Market Overview

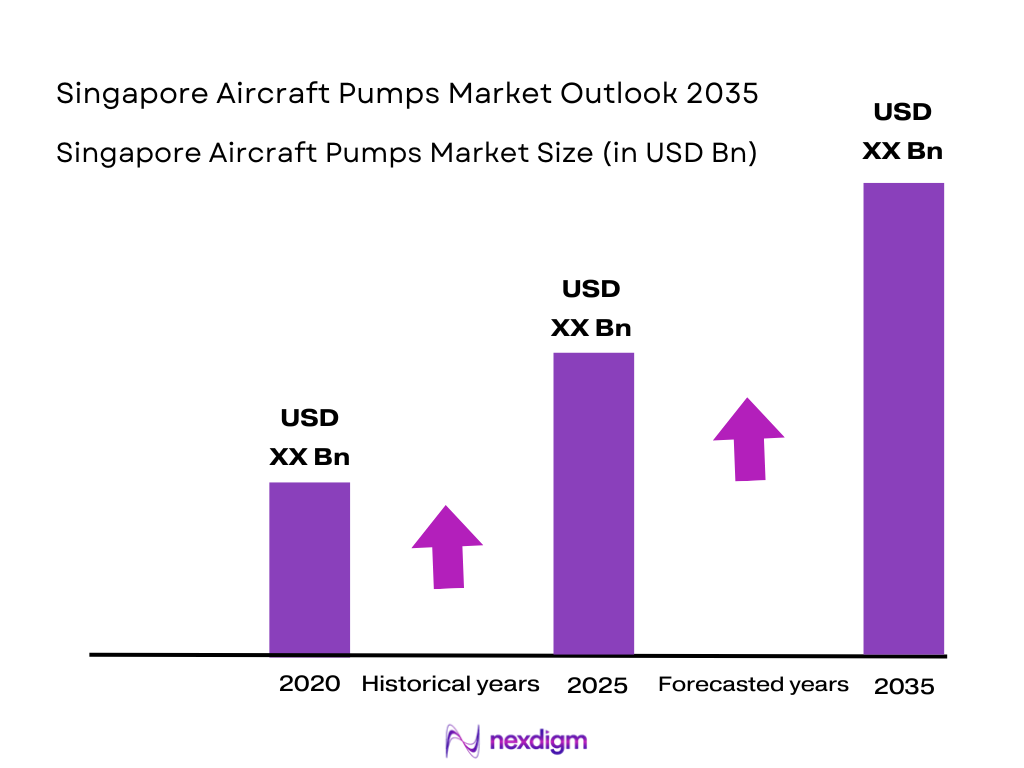

The Singapore Aircraft Pumps market is valued at USD ~ million as of 2025, with a consistent growth trajectory driven by the aviation sector’s expansion. This growth is underpinned by the increasing fleet size in Southeast Asia, the rise in airline activities, and the growing MRO (Maintenance, Repair, and Overhaul) demand in the region. Aircraft pumps, such as fuel, hydraulic, and lubrication pumps, are crucial for efficient operation and reliability of aircraft systems, contributing significantly to the market size. The evolution towards fuel-efficient, environmentally friendly, and reliable systems, coupled with advancements in pump technologies, is also fueling market growth.

Singapore, as a key aviation hub in Southeast Asia, dominates the aircraft pumps market due to its strategic position as a regional center for aircraft maintenance, repair, and overhaul (MRO) services. The country’s well-developed infrastructure, proximity to major airline operations, and government support for aviation technology and innovation have made it the dominant player in the Southeast Asia market. Additionally, its robust trade connections with major global aviation stakeholders make Singapore a key hub for the import and export of aircraft components, including pumps.

