Market Overview

The Singapore Aircraft Radome Market is valued at USD ~ million in 2025, with projections indicating steady growth as the aviation sector recovers from the global pandemic and continues to expand. The market is primarily driven by the increasing demand for radar transparency and protection from harsh environmental conditions, which radomes provide. In addition, advancements in composite materials and radar technology are fueling the adoption of new, high-performance radomes. Both commercial and military sectors contribute significantly to the market’s growth, with airlines and defense agencies continuing to invest in upgraded radome systems to enhance aircraft performance and communication capabilities.

Singapore’s Aircraft Radome Market is primarily influenced by its position as a leading aviation hub in Southeast Asia. The country serves as a major center for aircraft maintenance, repair, and overhaul (MRO) services, with the Singapore Airshow being a key event for the aerospace industry. Additionally, Singapore Airlines, one of the largest and most technologically advanced airlines in Asia, plays a significant role in driving demand for high-quality radome systems. The country’s regulatory frameworks and strong industry alliances also make it a dominant player in the regional and global markets. Other contributing factors include Singapore’s proximity to key aerospace manufacturing centers in the Asia-Pacific region and the strategic location of its airport infrastructure.

Market Segmentation

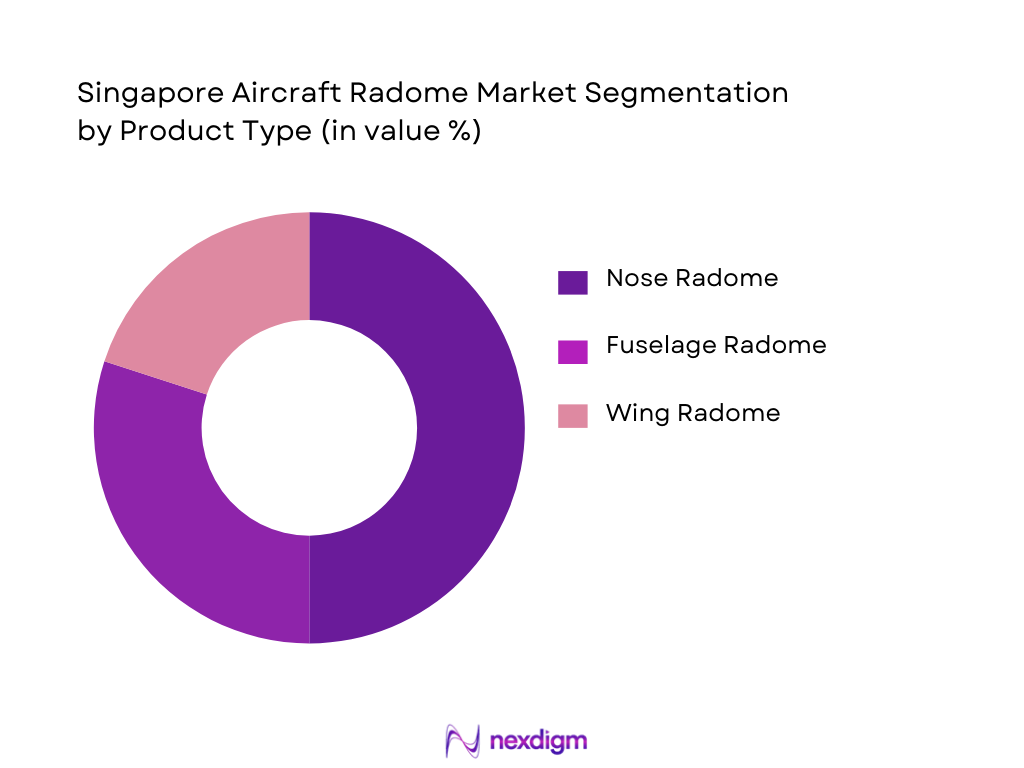

By Product Type

The Singapore Aircraft Radome Market is segmented into various product types, including nose radomes, fuselage radomes, and wing radomes. Among these, nose radomes hold a dominant market share due to their critical role in radar and communication system integration on commercial and military aircraft. The necessity for improved aerodynamic performance and reduced radar interference in modern aircraft platforms contributes to the dominance of this segment. The increasing adoption of advanced materials like carbon fiber and composites for nose radomes, which offer superior performance and durability, further boosts their market share. Major global players and local manufacturers in Singapore are focused on developing lighter, more efficient radome solutions, catering to both new aircraft production and the retrofitting of older aircraft.

