Market Overview

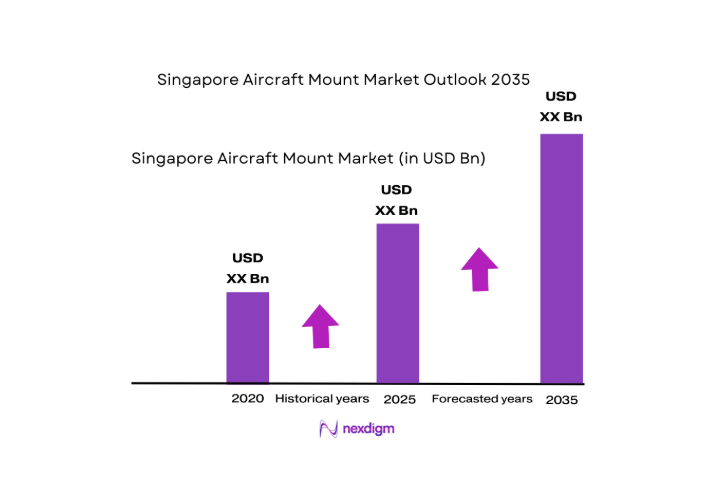

The Singapore Aircraft Mount Market is valued at USD ~ as of 2024, driven primarily by the growth of the aviation sector in Singapore, which is a key hub in the Asia-Pacific region. The market has been steadily growing due to the increasing fleet size of airlines in the region and the expansion of the Maintenance, Repair, and Overhaul industry in Singapore. The country’s strategic position as a key aerospace hub for Southeast Asia and strong infrastructure support, including Changi Airport’s growth, are key drivers behind this market. Additionally, the increasing demand for lightweight materials and high-performance components is pushing the market’s expansion.

Singapore leads the Aircraft Mount Market in Southeast Asia due to its strong presence in the aviation sector. The city-state’s advanced aerospace industry, including MRO services provided by SIA Engineering Company, and proximity to major Asian airline fleets make it a dominant force. Other significant players in the market include Malaysia, Indonesia, and Thailand, which also contribute heavily due to their rapidly growing commercial fleets and rising demand for aviation maintenance services. Singapore’s reputation as an international aviation hub and its well-established infrastructure support this market dominance.

Market Segmentation

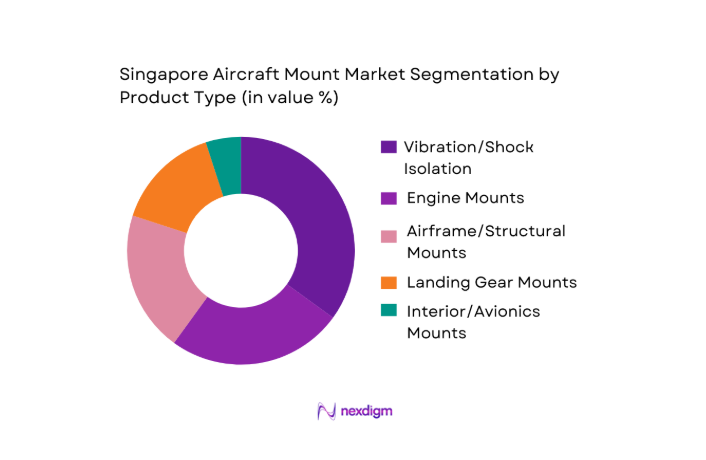

By Product Type

The Singapore Aircraft Mount market is segmented by product type into vibration/shock isolation mounts, engine mounts, airframe/structural mounts, landing gear mounts, and interior/avionics mounts. Among these, vibration/shock isolation mounts dominate the market due to their crucial role in reducing engine vibrations and ensuring smooth aircraft operations. These mounts are integral in ensuring the safety and comfort of passengers, which drives their demand, especially with newer, larger aircraft in operation. As aircraft manufacturers and airlines focus on performance efficiency, vibration/shock isolation mounts remain a top priority in the market.

