Market Overview

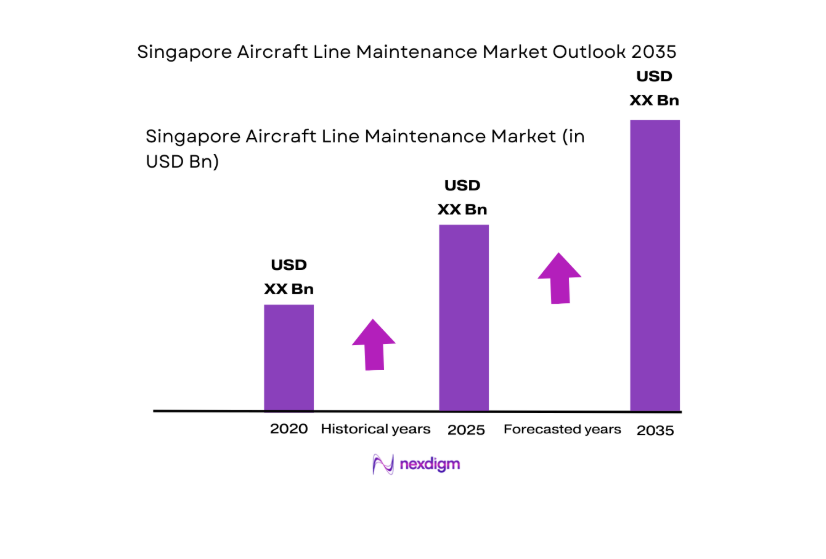

The Singapore Aircraft Line Maintenance market is valued at USD ~ in 2024, with a steady growth trajectory observed throughout 2025. This market is primarily driven by the robust demand for quick turnaround times, frequent international flight operations, and Singapore’s status as a global aviation hub. Airlines, including both low-cost carriers and full-service airlines, require efficient and reliable line maintenance services to ensure optimal fleet performance. Additionally, the increasing use of wide-body aircraft and the growing trend of outsourced MRO services contribute to the expansion of this market.

Singapore’s strategic position in Southeast Asia, bolstered by Changi Airport’s world-class infrastructure, positions it as the leading city for aircraft line maintenance. The country dominates due to its highly skilled labor force, advanced technical expertise, and its status as a key international transit hub. The presence of global MRO providers and regulatory frameworks like the Civil Aviation Authority of Singapore (CAAS) enhances its attractiveness. Additionally, other regional players like Malaysia, Thailand, and Indonesia are significant contributors, but none match Singapore’s comprehensive service ecosystem.

Market Segmentation

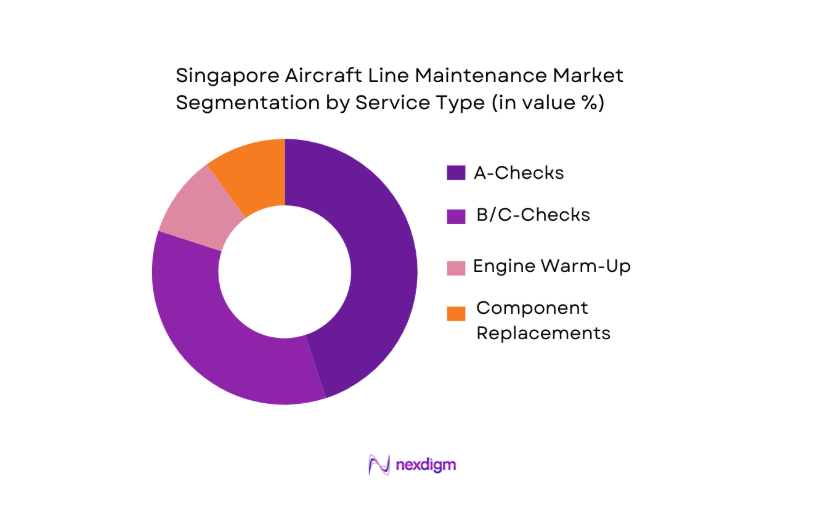

By Service Type

The market for aircraft line maintenance is segmented into various service types including A-checks, B/C-checks, engine warm-up services, and component replacements. Among these, A-checks are the dominant service type due to their routine and frequent nature. These checks are typically required after a specified number of flight hours or cycles and are crucial for ensuring aircraft safety and performance. Airlines and operators across Singapore prioritize A-checks due to their critical role in maintaining operational efficiency, minimizing downtime, and ensuring timely departures. This segment enjoys a high market share due to its consistent demand across different aircraft types, especially narrow-body fleets.

