Market Overview

The Singapore Aircraft Propeller Systems Market is driven by a combination of factors including rising demand for fuel-efficient regional aircraft and advancements in propeller technologies. In 2025, the market was valued at approximately USD ~ million, with a steady demand for high-performance propeller systems driven by increasing air travel connectivity within Southeast Asia and expanding regional aircraft fleets. The market’s growth is particularly fueled by technological innovations in materials, such as composite blades, and increasing investments in sustainability, such as electric-hybrid propeller systems.

The market is largely dominated by key players from technologically advanced nations, including the United States, Germany, and the United Kingdom. Singapore, due to its strategic geographic location and established aviation hub status, serves as a key player in the Southeast Asian market. The country benefits from its proximity to emerging markets in ASEAN, an advanced aerospace ecosystem, and its robust regulatory framework, making it a preferred destination for aircraft OEMs and MRO (Maintenance, Repair, and Overhaul) service providers. Additionally, cities such as Singapore City and Johor Bahru play significant roles in driving the growth due to their connectivity, industrial capabilities, and governmental support for aviation industry development.

Market Segmentation

By Propeller Type

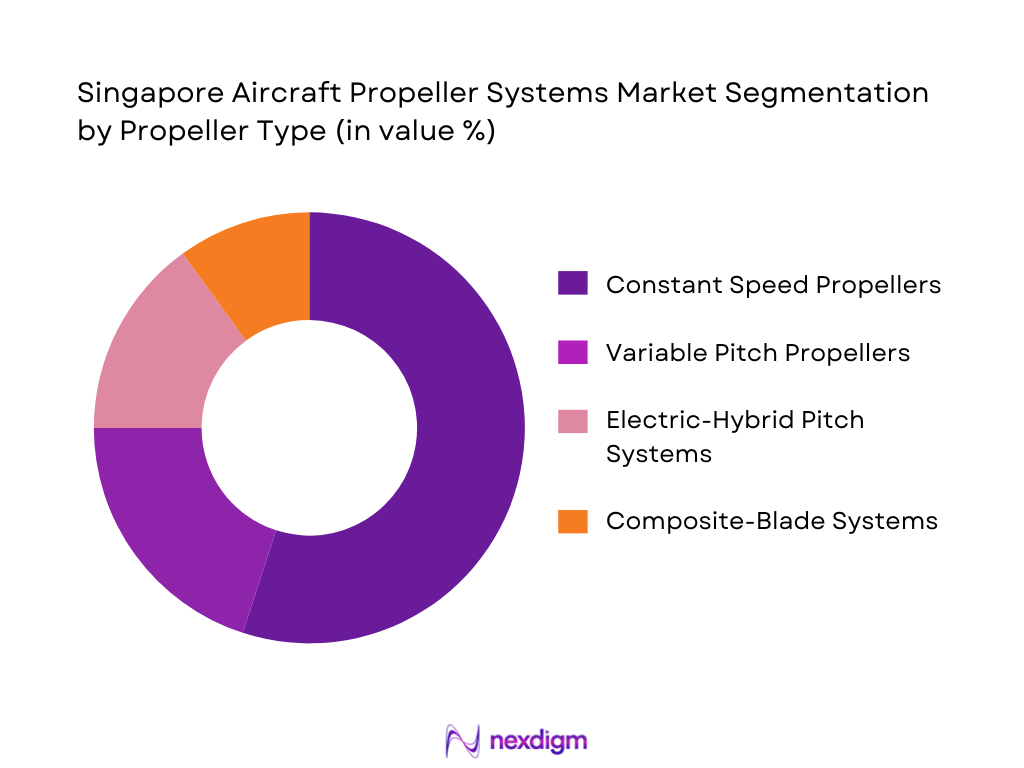

The Singapore Aircraft Propeller Systems Market is segmented by propeller type into Constant Speed Propellers, Variable Pitch Propellers, Electric-Hybrid Pitch Systems, and Composite-Blade Systems. Constant Speed Propellers dominate the market due to their long-established presence in both commercial and military aircraft. Their efficiency in optimizing engine power at different flight speeds makes them indispensable, especially for regional aircraft operating in ASEAN regions. As more turboprop aircraft enter service, constant speed propellers will continue to secure a significant share of the market.

