Market Overview

The Singapore Aircraft Lightning Protection market is valued at approximately USD ~ in 2025, a figure that underscores the region’s advanced aerospace industry and stringent aviation safety standards. This market is driven by the growing adoption of composite materials in aircraft construction, which require advanced lightning protection systems to ensure safety. Moreover, stringent government regulations concerning lightning strike resistance in aircraft, coupled with the increasing demand for commercial and defense aircraft in Asia-Pacific, contribute to the steady market growth. Technological advancements in lightning strike detection and protection systems further fuel the market’s expansion, making it a pivotal component of modern aircraft design and manufacturing.

Singapore is a dominant player in the Aircraft Lightning Protection market, primarily due to its strategic location as a key aviation hub in Asia-Pacific. The country’s advanced aerospace manufacturing industry, coupled with its regulatory body, the Civil Aviation Authority of Singapore (CAAS), ensures stringent adherence to international safety standards, driving the demand for lightning protection systems. Additionally, Singapore’s highly developed infrastructure for aircraft maintenance, repair, and overhaul (MRO) services enhances the market’s prominence, with several major global airlines and aerospace manufacturers operating out of the country. Furthermore, the city’s focus on technological innovation in aviation contributes to its leadership role in the market.

Market Segmentation

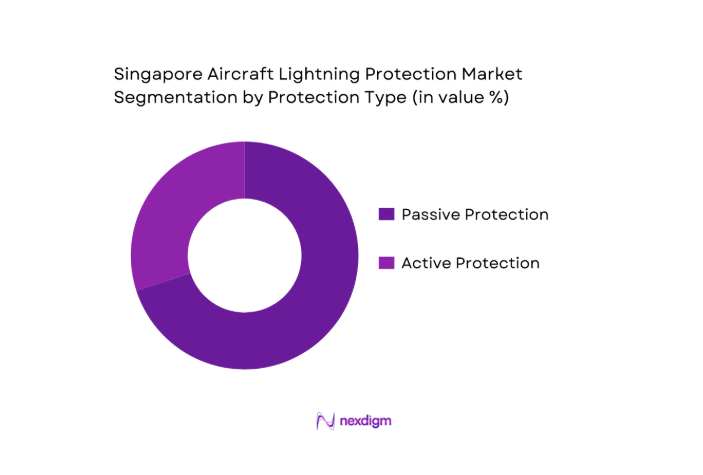

By Protection Type

The Singapore Aircraft Lightning Protection market is segmented into active and passive protection systems. Passive protection systems dominate the market due to their lower cost and established reliability in commercial aircraft. These systems, primarily involving conductive mesh, lightning diverter strips, and static dissipators, offer long-term operational efficiency and compliance with safety standards. Passive protection systems are crucial in preventing lightning strikes from damaging the aircraft’s essential components. The growing fleet of commercial and regional jets, particularly those using composite materials, has increased the demand for passive protection systems, solidifying their market leadership.

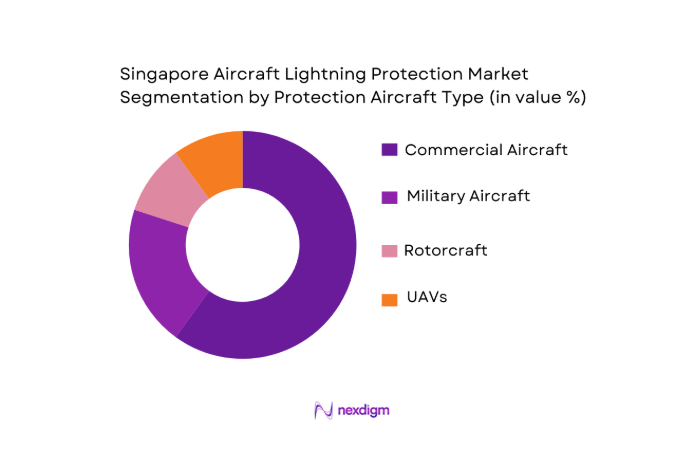

By Aircraft Type

The market is also segmented by aircraft type, including commercial, military, rotorcraft, and unmanned aerial vehicles (UAVs). Commercial aircraft hold the largest market share in the lightning protection segment, driven by the continuous growth of air travel in Asia-Pacific and the region’s increasing fleet of new aircraft. The adoption of advanced composite materials in commercial aircraft, such as Boeing 787 and Airbus A350, necessitates high-performance lightning protection systems. This, combined with growing regulatory demands for enhanced safety standards, has made commercial aircraft the largest segment in the market.