Market Segmentation

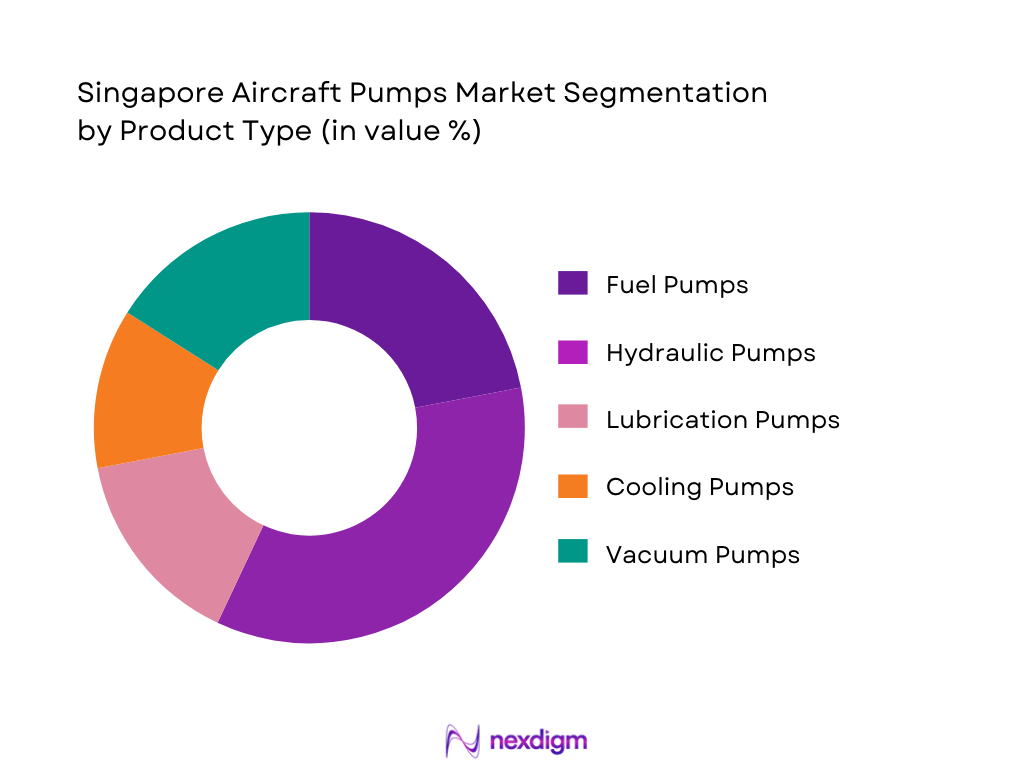

By Product Type

The Singapore Aircraft Pumps market is segmented by product type into fuel pumps, hydraulic pumps, lubrication pumps, cooling pumps, and vacuum pumps. Among these, hydraulic pumps hold the dominant market share in Singapore due to their essential role in aircraft flight control systems and high reliability requirements. Hydraulic pumps are integral in various aircraft applications, such as brake systems, flight control actuators, and landing gear systems. Their widespread use in both commercial and defense aircraft in Singapore has solidified their market leadership, driven by the continuous demand from both OEM and aftermarket sectors.

