Market Overview

The Singapore Aircraft Paint Market is valued at approximately USD ~ million, primarily driven by the aviation sector’s continuous expansion. The market growth is influenced by the rapid growth of the aviation fleet, particularly with the rise in low-cost carriers (LCCs) and increased air travel within the Asia-Pacific region. Furthermore, demand for maintenance, repair, and overhaul (MRO) services plays a significant role, as airlines in Singapore regularly repaint their fleets to maintain brand aesthetics and protect aircraft from environmental factors. This market is also driven by the increasing adoption of high-performance coatings that offer improved fuel efficiency and longer service life for aircraft.

Singapore is one of the leading markets for aircraft paint, due to its strategic position as a hub for aviation in the Asia-Pacific region. The country is home to major MRO facilities and OEMs (Original Equipment Manufacturers) that require high-quality aircraft paints for their operations. The nation’s aviation ecosystem benefits from its status as an international aviation hub with a substantial presence of leading global airlines such as Singapore Airlines and regional carriers. Singapore’s regulatory standards, advanced aviation infrastructure, and thriving MRO sector make it a dominant player in the aircraft paint market.

Market Segmentation

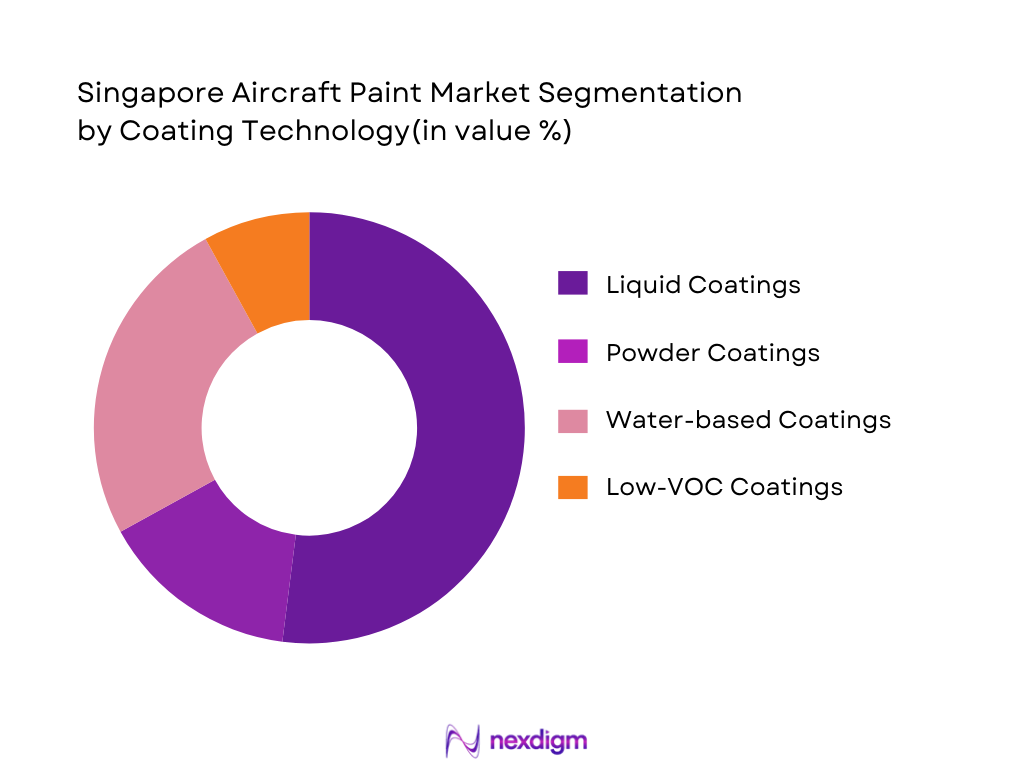

By Coating Technology

The Singapore Aircraft Paint Market is segmented into liquid coatings, powder coatings, water-based coatings, and low-VOC (volatile organic compound) coatings. Among these, liquid coatings dominate the market share, accounting for a significant portion of the market in 2025. This is mainly because liquid coatings offer superior durability and aesthetic appeal, which are crucial for both functional and branding purposes in the aviation sector. Liquid coatings are commonly used in both OEM and MRO applications for their ease of application and versatility across various aircraft components. The ongoing trend towards low-VOC and water-based coatings is also gaining traction due to the increasing environmental regulations and demand for eco-friendly solutions.

