Market Overview

The Singapore Aircraft Landing Gear Systems market is valued at approximately USD ~billion in 2023. This market is driven by the increasing demand for air travel in Asia-Pacific, which fuels the need for more aircraft and aircraft components. Additionally, the aviation industry’s focus on enhancing the safety and reliability of aircraft systems has led to continuous advancements in landing gear technologies. The expansion of both commercial and military aircraft fleets is anticipated to keep driving demand for high-performance landing gear systems. With the growth of the airline industry in Singapore and the region, the market is expected to maintain a steady rise over the coming years.

Singapore is a dominant player in the aircraft landing gear systems market, driven by its strategic location as a major aviation hub in Southeast Asia. The country’s well-established aviation infrastructure, combined with its role as a key repair and maintenance center, attracts international aircraft manufacturers and MRO (maintenance, repair, and overhaul) service providers. Singapore’s robust economy, governmental support for aviation-related technologies, and its strong link to global aerospace supply chains contribute to its position as a leading market in the region. The city-state’s proximity to other major aerospace players, such as China, Japan, and Australia, further solidifies its dominance.

Market Segmentation

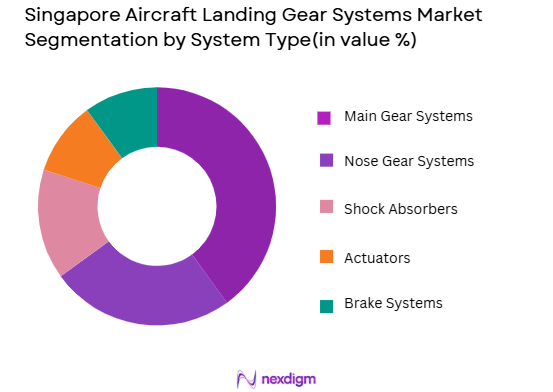

By System Type

The Singapore Aircraft Landing Gear Systems market is segmented by system type into main gear systems, nose gear systems, shock absorbers, actuators, and brake systems. Among these, the main gear systems segment holds a dominant market share, as they are critical for the stability and safety of aircraft during landing and take-off. Main gear systems are used in almost all types of aircraft, from commercial airliners to military jets, ensuring their continued high demand. The development of lighter yet more robust materials for landing gear components has further strengthened the position of main gear systems in the market. Major manufacturers like Collins Aerospace and Safran Landing Systems are constantly innovating in this area, contributing to the growing share of this segment in the market.

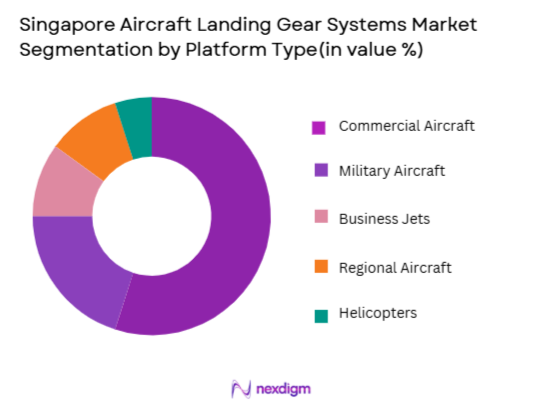

By Platform Type

The market is segmented into commercial aircraft, military aircraft, business jets, regional aircraft, and helicopters. Among these, commercial aircraft dominate the market share. This segment’s prominence is largely due to the rapid expansion of the aviation sector, driven by increased passenger traffic, especially in Asia-Pacific. Airlines such as Singapore Airlines, which are based in Singapore, continue to expand their fleets with the latest aircraft, thus fueling demand for landing gear systems. The growth in long-haul flights and the procurement of new aircraft for both domestic and international routes has solidified the dominance of commercial aircraft in this segment.