By Material Technology

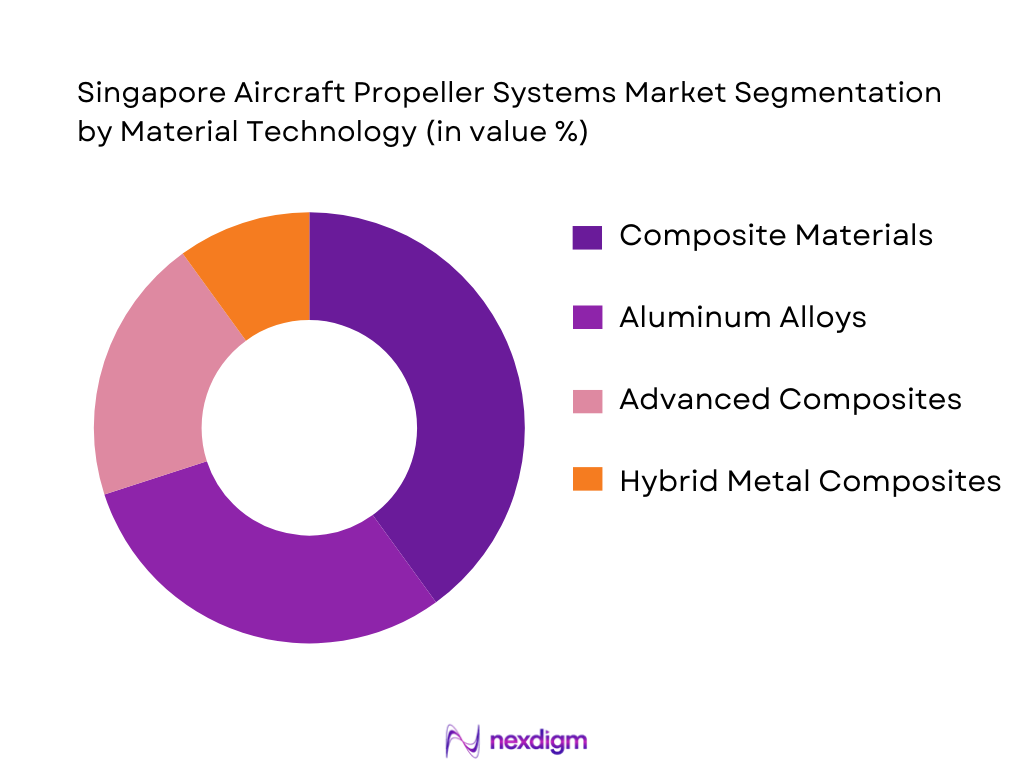

The material technology segment includes Composite Materials, Aluminum Alloys, Advanced Composites, and Hybrid Metal Composites. Composite materials, particularly carbon-fiber blades, have been gaining dominance in the market due to their light weight, superior strength, and durability. They offer enhanced fuel efficiency and longer service life, which aligns with the growing demand for more efficient aircraft. As regional aircraft fleets modernize, composite materials are expected to maintain their lead due to their advantages over traditional metal alloys.

Competitive Landscape

The Singapore Aircraft Propeller Systems Market is characterized by a competitive landscape with a few established players leading the market. These players include global manufacturers such as Hartzell Propeller, MT‑Propeller, and McCauley Propeller Systems, among others. The competitive dynamic is shaped by technological advancements, particularly in composite and electric-hybrid systems, as well as regional manufacturing and after-sales services.

| Company Name | Establishment Year | Headquarters | Technology Portfolio | OEM Partnerships | Revenue Streams | Market Focus |

| Hartzell Propeller | 1917 | USA | ~ | ~ | ~ | ~ |

| MT-Propeller | 1980 | Germany | ~ | ~ | ~ | ~ |

| McCauley Propeller Systems | 1939 | USA | ~ | ~ | ~ | ~ |

| Dowty Propellers | 1935 | UK | ~ | ~ | ~ | ~ |

| Sensenich Propellers | 1932 | USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Propeller Market Analysis

Growth Drivers

Regulatory Influence

The Singapore Aircraft Propeller Market is significantly driven by regulatory influence, particularly with the stringent safety and performance standards set by global aviation bodies such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). In addition to these international regulations, the Civil Aviation Authority of Singapore (CAAS) ensures that all aircraft operating within Singapore’s airspace meet the highest safety and operational standards, directly impacting propeller system design and certification. As regulations evolve, with a focus on noise reduction, fuel efficiency, and emissions compliance, propeller manufacturers are driven to innovate to comply with these standards, thus supporting market growth. These regulatory frameworks encourage the development and adoption of advanced technologies that improve both safety and environmental performance in aircraft propeller systems.