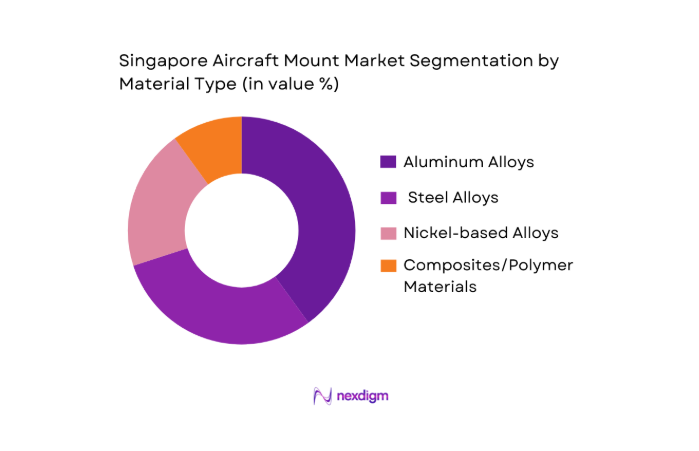

By Material Type

The market is further segmented by material type, including aluminum alloys, steel alloys, nickel-based alloys, and composites/polymer materials. Aluminum alloys dominate the material segment due to their lightweight characteristics, high corrosion resistance, and cost-effectiveness. These materials are commonly used in aircraft mounts, making them the leading choice in the Singapore market, especially given the region’s emphasis on reducing weight for fuel efficiency in commercial fleets.

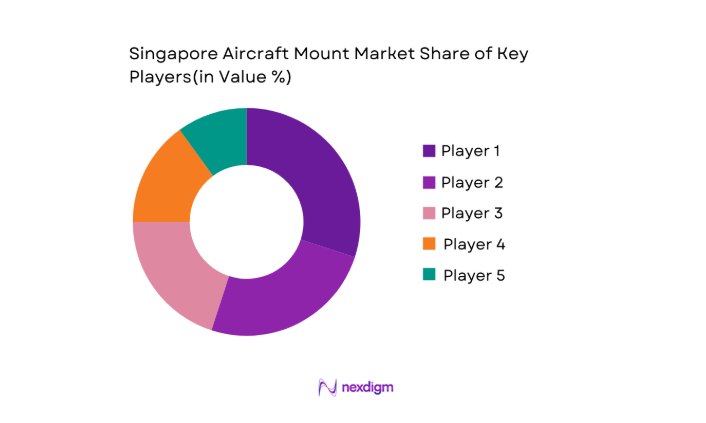

Competitive Landscape

The Singapore Aircraft Mount Market is competitive, with several global and regional players leading the market. Companies like LORD Corporation, Trelleborg, and Parker Hannifin dominate due to their strong product portfolios and established relationships with OEMs and MRO service providers. The market also sees regional competition from companies like SAM Suzho, a key player in the APAC region, providing specialized mounts for military and commercial aircraft.

| Company Name | Established Year | Headquarters | Product Portfolio | Market Presence | Manufacturing Capacity | Strategic Partnerships |

| LORD Corporation | 1924 | USA | ~ | ~ | ~ | ~ |

| Trelleborg AB | 1905 | Sweden | ~ | ~ | ~ | ~ |

| Parker Hannifin Corporation | 1917 | USA | ~ | ~ | ~ | ~ |

| Cadence Aerospace | 1998 | USA | ~ | ~ | ~ | ~ |

| SAM Suzho | 1992 | China | ~ | ~ | ~ | ~ |

Singapore Aircraft Mount Market Analysis

Growth Drivers

Airline Fleet Expansion & Route Reopenings

The expansion of airline fleets in the Asia-Pacific region plays a critical role in driving the Singapore Aircraft Mount market. As of 2024, airlines in the region are projected to add more than ~ aircraft to their fleets by 2026, with the Asia-Pacific region accounting for approximately ~ of global fleet growth. This growth is fueled by increasing passenger demand, particularly within Southeast Asia, where air traffic has seen a consistent increase. In 2024, Singapore Airlines alone expects to add 30 new aircraft to its fleet by 2026, contributing significantly to the demand for high-quality aircraft mounts. Additionally, the reopening of international routes post-pandemic is expected to support this growth, as airlines look to resume and expand their operations across global networks.

