Market Overview

The Singapore aircraft lighting market has been valued at USD ~million in 2024, driven by factors such as the growing aviation industry, increasing air travel, and technological advancements in lighting systems. The rising demand for energy-efficient and customizable lighting solutions in aircraft cabins and cockpits further propels market growth. Singapore’s position as a key aviation hub in Southeast Asia, coupled with its robust regulatory framework and focus on sustainable aviation, strengthens its role as a significant player in the global aircraft lighting market.

Singapore, along with other aviation-centric countries like the United States, the UK, and Germany, dominates the aircraft lighting market. This dominance can be attributed to Singapore’s strategic geographical location, state-of-the-art airports, and presence of key players like ST Engineering and Zodiac Aerospace. Additionally, the country’s strong commitment to sustainability and innovation in aviation further boosts the demand for advanced lighting solutions in both commercial and military aircraft.

Market Segmentation

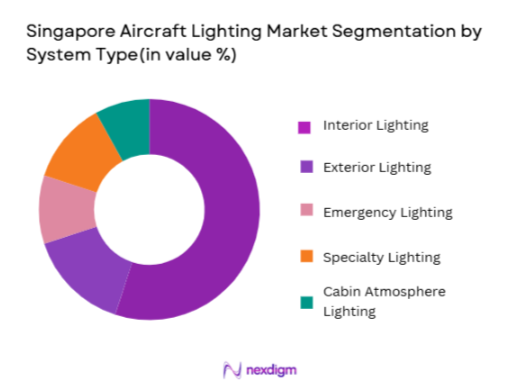

By System Type

The Singapore aircraft lighting market is segmented into interior lighting, exterior lighting, emergency lighting, specialty lighting, and cabin atmosphere lighting. Among these, interior lighting holds the largest market share due to its direct impact on passenger experience and airline differentiation. Airlines prioritize interior lighting systems for their cabins, offering better ambience, comfort, and energy efficiency. The increasing use of LED and smart lighting technologies in aircraft cabins is also contributing to the dominance of this subsegment.

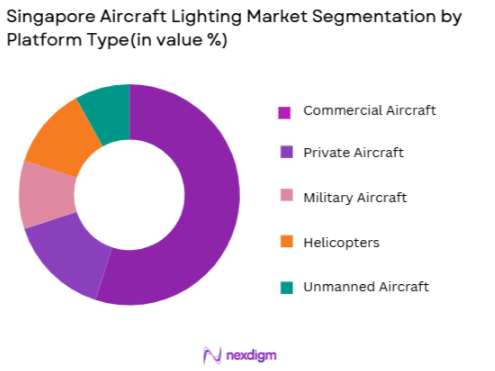

By Platform Type

The platform type segmentation includes commercial aircraft, private aircraft, military aircraft, helicopters, and unmanned aircraft. The commercial aircraft segment holds the largest share of the market due to the high volume of air travel and the growing fleet of commercial aircraft globally. The demand for enhanced lighting solutions in premium cabins and enhanced passenger experience features also bolsters this subsegment’s dominance.

Competitive Landscape

The Singapore aircraft lighting market is dominated by a few major players who shape the competitive dynamics. These companies include global industry giants and local innovators. Some of the leading players in the market include Zodiac Aerospace, Honeywell Aerospace, Rockwell Collins, Safran Electrical & Power, and Astronics Corporation. The competitive landscape highlights the influence of both established companies and new entrants bringing innovative lighting solutions to the market.

| Company | Establishment Year | Headquarters | Revenue | Market Share | Product Portfolio | Technological Advancements |

| Zodiac Aerospace | 1896 | Paris, France | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~ | ~ | ~ |

| Safran Electrical & Power | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | East Aurora, USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Lighting Market Analysis

Growth Drivers

Urbanization

Urbanization is a key growth driver in the Singapore Aircraft Lighting market, with rapid urban growth contributing to the increasing demand for air travel and modernized aviation infrastructure. Singapore’s urban population, estimated to reach ~million in 2024, plays a vital role in the increased need for efficient and innovative lighting solutions in the aviation sector. Urbanization leads to heightened consumer expectations, requiring airlines and aircraft operators to invest in advanced lighting solutions that enhance the passenger experience. As the population of major metropolitan areas continues to grow, the demand for flights and the corresponding demand for aircraft lighting systems will rise. Urbanization also drives infrastructure development, necessitating better and more energy-efficient lighting systems within airports and aircraft.