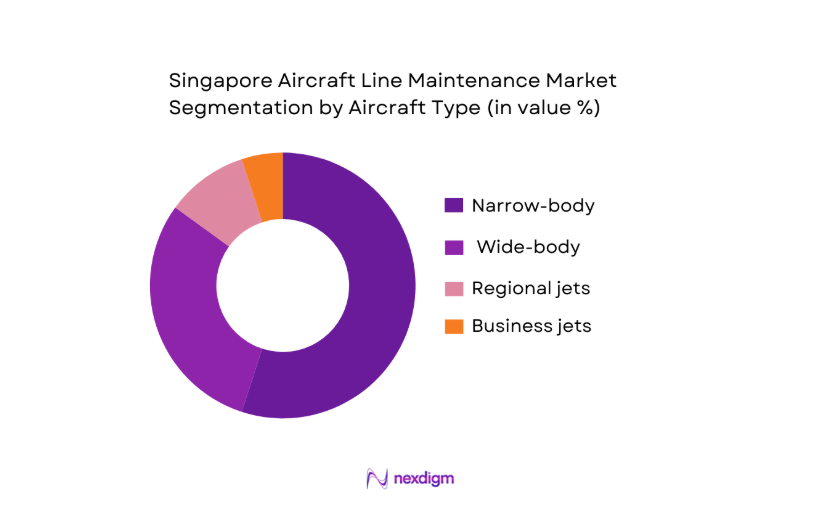

By Aircraft Type

The market is also segmented by aircraft type, which includes narrow-body, wide-body, regional jets, and business jets. Narrow-body aircraft dominate the segment, accounting for a significant portion of the market share. This is due to the high frequency of short-haul flights serviced by aircraft like the Boeing 737 and Airbus A320 families, which are widely used by regional airlines and low-cost carriers. The dominance of narrow-body aircraft is supported by the large number of budget airlines operating in the region, making them a central focus for line maintenance providers. As a result, this segment holds a majority of the market share.

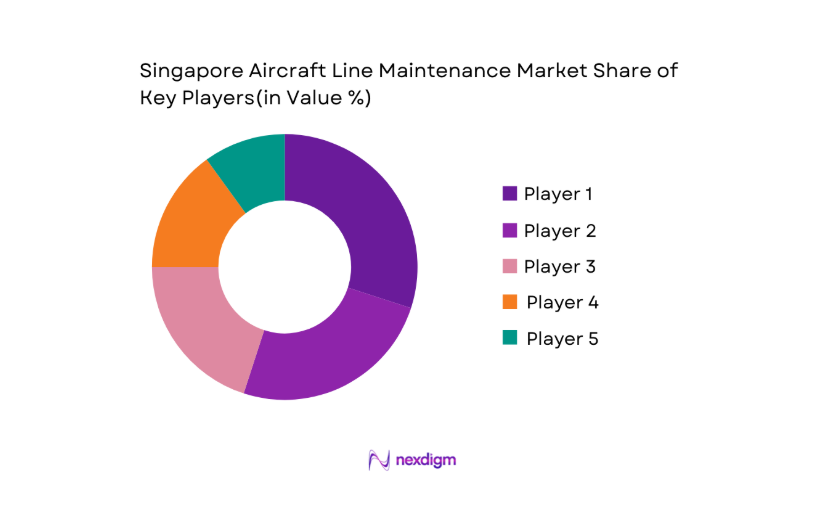

Competitive Landscape

The Singapore Aircraft Line Maintenance market is highly competitive, with several key players dominating the space. Local firms, such as SIA Engineering Company, lead the market, alongside international players such as Lufthansa Technik and Rolls-Royce. The competitive landscape is marked by a strong focus on quality, service reliability, and a diverse service offering that ranges from basic line checks to comprehensive fleet management solutions.