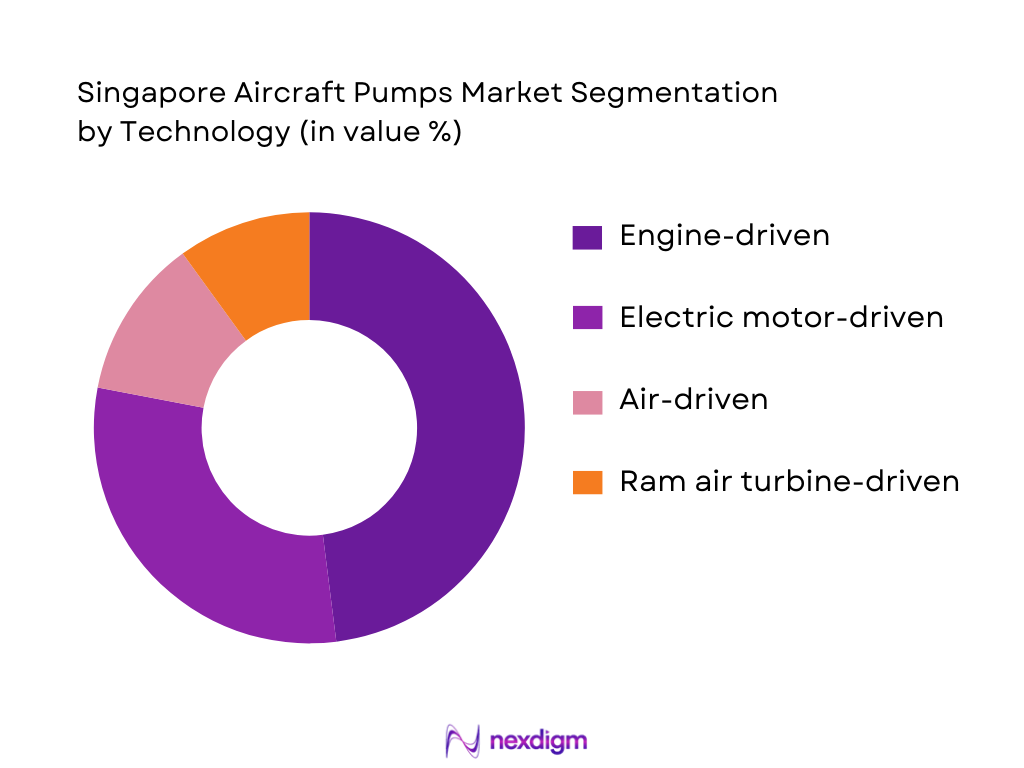

By Technology

The technology segment of the aircraft pumps market in Singapore includes engine-driven, electric motor-driven, air-driven, and ram air turbine-driven pumps. Engine-driven pumps have a dominant market share, largely due to their integration into the aircraft’s primary systems, particularly in commercial and military aviation. Engine-driven pumps offer high performance, ensuring that critical hydraulic and fuel systems operate seamlessly during flights. Their widespread adoption in modern aircraft and reliance on engine-driven components for consistent performance contribute to their leadership in this segment.