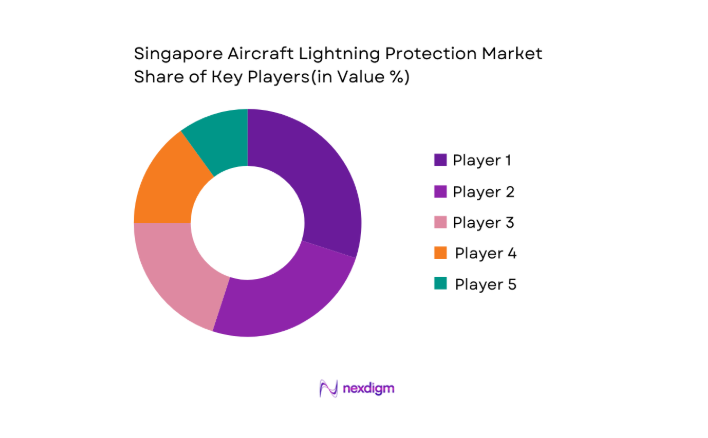

Competitive Landscape

The Singapore Aircraft Lightning Protection market is consolidated, with a few major players controlling a significant portion of the market share. Leading companies include both international aerospace giants and specialized local manufacturers. The market is primarily driven by technological innovation, regulatory requirements, and strategic partnerships with aircraft manufacturers and MRO service providers. Some key players dominate the market due to their strong capabilities in product innovation, research and development (R&D), and established relationships with OEMs and maintenance providers.

| Company | Establishment Year | Headquarters | Product Focus | Technological Strength | Regulatory Compliance | Market Reach |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ |

| Safran | 1905 | France | ~ | ~ | ~ | ~ |

| Parker-Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

| Eaton | 1911 | Ireland | ~ | ~ | ~ | ~ |

Singapore Aircraft Lightning Protection Market Analysis

Growth Drivers

Increasing Air Passenger Traffic & Fleet Expansion

The global aviation industry continues to witness strong growth in air passenger traffic, driven by rising disposable income and increasing urbanization, particularly in Asia-Pacific. According to the International Air Transport Association (IATA), global passenger traffic is expected to surpass pre-pandemic levels in 2024, with air travel demand growing at an average of 4% annually from 2023 onward. In Singapore, Changi Airport reported ~ passengers in 2024, a strong recovery post-pandemic. As the number of air passengers increases, airlines are expanding their fleets, driving demand for advanced safety systems, including lightning protection, to ensure passenger and aircraft safety. Additionally, the fleet expansion involves incorporating newer aircraft models that use composite materials, which require specialized lightning protection solutions.

Composite Airframes & Electrification Trend

The increasing use of composite materials in aircraft construction, such as carbon-fiber-reinforced plastics (CFRPs), is accelerating the need for advanced lightning protection systems. Composite materials are lightweight and offer better fuel efficiency but are more prone to lightning strike damage compared to traditional metallic airframes. In 2024, Boeing’s 787 and Airbus’s A350, both featuring extensive use of composite materials, accounted for a significant portion of global commercial aircraft deliveries. As these materials continue to be adopted in new aircraft designs, the demand for lightning protection systems that cater specifically to composites is expected to rise. Furthermore, electrification in aviation is on the rise, with hybrid and fully electric aircraft being developed to reduce carbon emissions. This development in electrification is further fueling the need for advanced systems that provide comprehensive protection from lightning strikes, especially in light of the increased sensitivity of electric systems to environmental factors.

Market Challenges

High Engineering Compliance Costs

Engineering compliance costs are a significant challenge in the aircraft lightning protection market, especially due to the complex and stringent safety standards imposed by regulatory bodies. The design, testing, and certification of lightning protection systems require high investment in research and development, material procurement, and testing facilities. For example, the cost of certifying a new aircraft lightning protection system can run into millions of dollars. The International Civil Aviation Organization (ICAO) sets international standards for safety, which must be adhered to by aircraft manufacturers. In addition, the rising costs of raw materials, such as conductive metals and composites, further exacerbate the financial burden on manufacturers. As the aviation industry increasingly adopts newer technologies, such as composites and hybrid aircraft, the engineering challenges and costs related to ensuring proper lightning protection systems also escalate.

Long Certification Cycles

The process of certifying aircraft lightning protection systems is lengthy and complex, which can delay the introduction of new technologies into the market. On average, the certification of an aircraft safety system takes 2 to 3 years, which can hinder the timely deployment of new innovations. This long certification cycle is due to the rigorous testing procedures that these systems undergo to meet safety standards set by authorities such as the FAA and EASA. Certification processes include a series of tests to simulate lightning strikes and assess the system’s effectiveness in protecting critical aircraft components. This delay in the certification cycle can restrict manufacturers from quickly capitalizing on advancements in technology and market demand, ultimately impacting market growth.

Opportunities

AI-Assisted Predictive Detection Systems

The integration of Artificial Intelligence (AI) in predictive detection systems presents a significant opportunity for the aircraft lightning protection market. AI-driven systems are being developed to predict lightning strike events in real time and provide alerts to pilots, enabling them to take preventive actions. The adoption of AI in these systems is set to revolutionize lightning protection by improving the response time and accuracy of lightning detection, as well as reducing the risk of potential damage to aircraft. Furthermore, AI-powered systems can assist in predictive maintenance, ensuring that lightning protection systems remain functional over the lifetime of the aircraft. As the use of AI in aviation continues to grow, with over ~ of global airlines already investing in AI technologies in 2024, the demand for such intelligent systems is likely to rise, providing an opportunity for market growth.

