Market Overview

The Singapore Aircraft Nacelle Systems Market is valued at USD ~ billion. The market is driven by the expansion of the aviation sector in the Asia-Pacific region, particularly in Southeast Asia, where air travel has grown significantly. The demand for advanced aircraft nacelle systems has increased due to the need for lighter, fuel-efficient, and low-emission systems to reduce operational costs for airlines. The growth in both commercial and military aircraft production in Singapore, along with its strategic positioning as a regional aerospace hub, supports the increasing demand for nacelle systems. Additionally, ongoing investments by major players in innovation, including lightweight composite materials and noise-reduction technologies, are further driving market expansion.

Singapore stands as the dominant player in the Southeast Asia aircraft nacelle systems market due to its strategic location as a key aerospace and defense hub. The country boasts a robust aerospace manufacturing ecosystem with key players like ST Aerospace and Rolls-Royce Singapore. In addition to Singapore, other countries in the region, such as Thailand and Malaysia, also play significant roles due to their expanding aviation industries. Singapore, however, remains the market leader due to its established aerospace infrastructure, skilled workforce, and proximity to major air travel routes, making it a preferred destination for aerospace companies and suppliers.

Market Segmentation

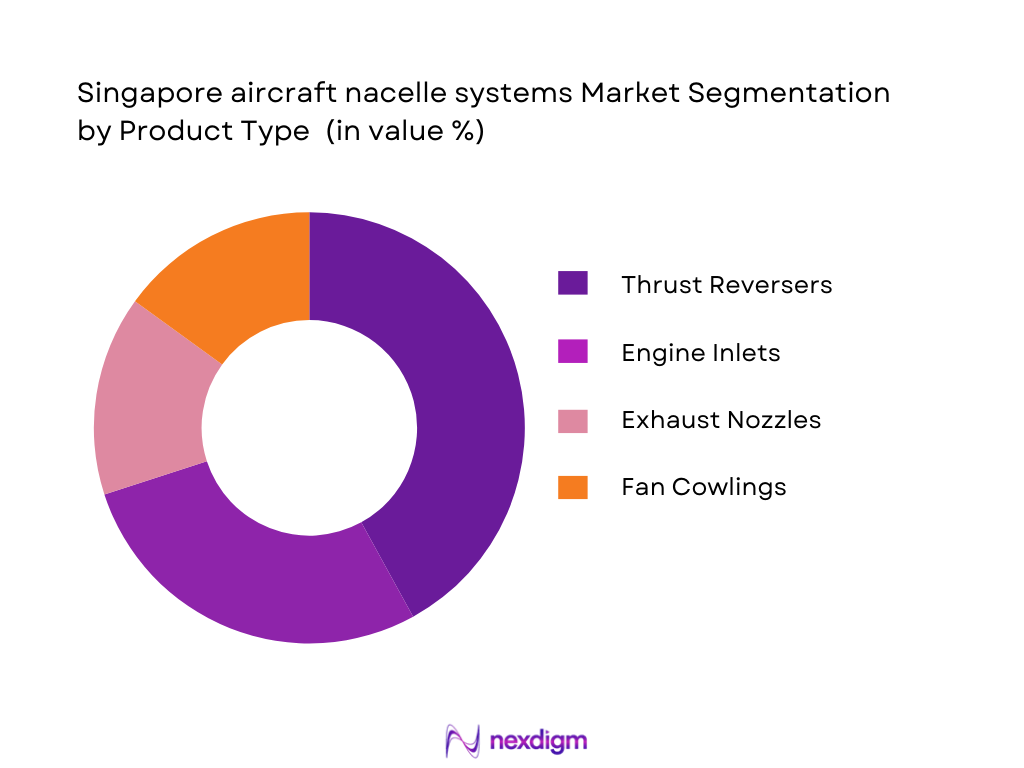

By Product Type

The Singapore Aircraft Nacelle Systems Market is segmented by product type into various components including Thrust Reversers, Engine Inlets, Exhaust Nozzles, and Fan Cowlings. Among these, the Thrust Reverser segment dominates the market, driven by its critical role in aircraft operations. Thrust reversers are essential for aircraft deceleration during landing, making them a high-demand component in commercial and military aircraft. The continuous advancements in thrust reverser systems, such as the development of lightweight materials and noise reduction technologies, further contribute to the dominance of this segment. Additionally, global regulations requiring noise reduction during takeoff and landing have accelerated the adoption of advanced thrust reverser systems, strengthening this segment’s market position.

