Market Overview

The Singapore aircraft micro turbine market, valued at approximately USD ~ in 2024, is driven by increasing demand for fuel-efficient propulsion systems, the expansion of urban air mobility (UAM) applications, and technological advancements in small turbine engine efficiency. Factors such as the growing adoption of UAVs (Unmanned Aerial Vehicles) and the increasing use of micro turbines in both military and civilian sectors further fuel the market’s growth. Technological breakthroughs and support from governmental regulations to boost sustainable aviation technologies have also contributed to the market’s upward trajectory.

Singapore, along with other major cities in Southeast Asia, holds a dominant position in the micro turbine market due to its strategic location, advanced aerospace ecosystem, and government initiatives aimed at fostering innovation in aviation technologies. Singapore’s aerospace industry benefits from a well-established infrastructure, robust manufacturing capabilities, and support from organizations such as the Civil Aviation Authority of Singapore (CAAS). Additionally, the country’s high investment in UAV and UAM technologies has positioned it as a leading player in the aircraft micro turbine sector.

Market Segmentation

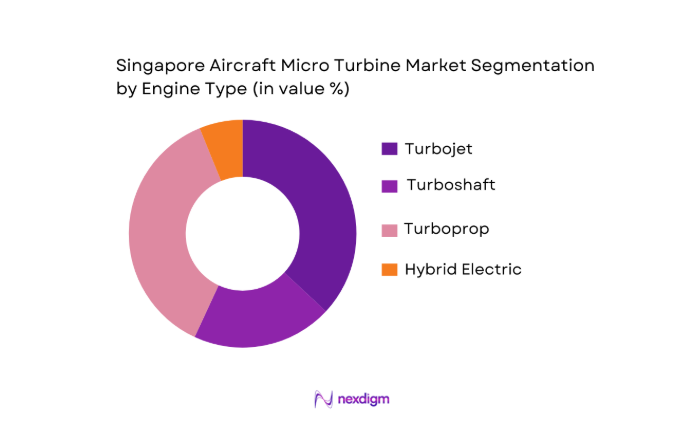

By Engine Type

The Singapore aircraft micro turbine market is segmented by engine type into turbojet, turboshaft, and turboprop micro turbines, as well as hybrid electric turbines. Currently, turbojet micro turbines dominate the market due to their widespread use in UAVs and light aircraft. The efficiency and compactness of turbojets make them ideal for both military and civilian applications, particularly in UAV propulsion systems. Additionally, advancements in fuel efficiency and thrust-to-weight ratio are contributing to their continued dominance in the market.

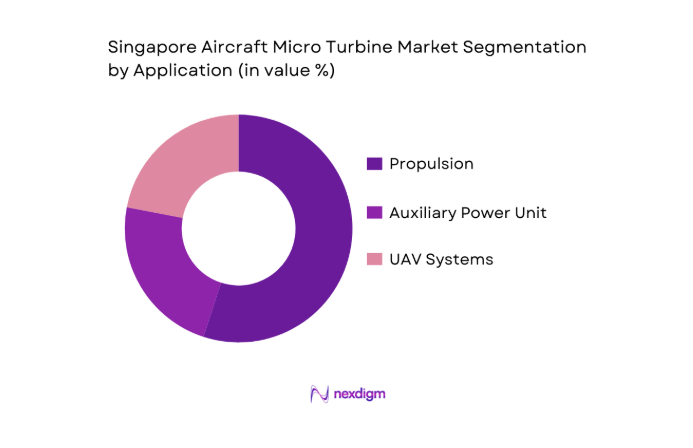

By Application

The market is also segmented based on application, including propulsion, auxiliary power units (APUs), and UAV systems. Propulsion systems dominate the market share due to the critical role that micro turbines play in providing efficient and lightweight propulsion for both military and commercial aviation. This is especially evident in the growing use of UAVs in various industries like defense, surveillance, and cargo delivery. The need for compact, high-efficiency turbines in these applications drives the demand for propulsion-based micro turbines.