Electric & Hybrid Aircraft Protection Needs

The global push toward sustainable aviation has led to an increase in the development of electric and hybrid aircraft. These new aircraft types have a higher sensitivity to environmental factors such as lightning strikes due to their electrical systems and lightweight construction. As of 2024, over 150 electric aircraft are under development worldwide, with major companies such as Airbus and Boeing leading the charge. This growing trend is driving demand for specialized lightning protection systems that can protect electric and hybrid aircraft from lightning strikes without compromising their electrical systems or efficiency. The protection needs of these aircraft are unique, requiring advanced materials and technology to ensure the safety of both passengers and the aircraft. The emergence of electric and hybrid aircraft presents a significant growth opportunity for companies specializing in lightning protection, positioning them to cater to the evolving needs of the aviation industry.

Future Outlook

Over the next decade, the Singapore Aircraft Lightning Protection market is expected to exhibit strong growth, supported by advancements in aircraft design, the expansion of the Asia-Pacific aerospace industry, and increasing safety regulations. The growing preference for composite materials in aircraft manufacturing, which are more susceptible to lightning strikes, will drive the demand for more efficient and advanced lightning protection systems. Additionally, the integration of smart technologies for lightning detection and mitigation, along with rising investments in aerospace manufacturing, will contribute to market expansion. The evolving regulatory frameworks and the push for higher safety standards in aircraft will remain key drivers in shaping the future of this market.

Major Players

- Honeywell International

- Raytheon Technologies

- Safran

- Parker-Hannifin

- Eaton

- Meggitt PLC

- Triumph Group

- TE Connectivity

- Cobham

- Carlisle Companies

- L3Harris Technologies

- Zodiac Aerospace

- S&P Global

- Ametek Inc.

- Astronics Corporation

Key Target Audience

- Aerospace OEMs

- MRO Service Providers

- Aircraft Fleet Operators

- Government and Regulatory Bodies

- Aircraft Safety and Certification Agencies

- Investments and Venture Capitalist Firms

- Aircraft Lightning Protection System Manufacturers

- Aircraft Maintenance & Retrofit Service Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key factors impacting the market, including technological developments, regulatory requirements, and economic factors such as demand for aircraft and MRO services. Data is sourced through secondary research from industry reports, market databases, and interviews with key stakeholders.

Step 2: Market Analysis and Construction

Historical market data, including key variables such as aircraft fleet size, adoption of composite materials, and safety regulations, is compiled and analyzed. This data forms the basis for understanding past market trends and provides insights into the future trajectory of the market.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy and reliability of the market data, consultations with industry experts, including engineers, OEMs, and regulatory bodies, are conducted. These consultations validate the hypotheses and provide deeper insights into technological trends and market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data from the bottom-up approach, combining insights from manufacturers, MROs, and regulatory bodies. This comprehensive analysis is used to refine market forecasts and provide actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increasing Air Passenger Traffic & Fleet Expansion

Composite Airframes & Electrification Trend

Regulatory Mandates - Market Challenges

High Engineering Compliance Costs

Long Certification Cycles

Supply Chain Constraints - Opportunities

AI‑Assisted Predictive Detection Systems

Electric & Hybrid Aircraft Protection Needs

Localised Manufacturing & Test Facilities in Singapore & ASEAN - Trends

Lightweight Conductive Materials

Smart Sensor Integration & Real‑Time Diagnostics

Retrofit Demand Surge in Mature Fleets - Government Regulations & Safety Standards

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- Protection Type (In Value %)

Active Protection

Passive Protection

Hybrid Integrated Systems

Detection & Warning Solutions - Component Type (In Value %)

Bonding & Grounding Hardware

Surge Protection Modules

Static Dissipater Wicks

Expanded Metal Foils/Meshes - Aircraft Type (In Value %)

Commercial Jets

Defence & Military Platforms

General Aviation

Urban Air Mobility & Drones - Fit Type (In Value %)

OEM Line‑fit

Aftermarket/Retrofit

MRO & Cert Services - Material Type (In Value %)

Aluminium Conductive Mesh

Composite Integrated Solutions

Nano/Hybrid Conductive Polymers

- Market Share of Major Players

- Cross Comparison Parameters (Product Portfolio Breadth, ASP & Cost Per Unit Installed, Certification & Compliance Credentials, R&D Investment Intensity,

Integration Capability with OEMs, Aftermarket & MRO Support Reach, Supply Chain Robustness) - SWOT of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

Honeywell International Inc.

Raytheon Technologies Corporation

Parker‑Hannifin Corp

Eaton Corporation plc

Safran S.A.

TE Connectivity Ltd.

Carlisle Companies, Inc.

Triumph Group, Inc

Cobham plc

Saab AB

L3Harris Technologies, Inc.

Astroseal Products Manufacturing Corp.

Dayton‑Granger, Inc.

Dexmet Corporation

NTS Pittsfield

- Safety & Certification Compliance

- Lifecycle Cost & Total Cost of Ownership

- Integration Compatibility with Aircraft Avionics

- After‑Sales Support/Service Agreements

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035