Competitive Landscape

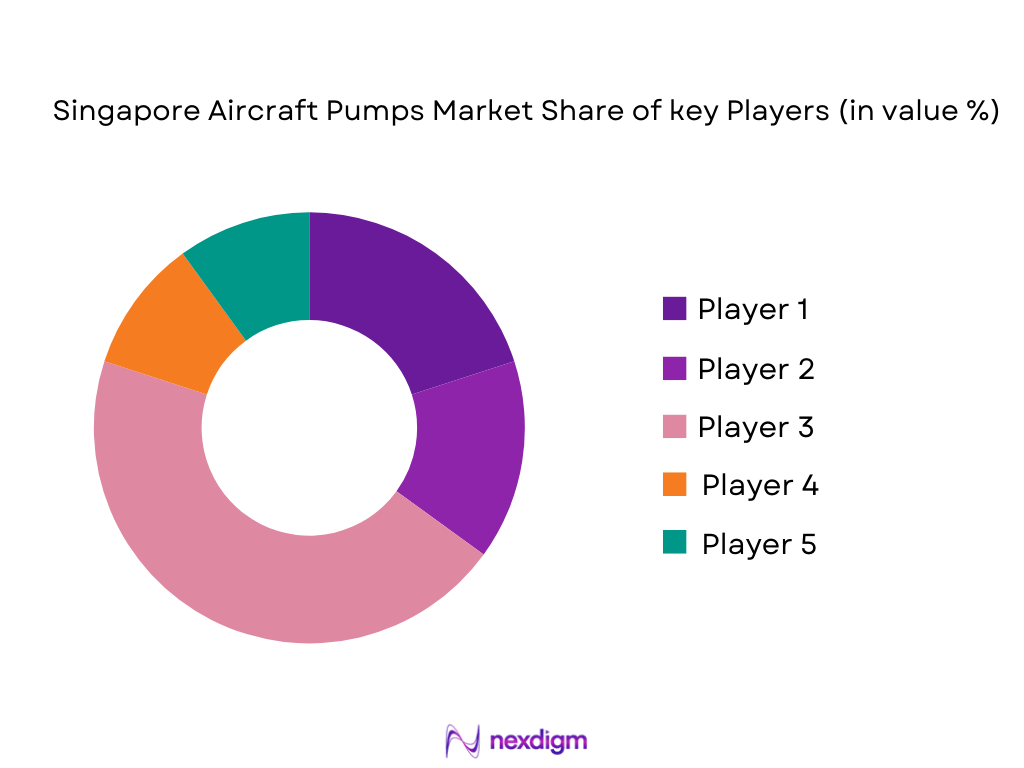

The Singapore Aircraft Pumps market is highly competitive, with both global giants and regional players driving innovations in pump technologies. Leading companies like Collins Aerospace, Eaton Corporation, and Honeywell Aerospace dominate the market by offering a wide range of pumps for different aircraft types and systems. These companies have strategically positioned themselves with strong manufacturing capabilities, global service networks, and a robust presence in the growing Asia-Pacific region. Their continuous investments in R&D and technological advancements have also strengthened their market foothold.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | Product Portfolio | Global Reach | R&D Investment |

| Collins Aerospace | 1999 | USA | ~ | ~ | ~ | ~ |

| Eaton Corporation | 1911 | Ireland | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1885 | USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

Singapore Aircraft Pumps Market Analysis

Growth Drivers

Expansion of Singapore Aviation Sector

The growth of Singapore’s aviation sector is a key driver for the Aircraft Pumps Market. Singapore is a major regional aviation hub, with Changi Airport handling over ~ million passengers in 2025. This expansion has driven the demand for aircraft pumps, which are integral to critical systems like fuel, hydraulic, and environmental controls. Singapore Airlines and other regional carriers are modernizing their fleets with advanced aircraft, increasing the demand for high-performance pumps. The continued development of aviation infrastructure in Singapore and the growing air traffic in the Asia-Pacific region contribute to an increasing need for reliable and efficient aircraft pumps.

Rising Fleet Deliveries & MRO Activity in SEA

Southeast Asia’s rapid growth in fleet deliveries and MRO (Maintenance, Repair, and Overhaul) activity is another key factor driving the aircraft pumps market in Singapore. As airlines in Southeast Asia, including Singapore Airlines, AirAsia, and others, continue to expand their fleets, the demand for reliable aircraft pumps increases. Additionally, the growing MRO activity in the region, which involves servicing both new and older aircraft, creates consistent demand for replacement parts and pump systems. With Singapore acting as a major MRO hub in Southeast Asia, this growth in fleet and MRO activity presents significant opportunities for the market.

Market Challenges

Supply Chain Disruptions & Raw Material Price Volatility

The aircraft pumps market in Singapore faces challenges related to global supply chain disruptions and the volatility in raw material prices. Aircraft pumps rely on specialized materials, such as high-strength alloys and composites, which are subject to fluctuations in global supply chains. Issues such as geopolitical instability, material shortages, and transportation delays have impacted the availability of these materials, leading to delays in manufacturing and increased costs. This price volatility poses challenges for manufacturers and can lead to higher prices for end-users in the aviation sector, affecting the overall market dynamics and profitability.

Stringent Aviation Safety & Regulatory Certifications

A significant challenge in the Singapore Aircraft Pumps Market is the stringent safety and regulatory certification requirements for aircraft components. Pumps must adhere to strict international standards set by aviation regulatory bodies such as the Civil Aviation Authority of Singapore (CAAS), EASA, and FAA. The certification process involves rigorous testing to ensure safety, reliability, and compliance with noise, emission, and performance standards. These regulations, while essential for ensuring the safety of aircraft, can significantly increase the time and cost associated with bringing new pump technologies to market. Manufacturers must invest heavily in meeting these certification standards, which may delay product development and increase costs.