Technology Push

The push for technological advancements is another significant growth driver in the Singapore Aircraft Propeller Market. Manufacturers are continually working to improve propeller efficiency, durability, and noise reduction capabilities. With increasing demand for fuel-efficient and environmentally friendly solutions, propeller systems are being developed with more advanced materials, aerodynamics, and control systems. Singapore’s role as a hub for aerospace innovation and its emphasis on R&D investments in aviation technologies help foster these advancements. The push towards integrating digital technologies for enhanced performance monitoring and predictive maintenance also drives the adoption of smarter and more efficient propeller systems, expanding market opportunities in the region.

Market Challenges

Certification Complexity (EASA/FAA Approvals; CAAS Equivalence)

Certification complexity poses a key challenge for the Singapore Aircraft Propeller Market. Aircraft propellers must comply with rigorous certification standards, including those set by EASA, the FAA, and the Civil Aviation Authority of Singapore (CAAS). These agencies require extensive testing for propellers, including aerodynamics, durability, and performance under various operating conditions. The challenge lies in the fact that obtaining approvals from these regulatory bodies can be a lengthy and costly process. Additionally, the need for CAAS equivalence — ensuring that locally manufactured or modified systems meet the same standards as international regulations — further complicates the certification process. As such, manufacturers face significant time and cost constraints in bringing new propeller technologies to market.

Competition from Alternative Propulsion (Turbofan, Hybrid Electric)

The emergence of alternative propulsion technologies, such as turbofan engines and hybrid electric systems, presents a growing challenge to the aircraft propeller market in Singapore. These alternative technologies, which offer greater fuel efficiency and lower emissions, are being increasingly adopted in both commercial and military aircraft, especially in next-generation aircraft models. The development of electric and hybrid-electric propulsion systems, in particular, has raised concerns about the future role of traditional propeller systems. As airlines and manufacturers move toward more sustainable, low-emission solutions, the demand for conventional propellers may be impacted, posing a competitive challenge to established propeller technologies in the market.

Market Opportunities

Digital Avionics Integration with Propeller Controls

An emerging opportunity in the Singapore Aircraft Propeller Market is the integration of digital avionics with propeller control systems. With the ongoing trend toward digitalization in aviation, propellers are becoming more sophisticated, incorporating real-time data collection and advanced control algorithms to optimize performance. This integration allows for improved fuel efficiency, predictive maintenance, and enhanced reliability. By utilizing digital avionics to monitor and adjust propeller operations in real time, operators can achieve better performance under various flight conditions, reducing operational costs and increasing overall safety. This opportunity aligns with Singapore’s commitment to being at the forefront of aerospace innovation and offers a significant growth avenue for manufacturers developing digital propeller systems.

Advanced Composite Adoption

The adoption of advanced composite materials in propeller design presents a significant growth opportunity in Singapore’s aircraft propeller market. Composites such as carbon fiber and fiberglass offer several advantages over traditional metal propellers, including reduced weight, increased strength, and improved fuel efficiency. These materials also contribute to lower maintenance costs and better corrosion resistance. As the demand for lightweight and high-performance aircraft components grows, manufacturers are increasingly turning to composites to meet these needs. With Singapore’s strong aerospace manufacturing base and its role as a hub for aerospace R&D, the market for advanced composite-based propeller systems is expected to expand, especially in next-generation aircraft models that prioritize performance and sustainability.

Future Outlook

Over the next 5 years, the Singapore Aircraft Propeller Systems Market is expected to experience steady growth. This growth will be driven by the increasing demand for fuel-efficient regional aircraft, technological innovations in propeller systems (especially electric-hybrid propellers), and the rising importance of environmentally sustainable aviation practices. The continued development of composite materials and the expansion of MRO services will also play a pivotal role in shaping the market’s future. Government regulations emphasizing noise reduction and emission standards will further fuel the adoption of advanced propeller technologies.

Major Players in the Market

- Hartzell Propeller

- MT-Propeller

- McCauley Propeller Systems

- Dowty Propellers

- Sensenich Propellers

- Airmaster Propellers

- Ratier-Figeac

- Hercules Propellers

- UTC Aerospace

- WhirlWind Propeller

- Electravia

- FP Propeller

- Aerotek Propulsion

- APS Malaysia

- McCauley Propeller Systems

Key Target Audience

- Aircraft Manufacturers

- Aviation MRO Providers

- Aerospace Component Suppliers

- Aircraft OEMs

- Airlines and Aviation Fleet Operators

- Aviation Regulatory Bodies (CAAS)

- Investments and Venture Capitalist Firms

- Government Agencies (Aviation and Aerospace Departments)

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables that impact the Singapore Aircraft Propeller Systems Market. This is achieved through extensive desk research, utilizing industry databases and government reports. Key variables such as technology trends, propeller types, and regulatory frameworks are mapped to understand their influence on the market.