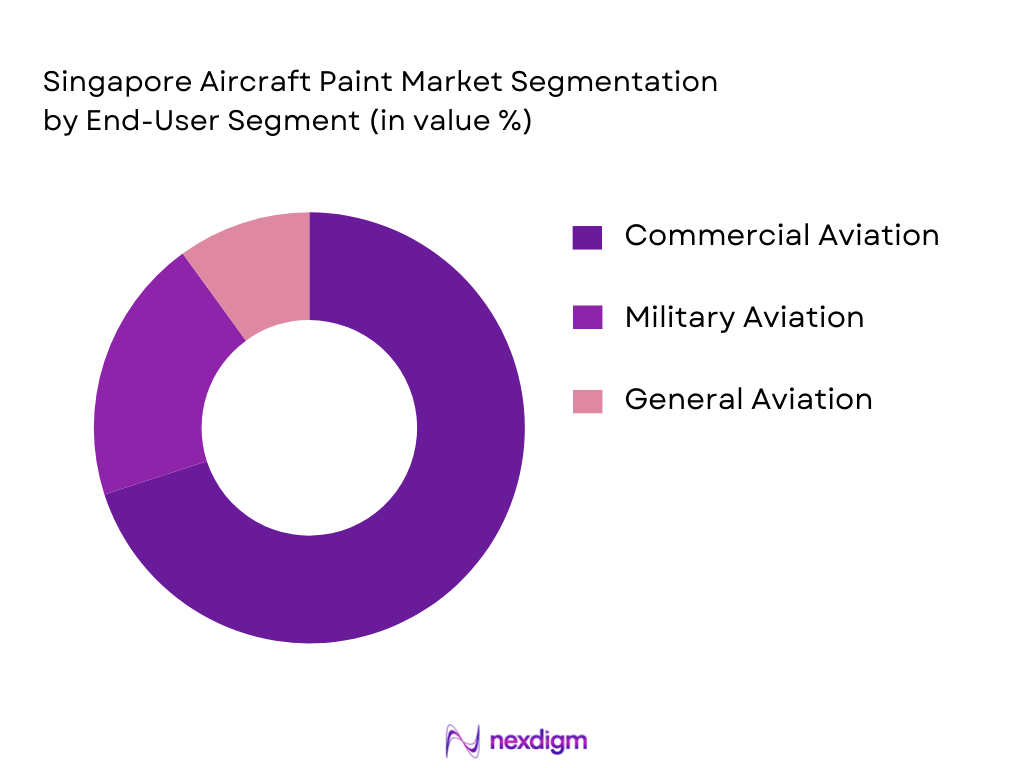

By End-User Segment

The aircraft paint market in Singapore is divided into commercial aviation, military aviation, and general aviation segments. The commercial aviation segment leads the market, comprising a substantial share due to the significant fleet of airlines operating in Singapore, including regional carriers. These airlines require regular repainting services as part of fleet maintenance and branding. Military aviation also contributes notably, driven by governmental demand for paint that meets specific durability and camouflage requirements. General aviation, while smaller, still maintains a steady demand driven by private jet operators and air charter services.