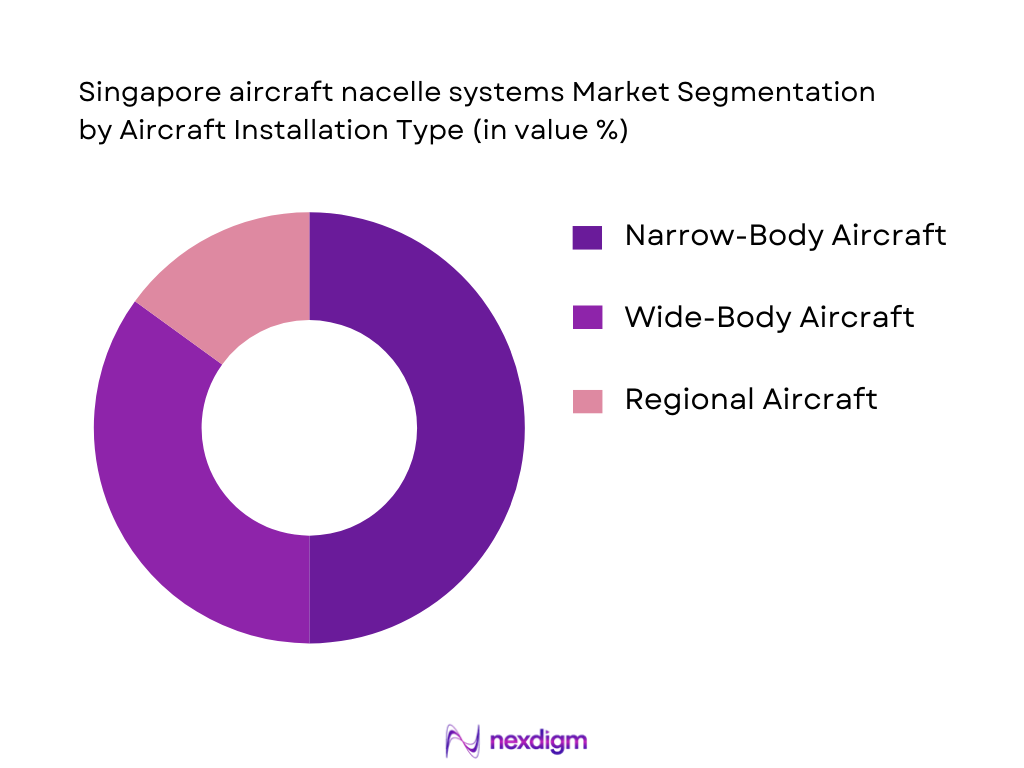

By Aircraft Installation Type

The market is segmented by aircraft installation type into Narrow-Body Aircraft, Wide-Body Aircraft, and Regional Aircraft. Narrow-body aircraft installations lead the segment due to their widespread use in commercial aviation. Airlines prefer narrow-body aircraft for short to medium-haul flights, where nacelle systems play a key role in enhancing fuel efficiency and reducing operational costs. As the demand for budget carriers and low-cost airlines rises, especially in the Southeast Asia region, the market share of narrow-body aircraft installations continues to expand. This segment also benefits from the growing trend towards lightweight nacelle solutions aimed at improving fuel efficiency and reducing emissions.