| Company Name | Establishment Year | Headquarters | Service Coverage | Fleet Served | Turnaround Time | Workforce Skill | Certifications | Technology Integration |

| SIA Engineering | 1982 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1995 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1997 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| HAECO Group | 1950 | Hong Kong | ~ | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Line Maintenance Market Analysis

Growth Drivers

Rising Asia-Pacific Flight Frequencies & Connectivity

The Asia-Pacific region remains the largest aviation market globally, with flight frequencies increasing significantly. According to the International Air Transport Association (IATA), Asia-Pacific airlines carried approximately ~ passengers in 2024. This number is expected to grow steadily as international air traffic rebounds post-pandemic. In Singapore, Changi Airport handled ~ passengers in 2023, and forecasts from the Civil Aviation Authority of Singapore (CAAS) predict a continued annual increase in passenger movements as global connectivity improves. This rise in air traffic directly drives demand for aircraft line maintenance services, particularly for quick turnarounds to ensure flight schedules are met.

Outsourcing Penetration

Outsourcing of aircraft maintenance services has become increasingly prevalent in the Asia-Pacific region. According to data from the International Civil Aviation Organization (ICAO), approximately ~ of MRO services in the region are outsourced. In Singapore, airlines are increasingly turning to third-party maintenance providers to reduce operational costs and enhance service efficiency. The trend of outsourcing is also fueled by the growing complexity of aircraft systems and the need for specialized expertise, making it difficult for airlines to maintain in-house capabilities. As a result, the number of outsourced contracts has surged, contributing to the growing market for line maintenance services.

Market Challenges

High Skilled Labor Scarcity & Turnover

The aviation industry, including aircraft line maintenance, is facing a shortage of skilled labor. According to the International Labour Organization (ILO), the demand for skilled aviation technicians has outpaced supply globally. In Singapore, the aviation sector struggles to attract and retain qualified maintenance personnel, with turnover rates in line maintenance exceeding 15% in certain companies. This is exacerbated by the global shortage of aviation mechanics, with IATA estimating a need for ~ additional aviation technicians by 2026. This talent gap makes it difficult for companies to meet growing maintenance demands, affecting the efficiency and reliability of line maintenance operations.

Competitive Pressure from Malaysia/Thailand/Indonesia

Singapore faces increasing competition from neighboring countries like Malaysia, Thailand, and Indonesia, which have become key players in the Asia-Pacific MRO market. Malaysia, with its well-established MRO hubs in Kuala Lumpur and Penang, provides cost-effective solutions that attract budget airlines, thus posing competition to Singapore’s market. Similarly, Indonesia and Thailand are investing heavily in airport infrastructure and MRO facilities. As the aviation industry expands, these countries have increasingly captured a share of the line maintenance market, affecting Singapore’s market dominance and increasing pressure on local providers to innovate and maintain competitive pricing.

Market Opportunities

Digital Predictive Turnaround Systems

The integration of digital technologies, including predictive analytics, into aircraft line maintenance is transforming the industry. Airlines and MRO providers are increasingly using predictive maintenance systems to anticipate and prevent equipment failure. By 2024, over ~ of MRO providers in the Asia-Pacific region are expected to incorporate IoT sensors and data analytics into their line maintenance services. This technology enables real-time monitoring of aircraft systems, reducing the need for unscheduled maintenance, which ultimately cuts operational costs. Predictive maintenance systems not only improve turnaround times but also enhance safety and reliability, providing a significant market opportunity for advanced maintenance solutions.

Green Line Maintenance Initiatives

Environmental sustainability is increasingly becoming a priority in the aviation sector, with several major airlines and MRO providers in Singapore adopting green practices. The Civil Aviation Authority of Singapore (CAAS) has launched initiatives to reduce carbon emissions and promote the use of environmentally friendly materials in aircraft maintenance. According to the International Air Transport Association (IATA), around ~ of global airlines are incorporating green initiatives into their line maintenance operations. These include reducing waste, optimizing fuel efficiency, and transitioning to sustainable aviation materials. As environmental regulations tighten, the demand for green maintenance solutions will grow, presenting significant opportunities for MRO providers who adopt such technologies.