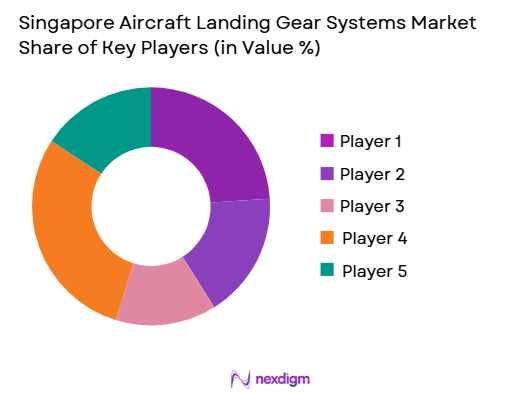

Competitive Landscape

The Singapore Aircraft Landing Gear Systems market is highly competitive and is dominated by global players with a significant presence in the Asia-Pacific region. Companies like Collins Aerospace, Safran Landing Systems, and Liebherr Aerospace lead the market, leveraging technological innovations and strong relationships with aircraft manufacturers. These companies have established robust supply chains and maintain state-of-the-art manufacturing facilities in Singapore and other parts of Southeast Asia, enhancing their ability to meet the growing demand for landing gear systems in the region.

| Company | Establishment Year | Headquarters | Technology & Innovation | Supply Chain Presence | Product Range | Market Focus |

| Collins Aerospace | 1930 | United States | ~ | ~ | ~ | ~ |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Germany | ~ | ~ | ~ | ~ |

| Meggitt PLC | 1943 | United Kingdom | ~ | ~ | ~ | ~ |

| UTAS | 1990 | United States | ~ | ~ | ~ | ~ |

Singapore Aircraft Landing Gear Systems Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in driving demand for more efficient infrastructure, including aircraft landing gear systems. In Asia-Pacific, urbanization rates are expected to increase steadily. For example, Singapore’s urban population reached over ~million in 2024, representing ~% of the country’s population. As more people migrate to urban areas, the demand for air travel continues to rise, prompting the need for more aircraft and advanced landing gear systems. This trend aligns with the global increase in airport and aviation infrastructure development, which fuels the aviation sector’s growth. Urban areas’ increasing reliance on aviation also reflects the accelerated demand for new aircraft systems.

Industrialization

Industrialization is a significant growth driver in the aircraft landing gear market as countries invest in manufacturing and infrastructure. In 2024, Singapore’s industrial production increased by ~% year-on-year. As industries like aviation manufacturing and MRO services expand, the demand for high-performance components like landing gear systems increases. Additionally, industrialization is promoting the construction of new airports, especially in emerging regions, further driving the need for modern and robust landing gear systems. The continuous development of advanced manufacturing facilities and the establishment of high-tech MRO centers also supports this market’s growth trajectory.

Restraints

High Initial Costs

High initial costs are one of the main constraints affecting the growth of the aircraft landing gear systems market. The materials and technologies required to manufacture advanced landing gear systems are expensive, which limits the entry of small and medium-sized aircraft manufacturers into the market. For example, in 2024, the cost of raw materials such as titanium and steel, which are critical in producing landing gear systems, rose by ~% globally. This increase in raw material costs further impacts the pricing of landing gear systems, making it a challenge for aircraft operators, particularly in emerging markets, to afford newer models.

Technical Challenges

The complex nature of landing gear systems presents technical challenges for manufacturers, particularly in areas such as durability and weight reduction. As the aviation industry strives to enhance fuel efficiency and reduce operating costs, landing gear manufacturers are required to develop lightweight yet durable systems. In 2024, the global demand for lighter aircraft components has led to increased R&D spending, with companies investing heavily in technologies such as composite materials for landing gear. However, the challenge remains in achieving the perfect balance between weight, strength, and cost.

Opportunities

Technological Advancements

Technological advancements in materials science and automation are creating significant opportunities for the aircraft landing gear market. In 2024, innovations in lightweight composites and titanium alloys are transforming the design of landing gear systems, offering higher performance with reduced weight. Moreover, advancements in artificial intelligence (AI) and automation are enabling manufacturers to create landing gear systems that are smarter and more efficient. These developments offer enormous potential for reducing maintenance costs and increasing the operational lifespan of landing gear systems, thus driving future demand.

International Collaborations

International collaborations are another key opportunity for the aircraft landing gear systems market. With increasing global demand for air travel and the expansion of the aviation industry, partnerships between regional and international players are creating new avenues for growth. Singapore, with its strategic position in Southeast Asia, is becoming a hub for joint ventures between global aircraft manufacturers and local MRO providers. These collaborations not only help share the cost of R&D but also bring innovative solutions to the market, benefiting the development of more efficient landing gear systems.