Singapore as APAC MRO Hub

Singapore has solidified its position as a key aerospace hub, particularly for MRO activities, providing a stable environment for the demand for aircraft mounts. In 2024, the country is expected to handle over ~ of Asia-Pacific’s total MRO spending, valued at USD ~. Singapore’s established infrastructure, such as Changi Airport and its world-class engineering facilities, supports this status. The Singapore Airshow in 2024 is projected to attract more than ~ exhibitors, further cementing its role in fostering a growing aviation ecosystem. This positioning directly influences the demand for aircraft components, including mounts, as airlines increasingly rely on the country for efficient MRO services.

Market Challenges

Supply Chain Bottlenecks

The aircraft mount industry faces challenges related to supply chain disruptions, particularly in the Asia-Pacific region. As of 2024, the global aviation supply chain is still recovering from the effects of the COVID-19 pandemic, leading to delays in component deliveries and longer lead times. Aircraft mount manufacturers in Singapore face supply chain bottlenecks due to dependence on key materials such as aluminum and nickel-based alloys, both of which have seen price fluctuations and delivery delays. Furthermore, shipping disruptions in major ports, like those in Shanghai and Singapore, continue to affect the timely delivery of components. In 2024, Singapore’s MRO sector is experiencing a backlog of around 2 months for routine maintenance services, a delay primarily attributed to part shortages and production slowdowns.

Regulatory Certification Complexity

Regulatory certification remains a challenge in the aircraft mounts market, particularly due to stringent airworthiness standards set by the Civil Aviation Authority of Singapore and global bodies like the Federal Aviation Administration. Aircraft mounts, as critical safety components, must meet detailed approval requirements, including fatigue testing, material safety assessments, and vibration analysis. In 2025, the process of obtaining these certifications has been significantly lengthened due to more rigorous testing procedures, with approval times for new mounts stretching over 12 months. For instance, new material certification for advanced composites is anticipated to add an additional 6 months to approval timelines. As a result, manufacturers in Singapore must factor in these long certification cycles into their production schedules, impacting their ability to quickly scale operations to meet demand.

Market Opportunities

Smart/Sensor-Enabled Mounts for Predictive Maintenance

The growing adoption of smart technologies in the aviation sector is a promising opportunity for the aircraft mounts market. As of 2025, more than ~ of commercial aircraft globally are being equipped with Internet of Things sensors for predictive maintenance. These sensors allow airlines to monitor the performance of critical components, including aircraft mounts, in real-time. In Singapore, the government is heavily investing in digital transformation for aviation, with a focus on smart airports and predictive maintenance technology. This has led to an increased demand for sensor-enabled aircraft mounts that can provide live data on structural health and vibration levels, allowing airlines to proactively address issues before they lead to failures.

3D-Printed Custom Mounts

3D printing technology is expected to revolutionize the aircraft mount market, particularly in the manufacturing of custom mounts. In 2025, 3D printing is becoming increasingly used for producing lightweight, high-strength aircraft components. For example, Singapore’s aerospace sector is adopting additive manufacturing techniques, with over 100 aircraft components, including mounts, being printed annually. The ability to create custom mounts with reduced lead times and improved precision is providing a competitive advantage. Major airlines in Singapore, such as Singapore Airlines, are exploring the use of 3D printing to produce replacement parts on-demand, reducing inventory costs and minimizing downtime during maintenance.