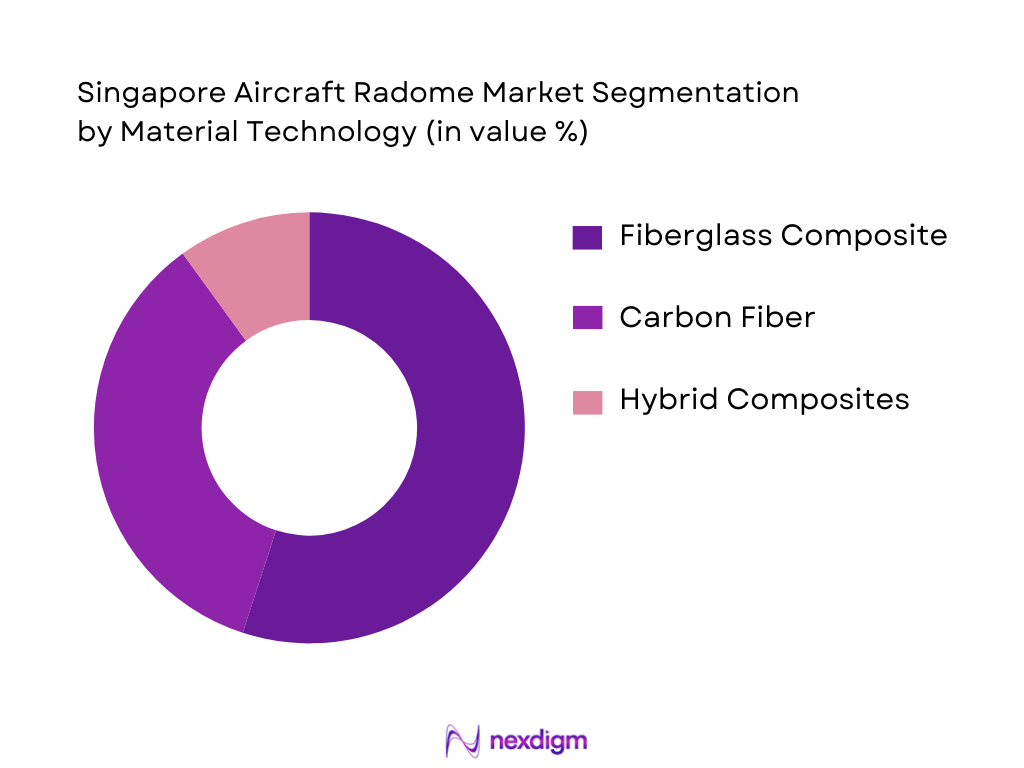

By Material Technology

Material technology is a key driver in the Aircraft Radome Market, with fiberglass composites and carbon fiber being the most commonly used materials. The dominance of fiberglass composite radomes is due to their cost-effectiveness, durability, and ease of production, which makes them suitable for commercial aircraft applications. However, carbon fiber radomes are gaining traction for military and high-performance aircraft due to their lightweight and strength properties, which provide better radar performance at higher speeds. The evolution towards hybrid composites and nano-materials is also making a significant impact on the market. The increasing demand for radomes that provide both structural integrity and minimal radar signal interference is pushing the market towards these advanced materials.