Industrialization

The industrialization of emerging sectors, particularly in Southeast Asia, positively impacts the aircraft lighting market. The Singaporean economy has witnessed an industrial growth rate of ~% in 2024, driven by sectors such as aerospace, manufacturing, and logistics. This growth boosts demand for both military and commercial aircraft, thus creating opportunities for the aircraft lighting market to expand. Additionally, the government’s push towards modernizing the industrial sector through technological advancements contributes to increased demand for higher-end lighting solutions. As aerospace industries continue to develop in Singapore and the broader Southeast Asian region, industrialization will provide the necessary stimulus for advanced aircraft lighting systems.

Restraints

High Initial Costs

High initial costs associated with advanced aircraft lighting systems represent a significant restraint in the market. While energy-efficient LED lighting solutions are gaining traction, the initial capital investment required for installation in both new and retrofit aircraft remains a barrier. In particular, the cost of retrofitting older aircraft fleets with state-of-the-art lighting systems can be prohibitively expensive for smaller airlines and operators. Additionally, the high cost of specialized lighting components, such as OLED panels and custom lighting configurations, further limits market adoption. Despite the long-term savings on energy consumption, the upfront capital requirements present a challenge for many stakeholders in the aviation industry.

Technical Challenges

Technical challenges related to the integration and performance of lighting systems in aircraft pose significant barriers. While advancements in LED and OLED technology have led to significant improvements in aircraft lighting systems, challenges remain in terms of integrating these systems into complex avionics and control systems. Furthermore, the maintenance and servicing of these advanced lighting systems require specialized expertise and tools. In the aviation sector, any malfunction in lighting systems, especially during flight, can have severe safety implications, making reliability a key concern for operators. Overcoming these technical hurdles is critical for the continued growth and adoption of innovative aircraft lighting technologies.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for growth in the aircraft lighting market. The aviation industry is increasingly adopting innovative technologies like Internet of Things (IoT)-enabled lighting, which allows real-time monitoring and control of lighting systems in aircraft. Additionally, the development of smart lighting solutions, such as those integrating sensors for automated adjustments based on cabin conditions, is expected to gain traction. These innovations enhance passenger comfort, reduce energy consumption, and improve operational efficiency, creating lucrative growth prospects for manufacturers of advanced aircraft lighting systems. With continuous advancements in lighting technologies, the market is set to experience significant development in the coming years.

International Collaborations

International collaborations present a major opportunity for the aircraft lighting market to expand. Partnerships between Singapore-based manufacturers and global aerospace companies, such as Boeing, Airbus, and Rolls-Royce, create opportunities for the development and deployment of next-generation lighting technologies. These collaborations enable the sharing of technical expertise, innovation, and resources, leading to the creation of cutting-edge lighting solutions. As Singapore strengthens its position as a key player in the global aviation supply chain, these international partnerships will drive the development of more advanced, cost-effective, and sustainable aircraft lighting systems, opening up new avenues for growth.

Future Outlook

The Singapore aircraft lighting market is expected to witness substantial growth over the next decade, driven by the increasing demand for energy-efficient, customizable, and smart lighting solutions in both commercial and military aircraft. Advancements in LED and OLED technologies, as well as a growing focus on passenger comfort and environmental sustainability, are expected to shape market trends. Government support for aviation infrastructure and sustainable technologies will also contribute to market expansion.

The market is projected to grow with a steady CAGR of approximately ~% from 2026 to 2035. Factors such as the modernization of existing aircraft fleets and the increasing adoption of retrofit lighting solutions will further boost the demand for advanced lighting systems. Additionally, technological innovations like integration with Internet of Things (IoT) systems will enhance the functionality and appeal of aircraft lighting.