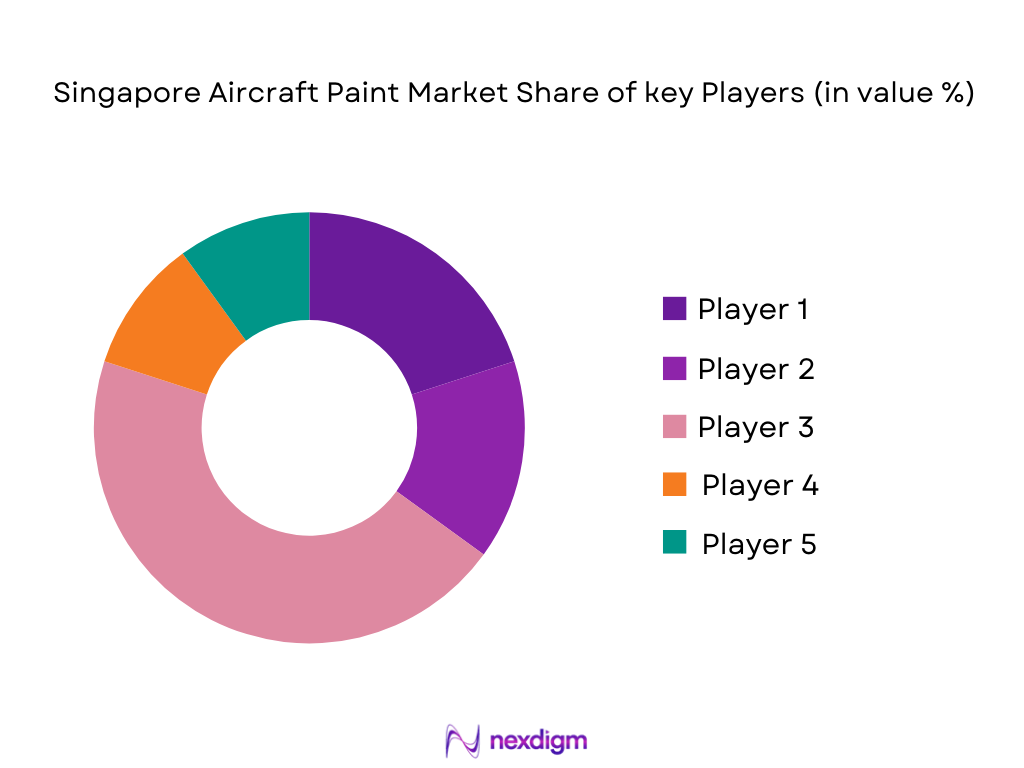

Competitive Landscape

The Singapore Aircraft Paint Market is dominated by several major players, including both global and regional companies. These players provide a wide range of coatings, from standard to highly specialized formulations that cater to the diverse needs of commercial and military aviation.

The competitive landscape is marked by innovation in coating technologies, with a growing trend towards eco-friendly formulations that meet increasingly stringent environmental standards. Key players are focusing on establishing long-term contracts with airlines and MRO facilities to secure a steady demand for their products. Companies like AkzoNobel and PPG Aerospace lead the market due to their strong global presence, advanced technologies, and comprehensive service offerings.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Leadership | R&D Investment | Market Strategy | Production Facilities |

| AkzoNobel | 1920 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ |

| PPG Aerospace | 1883 | Pittsburgh, USA | ~ | ~ | ~ | ~ | ~ |

| Sherwin-Williams | 1866 | Cleveland, USA | ~ | ~ | ~ | ~ | ~ |

| BASF Coatings | 1865 | Ludwigshafen, Germany | ~ | ~ | ~ | ~ | ~ |

| Mankiewicz | 1895 | Germany | ~ | ~ | ~ | ~ | ~ |

Singapore Aircraft Paint Market Analysis

Growth Drivers

Expanding Singapore MRO Hub Demand (MRO Paint Cycles & Repaints)

Singapore’s strong position as a leading Maintenance, Repair, and Overhaul (MRO) hub in Asia Pacific significantly drives demand for aircraft paint. The country’s key MRO centers, such as SIA Engineering Company, have seen growing demand for aircraft repainting services due to the frequent maintenance cycles required by commercial airlines and operators in the region. With airlines operating fleets across long service periods, repainting is essential for preserving aesthetics, protecting the aircraft structure from corrosion, and meeting brand requirements. This recurring demand for paint in MRO services, driven by frequent paint cycles and necessary repaints, significantly contributes to the growth of the aircraft paint market in Singapore.

Aviation Fleet Expansion & LCC Growth in APAC

The rapid expansion of the aviation fleet and the growth of low-cost carriers (LCCs) in the Asia-Pacific (APAC) region are key drivers for the aircraft paint market in Singapore. Airlines such as Singapore Airlines, Scoot, and other regional carriers continue to expand their fleets, which increases the demand for new aircraft paint applications. Additionally, the rise of LCCs, which often operate in high-turnover routes with frequent fleet updates, further accelerates the demand for paint and repainting services. As the APAC region remains one of the fastest-growing aviation markets globally, the fleet expansion and LCC growth will continue to stimulate significant demand for aircraft coatings in Singapore.