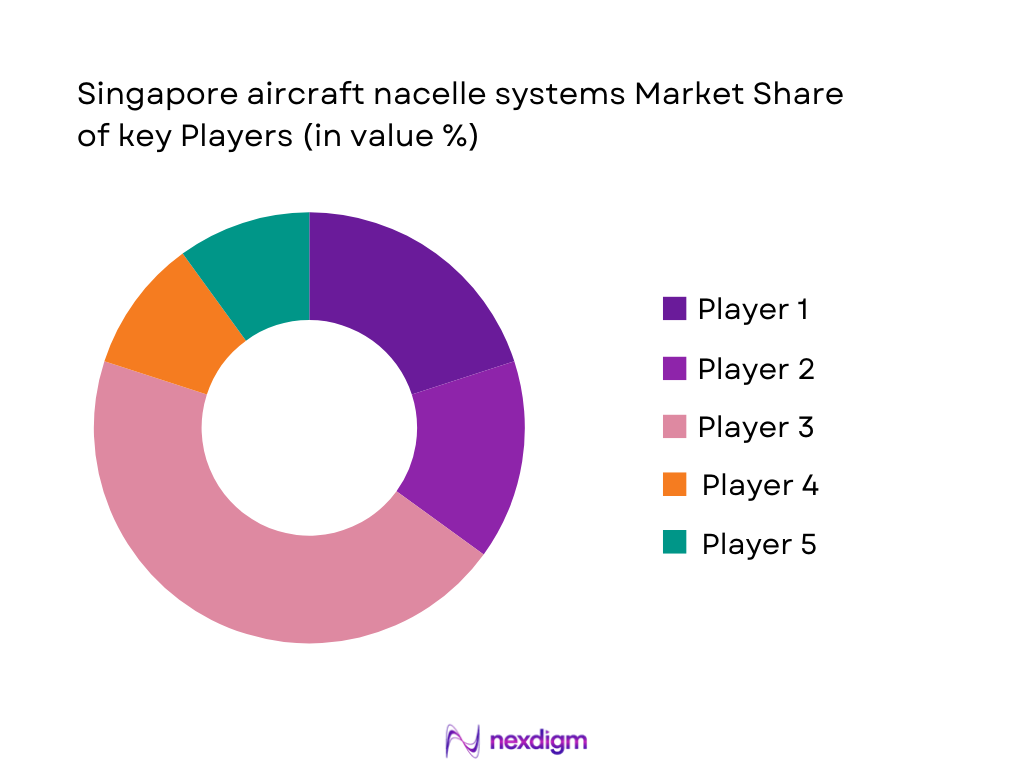

Competitive Landscape

The Singapore Aircraft Nacelle Systems Market is characterized by the presence of a few major players, including global giants like Rolls-Royce, Safran, and Spirit AeroSystems. These companies have established themselves as leaders due to their technological expertise, strong research and development pipelines, and extensive global reach. Other players, such as ST Aerospace and NORDAM, also hold a significant market share due to their deep ties with regional aerospace companies and their focus on offering innovative, cost-efficient solutions tailored to local market needs.

| Company | Establishment Year | Headquarters | Revenue (USD) | Product Portfolio | Market Position | Technology Focus |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| Spirit AeroSystems | 2005 | United States | ~ | ~ | ~ | ~ |

| ST Aerospace | 1982 | Singapore | ~ | ~ | ~ | ~ |

| NORDAM | 1969 | United States | ~ | ~ | ~ | ~ |

Singapore Aircraft Nacelle Systems Market Analysis

Growth Drivers

Fleet Growth

Singapore’s strategic position as a global aviation hub has driven significant fleet growth, particularly with Singapore Airlines and regional carriers expanding their aircraft portfolios. The national carrier has been continually investing in new aircraft, including the Boeing 787 and Airbus A350, both of which require state-of-the-art nacelle systems. As the demand for air travel continues to grow across Southeast Asia, the need for more advanced, efficient nacelle systems increases. Fleet expansion also leads to retrofitting and replacement of older nacelles, further boosting the market for modern, high-performance nacelle solutions.

Fuel-Efficiency Systems Demand

Fuel-efficiency has become a central focus within the aviation industry, and Singapore’s carriers are no exception. In an effort to meet both sustainability goals and cost-reduction targets, airlines in Singapore are increasingly adopting fuel-efficient aircraft. Modern nacelle systems play a crucial role in achieving these objectives by reducing drag and optimizing airflow around engines. With global and regional pressure on reducing carbon emissions, the demand for nacelles that support more fuel-efficient engines, particularly on long-haul routes, has significantly grown. This trend is expected to continue as airlines aim to improve fuel efficiency and reduce operational costs.