Major Players in the Market

- Zodiac Aerospace

- Honeywell Aerospace

- Rockwell Collins

- Safran Electrical & Power

- Astronics Corporation

- ST Engineering

- Diehl Aerospace

- Luminator Technology Group

- B/E Aerospace

- Curtiss-Wright Corporation

- AMETEK Aerospace

- O’Gara-Hess & Eisenhardt

- Sargent Aerospace

- Collins Aerospace

- Cobham PLC

Key Target Audience

- Airlines & Aircraft Operators

- Aircraft Manufacturers

- Aircraft Maintenance & Repair Organizations

- Military & Defense Contractors

- Aviation Regulatory Bodies

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Aircraft Lighting System Suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the key variables that influence the Singapore aircraft lighting market, focusing on factors such as technological advancements, market demand, and regulatory frameworks. This phase relies on secondary research, including industry reports, governmental publications, and proprietary databases, to build a comprehensive understanding of market trends.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to assess the size and growth trajectory of the aircraft lighting market in Singapore. This includes examining sales performance, lighting system adoption trends, and technological advancements. Data from market reports, industry surveys, and expert interviews is used to ensure a reliable estimate of current and future market performance.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from aviation, lighting, and technology sectors will be consulted to validate the market hypotheses. This phase involves gathering insights through direct interviews and consultations with stakeholders from aircraft manufacturers, lighting solution providers, and regulatory authorities. These consultations ensure accuracy and help refine market projections.

Step 4: Research Synthesis and Final Output

The final research phase consolidates all data and expert insights to provide a detailed and validated analysis of the Singapore aircraft lighting market. Key insights are gathered through direct engagement with key players in the aviation and lighting industries to ensure the final output provides a comprehensive, credible, and accurate overview of the market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in demand for energy-efficient lighting solutions in aircraft

Technological advancements in LED lighting systems for aviation

Growing adoption of premium and customized cabin lighting for passenger comfort - Market Challenges

High cost of advanced lighting systems

Stringent regulatory requirements and certifications

Supply chain disruptions due to geopolitical tensions - Trends

Integration of smart lighting with IoT for aircraft

Focus on sustainable and eco-friendly lighting solutions

Increased demand for ambient and mood lighting in passenger cabins

- Market Opportunities

Development of smart lighting systems with automation capabilities

Expansion of aircraft fleets in Asia-Pacific

Rising demand for retrofit lighting solutions in existing fleets - Government regulations

Compliance with FAA and EASA certifications for aircraft lighting

Stringent energy consumption regulations for aviation industry

Adoption of eco-friendly lighting solutions mandated by environmental agencies - SWOT analysis

Strength

Weakness

Opportunities - Porters 5 forces

Threat of new entrants

Bargaining power of suppliers

Bargaining power of buyers

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Interior Lighting

Exterior Lighting

Emergency Lighting

Specialty Lighting

Cabin Atmosphere Lighting - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Helicopters

Unmanned Aircraft - By Fitment Type (In Value%)

OEM

Aftermarket

Retrofit

Upgrades

Replacement - By EndUser Segment (In Value%)

Aircraft Manufacturers

Airlines & Operators

Aircraft Maintenance Organizations

Military & Defense Contractors

Private Owners - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Channels

Government Contracts

Third-Party Retailers

- Market Share Analysis

- CrossComparison Parameters(System Type, Platform Type, Fitment Type, Procurement Channel, Market Share)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lighting Innovations Ltd.

AvioTech Systems

Honeywell Aerospace

Safran Electrical & Power

Rockwell Collins

Astronics Corporation

Zodiac Aerospace

Luminator Technology Group

Diehl Aerospace

B/E Aerospace

Cabin Lighting Solutions

AMETEK Aerospace

O’Gara-Hess & Eisenhardt

Sargent Aerospace

Curtiss-Wright Corporation

- Growing need for customized lighting systems in commercial airlines

- Military and defense sectors focusing on functional lighting in combat and transport aircraft

- Airlines’ increasing focus on improving passenger experience through lighting

- Private aircraft owners seeking luxury and personalized lighting options

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035