Market Restraints

Regulatory Compliance on VOC/HAPS Emissions

A major restraint in the Singapore Aircraft Paint Market is the regulatory compliance concerning volatile organic compound (VOC) and hazardous air pollutant (HAPS) emissions in aircraft coatings. Regulations by agencies such as the Singapore Environmental Protection Agency and global standards such as the International Civil Aviation Organization (ICAO) are placing increasing pressure on aircraft paint manufacturers to reduce the environmental impact of their products. Aircraft coatings traditionally contain high levels of VOCs and HAPS, which are harmful to both the environment and human health. The need to comply with these stringent emissions standards adds complexity and cost to the formulation and production of aircraft paints, limiting some market players’ ability to innovate while maintaining compliance.

Price Volatility of Specialty Resin Feedstocks

The price volatility of specialty resin feedstocks, used in the production of high-performance aircraft coatings, is a key challenge in the Singapore Aircraft Paint Market. Resin feedstocks, especially those used for durable, corrosion-resistant, and heat-resistant coatings, are highly sensitive to fluctuations in the global supply chain. Factors such as raw material shortages, geopolitical instability, and supply chain disruptions, as seen in recent years, contribute to price instability. This unpredictability makes it difficult for manufacturers to plan and price their products effectively, leading to increased production costs and potentially higher prices for aircraft repainting services. The challenge of maintaining cost-effective pricing while ensuring high-quality and compliant coatings remains a significant restraint.

Opportunities

Green Coatings (Water-based & Bio-based) Adoption

The adoption of green coatings, including water-based and bio-based formulations, represents a significant opportunity in the Singapore Aircraft Paint Market. With increasing environmental awareness and regulatory pressure to reduce harmful emissions from coatings, the aviation industry is shifting toward more sustainable solutions. Water-based and bio-based coatings produce fewer harmful emissions and have lower environmental impacts compared to traditional solvent-based coatings. Singapore’s strong commitment to sustainability and its robust regulatory framework make it an ideal market for the introduction and adoption of green coatings. Manufacturers that develop and promote eco-friendly, low-VOC coatings have the opportunity to meet growing demand while complying with stringent environmental standards.

Seletar Aerospace Park Industrial Cluster Growth

The growth of the Seletar Aerospace Park industrial cluster offers a unique opportunity for the Singapore Aircraft Paint Market. The Seletar Aerospace Park is a key hub for aerospace manufacturing, research, and MRO services, housing a range of companies that provide services from aircraft maintenance to component manufacturing. The increasing development and expansion of the Seletar Aerospace Park create a conducive environment for collaborations between aircraft paint manufacturers and MRO service providers. The park’s growth fosters a stronger supply chain for the aviation sector and opens new business opportunities for paint manufacturers to tap into the expanding MRO demand. This industrial growth in Singapore further drives the need for aircraft paint and coatings in the region.

Future Outlook

Over the next 5 years, the Singapore Aircraft Paint Market is expected to grow steadily, driven by advancements in coating technologies, the growing demand for eco-friendly solutions, and the increasing need for regular aircraft maintenance. The market will witness a shift towards sustainable paint options, with manufacturers investing in water-based and low-VOC formulations to meet stringent environmental regulations. Additionally, the expansion of the airline fleet in Asia-Pacific and the continued rise in air travel will further boost demand for high-quality aircraft paint and coatings. This period is also likely to see innovations in anti-corrosion and anti-icing coatings, improving the durability and performance of aircraft paints.

Major Players in the Market

- AkzoNobel

- PPG Aerospace

- Sherwin-Williams

- BASF Coatings

- Mankiewicz

- Henkel AG & Co.

- IHI Ionbond AG

- Axalta Coating Systems

- Zircotec Ltd.