Market Restraints

Certification Complexity

The certification process for nacelle systems is highly complex and time-consuming, which can pose a restraint on market growth in Singapore. Nacelles are critical components that affect both the safety and performance of aircraft, requiring rigorous testing to meet global safety standards set by agencies such as the Civil Aviation Authority of Singapore (CAAS), EASA, and the FAA. The certification involves numerous phases, including aerodynamic testing, noise compliance, and environmental performance checks, all of which can delay the introduction of new nacelle technologies into the market. Additionally, the costs associated with this certification process can be a barrier for manufacturers.

Supply Chain Constraints

The supply chain for aircraft nacelle systems faces significant constraints, particularly in sourcing specialized materials and components required for their production. Due to the high level of engineering and the need for precision in manufacturing, nacelle systems rely on a network of suppliers for advanced materials such as composites, metals, and complex mechanical parts. Disruptions in the global supply chain, such as material shortages or geopolitical tensions, can lead to delays in production, impacting the timely delivery of nacelle systems. As the aviation industry in Singapore expands, these supply chain challenges could hinder manufacturers’ ability to meet growing demand.

Market Opportunities

Singapore OEM Clusters

Singapore’s established position as a leader in aerospace manufacturing presents a significant opportunity for the aircraft nacelle systems market. The country is home to several Original Equipment Manufacturers (OEMs) and specialized aerospace companies, including key players in nacelle system design and manufacturing. The presence of major OEMs, such as Rolls-Royce and Pratt & Whitney, within Singapore’s aerospace ecosystem fosters collaboration, innovation, and a strong local supply chain for nacelle components. Additionally, Singapore’s robust infrastructure, skilled workforce, and supportive regulatory environment make it an ideal base for nacelle manufacturers to develop and test next-generation nacelle systems tailored to modern aircraft fleets.

Southeast Asia Demand

The growing demand for air travel in Southeast Asia presents an immense opportunity for the aircraft nacelle systems market in Singapore. As the region’s aviation industry expands, there is a rising need for efficient and technologically advanced nacelle systems. Southeast Asia is experiencing significant fleet growth, with airlines across the region investing in modern, fuel-efficient aircraft. This increase in fleet size and modernization creates a demand for advanced nacelle solutions that optimize engine performance and fuel efficiency. Singapore, as a central player in Southeast Asia’s aerospace ecosystem, is well-positioned to capitalize on this demand and supply nacelle systems to both regional and international markets.

Future Outlook

Over the next few years, the Singapore Aircraft Nacelle Systems Market is expected to show significant growth driven by continuous government support, advancements in lightweight nacelle materials, and increasing demand for fuel-efficient solutions. The shift towards electric and hybrid propulsion systems is expected to further impact the nacelle market, driving innovation in design and materials. Furthermore, as Singapore continues to strengthen its position as a key aerospace hub in the Asia-Pacific region, its role in nacelle system production and innovation will remain pivotal. The market is also anticipated to benefit from the expansion of regional aircraft fleets and increasing demand from military aircraft programs.

Major Players

- Rolls-Royce

- Safran

- Spirit AeroSystems

- ST Aerospace

- NORDAM

- GKN Aerospace

- Honeywell Aerospace

- Collins Aerospace

- Mitsubishi Heavy Industries

- Leonardo S.p.A

- MTU Aero Engines

- UTC Aerospace Systems

- Thales Group

- Parker Hannifin

- Liebherr Aerospace

Key Target Audience

- Aerospace Manufacturers

- Aircraft Operators

- Investment and Venture Capitalist Firms

- Airlines (Commercial, Military)

- OEMs (Original Equipment Manufacturers)

- Aircraft Maintenance & Repair Organizations (MRO)

- Government and Regulatory Bodies (Civil Aviation Authority of Singapore, FAA)

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the aerospace value chain, identifying all key stakeholders such as OEMs, suppliers, MRO providers, and regulatory bodies. This process includes comprehensive desk research to understand market dynamics and the factors driving the adoption of nacelle systems.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess the growth trajectory of the market. Key metrics such as market penetration rates, the ratio of commercial vs military aircraft, and their respective nacelle requirements will be evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from aerospace manufacturing, supply chain, and regulatory agencies will be consulted through interviews to validate market assumptions. These consultations will refine our market hypotheses and provide insights into emerging technologies, such as hybrid propulsion.