Step 2: Market Analysis and Construction

In this phase, historical market data, including product types and customer demand, are analyzed. A comprehensive breakdown of propeller sales and MRO services across different aircraft types is conducted to ensure accurate market size estimation and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct consultations with industry experts, including aircraft manufacturers and service providers. These insights are used to refine the data and provide a more granular understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and creating a comprehensive report. This step includes detailed product breakdowns, customer preferences, and technological developments, ensuring that the final output accurately reflects the current and future market trends.

- Executive Summary

- Research Methodology (Market Definitions and Propeller System Framework (propulsion type, blade tech), Abbreviations (OEM, MRO, APAC, EASA, CAAS standards), Market Sizing Approach (value & unit shipment, installed base vs new build penetration), Primary & Secondary Research Sources, Top‑Down vs Bottom‑Up Integration Logic, Data Triangulation and Forecasting Assumptions, Limitations and Bias Controls)

- Definition and Scope

- Genesis of Singapore Propeller Systems Market

- Historical Adoption Curves

- Global & ASEAN Supply Chain and Value Chain Analysis

- Growth Drivers

Regulatory Influence

Technology Push

Customer Preference Dynamics

- Market Challenges

Certification Complexity (EASA/FAA approvals; CAAS equivalence)

Competition from Alternative Propulsion (Turbofan, Hybrid Electric)

Raw Material Price Volatility (advanced composites, alloys)

- Market Opportunities

Digital Avionics Integration with Propeller Controls

Advanced Composite Adoption

Local MRO & Propeller Overhaul Services Expansion

ASEAN Regional Connectivity Initiatives (increasing turboprop usage)

- Market Trends

Adoption of Smart Propulsion Analytics

Shift to Low‑Noise Composite Blade Configurations

Integration of Electric Pitch Systems

- Government & Regulatory Analysis

Singapore CAAS Propeller Certification Requirements

ASEAN Aviation Standards Impact

Noise & Emission Compliance Frameworks

- Porter’s Five Forces Analysis

- SWOT Analysis

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Propeller Type (In Value %)

Constant Speed Propellers

Variable Pitch Propellers

Electric-Hybrid Pitch Systems

Composite-Blade Systems

- By Material Technology (In Value %)

Composite Materials

Aluminum Alloys

Advanced Composites

Hybrid Metal Composites

- By Aircraft Type (In Value %)

Regional Turboprops

General Aviation

Military Trainer & Utility Aircraft

UAV/Remotely Piloted Propulsion Platforms

- By End Market Channel (In Value %)

OEM New Build

Aftermarket Sales

MRO & Overhaul Services

Retrofit Upgrade

- By Propeller Architecture (In Value %)

Two-Blade

Three-Blade

Four-Blade

Five+ Blade

- Market Share by Value & Units (Singapore Propeller Systems)

- Cross‑Comparison Parameters (Company Overview, Business Strategy, Tech Portfolio, Composite Blade Competency, Aftermarket MRO Capabilities, Certification Footprint, Production Capacity, Installed Fleet Support, Distribution & Logistics, Revenue by Propeller Type, R&D Intensity, Service Network Density, Blade Innovation Index, Digital Integration Capability)

- Detailed Profiles of Key Competitors

Hartzell Propeller

Dowty Propellers

MT‑Propeller

McCauley Propeller Systems

Airmaster Propellers

FP Propeller (European specialist)

Ratier‑Figeac (French aerospace tech)

Hoffmann Propeller

Sensenich Propeller (US composites & wooden legacy)

Hercules Propellers (fixed pitch innovators)

UTC Aerospace/Curtiss‑Wright

Electravia (Electric propulsion specialist)

WhirlWind Propellers (Light‑sport aircraft focus)

AEROTEK Propulsion

APS Malaysia

- Propeller Demand by Operator Segment

- Procurement Criteria (reliability, cost, certification, retrofit footprint)

- Service & Maintenance Budgeting Dynamics

- Pain Point Analysis (noise, efficiency, certification timelines)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035