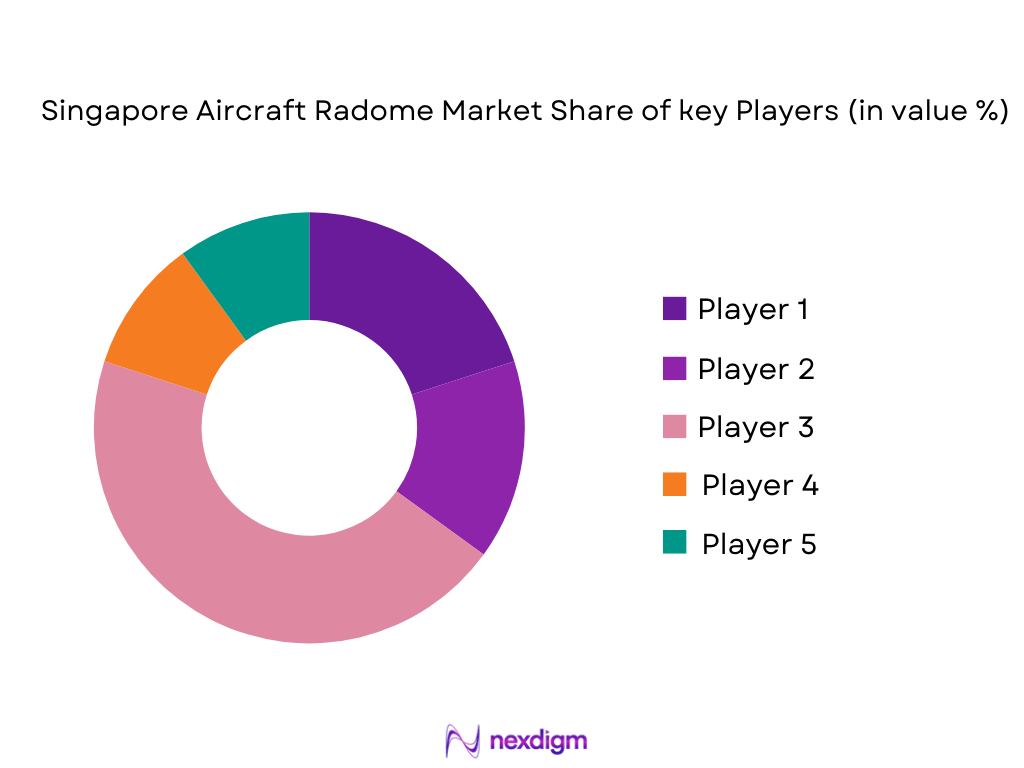

Competitive Landscape

The Singapore Aircraft Radome Market is dominated by a few major global players alongside key local manufacturers. Companies such as Honeywell, Northrop Grumman, and Meggitt PLC have a significant presence due to their expertise in aerospace technologies, long-standing relationships with airlines, and military contracts. Local players, including ST Engineering, have carved a niche in the aftermarket and MRO services. The competitive landscape reflects a high degree of consolidation, with major players investing heavily in research and development to provide next-generation radome systems that offer enhanced radar transparency, durability, and weight reduction.

| Company Name | Establishment Year | Headquarters | Product Type Focus | Market Positioning | Key Clients | Distribution Network |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ |

| Meggitt PLC | 1947 | UK | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ |

| FACC AG | 1987 | Austria | ~ | ~ | ~ | ~ |

Singapore Aircraft Radome Market Analysis

Growth Drivers

Commercial Fleet Expansion & Connectivity Systems Demand

The demand for radomes in Singapore is significantly driven by the expansion of its commercial fleet. In 2025, Changi Airport handled ~ million passengers, and aircraft movements increased by ~ %. The growth of regional airlines like Singapore Airlines, which is modernizing its fleet with aircraft like the Boeing 787-9 and Airbus A350, is increasing the need for advanced radomes. Additionally, the rise in demand for in-flight connectivity, including internet access and operational systems, requires radomes to provide reliable radar and communication systems, further supporting the market for radomes in commercial aircraft.

Defense Modernization Radar Systems

Singapore’s defense sector is modernizing rapidly, with significant investments in advanced military aircraft. The Singapore Armed Forces (SAF) has prioritized upgrading its fleet with next-generation fighter aircraft like the F-35 and F-15SG. These aircraft require radomes capable of supporting high-performance radar systems used for defense, surveillance, and reconnaissance operations. As defense spending increases, particularly for the modernization of air defense capabilities, the demand for advanced radar and communication technologies, including radomes, continues to grow. This focus on military radar systems drives the need for high-quality, durable radomes tailored to modern defense platforms.