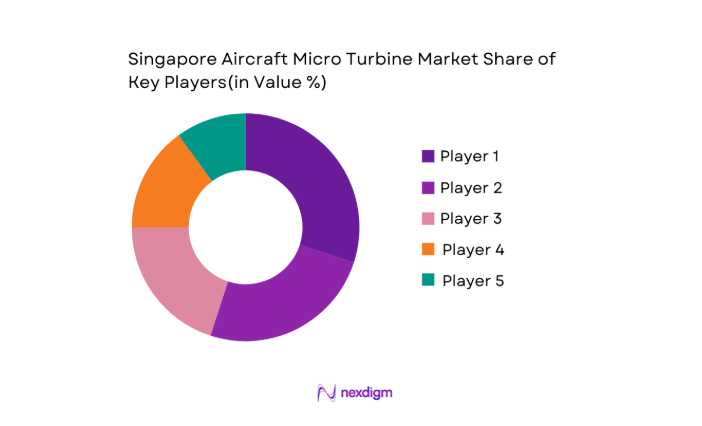

Competitive Landscape

The Singapore aircraft micro turbine market is highly competitive, with a mix of global players and regional firms vying for market share. Major players include Rolls-Royce, Honeywell, and Safran, who lead the market in terms of innovation, product offerings, and partnerships with aerospace manufacturers. Local companies in Singapore, such as Pacific Turbine Australia and Capstone Turbine, are also making significant strides in the development of micro turbines, particularly for UAV and defense applications.

| Company | Establishment Year | Headquarters | Products/Services | Market Positioning | R&D Focus Area | Strategic Partnerships |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | United States | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| Capstone Turbine | 1988 | United States | ~ | ~ | ~ | ~ |

| Pacific Turbine Australia | 2002 | Singapore | ~ | ~ | ~ | ~ |

Singapore Aircraft Micro Turbine Market Analysis

Growth Drivers

Fuel Efficiency Demands

The demand for fuel-efficient propulsion systems is on the rise due to increasing global fuel prices and a push for sustainable aviation practices. The global aviation industry consumed over ~ gallons of jet fuel in 2022, according to the U.S. Energy Information Administration (EIA). Rising fuel costs, which have reached as high as USD ~ per barrel in early 2024, are prompting airlines and defense sectors to seek more efficient engines that reduce fuel consumption and operating costs. Additionally, fuel efficiency is central to environmental regulations, with the International Civil Aviation Organization (ICAO) setting stringent emissions reduction goals for the next decade. This shift towards efficiency is expected to push micro turbine demand, as they offer higher fuel-to-power ratios than traditional piston engines.

UAV Adoption

The adoption of Unmanned Aerial Vehicles (UAVs) is growing rapidly, supported by increased applications in both military and civilian sectors. In 2024, the global UAV market was valued at approximately USD ~ and is set to expand with military spending on drones projected to reach USD ~ in 2025. UAVs are being utilized in diverse sectors, from defense and surveillance to logistics and agriculture. Singapore, being a hub for technological innovation, has significantly invested in UAV infrastructure, which drives the need for efficient micro turbines. With over 10,000 commercial drones projected to be in use by 2025 in Southeast Asia alone, micro turbines are seen as a key enabler for enhanced drone efficiency and payload capacity.

Market Challenges

Certification Hurdles

Certification remains a key challenge for micro turbines, particularly in the context of aviation regulations. In 2024, the European Union Aviation Safety Agency (EASA) highlighted delays in the certification process for small aircraft engines, including micro turbines. The certification process is time-consuming and costly, often taking 2-3 years for new engine types to be fully approved. This delay is exacerbated by the high complexity of ensuring that micro turbines meet stringent safety and environmental standards. For example, the certification of hybrid propulsion systems, which are becoming more common in UAVs, has faced additional scrutiny due to their novel design and integration challenges, creating bottlenecks for manufacturers.

Supply Chain Constraints

The micro turbine market faces significant supply chain challenges, especially related to the sourcing of advanced materials and components. In 2024, global supply chain disruptions have impacted the aerospace industry, with critical parts such as high-performance alloys and specialized turbines facing delays. For instance, shortages of rare earth metals, essential for producing turbine blades, have resulted in extended lead times for manufacturers. According to the World Trade Organization, global supply chain disruptions are expected to continue into 2025, influencing production timelines. These disruptions create uncertainty for manufacturers and increase operational costs, making it difficult to meet growing demand in the micro turbine sector, especially for new UAV and UAM platforms.

Market Opportunities

Hybrid Electric Aircraft

Hybrid electric aircraft are an emerging opportunity within the aviation sector. With increased emphasis on reducing carbon emissions and improving fuel efficiency, hybrid systems that combine micro turbines and electric motors are gaining traction. In 2024, the global aviation industry saw more than 15 hybrid electric aircraft prototypes tested, with a significant push from companies in Europe and North America. This innovation aligns with the global aviation industry’s goal to reduce carbon emissions by ~ by 2050, as outlined by the International Air Transport Association (IATA). Hybrid propulsion systems offer the promise of cleaner, quieter, and more efficient aircraft, making micro turbines integral to future aviation designs, especially in small aircraft and UAM programs.