- Hentzen Coatings

- International Aerospace Coatings

- Mapaero

- Argosy International

- Chemetall Aerospace

- NVSC Specialty Coatings

Key Target Audience

- Airline Operators and Fleet Managers

- Aircraft Maintenance and Repair Organizations (MROs)

- Aerospace OEMs (Original Equipment Manufacturers)

- Military and Defense Agencies (e.g., Singapore Ministry of Defense)

- Regulatory Bodies (e.g., Civil Aviation Authority of Singapore – CAAS)

- Investment and Venture Capitalist Firms

- Aircraft Coating Manufacturers and Suppliers

- Airport Authorities (e.g., Changi Airport Group)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Singapore Aircraft Paint Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the demand for aircraft coatings, their usage across different segments (e.g., commercial, military), and material specifications will be compiled and analyzed. A thorough understanding of consumer preferences and market penetration will be central to constructing a comprehensive market forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts, including representatives from OEMs, MROs, and coatings suppliers. These interviews will provide valuable operational insights and offer a firsthand look at how current market trends are evolving.

Step 4: Research Synthesis and Final Output

The final phase will involve compiling and synthesizing insights from all research activities to produce a comprehensive report. This stage will integrate feedback from primary interviews, historical data, and industry reports, ensuring a robust and accurate representation of the Singapore Aircraft Paint Market.

- Executive Summary

- Research Methodology (Market Definitions and Boundaries; Singapore Aircraft Paint Value Chain; Import/Export Trade Methodology; Primary and Secondary Data Sources; In‑Country Expert Interviews; Data Triangulation Protocol; Forecasting Assumptions)

- Definition and Scope of Aircraft Paint & Aerospace Coatings

- Singapore Aviation Ecosystem Context (Commercial Fleet, MRO, Military)

- Role of Aircraft Paint in Lifecycle Cost and Aircraft Branding

- Industry Evolution and Major Milestones in Singapore

- Supply Chain Mapping (Raw Resin to Finished Coatings)

- Value Chain Analysis (OEM vs MRO vs Aftermarket Paint Services)

- Growth Drivers

Expanding Singapore MRO Hub Demand (MRO Paint Cycles & Repaints)

Aviation Fleet Expansion & LCC Growth in APAC

Fuel‑Burn Efficiency Drives Low‑Drag Coatings

- Market Restraints

Regulatory Compliance on VOC/HAPS Emissions

Price Volatility of Specialty Resin Feedstocks

- Opportunities

Green Coatings (Water‑based & Bio‑based) Adoption

Seletar Aerospace Park Industrial Cluster Growth

- Trends

Digital Paint Inspection & Robotics in MRO

Smart Coatings and Anti‑Icing Systems

- Regulatory Landscape

Civil Aviation Requirements (CAAS/FAA/EASA)

Environmental Laws Impacting Formulations

- Market Life Cycle & Porter’s Five Forces

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Coating Technology (In Value %)

Liquid Coatings

Powder Coatings

Water‑based & Low VOC - By Resin Class (In Value %)

Polyurethane

Epoxy

Fluoropolymers

Specialty High‑Performance - By End‑User (In Value %)

Commercial Aviation

Military Aviation

General Aviation - By Application Area (In Value %)

Exterior

Interior

Specialized Systems - By Sales Channel (In Value %)

Direct OEM Contracts

MRO Contracts

Distributors

Value‑Added Resellers

- Market Share (By Value, By Volume)

- Cross‑Comparison Parameters (Company Overview; Product Portfolio (% by Coating Type); Proprietary Technologies; R&D Intensity; Regulatory Approvals; Production Footprint (Local/Regional); MRO Network Reach; Supply Chain Robustness; Average Contract Value; Warranty & After‑Service Support; Strategic Partnerships)

- SWOT Profiles (Key Competitors)

- Price Benchmarking by SKU Tier

- Detailed Competitive Profiles

AkzoNobel Aerospace Coatings

PPG Aerospace Coatings

Sherwin‑Williams Aerospace

BASF Coatings

Mankiewicz Gebr. & Co.

Henkel AG & Co.

Axalta Coating Systems

Hentzen Coatings, Inc.

International Aerospace Coatings Holdings

IHI Ionbond AG

Zircotec Ltd

Mapaero

Argosy International

NVSC Specialty Coatings

Chemetall Aerospace

- Market Demand Patterns by Airline Segment

- Procurement Drivers (Durability, Weight, Compliance)

- Decision Matrix for Paint Supplier Selection

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035