Future Outlook

The Singapore Aircraft Mount Market is expected to experience steady growth over the next decade, driven by the increasing demand for high-performance, lightweight materials in aviation. Key factors such as the expansion of the Asia-Pacific airline fleet, growing MRO activities in Singapore, and advancements in aircraft manufacturing technologies will continue to drive the demand for specialized aircraft mounts. Additionally, the rise of advanced materials and smart sensors for predictive maintenance will open up new opportunities within the market, contributing to its expansion.

Major Players

- LORD Corporation

- Trelleborg AB

- Parker Hannifin Corporation

- Cadence Aerospace

- SAM Suzho

- VMC Group

- Shock Tech Inc.

- Acorn Welding

- Mayday Manufacturing

- Continental Aerospace Technologies

- EPI Inc.

- AirLoc Ltd.

- GMT Rubber-Metal-Technic Ltd.

- VibraSystems Inc.

- Airframe Components Inc.

Key Target Audience

- Aircraft OEMs

- MRO Service Providers

- Aviation Fleet Operators

- Airline Procurement Managers

- Defense and Military Aviation Authorities

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Component Suppliers and Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research focuses on understanding the core drivers of the Singapore Aircraft Mount Market, such as demand from aircraft OEMs, MRO activities, and regulatory compliance. This is achieved through a combination of desk research, secondary data collection, and primary interviews with industry professionals.

Step 2: Market Analysis and Construction

In this step, we will assess historical market data, including trends in aircraft fleet growth, material innovations, and advancements in aircraft maintenance. This analysis will help create a comprehensive view of the market size and potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth and challenges will be tested through discussions with industry experts, including engineers, fleet operators, and MRO service providers. These consultations will help validate the data collected in previous phases and refine the analysis.

Step 4: Research Synthesis and Final Output

This phase involves compiling all research data and insights into a detailed report. We will engage with manufacturers and key industry stakeholders to gather final inputs and ensure the accuracy of our findings, ensuring the report provides actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Airline Fleet Expansion & Route Reopenings

Singapore as APAC MRO Hub

Commercial Aircraft Orders & Fleet Modernization

- Market Challenges

Supply Chain Bottlenecks

Regulatory Certification Complexity

- Opportunities

Smart/Sensor‑Enabled Mounts for Predictive Maintenance

3D‑Printed Custom Mounts

Growth in Defense Aviation Procurement

- Market Trends

Shift to Advanced Composites

Integrated MRO + Aftermarket Service Models

- Government Regulations & Certifications

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Aircraft Mount Type (In Value %)

Vibration/Shock Isolation Mounts

Engine Mounts

Airframe/Structural Mounts

Landing Gear Mounts

- By Material Technology (In Value %)

Aluminum Alloys

Steel Alloys & Specialty Steel

Nickel‑Based Alloys

Composites & Polymer Materials - By End‑Use/Application (In Value %)

Commercial Aircraft

Defense & Military Platforms

Business & General Aviation

MRO Aftermarket Services - By Supply Chain Tier (In Value %)

OEM Direct

Tier‑1

Tier‑2 - By Procurement/Fit Type (In Value %)

Line‑Fit

Retrofit/Replacement Market

- Market Share of Major Players

- Cross Comparison Parameters (Mount Performance, Material Innovation Score, Certification Footprint, Aftermarket Service Coverage, Price Competitiveness)

- SWOT Analysis of Key Players

- Pricing Analysis Across Major Competitors

- Detailed Profiles of Major Players

LORD Corporation

Trelleborg AB

Cadence Aerospace

GMT Rubber‑Metal‑Technic Ltd.

VibraSystems Inc.

Shock Tech, Inc.

AirLoc Ltd.

VMC Group

MAYDAY Manufacturing

Parker Hannifin Corporation

Continental Aerospace Technologies

Acorn Welding

EPI Inc.

SAM Suzho

Regional/Local MRO OEM Partners

- End‑User Decision Factors

- Performance & Reliability Requirements

- Certification & Compliance Mandates

- Total Cost of Ownership

- Aftermarket Support & MRO Service Level Agreements

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035