Challenges

High CAPEX Manufacturing & Certification Barriers

Manufacturing high-performance radomes requires substantial capital investment due to the complex materials and technologies involved. These components need to meet stringent regulatory standards imposed by agencies such as the Civil Aviation Authority of Singapore (CAAS) and the FAA. The certification process, which ensures that radomes meet safety and electromagnetic performance standards, is both lengthy and costly. Additionally, the advanced composite materials used in radomes, such as carbon fiber and fiberglass, require specialized manufacturing techniques and equipment, adding to the overall capital expenditure and making it difficult for manufacturers to scale production quickly.

Skilled Workforce Constraints

The development of advanced radomes requires a highly skilled workforce with expertise in aerospace engineering, materials science, and electromagnetic systems. Singapore faces a shortage of such specialized talent, which limits the ability of radome manufacturers to expand production capacity. The need for highly trained engineers and technicians is compounded by global competition for skilled labor in the aerospace sector. Training and retaining this workforce can be costly and time-consuming, which affects the ability of companies to meet growing demand and develop innovative new products, thereby presenting a significant challenge to the market’s growth.

Opportunities

Lightweight High-Performance Radomes

The growing demand for lightweight, fuel-efficient aircraft presents a major opportunity for radome manufacturers. Advanced composite materials, such as carbon fiber and fiberglass, allow radomes to be lighter while maintaining or improving their durability and radar transparency. This shift towards lightweight radomes supports the broader aviation industry’s goals of reducing fuel consumption and operational costs. As airlines and defense agencies continue to prioritize fuel efficiency, radome manufacturers can capitalize on this demand by developing and supplying lightweight, high-performance solutions that help aircraft meet modern performance and efficiency standards.

Satellite Communications (SATCOM) Integration

The integration of satellite communications (SATCOM) systems in both commercial and military aircraft is driving the demand for radomes. SATCOM systems require specialized radomes that offer minimal signal interference while maintaining high levels of transparency. The growing need for in-flight connectivity, both for passengers and operational purposes, has made SATCOM a critical feature for modern aircraft. As airlines and defense forces continue to adopt SATCOM technology to enhance communication and operational capabilities, the need for radomes that can seamlessly integrate with these systems is set to grow, offering manufacturers a key opportunity for growth.

Future Outlook

Over the next five years, the Singapore Aircraft Radome Market is expected to see steady growth driven by several factors, including the growing demand for high-performance radomes, advancements in composite materials, and an expanding fleet of commercial and military aircraft in the region. With increasing investments in research and development by key players, especially in the field of additive manufacturing and nanotechnology, the market is set to witness innovations that will enhance radar transparency and reduce the weight of radomes. The government’s emphasis on aviation and defense spending, as well as the ongoing recovery of the aviation sector, will further support market expansion. Additionally, with Singapore being a key hub for MRO activities, the aftermarket segment is poised for growth, as older aircraft are retrofitted with advanced radome solutions.

Major Players in the Market

- Honeywell

- Northrop Grumman

- Meggitt PLC

- ST Engineering

- FACC AG

- Astronics Corporation

- Ametek Inc.

- Safran Electronics & Defense

- Goodrich Corporation

- Cobham plc

- Raytheon Technologies

- Teledyne Technologies

- General Electric

- Airbus

- Boeing

Key Target Audience

- Aircraft OEMs (Original Equipment Manufacturers)

- Airlines and Aviation Operators

- MRO (Maintenance, Repair, and Overhaul) Providers

- Aerospace Component Suppliers

- Military and Defense Agencies (Singapore Ministry of Defense)

- Regulatory Bodies (Civil Aviation Authority of Singapore, ICAO)

- Investments and Venture Capitalist Firms

- Research and Development Departments in Aerospace Manufacturers

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying all the crucial variables affecting the Singapore Aircraft Radome Market. These include product type, material technologies, regional demand, and the regulatory environment, which will be derived from both secondary and primary sources such as company reports, government publications, and expert interviews.