Future Outlook

Over the next decade, the Singapore Aircraft Landing Gear Systems market is expected to experience steady growth driven by continued expansion in the Asia-Pacific aviation industry. The growing number of new aircraft deliveries, supported by both governmental and private investments in the aerospace sector, will significantly contribute to the demand for landing gear systems. Furthermore, advancements in materials technology, such as the development of lighter, more durable components, will provide opportunities for innovation within the market. The increasing demand for aircraft maintenance, repair, and overhaul (MRO) services will also drive the market’s growth, with Singapore serving as a regional hub for these services.

Major Players in the Market

- Collins Aerospace

- Safran Landing Systems

- Liebherr Aerospace

- Meggitt PLC

- UTAS

- Goodrich Aerospace

- Rockwell Collins

- Honeywell International

- Trelleborg Group

- Schaeffler Group

- AAR Corporation

- GE Aviation

- Aircelle

- Fokker Technologies

- Nabtesco Corporation

Key Target Audience

- Investments and venture capitalist firms

- Airlines and aircraft operators

- Aircraft manufacturers

- Government and regulatory bodies

- Aerospace contractors

- Military organizations

- Aviation maintenance, repair, and overhaul (MRO) providers

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map that identifies key stakeholders in the Singapore Aircraft Landing Gear Systems market. Desk research, utilizing both secondary and proprietary databases, is conducted to gather comprehensive information regarding the various components of the landing gear systems industry, such as suppliers, manufacturers, and end-users.

Step 2: Market Analysis and Construction

In this phase, historical data is collected and analyzed to assess market trends, technological advancements, and financial performance in the Singapore Aircraft Landing Gear Systems market. We focus on analyzing product demand, regional supply chains, and market penetration.

Step 3: Hypothesis Validation and Expert Consultation

We will conduct interviews with industry experts to validate market hypotheses and gather insights on current market trends, regulatory challenges, and emerging opportunities. These consultations will help refine and validate the initial market data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all research data and presenting an integrated market report. This phase includes engaging with manufacturers, MRO providers, and key stakeholders in the landing gear systems supply chain to gather accurate, up-to-date information on the market’s dynamics

- Executive Summary

- Research Methodology([Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for air travel in Asia-Pacific

Increased aircraft production and fleet modernization

Technological advancements in landing gear systems - Market Challenges

High maintenance and operational costs

Stringent regulatory requirements

Complexities in supply chain management - Trends

Adoption of smart landing gear technology

Sustainability initiatives in aircraft manufacturing

Increased collaboration between OEMs and MRO service providers

- Market Opportunities

Expansion of regional air travel hubs

Growing investments in military aircraft

Advancements in lightweight and durable materials - Government regulations

Regulatory compliance for safety standards in landing gear

Environmental regulations regarding aircraft emissions

International standards for maintenance and repair procedures - SWOT analysis

Strength in technological innovation within landing gear systems

Weakness in dependency on a limited number of suppliers

Opportunity in expansion of emerging markets

Threat from fluctuating fuel prices affecting the aviation industry - Porters 5 forces

Threat of new entrants

Bargaining power of suppliers

Intensity of competitive rivalry

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Gear Systems

Nose Gear Systems

Shock Absorbers

Actuators

Brake Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Regional Aircraft

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Upgrades

Maintenance - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

MRO (Maintenance, Repair, and Overhaul)

Defense Contractors

Private Jet Owners - By Procurement Channel (In Value%)

Direct Procurement

Third-party Suppliers

OEM Distributors

Government Contracts

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters(Technological advancements, Price competitiveness, Brand recognition, Distribution channels, Customer service quality)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Collins Aerospace

Safran Landing Systems

Liebherr Aerospace

Meggitt PLC

UTAS

Goodrich Aerospace

Honeywell International

Boeing

Airbus

Rockwell Collins

Nabtesco Corporation

GE Aviation

Trelleborg Group

Schaeffler Group

Aero Wheel and Brake Services

- Airlines’ demand for efficient landing gear systems

- Military sector focus on high-performance landing gear systems

- Increased aftermarket demand from MRO service providers

- Growing demand for aircraft components in private jet market

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035