Step 4: Research Synthesis and Final Output

The final research phase includes validating findings with key market players, particularly those involved in the production of nacelle systems and aerospace technology. These insights will be synthesized to ensure an accurate, data-backed forecast for the market.

- Executive Summary

- Research Methodology (Research Scope & Singapore Market Boundaries, Primary & Secondary Data Triangulation, Aviation Ecosystem Data Sources, Assumptions & Nacelle‑Specific Definitions, Market Sizing & Validation Protocols, Limitations & Confidence Intervals)

- Global Aircraft Nacelle Systems Market vs Singapore Market Dynamics

- Market Genesis & Industry Adoption Trends

- Singapore Aerospace Ecosystem Positioning

- Supply & Value Chain Flow (OEMs → Tier‑1 → Tier‑2 → Aftermarket)

- Regulatory, Safety & Certification Context (CAAS, EASA, FAA)

- Singapore Export & Trade Enablers

- Growth Drivers

fleet growth

fuel‑efficiency systems demand

- Market Restraints

certification complexity

supply chain constraints

- Market Opportunities

Singapore OEM clusters

SE Asia demand

- Technology & Innovation Trends

composite nacelles

sensors

- Porter’s Five Forces

supplier power

entry barriers

competitive rivalry

- Value Chain Economics & Margin Pools

- Impact of Global Air Travel Recovery & Defense Spending

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Component (In Value %)

Thrust Reversers (system & mechanism)

Engine Inlets & Cowls

Fan Cowlings

Exhaust Nozzles & Plug Systems

Integrated Nacelle Structure Packages

- By Aircraft Installation Type (In Value %)

Narrow‑Body Commercial Aircraft

Wide‑Body Commercial Aircraft

Regional Aircraft

Business / Corporate Jets

Military & Defense Platforms

- By Engine Compatibility (In Value %)

Turbofan Engine Nacelle Systems

Turboprop Nacelle Systems

Hybrid / Electric Propulsion Systems

New‑Generation Ultra‑High Bypass Engines

- By Material & Technology Used (In Value %)

Advanced Composite Structures

Titanium / Aluminum Alloy Components

Multi‑Material Hybrid Solutions

Acoustic & Noise‑Mitigating System Technologies

- Market Shares (Value & Volume)

Market Share of Key Players (local vs global) - Cross‑Comparison Parameters (Product Portfolio Breadth, Advanced Material Adoption (e.g., composites share %), Certification & Compliance Footprint (CAAS/EASA/FAA), Singapore OEM/Integrator Partnerships, Aftermarket Service Penetration, R&D Investment in Noise & Drag Reduction, Production Footprint & Scalability (Seletar Park, Singapore), Supply Chain Integration & Localization)

- Company SWOT Analyses

- Regional OEM Support & Pricing Benchmarking

- Detailed Company Profiles

Safran Nacelles

Spirit AeroSystems

RTX Corporation (Collins Aerospace)

General Electric Aviation (nacelle OEM partners)

GKN Aerospace

NORDAM Group

Leonardo S.p.A

Composites Technology Research Malaysia (regional relevance)

Boeing Defense (nacelle assemblies)

Airbus (nacelle partnerships)

MTU Aero Engines (nacelle integrations)

Mitsubishi Aircraft (regional supply dynamics)

Parker Hannifin (actuation & nacelle systems components)

Honeywell Aerospace (systems adjuncts)

AJW Group (aftermarket MRO services)

- End‑User Demand Profiles

- Procurement Cycles & Lead Time Analysis

- Capital Allocation & Budgeting Trends

- Adoption Drivers (fuel savings, noise compliance, weight reduction)

- Operational Pain Points (lead times, certification gaps)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035