Future Outlook

Over the next decade, the Singapore Aircraft Line Maintenance market is expected to see steady growth driven by increasing air traffic volumes, the expansion of international aviation routes, and the rise in demand for outsourced MRO services. The growth in wide-body aircraft operations and the rising number of international flight connections will lead to greater demand for comprehensive line maintenance services. Furthermore, the growing integration of digital technologies like predictive maintenance and IoT-based monitoring systems will enhance operational efficiency and ensure faster turnaround times. With continued investment in infrastructure, Singapore will maintain its position as a hub for aircraft line maintenance in the Asia-Pacific region.

Major Players

- SIA Engineering Company

- Lufthansa Technik

- Rolls-Royce

- ST Engineering

- HAECO Group

- Pratt & Whitney

- Jet Aviation

- Collins Aerospace

- Safran MRO Services

- Singapore Airlines

- Turkish Technic

- Boeing Global Services

- Air France Industries KLM

- Emirates Engineering

- AAR Corp

Key Target Audience

- Airline Operators

- MRO Service Providers

- Investments and Venture Capitalist Firms

- Aviation Regulatory Bodies

- Aircraft OEMs

- Airport Authorities

- Third-party Maintenance Facilities

- Defense and Military Aviation Units

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the key market drivers, challenges, and opportunities that impact the aircraft line maintenance sector in Singapore. Desk research and secondary databases will be used to map out these critical variables.

Step 2: Market Analysis and Construction

We will analyze the current market size using historical data and evaluate trends such as fleet growth, increasing air traffic, and outsourcing of MRO services. This data will help project future trends and estimate growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through expert consultations with industry stakeholders such as airline operators, MRO providers, and airport authorities. These consultations will validate our findings and provide deeper insights.

Step 4: Research Synthesis and Final Output

After compiling all insights and validating them through industry interviews, we will synthesize the research into a comprehensive final report. This will ensure that all market data is accurate and actionable for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising Asia‑Pacific Flight Frequencies & Connectivity

Outsourcing Penetration

Increase in Wide‑Body Night‑Turn Operations - Market Challenges

High Skilled Labor Scarcity & Turnover

Competitive Pressure from Malaysia/Thailand/Indonesia

Cost Inflation - Opportunities

Digital Predictive Turnaround Systems

Green Line Maintenance Initiatives

Expansion into Secondary Airports - Market Trends

Outsourced Third‑Party Line Maintenance Growth

Adoption of IoT / AI Predictive Checks

Average On‑Wing Time Optimization Metrics - Government Regulation & Aviation Safety Standards

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- Segmentation by Service Type (In Value %)

A‑Check Line Services

B/C Line Support

Component Replacement & Defect Rectification

On‑Site Engine Warm‑Up/Rotables Support - Segmentation by Aircraft Type (In Value %)

Narrow‑Body

Wide‑Body

Regional Jets

Business Aviation - Segmentation by End User (In Value %)

Flag Airline Services

Low‑Cost Carrier Outsourced

Third‑Party MRO Utilisation

Military / Government Aviation - Segmentation by Service Delivery Model (In Value %)

Fixed Base Contract Services

Ad‑Hoc Turnaround Contracting

OEM‑Branded Service Centres - Segmentation by Operational Scope (In Value %)

Airport Anchored

Satellite & Remote MRO Support

- Market Share

- Cross Comparison Parameters (Turnaround Time Performance, Service Coverage, Technical Certification Levels, Workforce Skill Index, Contract Pricing Benchmarks)

- SWOT Analysis of Key Players

- Pricing Analysis

- Detailed Profiles of Major Players

SIA Engineering Company

Singapore Technologies Engineering Ltd

Safran SA

Rolls‑Royce Holdings plc

Jet Aviation Singapore

StandardAero

Lufthansa Technik Component Services Asia

Collins Aerospace MRO Services

Pratt & Whitney Services Singapore

Asia Digital Engineering

Air France Industries KLM Engineering & Maintenance

HAECO Group

Joramco Middle East

Taikoo MRO divisions in SEA

Garuda Maintenance Facility AeroAsia

- Operational Efficiency Expectations

- Cost Sensitivity & Contract Pricing Models

- Reliability & SLA Requirements

- Safety & Regulatory Compliance Thresholds

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035