Step 2: Market Analysis and Construction

Market analysis is carried out by evaluating historical data on the demand and supply for aircraft radomes, alongside market pricing strategies. This process includes a detailed analysis of growth trends and sector-specific factors influencing the market, such as aircraft fleet expansion and defense procurement.

Step 3: Hypothesis Validation and Expert Consultation

The next step involves validating hypotheses developed during the market construction phase through expert consultations. Industry stakeholders, including aerospace engineers, radome manufacturers, and military contractors, will be interviewed to gain insights into the current and future market dynamics.

Step 4: Research Synthesis and Final Output

The final output phase will combine data gathered from the bottom-up and top-down approaches to present a comprehensive analysis. This phase includes validating data points with major radome manufacturers and refining the market trends to ensure accuracy and relevance to industry stakeholders.

- Executive Summary

- Research Methodology (Definitions & Scope Clarification (Aircraft Radome, Radome Shell, RF Transparency performance metrics), Primary & Secondary Data Sources Market Sizing & Forecasting Models (bottom‑up consensus modeling with aerospace delivery data), Risk/Assumption Framework (regional defense procurement, airline fleet orders))

- Industry Genesis and Market Evolution

- Singapore Industry Context and Capability Overview (aerospace tech ecosystem, events like Singapore Airshow)

- Global vs Asia‑Pacific Comparison

- Supply Chain & Value Chain (OEMs, Tier‑1 suppliers, MRO)

- Growth Drivers

Commercial Fleet Expansion & Connectivity Systems Demand

Defense Modernization Radar Systems

Advanced Composite Adoption

- Challenges

High CAPEX Manufacturing & Certification Barriers

Skilled Workforce Constraints

Regulatory Aviation Standards (ICAO, EASA, FAA)

- Opportunities

Lightweight High‑Performance Radomes

Satellite Communications (SATCOM) Integration

Servitization & Digital Prognostics

- Market Trends & Technology Adoption

Composite Material Evolution

RF Performance Benchmarking (frequency transparency optimization)

Additive Manufacturing Adoption

- Sensor & System Integration Trends

Regulatory Framework & Standards

Aviation Approval Standards (radome structural & RF standards)

Defense Contracting Compliance

Export Controls & Dual‑Use Limitations

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Platform Type (In Value %)

Commercial Jets (narrowbody, widebody)

Military Fixed Wing (fighters, transport)

Regional/Turboprop

UAV/Remotely Piloted Platforms

Helicopters - By Radome Type (In Value %)

Nose Radome

Fuselage Radome

Tail Radome

Wing Radome Integration

SATCOM/Communications Radome - By Material Technology (In Value %)

Fiberglass Composite (cost efficiency)

Carbon Fiber (structural performance)

Quartz Fiber Hybrid (signal transparency optimization)

Kevlar Reinforced (impact resilience)

Advanced Nano‑composite - By Technology (In Value %)

Resin Transfer Molding

Prepreg/Autoclave Layup

Additive Manufacturing (3D printing fiber composites)

Surface Finish & RF Tuning Processes

- Market Share – Value & Volume (global + Singapore linkage)

- Cross‑Comparison Parameters (Company Positioning, Technology Portfolio, RF Transparency Ratings, Material Mix Index, Installed Base, Supplier Tier, Certification Level, Warranty Terms, Aftermarket Support Coverage)

- Key Competitor Profiles

General Dynamics Mission Systems

Airbus SE

Northrop Grumman Corporation

Meggitt PLC

Jenoptik AG

Saint‑Gobain Performance Plastics

Astronics Corporation

Starwin Industries

FACC AG

Vermont Composites Inc.

Parker Hannifin Corporation

Lufthansa Technik Aerospace Radome Division

BAE Systems Radome Solutions

Kitsap Composites

Orbital ATK Aerospace Components

- Demand Forecast by Buyer Segment

- Procurement Decision Factors

- Lead Times & Specification Requirements

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035