Market Opportunities

Electrification of Aircraft Pumps

The electrification of aircraft systems presents a significant opportunity for growth in the aircraft pumps market. As the aviation industry moves toward more sustainable technologies, the electrification of hydraulic and fuel pumps is becoming a priority. Electrically powered pumps offer advantages such as reduced weight, improved energy efficiency, and the potential for lower maintenance costs compared to traditional hydraulic pumps. With airlines increasingly looking for ways to reduce fuel consumption and carbon emissions, the adoption of electric pumps, particularly in next-generation aircraft, provides an exciting opportunity for market growth. Singapore’s emphasis on innovation and sustainability in aviation positions it as a key market for the electrification of aircraft pumps.

Smart Pump Diagnostics / Predictive Maintenance

The integration of smart diagnostics and predictive maintenance technologies in aircraft pumps is another key opportunity in the Singapore market. With the increasing demand for operational efficiency, airlines and MRO providers are adopting predictive maintenance solutions to reduce unscheduled downtimes and extend the lifespan of their equipment. Smart aircraft pumps equipped with sensors and IoT technology allow for real-time monitoring of performance, enabling the detection of potential issues before they cause failures. This shift toward predictive maintenance can help reduce maintenance costs, improve system reliability, and enhance overall operational efficiency, creating a significant opportunity for manufacturers of advanced, digitally enabled aircraft pumps in Singapore and the broader Southeast Asia region.

Future Outlook

Over the next five years, the Singapore Aircraft Pumps market is expected to exhibit steady growth, driven by increased demand from both commercial and defense aviation sectors. The market will benefit from advancements in pump technologies, including enhanced fuel efficiency, environmental regulations pushing for greener alternatives, and ongoing innovations in smart pump solutions for predictive maintenance. Additionally, Singapore’s strategic role as a MRO hub will continue to drive demand, particularly as the aviation industry recovers and grows post-pandemic, leading to a larger fleet size and the need for maintenance services.

Major Players in the Market

- Collins Aerospace

- Eaton Corporation

- Honeywell Aerospace

- Moog Inc.

- Parker Hannifin

- Safran

- United Technologies Corporation

- Rolls-Royce

- Zodiac Aerospace

- Meggitt

- Woodward Inc.

- CapitaMRO

- Aeronamic

- Hamilton Sundstrand

- Sogefi Group

Key Target Audience

- Investments and Venture Capitalist Firms

- Aviation OEMs (Original Equipment Manufacturers)

- Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aircraft System Suppliers

- Government and Regulatory Bodies (CAAS, FAA, EASA)

- Aircraft Fleet Operators

- Aerospace Engineers and Technologists

- Aircraft Component Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying all critical market drivers, key technological trends, and the competitive landscape within the Singapore Aircraft Pumps market. A detailed ecosystem map is created to understand the stakeholders, including OEMs, MROs, suppliers, and regulatory bodies. This step relies on extensive desk research, utilizing secondary databases and proprietary sources to establish a foundational understanding of the market’s dynamics.

Step 2: Market Analysis and Construction

Historical data related to market penetration and the performance of aircraft pumps in Singapore is compiled. This phase also evaluates the supply chain, distribution channels, and the growth potential for new technology adoption in the market. Key metrics related to market share, growth rates, and regional influences are incorporated to understand the market’s structure.

Step 3: Hypothesis Validation and Expert Consultation

The next phase involves validating the hypotheses derived from initial research through direct consultations with industry experts, including engineers and senior executives at major players. These consultations provide valuable operational insights and help refine market data, ensuring that the analysis is comprehensive and reflects the latest industry trends.