SAF Compliance

Sustainable Aviation Fuel (SAF) compliance is a significant market opportunity for micro turbines. As airlines and aerospace companies work towards achieving net-zero emissions, SAF has become a cornerstone of aviation decarbonization strategies. In 2024, over ~ flights globally used SAF, with production capacity expected to increase by ~ by 2025. The Civil Aviation Authority of Singapore (CAAS) has been actively involved in SAF development, including partnerships with local refineries to ensure a steady supply. Micro turbines, particularly those used in smaller aircraft and UAVs, are increasingly designed to be SAF-compliant, allowing for reduced emissions and better fuel efficiency. This growing trend presents significant opportunities for turbine manufacturers to align with global sustainability goals.

Future Outlook

The future of the Singapore aircraft micro turbine market looks promising, with significant growth expected over the next few years. The rising demand for more efficient and sustainable propulsion systems, coupled with increasing UAV and UAM applications, will continue to drive market growth. With government support, technological advancements, and a focus on reducing carbon emissions, Singapore’s aerospace industry is well-positioned to be a leader in the development of micro turbine technologies.

Major Players

- Rolls-Royce

- Honeywell International

- Safran

- Capstone Turbine

- Pacific Turbine Australia

- General Electric

- Williams International

- PBS Group

- Bladon Jets

- JetCat GmbH

- Microturbo

- Turbotech SARL

- Elliott Company

- UAV Engines Ltd.

- KHI Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- UAV Manufacturers

- Urban Air Mobility Developers

- Military and Defense Contractors

- OEMs

- MRO Service Providers

- Aerospace Engineering Firms

Research Methodology

Step 1: Identification of Key Variables

In this step, we will construct an ecosystem map that identifies the critical stakeholders in the Singapore aircraft micro turbine market. This includes turbine manufacturers, UAV developers, military contractors, and aviation regulators. Desk research, including proprietary databases, will be used to gather industry-level information on key drivers and restraints.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data from the micro turbine market. We will evaluate product penetration, platform adoption, and regional revenue generation. A thorough evaluation of market size and application will ensure accurate growth projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations with industry leaders, including aerospace manufacturers, UAV specialists, and defense contractors. These insights will provide a practical understanding of the dynamics influencing the micro turbine market in Singapore.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with manufacturers and developers in the region. Their insights into product segments, market demands, and technological trends will be used to refine the final report and ensure its accuracy and relevancy to stakeholders in the Singapore aircraft micro turbine market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Fuel efficiency demands

UAV adoption

UAM programs - Market Challenges

Certification hurdles

supply chain constraints - Opportunities

Hybrid electric aircraft

SAF compliance

regional defense procurements

Emerging Trends

Digital twin engine monitoring

additive manufacturing in turbine components - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Engine Type (In Value %)

Turbojet micro turbines

Turboshaft micro turbines

Turboprop micro turbines

Hybrid electric integrated micro turbines - By Installation Type (In Value %)

OEM Installed Engines

Aftermarket & Retrofit Engines - By Fuel Type (In Value %)

Jet fuel

Sustainable Aviation Fuel compatible

Multi‑fuel capable turbines - By Application (In Value %)

Propulsion

Auxiliary Power Unit

UAV & RPAS propulsion - By Horsepower / Output Class (In Value %)

Sub‑50 HP

50–100 HP

100–200 HP

Above 200 HP

- Market Share of Major Players

- Cross Comparison Parameters (Engine Output Efficiency, Fuel Type Flexibility, Aftermarket Service Footprint, Certification Approvals, Supply Chain Localization, UAV/UAM Platform Adoption Index)

- SWOT Analysis of Key Competitors

- Pricing Analysis of Major Players

- Detail Profile of Major Players

Rolls‑Royce Holdings plc

Honeywell International Inc.

General Electric

Pratt & Whitney

Safran S.A.

Williams International Co.

PBS Group

Elliott Company

Bladon Jets Ltd.

JetCat GmbH

Turbotech SARL

Capstone Turbine Corporation

UAV Engines Limited

Microturbo

KHI Corporation

- End‑User Cost Sensitivity

- Performance Priorities

- Certification & Compliance Risk Appetite

- Integration & Lifecycle Support Requirements

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035