

High Initial Costs

One of the significant challenges facing the aircraft interiors market in Singapore is the high initial cost of upgrading and installing advanced interior systems. The complexity and sophistication of modern aircraft interiors, which include advanced seating systems, cabin management technologies, and in-flight entertainment options, lead to considerable investment from airlines. In 2024, the cost of retrofitting an existing aircraft with advanced interiors can range from SGD ~million to SGD ~million depending on the system’s complexity. Although airlines are willing to invest in these upgrades, the high upfront costs remain a restraint, especially for smaller regional carriers and private operators.

Technical Challenges

Technical challenges also present a significant restraint in the growth of the aircraft interiors market in Singapore. The development of complex systems such as smart seating, advanced lighting, and in-flight entertainment integration requires a highly skilled workforce, specialized materials, and adherence to stringent safety regulations. In 2024, the lack of skilled technicians and engineers in certain high-tech sectors of the aircraft interiors industry presents a barrier to the timely production and installation of these advanced systems. Furthermore, continuous technological advancements demand frequent updates and modifications to existing systems, adding to the complexity of integration and maintenance.

Opportunities

Technological Advancements

Technological advancements offer substantial opportunities for the growth of the Singapore aircraft interiors market. The integration of smart technologies, such as IoT-enabled cabin management systems, smart seating, and energy-efficient lighting, is transforming the aviation industry. In 2024, major airlines are increasingly adopting these systems to enhance passenger experience, reduce operational costs, and improve energy efficiency. With Singapore positioning itself as a hub for innovation in aerospace, the demand for such technologies in aircraft interiors is expected to surge. The increasing investment in R&D for sustainable technologies further amplifies the growth potential of the market.

International Collaborations

International collaborations are opening up new growth avenues for the Singapore aircraft interiors market. As Singapore strengthens its position as a global aerospace hub, partnerships between local companies and international players are becoming more frequent. These collaborations foster knowledge exchange, technology transfer, and joint ventures, all of which contribute to the development of cutting-edge aircraft interiors. In 2024, Singapore’s aerospace companies are collaborating with major global players like Boeing and Airbus to design and produce advanced interior systems. This cross-border partnership enhances the technological capabilities of Singaporean companies, positioning them as leaders in the aircraft interiors market.

Future Outlook

Over the next 5 years, the Singapore Aircraft Interiors market is expected to witness significant growth driven by advancements in interior design, increasing air travel demand, and the continued focus on passenger comfort. A combination of technological innovations, including smart cabin management systems and eco-friendly materials, will continue to shape the demand for high-end aircraft interiors. As airlines prioritize sustainability and customer experience, demand for aircraft interiors that incorporate energy-efficient lighting, ergonomic seating, and improved in-flight entertainment will rise, fueling market growth. Additionally, the growing regional fleet and retrofitting of existing aircraft will further contribute to market expansion.

Major Players

- Collins Aerospace

- Safran

- Zodiac Aerospace

- B/E Aerospace

- Recaro Aircraft Seating

- Rockwell Collins

- Thales Group

- Panasonic Avionics Corporation

- Honeywell International

- GKN Aerospace

- MTU Aero Engines

- Liebherr Aerospace

- Sodecia Aerospace

- Hansa Aerospace

- Lufthansa Technik AG

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Leasing Companies

- Aerospace Component Suppliers

- Airline Maintenance, Repair, and Overhaul (MRO) Providers

- Aerospace R&D Firms

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research process involves identifying the key variables that drive the aircraft interiors market in Singapore. This includes understanding the market dynamics, stakeholder ecosystem, technological trends, and economic factors that influence growth. A combination of secondary data from credible sources, such as industry reports and government publications, and primary data from interviews with industry experts, forms the basis of this step.

Step 2: Market Analysis and Construction

The market analysis phase involves a thorough evaluation of historical data and trends, including the performance of various segments such as seating systems, in-flight entertainment, and cabin management systems. Data is gathered from public sources, trade publications, and proprietary databases to generate a comprehensive market size and growth projection. Additionally, competitor analysis is conducted to identify the strengths and weaknesses of key market players.

Step 3: Hypothesis Validation and Expert Consultation

This phase focuses on validating the research hypothesis through consultations with industry experts, including airline executives, aircraft manufacturers, and component suppliers. Computer-assisted telephone interviews (CATIs) will be conducted with key players across the value chain to gain insights into market developments, future trends, and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase consolidates all findings from the previous steps into a cohesive market report. The data collected is analyzed, and key insights are synthesized into actionable recommendations. Interviews with key stakeholders, including airline representatives and manufacturers, are used to further validate and complement the data. The report is then reviewed for accuracy and consistency, ensuring it provides a reliable, actionable, and thorough analysis of the Singapore Aircraft Interiors market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air travel demand in Asia-Pacific

Advancements in aircraft interior technology

Increase in aircraft fleet size and deliveries - Market Challenges

High initial investment for advanced systems

Stringent government regulations and certifications

Supply chain disruptions affecting production schedules - Trends

Smart seating solutions for enhanced passenger comfort

Increasing adoption of cabin management systems

Sustainability-driven innovations in materials and designs

- Market Opportunities

Rising demand for eco-friendly materials in interiors

Technological innovations in passenger comfort

Expansion of low-cost carriers in Asia - Government regulations

Regulatory frameworks for aircraft interior safety

Certification standards for in-flight entertainment systems

Government initiatives for aircraft eco-efficiency standards - SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cabin Seating

Lighting Systems

In-flight Entertainment Systems

Aircraft Galley Systems

Cabin Management Systems - By Platform Type (In Value%)

Commercial Aircraft

Business Jets

Regional Aircraft

Freight Aircraft

Helicopters - By Fitment Type (In Value%)

OEM

Retrofit

Aftermarket

Maintenance, Repair, and Overhaul

Upgrades - By EndUser Segment (In Value%)

Airlines

Leasing Companies

Aircraft Manufacturers

Government and Military

Charter Services - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Online Procurement

Government Tenders

Leasing and Financing Companies

- Market Share Analysis

- CrossComparison Parameters(Product Innovation, Customer Support, Pricing Strategy, Market Reach, Technological Advancements)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Collins Aerospace

Safran

Diehl Aviation

Zodiac Aerospace

B/E Aerospace

Recaro Aircraft Seating

Rockwell Collins

Thales Group

Panasonic Avionics Corporation

Honeywell International

GKN Aerospace

MTU Aero Engines

Liebherr Aerospace

Sodecia Aerospace

Hansa Aerospace

- Airlines seeking to enhance passenger experience through advanced interiors

- Leasing companies focusing on flexible and cost-effective solutions

- Government and military users requiring robust, durable interior solutions

- Charter services looking for luxury and customization in aircraft interiors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform, 2026-2035