Step 4: Research Synthesis and Final Output

The final step consolidates all insights obtained from both the bottom-up and top-down approaches. Direct engagement with market players is crucial in validating the information collected and ensuring that the final output includes accurate projections, industry insights, and actionable strategies. The final report delivers a comprehensive analysis of the market, offering both historical and forecasted data.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Abbreviations and Terminologies, Top‑Down & Bottom‑Up Sizing Methodologies, Data Sources, Primary/Secondary Research Protocol, Market Estimation Techniques (Value & Volume Validation), Competitive Intelligence Methodology, Research Limitations and Assumptions)

- Market Landscape and Operating Environment

- Aviation Ecosystem in Singapore (Airlines, MRO Hubs, OEM Supply Partners)

- Role of Singapore as APAC Aerospace Components Hub

- Market Evolution and Genesis

- Historical Market Milestones (Pumps Adoption in Civil & Defense Fleets)

- Technology Milestones (Hydraulic, Fuel, Vacuum Pump Integration Trends)

- Market Value Chain & Supply Chain Analysis

- Growth Drivers

Expansion of Singapore Aviation Sector

Rising Fleet Deliveries & MRO Activity in SEA

Focus on Fuel Efficiency, Weight Optimization, System Redundancy - Challenges

Supply Chain Disruptions & Raw Material Price Volatility

Stringent Aviation Safety & Regulatory Certifications

High CapEx for Technology Upgrades - Opportunities

Electrification of Aircraft Pumps

Smart Pump Diagnostics / Predictive Maintenance

Localization of Aerospace Components Manufacturing - Trends

Modular Pump Designs

Additive Manufacturing Adoption

Energy Efficient Hydraulic Systems - Regulatory & Certification Landscape

CAAS, FAA, EASA Impact on Product Standards

Import/Export Compliance and Trade Regulations

Safety, Environmental & Emission Norms - SWOT Analysis

- Singapore Aircraft Pumps Ecosystem

- Porter’s Five Forces

- Industry Competitive Intensity & Supplier Power

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Pump Type (In Value %)

Fuel Pumps (Fuel Transfer, Booster, Dynamic Fuel Pumps)

Hydraulic Pumps (Axial Piston, Vane, Gear)

Lubrication & Scavenge Pumps

Cooling & Air‑Conditioning Pumps

Vacuum Pumps (Air Extraction Modules)

- By Technology (In Value %)

Engine Driven

Electric Motor Driven

Air Driven

Ram Air Turbine Driven

- By Aircraft Type (In Value %)

Commercial Fixed Wing (Narrow & Widebody)

Regional Jets / Turboprops

Rotary Wing (Helicopters)

Unmanned Aerial Vehicles (UAVs/Drone Systems)

Business & General Aviation

- By End Use (In Value %)

OEM (Aircraft Manufacturing)

Aftermarket & MRO (Maintenance, Repair & Overhaul)

Defense & Government Applications

Specialty Aerospace Systems

- By Sales Channel (In Value %)

Direct OEM Contracts

Distributor Networks & Aviation Parts Dealers

Online & Digital Marketplaces

- Market Share Analysis by Value and Volume

- Cross‑Company Comparison Parameters (Market Positioning, Product Portfolio Breadth, Aftermarket Support & Service Coverage, Technology Roadmap, Certified Aviation Standards Compliance, Singapore/SEA Footprint, R&D Intensity, Pricing Strategy)

- SWOT Profiles for Key Players

- Pricing Structure Benchmarking

- Competitive Intelligence Summaries

- Detailed Company Profiles

Collins Aerospace (Fuel & Hydraulic Pumps)

Parker Hannifin Corporation (Aerospace Pump Systems)

Safran Group (Aircraft Pump Technologies)

Eaton Corporation (Aero Pumps & Systems)

Honeywell Aerospace (Hydraulic & Pneumatic Pumps)

Moog Inc. (Precision Pump Solutions)

Magneti Marelli (Fuel System Components)

UTC Aerospace Systems

Sundstrand Corporation

AeroFluid Products

PCE Engineering (Hydraulic Pumps)

Sauer Compressors (Aerospace Division)

Airwolf Aerospace (Aftermarket Pumps)

Rolls‑Royce Controls & Pump Technologies

- Market Consumption Patterns in Commercial and Defense Fleets

- Procurement Rationales and Specification Preferences

- Budgeting Drivers among Airlines and MROs

- Pain Point and Value Proposition Mapping

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035